Table of Contents

The foreign exchange market is one of the most liquid markets in the world, with a daily turnover exceeding 6 trillion dollars. This considerable liquidity means buyers and sellers are always ready to participate in a trade, making it attractive to traders who want quick and frequent profits. However, this also makes it very competitive and risky – no one is guaranteed success when trading forex. The key is to be prepared before entering a trade and understand how different economic indicators and news events will impact various currencies.

Is Forex Trading Profitable?

Based on various brokers ‘ reports, Forex trading is not highly profitable for retail traders because 70%-95% of all retail traders lose money yearly. Retail traders risk too much, overtrade or create small profits on several positions but then hold losing trades for too long. However, institutional traders and traders from prop companies generate profits trading currencies and managing large portfolios. The best forex trader in prop companies can profit from 20%-25% with less than 5% maximum drawdown.

In the video below, I analyzed forex trading profitability by analyzing six different groups of traders:

There are six groups of traders by profitability:

- Unprofitable traders

- Signal followers

- Stagnation traders

- “Invest in everything” traders/investor

- Profitable remote trader

- “Big Dogs” Traders

Unprofitable Traders

- Invest up to $500

- Lose all money in the portfolio

- There are 70%-75% of all traders in this unprofitable traders group

- Lack of discipline: Unprofitable forex traders may struggle with following a consistent and well-defined trading plan. They may be easily swayed by emotions, news, or other external factors, leading them to deviate from their strategies and make impulsive decisions.

- Overtrading: An unprofitable trader may engage in excessive trading, taking on too many positions or risking too much on individual trades. This can lead to high transaction costs and losses that outweigh any gains.

- Lack of risk management: Unprofitable traders may not understand risk management and may not use stop-loss orders, position sizing, or other risk management techniques to limit their losses.

- Inability to cut losses: An unprofitable trader may hold on to losing trades for too long, hoping the market will eventually turn in its favor. This can lead to significant losses that could have been minimized or avoided altogether.

- Failure to adapt: Forex markets constantly change, and unprofitable traders may struggle to adapt to new market conditions or adjust their strategies accordingly.

- Emotional trading: Unprofitable traders may make decisions based on fear, greed, or other emotions rather than following their trading plan or sticking to a well-thought-out strategy.

- Lack of knowledge and experience: Unprofitable traders may not have a solid understanding of forex markets, trading strategies, or technical analysis and may not have enough experience to make informed trading decisions.

- Poor money management: Unprofitable traders may not have a clear plan for managing their trading capital or may not have enough capital to weather losses or volatility in the market. They may also trade with money they cannot afford to lose, leading to financial difficulties.

It’s important to note that any trader can experience losses, even the most experienced and successful ones. However, by addressing and overcoming these characteristics, unprofitable traders can improve their chances of success in the forex market.

Signal followers

Signal followers are beginner traders that use EA, signals from various portals, in trading. They do not understand trading, but they are ready to invest money in portfolios that manage money managers.

However, 99% of all money managers risk too much, use martingale strategies, keep losing trades forever, etc. Usually, after a few months or one year, they lose all their money because money managers burn their accounts.

Usually, “signal followers” are profitable few months, and then they lose all investment. There are 10% of all traders in this group.

Stagnation traders

Stagnation traders represent traders that trade as a hobby, sometimes. Usually, they trade once or twice weekly, and they are positional or swing traders. Stagnation traders’ profitability is around zero because they do not lose money but are not profitable.

“Invest in Everything” traders.

“Invest in everything” traders usually invest in forex, as in stocks, commodities, ETFs, crypto, etc. They do not use fundamental and technical analysis; they buy “hot” assets.

Finally, the last two groups are profitable forex traders:

Profitable remote trader

- Earn monthly profit from $5K up to $100K

- Use prop trading companies’ capital or your capital larger than $100K.

- Disciplined and patient: A profitable forex trader will have a clear and well-defined trading plan and the discipline and patience to stick to it, even when unfavorable market conditions.

