Table of Contents

Unlike stock exchanges with centralized governing bodies like the New York Stock Exchange or Nasdaq, the forex market operates decentralized. This decentralized structure is characterized by an extensive network of interbank transactions that occur around the clock, spanning different time zones and continents. The absence of a central authority may lead one to wonder who, if anyone, is responsible for overseeing this colossal market.

Who Control Forex?

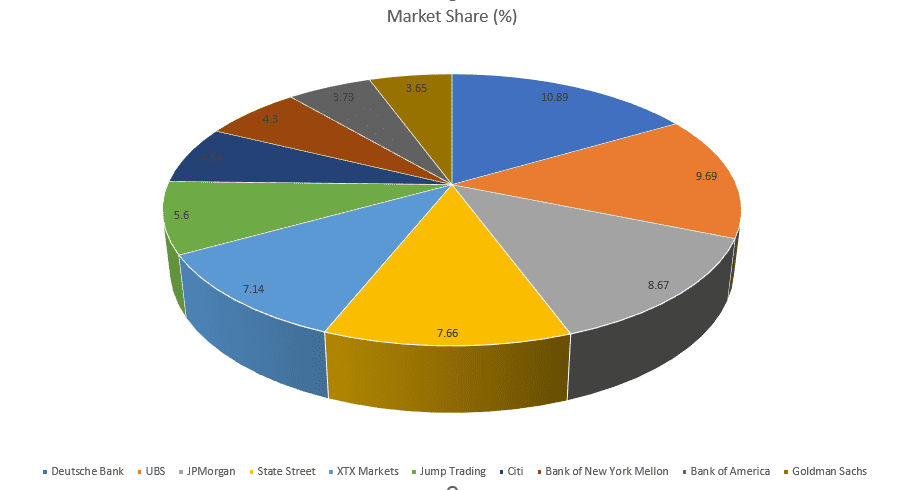

The forex market is not controlled by any single entity or institution because it is a decentralized market where there is no one physical location where investors go to buy and sell currencies. However, ten leading commercial banks that do not control but move the Forex Market have a 65.87% market share.

Please see my video:

At the helm of the forex market are the central banks and governments, which control the exchange rate and interest rates to ensure stability in the economy. They intervene in the market by buying or selling currencies at scale to manage exchange rates that are too low or high. This intervention is crucial to maintain the balance of the global economy and prevent chaos in the currency markets.

The forex market is also a favorite among hedge funds and investment managers. These entities use forex to hedge against international currency and interest rate risks, speculate on geopolitical events, and diversify their portfolios. The high liquidity and volatility of the forex market make it an attractive option for traders who seek to make profits from short-term movements.

Multinational corporations also participate in the forex market to hedge currency risks from doing business in foreign countries. They buy and sell currencies to protect their revenues and ensure the stability of their cash flows.

Lastly, we have individual retail traders, who make up a small portion of the forex volume. Despite this, they play a crucial role in the forex market by creating liquidity and market depth. Retail traders use the forex market mainly to speculate and day trade, hoping to make small profits from the price movements of different currencies.

Based on the latest 2023 Euromoney report, the top 10 largest banks in the forex market have 65,87% of the market share as follows:

| Bank | Market Share (%) |

|---|---|

| Deutsche Bank | 10.89 |

| UBS | 9.69 |

| JPMorgan | 8.67 |

| State Street | 7.66 |

| XTX Markets | 7.14 |

| Jump Trading | 5.6 |

| Citi | 4.54 |

| Bank of New York Mellon | 4.3 |

| Bank of America | 3.73 |

| Goldman Sachs | 3.65 |

The unique distinctions that separate institutions with direct interbank access from other participants in the foreign exchange market can be summarized as follows:

- Access to Tight Pricing: One of the most significant advantages of having direct interbank access is the ability to access tight pricing. Tight pricing refers to the small spread between the bid and ask price for a currency pair in the foreign exchange market. Since the interbank market is where large banks and other financial institutions trade currencies with each other, the volume of transactions is incredibly high. This high trading volume leads to a minimal spread and tight pricing. This allows those with direct access to save significantly on transaction costs.

- Access to Best Liquidity: Liquidity in the foreign exchange market refers to the ease with which a currency can be bought or sold without affecting its price. Those with direct interbank access can make larger trades more efficiently and with less price slippage than those without. The interbank market has the most liquidity of any part of the foreign exchange market because of the massive volumes of currency traded there daily.

