Table of Contents

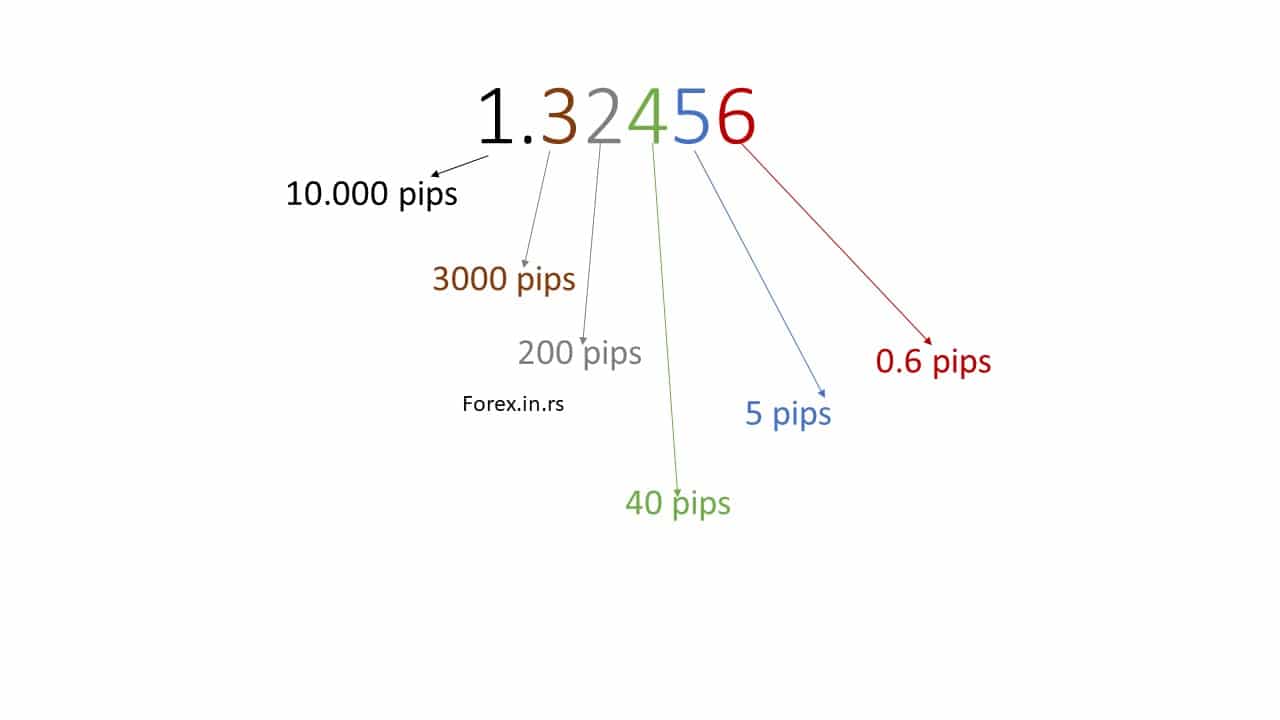

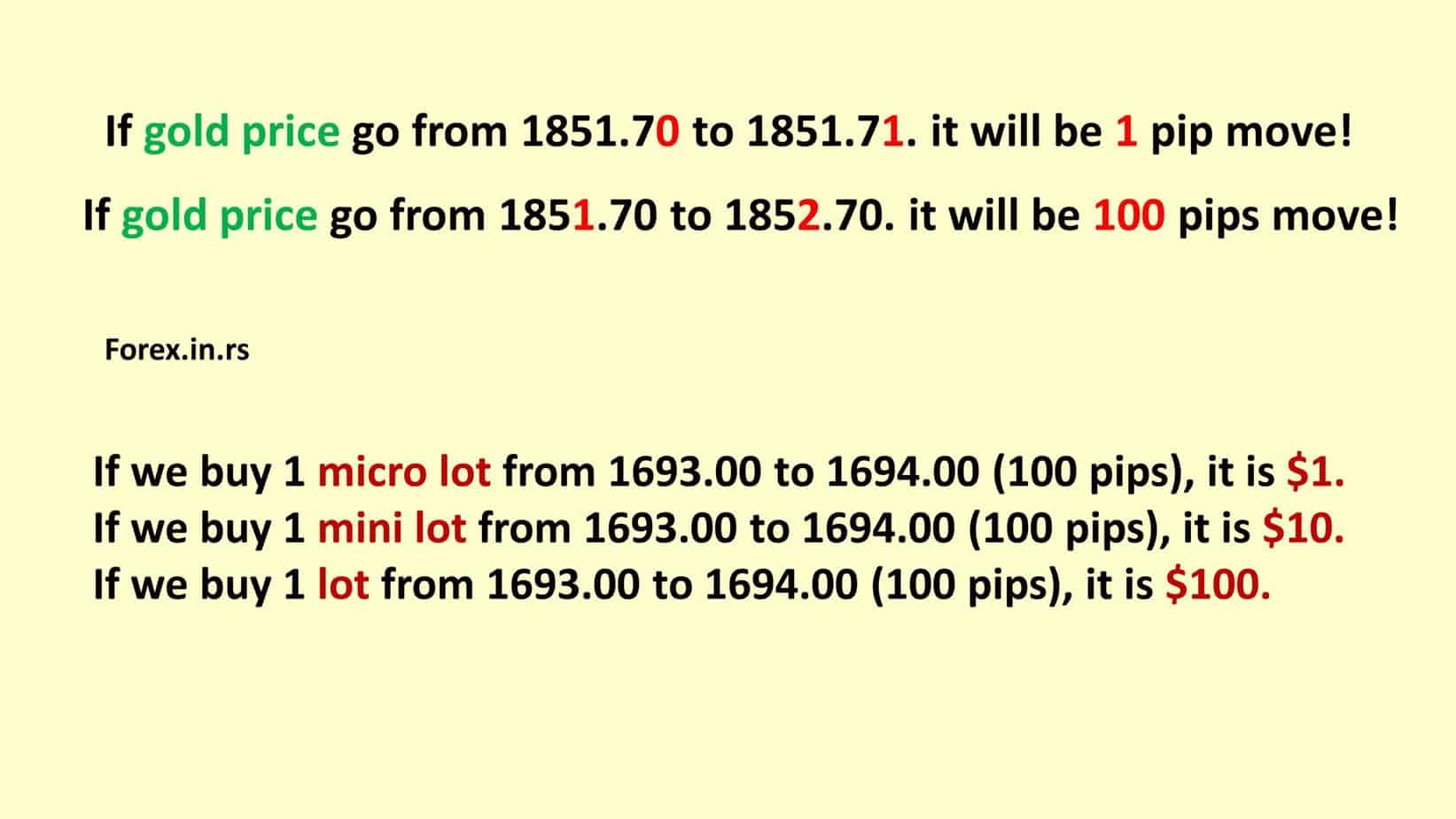

Pips, also known as price interest points, are one of the most fundamental terms in forex trading. Most forex traders have to deal with pips daily. A pip is a measurement unit representing the smallest change in a currency pair’s value. It is the fourth decimal place in a currency pair’s price. For instance, if the EUR/USD pair moves from 1.1234 to 1.1235, that represents a one-pip movement.

Pips help traders determine the profit or loss that they have made on a trade. A pip’s value depends on the size of the lot traded, which is why some traders prefer to use a pip value calculator. Understanding pips is crucial in forex trading as it enables traders to analyze the market and determine when to enter or exit a trade. Additionally, traders can use pips to measure risk and reward ratios, which helps to minimize losses and optimize profits. As such, for anyone looking to be a successful forex trader, understanding the concept of pips is vital.

However, we can see another expression, the basis point in terminology.

When it comes to trading and finance, it is essential to understand the language and the different terminologies used to help you make informed decisions. For example, basis points and pip are commonly used in the financial industry.

A basis point and a pip are measurement units used to express the movement in the value of a financial instrument, currency exchange rate, or interest rate. Understanding the difference between these terms can be crucial for traders, investors, and anyone involved in finance.