- Effective risk management: A profitable trader will use appropriate risk management techniques to manage their trading capital, limit their losses, and protect their profits. This can include using stop-loss orders, position sizing, and other risk management tools.

- Strong technical and fundamental analysis skills: A profitable forex trader will have a deep understanding of technical and fundamental analysis and will use these skills to identify potential trading opportunities and make informed trading decisions.

- Use of custom indicators or manual strategies: A profitable trader may use custom indicators or manual trading strategies to help them identify trading opportunities and make more effective trading decisions.

- Adaptability: A profitable trader can adapt to changing market conditions and adjust their trading strategies accordingly. This may involve changing their indicators or adjusting their trading plan based on market trends.

- Focus on long-term profitability: A profitable trader will be focused on achieving consistent profitability over the long term rather than seeking short-term gains at the expense of long-term success.

- Professionalism: Profitable traders will treat their trading as a professional business, focusing on risk management, profitability, and continued learning and improvement.

- Collaborative: A profitable trader working for a prop company will be a team player and able to collaborate effectively with colleagues, providing insight and contributing to a positive trading environment.

- Analytical: A profitable trader can analyze and evaluate their trading performance, identify improvement areas, and adjust their trading plan and strategies as needed.

By exhibiting these characteristics, a profitable forex remote trader can succeed in trading for prop companies using custom indicators or manual strategies.

“Big dogs” trader

“Big dogs” traders are professionally certified traders who work as employees for large investment companies, hedge funds, or prop companies. They sometimes earn more than 100K monthly and manage extensive portfolios.

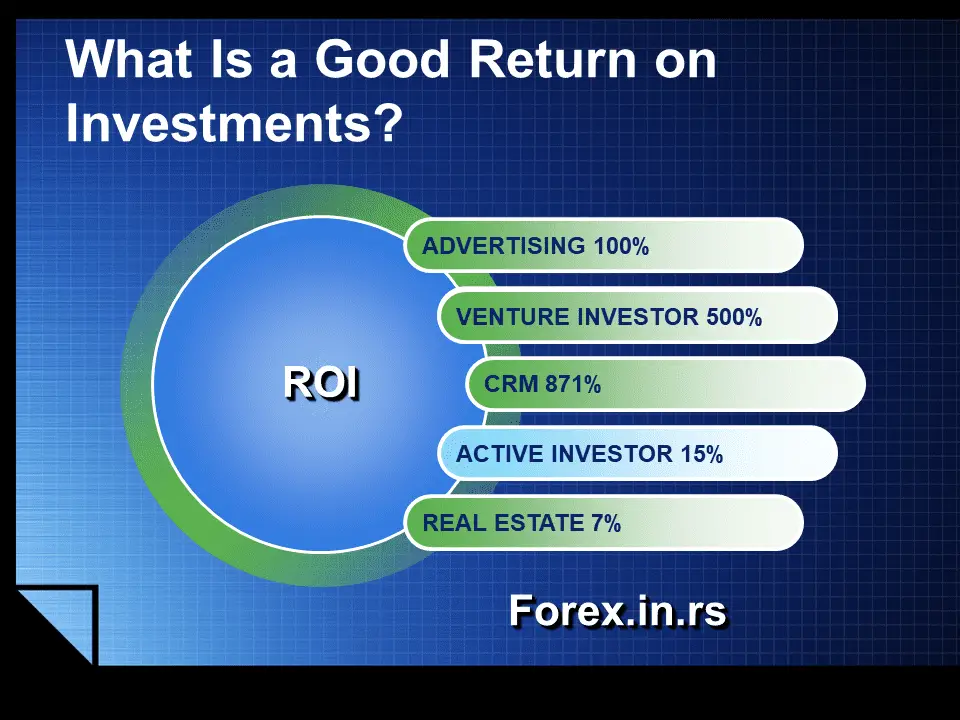

Forex trading profitability expectation

Based on ROI, forex trading is not a highly profitable business too. If traders risk less than 1% of the portfolio at the end of the successful year, profit can be 20%-25% on average. Many other professions offer better ROI (Return on investment).