- Credit Line System: Institutions must be large and financially stable enough to secure credit lines from top-tier banks to be part of the direct interbank market. These credit lines allow these institutions to borrow money to trade, enabling them to make large transactions without depositing equivalent cash.

- Market Influence: Due to the size of their transactions, these institutions can also significantly impact currency exchange rates. They can move the market in ways smaller players cannot, making them significant actors in the global financial landscape.

- Exclusivity and Hierarchy: Interbank market access is limited to a select group of financial institutions, creating a clear hierarchy within the forex market. This includes major banks, certain hedge funds, and other large financial institutions. Other market participants, such as smaller banks, corporations, and retail forex brokers, have lesser access and often face higher transaction costs.

Now we can answer another similar question:

Who Own Forex?

The Forex market is not owned by any single entity or institution because it is a decentralized market without a physical location. The top ten leading commercial banks have 65.87% of the market’s share, but they do not control it; they only have the impact of the market movements.

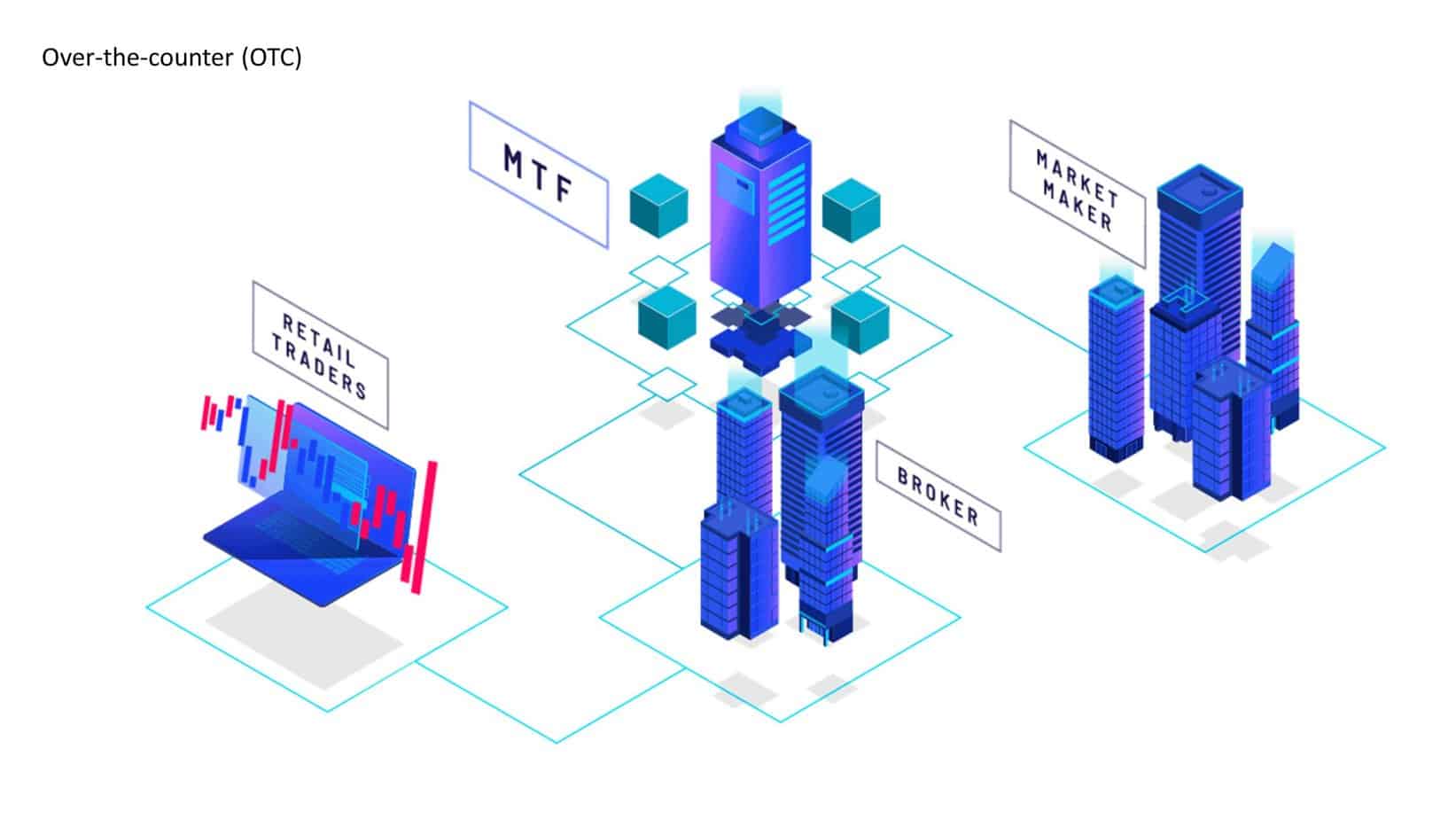

The interbank market is a fascinating example of decentralized financial operations. Unlike many other market structures, a central authority doesn’t govern it. Instead, it’s a peer-to-peer system where each participating institution can simultaneously act as a currency buyer and seller.

This system is governed by a heart: exchange rates. Financial institutions, such as banks, utilize these rates to facilitate their transactions of buying and selling currencies. But these rates aren’t merely indicative. They represent actual dealing prices, ensuring that every transaction is based on reliable, fair, and transparent pricing.

The mechanism that maintains the uniformity of these rates is genuinely remarkable. Picture a network where prices from hundreds of institutions are instantaneously aggregated, resulting in a price derived from a vast array of crossed prices. Such technological prowess ensures each transaction’s reliability, fostering an environment of fairness and transparency within the financial ecosystem.

A distinct advantage of the interbank market is its ability to maintain narrow spreads, referring to the gap between a given currency’s buying and selling prices. Intense competition among banks ensures that these spreads remain tight. The underlying principle is simple: banks that wish to attract customers and safeguard their market share must offer the most attractive prices.

To streamline transactions, the interbank market heavily relies on electronic currency networks. These sophisticated systems serve as hubs, linking buyers with sellers and ensuring the accuracy and speed of transactions. As technology advances, these electronic networks become even more efficient, making transactions quicker and more precise.

