Traders often attempt to develop Expert Advisors (EAs) to outperform the market, but this approach is typically a significant mistake. Instead, traders should focus on creating a trading system that aligns with the strategies employed by large institutions.

These institutions often gravitate towards trading on crucial price levels where most trading volume is concentrated. By adopting a strategy in sync with institutional practices and trading at these critical levels, traders can increase the probability of success in the market. Consequently, this shift in mindset can lead to more sustainable and profitable trading strategies.

While avoiding essential price levels for stop loss, targets, and entry positions can be a significant error, it is not the most critical mistake made by quants. The most significant blunder lies in the improper application of filters within their trading systems. These filters play a pivotal role in determining the conditions under which a trade is executed or avoided, and any inaccuracies or inadequacies in their design can lead to flawed trading decisions. Therefore, quants should prioritize developing and refining effective filters to enhance the reliability and profitability of their trading strategies.

Please watch my video for more info:

One common mistake in optimizing Expert Advisors (EAs) is the belief that adding rules to follow the primary trend across different time frames will improve accuracy. For instance, if an EA is programmed to buy when a bullish indicator appears on the M30 chart, traders may think adding a rule to follow the bullish trend on the H4 chart will enhance performance. However, this logic often fails in practice; in some cases, it can even worsen accuracy.

This misconception is rooted in the market’s complex dynamics. When traders add rules to filter trades across multiple time frames, they might inadvertently reduce the number of viable trading opportunities. This can result in missed profitable trades, as the market doesn’t always align perfectly across different time frames. Additionally, over-optimization can lead to curve-fitting, where the EA becomes overly tailored to historical data but fails to perform well in real-time conditions.

To determine the effectiveness of such modifications, traders should rigorously test their EAs on a wide range of historical data, ideally from different market conditions and periods. This extensive testing is crucial to assess whether the added rules improve accuracy or introduce unnecessary complexity. It’s important to note that the best trading strategies often rely on simplicity and robustness rather than overcomplicated rules. A well-balanced approach to EA optimization is essential, considering factors like risk management, position sizing, and the inherent limitations of technical indicators and time frame analysis.

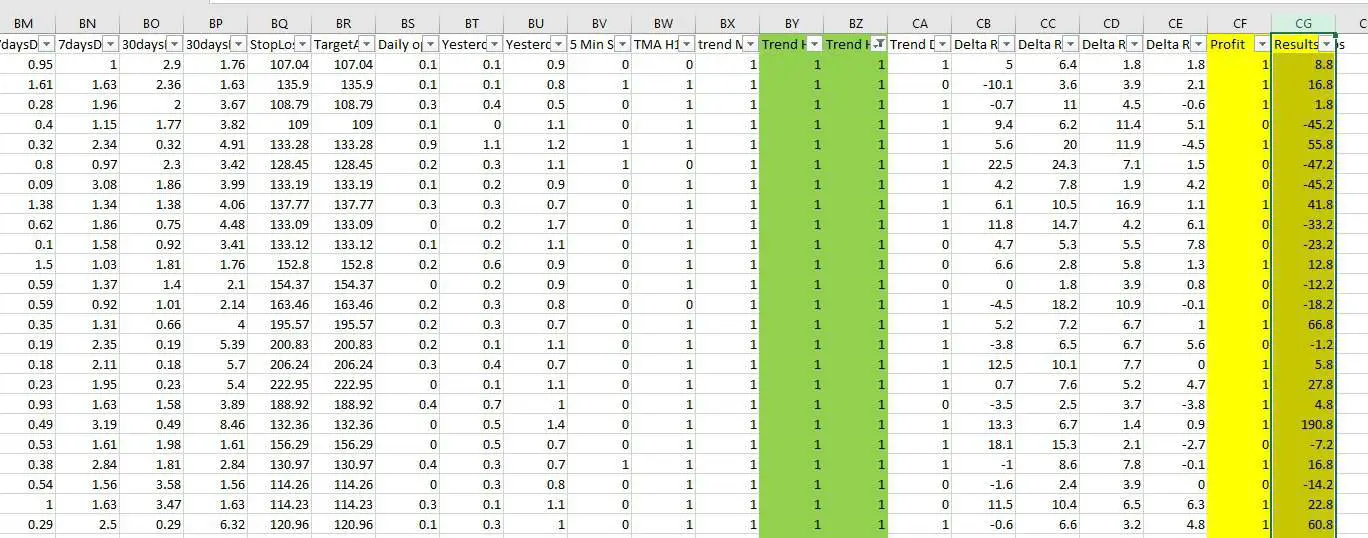

Look at one example that I showed in the video above:

Data from the Fxigor database used for machine learning (more than 200 features and 20 years of data)

As you can see in the video, when I filter data and set bullish trend features for H1 and H4,l, I get worse resultsts than when I test only with ththe e H1 trend rule.

Filtering data and setting bullish trend features for both H1 and H4 timeframes can often yield worse results than testing with just the H1 trend rule. This is because the market dynamics on different timeframes can sometimes conflict. When an EA follows trends on multiple timeframes, it may lead to fewer trading opportunities, missing out on profitable trades that align with the primary trend on H1.

The discrepancy between the two timeframes can also introduce more complexity, making it harder to adapt to changing market conditions. Additionally, over-optimization can occur when trying to fit the strategy to both timeframes, leading to poor performance in real-time trading. In many cases, a simpler and more focused approach, such as relying solely on H1 trend rules, can be more effective in achieving consistent trading results. Traders should thoroughly test their strategies to determine the best approach based on their specific goals and market conditions.

Using the same trend filtering across different timeframes can be ineffective because market dynamics on various timeframes may not always align. Instead, employing machine learning methods to identify the best model can yield superior results by adapting to evolving market conditions and uncovering patterns that may not be apparent through static rule-based filtering.

Conclusion

I’ve discussed the common mistake of attempting to improve accuracy by filtering data and setting trend rules across multiple timeframes, which can often lead to decreased performance due to conflicting market dynamics. Traders need to recognize that simplicity and robustness in trading strategies can often outperform overly complex approaches.

Moreover, the conversation emphasized the significance of thorough testing and avoiding over-optimization, which can result in strategies that work well in historical data but fail in real-world trading. Instead, machine learning methods were recommended as a more adaptive and effective way to identify profitable trading models that can maximize profit potential.