Above, we can see the part answer to the question is forex trading profitable. Forex trading is a profitable business in the case when trading portfolio capital is significant. Forex trading ROI is less than many other businesses, such as IT business, advertising, etc. However, trading profitability is different when comparing less-than-million-dollar and billion-dollar businesses (significant capital) because each business is scalable. Investing and trading have enormous profitability with more substantial funds.

Many people have developed a misconception that forex trading is a scam. These people do not understand anything substantial about forex. I will be explaining how forex trading is a genuine way, if not one of the best ways, of making a lot of money online from your home.

Forex can not make people rich if they do not invest a large amount of money and do not follow risk management rules.

Forex trading does not require so much labor as other professions. External factors such as raw materials do not affect it as it is internet-based and has excellent flexibility and simplicity.

Beginners must equip themselves with many books on what happens in the trading and financial markets and join social media forums that chat about forex. Also, legitimate and reputable courses and successful forex traders with no ulterior motives or an easy-money mentality will help you. Notably, making money on forex involves overcoming failures before winning.

Forex trading is about taking well-calculated risks; the more extensive the risks, the more significant the potential to make huge profits. Successful forex traders would not be there if not for taking risks, and they do not hesitate to say it by themselves. Note that risks mean you should be prepared to lose at times according to the amount you risk. Ask yourself a couple of questions.

How big is my risk appetite? Should I continue after losing my first two trades? Even the most successful forex traders still make losses, but the question remains; can you handle failure? If not, stay away from forex. However, risk management and emotion management are what you must rely on to control yourself when risk-taking and emotions are putting pressure on you. That minimizes your chances of losing.

Whatever you plan on making on forex, it always boils down to forex trading profit per day. Your trading strategy and level of risk, and management determine how profitable your time on forex is to you. If you have not been winning, change your risk appetite level and trading strategy, and upgrade your forex’s understanding to win on forex. Losing traders trade for profit instead of skill is not correct. Skill is what brings profits.

Forex trading does not involve paying commissions, exchange, clearing, or brokerage fees (since forex has no middlemen). Brokers hang on bid/ask spread. You do your trading straight away with the market controlling the prices of currency pairs. Forex also does need big money for you to trade and make money. The absence of the above restrictions only helps you to make more money on forex.

Forex trader characteristics:

- Patience

- Discipline

- Objectivity

- Having Realistic Expectations

How Much Can You Make on Trading Forex?

Many people ask this question regularly. Determining the exact amount you can make from trading on forex is difficult. Whether successful or not, how much traders make depends on each trader’s skills and exercises on the platform.

The activities you carry out on forex and how often you stay determined how much you can make. However, your level of success, as per your risk levels, must be considered. Besides, we are all aware that forex trading is an unpredictable business. One key question is how good you are as a trader. Sometimes, months of big downpours come and go, giving traders huge profits. Dry months also come and go, giving traders huge losses. Successful traders take full advantage of such months of high yields to make significant profits.

Have you been wondering how do you profit from Forex trading?

70%-95% of traders lose money because of inadequate risk management, greed, overtrading, and lack of knowledge.

With Forex sitting as a global currency exchange market with almost two trillion dollars, it is understandable that you want a chunk of the profits. This is indeed possible when you trade in a responsible and well-informed manner. However, if you do not prepare well and do not commit to planning regarding the trades you make, you will experience the odds of being against you and being upset with the money you lose.

Risk and profitability

1. The risk of ruin is not linear in trading. The more money you lose, the harder it is to recover your losses.

If you trade and make a loss at some moment, 10%, you will need 11% to recover the loss in the following positions.

If you trade and make a loss at some moment 20%, you will need 25% to recover the following positions’ loss.

If you trade and make a loss at some moment 50%, you will need 100% to recover the loss in the following positions.