However, the interbank market isn’t immune to challenges. Its operations can suffer shocks if multiple institutions default on their obligations. Yet, the market’s decentralized nature is the silver lining in these potential clouds. This structure disperses risks across multiple players, thereby diluting the impact of any single institution’s failure and contributing to the overall resilience of the financial system.

Does Politic impact the forex market?

Politics significantly influence the forex market, shaping a country’s economic policies and stability and impacting its currency’s value. However, given its decentralized nature, politics does not control the forex market, where multiple factors and actors contribute to its dynamics.

A country’s political landscape can shape its economic health and investor perception, leading to currency fluctuations. For instance, rampant corruption and poor governance can deter foreign investment, diminishing demand for the currency and causing depreciation. Likewise, the failure to curtail illegal activities like money laundering can erode investor confidence and negatively impact the currency’s value.

Political instability, such as terrorist attacks, can destabilize the economy, reduce foreign investment and tourism, and depress currency value. Conversely, a popular political leader can instill investor confidence, boost the economy, and enhance the value of a nation’s currency.

Economic indicators tied to political decisions, like the housing market’s health, can also influence a currency’s value. A thriving housing market signals economic growth and a robust job market, increasing demand for the currency and its value.

Forex Market Participants

- Commercial Banks: These institutions trade currencies on behalf of their customers or for themselves. They facilitate international trade by exchanging the currencies of different countries.

- Governments and Central Banks: Governments and central banks, such as the Federal Reserve in the U.S., manage currency stability and economic growth. They can influence the Forex market by implementing policies that affect currency values, such as changing interest rates or quantitative easing.

- Hedge Funds: Hedge funds speculate on currency movements to profit from volatility in the Forex market. They use complex strategies, including leverage, to amplify returns.

- Real Money: This term usually refers to institutional investors such as pension funds, mutual funds, and insurance companies. They use the Forex market to hedge against currency risks in their international investments.

- Sovereign Wealth Funds: These state-owned investment funds trade currencies to hedge their portfolios or profit from currency movements. Their size can influence the Forex market significantly.

- Prime Brokers are large financial institutions providing services to market participants like hedge funds. They provide leverage, lend securities, and execute trades.

- Retail Brokers: These brokers act as intermediaries for retail traders, providing them access to the Forex market. They earn money through spreads and commissions.

- Proprietary Trading Firms: These firms trade their money on the Forex market to make profits. They can be significant players in the Forex market due to their high-volume trading.