What is the Difference Between a Basis Point and a Pip?

In forex CFD trading, basis points and pips are equal values and represent percentage changes in the exchange rate. A basis point or pips are units of measurement equivalent to 1/100th of 1%, which means one basis point or pips equals 0.01%. However, the main difference between basis points and pips lies in their specific uses and the magnitude of the measurement.

We should use the bps (base point) expression when discussing interest rates, bond yields, and other financial metrics. On the other side, pip expression is characteristic of forex trading and CFD trading, and we need to use it when we describe currency pairs’ price changes.

What is a Basis Point?

A basis point is a unit of measurement equivalent to 1/100th of 1%, which means one basis point equals 0.01%. It is a standardized way of measuring the changes in interest rates, bond yields, and other financial instruments. A basis point is widely used in the financial industry to simplify calculations and express tiny percentage changes.

For example, if the interest rate moves from 2.50% to 2.60%, it has moved ten basis points or 0.10%. The term basis point is widely used to express the spread between different rates or the difference between bond yields.

What is a Pip?

A pip stands for “percentage in point,” a standardized measure of the movement in the exchange rates of currencies. As mentioned, one pip is the equivalent of 1/100th of 1% or one basis point. The slightest price movement is possible in a currency pair, representing the fourth decimal place for EURUSD or GBPUSD in the exchange rate.

For instance, if the EUR/USD pair moves from 1.2000 to 1.2010, it has moved ten pips. A pip is widely used in Forex trading to quantify the profit or loss of a trade. To learn more, visit our article on how to calculate pips.

Difference Between a Basis Point and Pip

Basis Points (bps):

- Equal to one-hundredth of one percentage point or 0.01%

- Used to measure changes in interest rates, bond yields, and other financial metrics

- Represents small percentage changes

Pips:

- It stands for “percentage in point.”

- Used in currency trading to measure the slightest price change in a currency pair

- Most currency pairs have one pip as the fourth decimal place

- Some currency pairs may have different pip values (e.g., Japanese yen)

- Represents the smallest price change in a currency pair

Both basis points (bps) and pips are units of measurement used in finance and trading to denote changes in financial instruments’ value, such as currencies or bonds. However, the main difference between basis points and pips lies in their specific uses and the magnitude of the measurement.

A basis point (bps) equals one-hundredth of one percentage point or 0.01%. For example, a change in interest rates from 3.00% to 3.25% represents an increase of 25 bps. Basis points are commonly used to measure changes in interest rates, bond yields, and other financial metrics where small percentage changes are significant.

On the other hand, a pip stands for “percentage in point” and is a unit of measurement used in currency trading to measure the smallest price change in a currency pair. For most currency pairs, one pip represents the fourth decimal place, such as the change from 1.2000 to 1.2001. However, some currency pairs may have different pip values, such as the Japanese yen, which has a pip value of 0.01 due to its lower exchange rate than other major currencies.

While both the pip and the basis point represent a percentage change, they are used to express different things. For example, a basis point measures the percentage change between two interest rates or bond yields, while a pip measures the percentage change in the exchange rate of two currencies.

Another difference is in the way these two units are expressed. For example, a basis point is expressed in decimal points, while pips are expressed in fractional terms, typically including two decimal places.

Furthermore, while a pip represents a slight price movement in the currency exchange rate, a basis point can mean a more significant move, typically used when dealing with expressed interest rates. For instance, a change in interest rates of 0.25% would represent 25 basis points. However, the equivalent in pips would depend on the currency pair being considered, as different currency pairs have varying pip values.

Conclusion

To sum up, the difference between a basis point and a pip lies in what they measure and how they are expressed. A basis point calculates the percentage change between two interest rates or bond yields. At the same time, a pip measures the percentage change in the exchange rate of two currencies addition; a basis point is expressed in decimal points, while a pip is expressed in fractional terms. Proper knowledge and understanding of these terms can help you make informed decisions when dealing with financial instruments and currency pairs as a trader or investor.