See Table below:

I will repeat this Table a lot of times. This is the most critical path to success. This is the difference between retail and pro traders. Pro traders do not have a drawdown in the portfolio above 10%.

One of the most important things to consider when determining whether currency trading offers potential profitability is leverage. Leverage refers to how much money you borrow from a broker to open a position – essentially using other people’s money (the broker) instead of your own. It enables traders with limited capital to enter into large trades without having enough money, but it can also result in heavy losses if not used responsibly. Generally speaking, higher leverage levels mean greater risk and greater potential rewards; traders need to understand their risk appetite before choosing their level of leverage and what types of risks they’re comfortable with taking.

When you max risk 1% of the portfolio in one moment, you can create a 10% drawdown in the long run, and then you need an 11% gain to recover from breaking even.

Retail traders with massive losses and drawdowns 50% or 30% – can be broke easily because they need a considerable percentage to recover their losses.

Money management for better profitability

As a trader, you need to have a strategy and edge and test that strategy statistically. Using the trading journal, you need to see when your system gives results and when it doesn’t.

My choice is the Kelly criterion as a mathematical formula relating to the long-term growth of capital developed by John L. Kelly. I use each trade to maximize long-term growth.

Mathematically shown in the formula below:

Position size = Winrate – ( 1- Winrate / RRR)

To get the Kelly ratio – we can use an example from my older article :

W = 26/50=0.52

R = (780/26)/ (600/24) =1.2

K% = W – [(1 – W) / R]

K% = 0.52- [(1 – 0.52) / 1.2]

K% = 12%

The goal is to compare various systems to see which system has the slightest risk.

Using this number, I can compare my strategies and performance – to improve myself as a trader.

Since there is much leveraging in the Forex market, such as up to fifty to one, this can present a high appeal, such as purchasing a lottery ticket. There is a relatively small opportunity to make a large sum of money. However, buying a lottery ticket is not the same, as it is not trading and is gambling. The odds are truly stacked against you about purchasing a lottery ticket.

To enter the Forex market better requires accurate and careful preparation. It is an excellent idea to commence with a practice account. This will prove to be risk-free and deeply helpful. As you engage in trading in your practice account, reading high-quality books about Forex trading is advised. You can readily access such books via Amazon for purchase or choose some books from your library if you do not wish to pay for such books.

Applying the information you can access from what you read is wise. This will allow you to engage in your trading strategies’ proper planning before going full speed ahead with trading. Sticking with your trading strategy instead of changing your plan frequently is advised. The truth is that the more one changes their trading strategy plan, the less likely they will make a profit. In other words, the Forex trade profit will slip away.

Conclusion

So how to become profitable in forex? Do not try to predict the market all the time and chase money. The trick is position sizing, small risk, and preparation for each trade. Wait for the right moment to enter the trade and always create a position exit plan.

Forex trading can be profitable for trading companies and high-volume retail traders, but it is not beneficial for most retail traders. Usually, 70%-95% of all retail traders lose all their money in trading yearly. The best forex trader in prop companies can profit from 20%-25% with less than 5% maximum drawdown.

Making a living off whatever trading activities you do is the goal of every trader, and the same is valid with forex traders. Forex is one of the best go-to marketplaces to make money. It does not need you to stress yourself looking for colossal capital to begin. With as little as 25 U.S. dollars, you can become a beginner in forex trading. Unlike other busy and big capital businesses, Forex allows you to trade anytime. You are good to go with enough demo account practice sessions, learning, and a complete understanding of forex trading and the market. However, even if you have undergone a lot of training on forex trading, practiced so hard, and planned so well, you will still not make money on forex if you lack self-belief. But, traders need to invest a lot of money for a good salary.

Overall, there is significant profit potential when trading forex – however, it’s essential not only for people interested in entering this exciting market to understand the basics but also to familiarise themselves with more advanced strategies to make informed decisions about when opening and closing positions. With the proper knowledge and best practices, you could potentially generate impressive returns from your investments over time!