- Money Transfer/Remittance Companies: These firms must buy and sell currencies to provide services, including helping individuals send money between countries.

- Foreign Exchange Fixing refers to the daily monetary exchange rate fixed by national banks or related organizations. It provides a standardized measure for currency conversion, particularly relevant for businesses and investors.

- Commercial Companies: Firms that conduct business in foreign countries use the Forex market to convert profits from foreign sales into their domestic currency. They may also use Forex markets to hedge against potential currency shifts.

- Retail Traders: These are individuals who trade on the Forex market. They often use the leverage brokers provide and trade based on market speculation. Retail traders have a minor impact on the forex market based on market share.

Central Banks

Central banks’ announcement of monetary policy decisions is another significant factor impacting the forex market. Traders and investors carefully scrutinize these announcements to predict future economic conditions and make decisions accordingly. For example, if a central bank hints at tightening its monetary policy in the future, it might indicate an upcoming rise in interest rates, which could strengthen its currency.

In my opinion, there are eight essential impacts of Central banks on the forex market:

- Interest Rate Decisions: Central banks regulate interest rates to control inflation and economic growth. Higher interest rates can attract foreign investors, increasing the demand and value of the currency. Lower interest rates might reduce its attractiveness, lowering demand and value.

- Currency Interventions: Central banks can buy or sell their currency in the forex market to stabilize its value. They might intervene if a currency’s value rises or falls too quickly.

- Foreign Exchange Reserves: Central banks hold foreign currency deposits known as reserves. These reserves help stabilize a country’s currency and reflect its ability to repay foreign debts.

- Public Statements or “Jawboning”: Central banks can influence market participants’ behavior and affect their currency’s value by making public statements about desired exchange rate levels.

- Monetary Policy Announcements: Central banks’ statements about their monetary policies can impact future economic conditions. Traders analyze these announcements to predict how a currency might perform.

- Open Market Operations: Central banks buy or sell government securities in the open market to regulate the money supply. These operations can affect a currency’s value in the forex market.

- Economic Stability Measures: In times of economic instability, central banks might implement measures like quantitative easing to stimulate growth. While these actions can boost the economy, they might also result in a currency’s depreciation in the forex market.

- Inflation Control: Central banks aim to maintain optimal inflation levels. High inflation can devalue a currency, while low inflation can increase a currency’s value.

The role of the central banks in maintaining economic stability. During economic instability or crisis, central banks can implement measures such as quantitative easing, increasing the money supply by buying government bonds and other securities. This action is often taken to stimulate economic growth. Still, it can also weaken the currency in the forex market due to the increased money supply.

Commercial banks

Commercial banks are critical players in the forex market due to the sheer volume of trades they facilitate and the vast amounts of capital they manage. The market share report from 2023 shows that some commercial banks hold significant influence in the forex market.

- Deutsche Bank: With a market share of 10.89%, Deutsche Bank is the leading player in the forex market. Based on their size and influence, trading decisions, forecasts, and analyses can significantly impact currency exchange rates; its large trading volume also enables it to provide liquidity to the market, making it easier for other participants to buy and sell currencies.

- UBS: UBS’s 9.69% market share makes it another dominant force in the forex market. As one of the world’s largest and most well-known banks, UBS’s actions can drive market trends and influence investor sentiment. Other market participants often use its research and market analysis reports to inform their trading decisions.

- JPMorgan: With an 8.67% market share, JPMorgan also plays a vital role in the forex market. Its global presence and extensive client base mean it has a large volume of forex transactions, contributing to overall market liquidity. Additionally, its market predictions and investment strategies are closely followed by traders worldwide.

- State Street and XTX Markets: State Street, with a 7.66% market share, and XTX Markets, with a 7.14% market share, significantly contribute to the forex market. Both institutions have a vast client base, including other financial institutions, corporations, and governments, and their trading activities help shape currency trends and provide market liquidity.

- Jump Trading, Citi, Bank of New York Mellon, Bank of America, and Goldman Sachs: With market shares ranging from 3.65% to 5.6%, these banks also influence the forex market. Their trading activities can affect exchange rates, and their market analyses and forecasts can shape market sentiment. Furthermore, they also contribute to market liquidity, facilitating the trading activities of other market participants.

As we can see from a previous market share of 65.87% for the top 10 large commercial banks in the forex market, we can see that commercial banks indeed have the most significant impact on the forex market.

Hedge Funds

Investment managers and hedge funds wield substantial influence in the forex market. They manage large portfolios and carry out currency trades for various sizable accounts, including pension funds, endowments, and foundations. Due to the sheer size of their portfolios and the frequency with which they engage in trades, they are critical participants in the forex market.

When investment managers and hedge funds buy and sell currencies as part of their operations, they often have a measurable impact on the value of those currencies. For example, if an investment manager decides to diversify a client’s portfolio and invest in foreign securities, they may need to purchase a significant amount of the relevant foreign currency.

This increase in demand can lead to a strengthening of that currency’s value against other currencies. Conversely, if the investment manager decides to sell those foreign securities, this may decrease demand for the relevant currency and consequently lower its value.

Hedge funds, on the other hand, often involve speculative currency trading in their strategies. For example, a hedge fund may use leverage to make a substantial bet on the rise or fall of a particular currency’s value. The speculation involved in such trades can cause significant fluctuations in the value of that currency.

The impact of such fluctuations can create ripple effects throughout the forex market, influencing the trading behavior of other participants and potentially prompting actions from central banks. Hedge funds maybe do not control the forex market but have some impact.

Therefore, investment managers and hedge funds can contribute significantly to currency exchange rate volatility. However, it’s essential to remember that the forex market is a vast, interconnected system with many factors contributing to exchange rate fluctuations.

While they can create volatility, investment managers and hedge funds also play a vital role in providing liquidity to the forex market and managing risk for their clients. They are key players, and other participants in the forex market closely watch their actions and strategies.

Here are some of the most significant hedge funds globally, which command a strong presence in the forex market due to their sheer size, the scale of their operations, and their sophisticated trading strategies:

- Bridgewater Associates: Founded by Ray Dalio in 1975, Bridgewater is one of the world’s largest and most well-known hedge funds. It manages assets for various institutional clients, including pension funds, endowments, foundations, foreign governments, and central banks.

- Renaissance Technologies: Renowned for its mathematical and statistical approach to investing, Renaissance Technologies is considered one of the most successful hedge funds. Its Medallion Fund is particularly famous for its impressive returns.

- Man Group: Founded in 1783, the Man Group is one of the oldest active hedge funds in the world. It’s known for its diversified business model, offering various strategies such as quantitative (through Man AHL and Man Numeric), discretionary (through Man GLG), and private markets (through Man GPM).

- AQR Capital Management: Known for its systematic and quantitative approach to investing, AQR Capital Management employs diverse strategies, including investing in traditional assets like stocks and bonds and more complex assets like derivatives.

- Two Sigma: Two Sigma is known for using technology and data science to drive its investment strategies. It combines the systematic trading methods of a quantitative hedge fund with discretionary strategies.

- BlackRock: While not strictly a hedge fund, BlackRock’s size, and influence are such that its actions can significantly impact financial markets, including the forex market. BlackRock manages many assets, including equities, fixed income, and alternative investments.

Multinational companies

Multinational corporations exert considerable influence on the market due to their sizeable forex transactions. As global entities, these companies deal with various currencies for purchasing goods and services or making investments, leading to a significant exchange of currencies every day.

Their trading volumes alone can sway the forex market. Multinational corporations, with their large cash reserves, often engage in currency movements. For instance, when a large corporation trades billions of dollars worth of currency, it can trigger significant shifts in the exchange rate within a short period.

Moreover, their foreign investments can cause considerable currency fluctuations. When a multinational corporation invests in a foreign country, it must convert its home currency into the host country’s currency, creating a high demand for foreign currency. This demand can lead to an appreciation of the foreign currency’s value. Conversely, if the corporation withdraws its investment, it must convert the currency back, leading to an increase in supply and, subsequently, a depreciation in the foreign currency’s value.

However, multinational corporations also contribute to market stability through their hedging strategies. Using forex transactions like currency swaps, these corporations can mitigate their exposure to foreign currency risk, providing an added layer of stability to the forex market.

Here is a list of some of the world’s largest multinational corporations that have significant impacts on the forex market due to their extensive international operations:

- Walmart: The retail giant operates worldwide, with a significant presence in countries like the USA, Canada, and Mexico.

- Amazon: With its global e-commerce operations and cloud services, Amazon is a significant player in the forex market.

- Apple: One of the world’s most valuable companies, Apple operates in numerous countries around the globe.

- Exxon Mobil: This energy company operates in numerous countries involving substantial currency transactions.

- Royal Dutch Shell: Another giant in the energy sector, Shell operates in many countries and regions, influencing the forex market.

- Volkswagen: This German automotive company has a significant global presence, making it an essential player in the forex market.

- Toyota Motor: Toyota’s operations span many continents, impacting various currencies.

- Berkshire Hathaway: Warren Buffet’s conglomerate has diverse global investments.

- Microsoft: As a global tech company, Microsoft deals in various currencies due to its worldwide operations.

- Johnson & Johnson: The pharmaceutical giant has a broad global reach and influences multiple currencies.

Sovereign wealth funds

Sovereign wealth funds (SWFs), managed by state-owned investment bodies, substantially impact the foreign exchange (forex) market. These funds typically originate from countries with significant foreign currency inflows, such as Qatar and Kuwait, primarily from their rich natural gas and oil reserves.

These funds manage vast amounts of capital, and their investment decisions lead to enormous transactions, impacting currency exchange rates and instigating volatility within the market. When sovereign wealth funds execute significant purchases or sales of foreign currency, they can dramatically influence exchange rates, which, in turn, can affect associated businesses and markets. The impact can be positive or negative, depending on the situation’s specifics. For instance, if an SWF sells a large volume of a particular currency, it may result in the depreciation of that currency’s value and potentially increased demand for other currencies.

Additionally, the investments of these funds often serve as indicators of a country’s economic health and prospects. Foreign investors may view these funds as signals of a stable investment climate, potentially leading to further investments in that country.

As we can see, Sovereign Wealth Funds can not control the forex market but can have an impact.

The world’s largest Sovereign Wealth Funds, based on their total assets, are:

- Norway’s Government Pension Fund Global: Also known as the Norwegian Oil Fund, it’s the largest sovereign wealth fund in the world, with assets exceeding $1 trillion.

- China’s China Investment Corporation (CIC): CIC is one of the most prominent sovereign wealth funds, with hundreds of billions of dollars in assets.

- Abu Dhabi Investment Authority (ADIA): This is the sovereign wealth fund for the Emirate of Abu Dhabi, managing a large amount of the country’s oil surplus.

- Kuwait Investment Authority (KIA): As the world’s first sovereign wealth fund, the KIA manages a significant portion of the country’s oil revenues.

- Saudi Arabia’s Public Investment Fund (PIF): The PIF is Saudi Arabia’s leading sovereign wealth fund and is vital in diversifying its economy.

- Singapore’s GIC Private Limited: Formerly known as the Government of Singapore Investment Corporation, GIC manages Singapore’s foreign reserves.

- Singapore’s Temasek Holdings: Another central fund from Singapore, Temasek Holdings manages a diverse portfolio of investments.

- China’s National Social Security Fund: This fund was established to serve China’s social security needs and has grown significantly in size.

- Qatar Investment Authority (QIA): The QIA manages the oil and gas surpluses of the Qatari economy.

- Hong Kong’s Hong Kong Monetary Authority Investment Portfolio (HKMA IP): The HKMA IP manages a significant portion of Hong Kong’s Exchange Fund.

Conclusion

As a decentralized marketplace, the forex market isn’t controlled by any single entity or institution. It’s an intricate network where many participants – including central banks, commercial banks, multinational corporations, sovereign wealth funds, hedge funds, and investment managers – come together to buy and sell currencies. These participants collectively contribute to the market dynamics observed in the forex market.

Central banks play a crucial role by adjusting interest rates and engaging in currency interventions to stabilize their currencies’ values. Commercial banks, which hold a significant market share, provide liquidity, facilitate trades, and actively engage in speculation. With Deutsche Bank, UBS, and JPMorgan leading the pack, ten central commercial banks account for 65.87% of the forex market, greatly influencing its flow.

Multinational corporations impact the forex market through their foreign trade and investment activities. In contrast, investment managers and hedge funds, managing vast portfolios, can drive demand for certain currencies and contribute to market volatility. Sovereign wealth funds, often linked to countries with abundant resources, can substantially influence the forex market with large-scale currency transactions.

While no single participant controls the forex market, their collective actions define its trends and dynamics. They contribute to the ebb and flow of currency values and create the complex, interconnected web that is the global forex market.