Round numbers in pricing, often referred to as psychological pricing levels, hold significant importance in financial markets and trading. These levels, such as 50, 100, or 1000, are manageable for traders to remember and often act as mental benchmarks. As a result, these round numbers can become self-fulfilling prophecies, where traders expect significant market reactions at these levels, leading to increased buying or selling activity.

The mystique surrounding these numbers is rooted in behavioral finance, where psychological and emotional factors influence the financial decisions of traders. This can increase market volatility around these levels, as traders might place stop-loss orders or target profits at these round numbers, further reinforcing their significance.

In this article, I will describe my journey over the last two weeks, where I had a lot of trades using round numbers for entry, stop loss, and target levels.

But before that:

Please check my video with detailed examples:

In trading, round numbers refer to price levels perceived as psychologically significant due to their simplicity and memorability, such as 10, 50, 100, or 1000. These levels often act as critical points of support, resistance, or targets for traders, as they tend to place orders around these numbers, influencing market behavior.

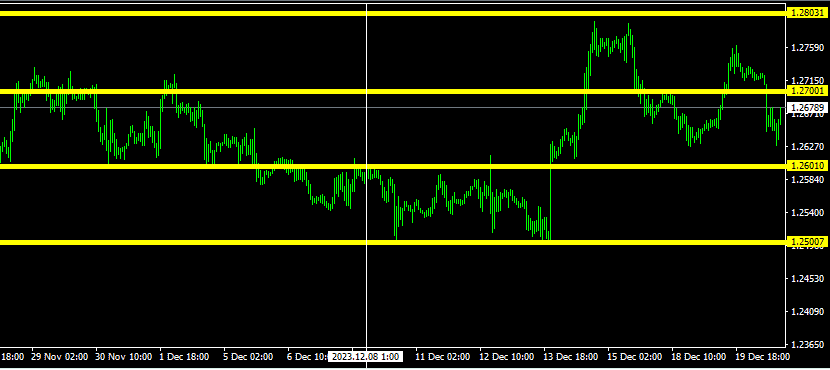

In the image below, I put GBPUSD round numbers that are active in the last 30 days:

As you can see, level 1.26 was two times support and resistance. All levels on this image were essential price levels in the last 30 days. However, sometimes round numbers are not critical price levels but only soft ones.

While round numbers in trading are often considered critical psychological levels, they can be soft or insignificant in 10-20% of cases. This variability occurs because many factors beyond psychological pricing, such as fundamental news, economic indicators, and technical patterns, influence market dynamics.

In these instances, the market may not react strongly to round numbers, as traders might focus more on other, more pressing drivers of price movement. Consequently, while round numbers are helpful as general guides, they do not always command the decisive market response that is typically anticipated.

So a summary remember:

- Psychological Significance: Round numbers act as mental benchmarks in trading due to their simplicity and ease of recall.

- Support and Resistance: These levels often become support or resistance points as traders place orders around them.

- Market Expectations: Traders may expect significant reactions at round number levels, potentially leading to self-fulfilling prophecies.

- Variable Impact: The influence of round numbers can vary; they are not always definitive, as market dynamics are affected by various factors.

- Strategic Use: Traders use round numbers to set targets, stop losses, and enter or exit points.

- Volatility Indicators: Due to concentrated trading activity, markets can experience increased volatility around these levels.

- Not Always Conclusive: While important, round numbers should be considered alongside other technical and fundamental analysis tools for a comprehensive trading strategy.

Personal Story

I, an intraday trader, had my eyes intently set on the 1.2504 price level, anticipating a significant market movement triggered by the upcoming Federal Reserve (Fed) announcement. With a calculated strategy, I placed a tight stop loss of just five pips, understanding the potential volatility such news events often bring. My target was ambitious, aiming for a 125-pip gain, a move that could capitalize on any significant currency fluctuations.

As the moment of the Fed announcement drew near, the tension was palpable. Then, the news hit: the Fed adopted a dovish stance, unexpectedly influenced by recent favorable inflation reports. Contrary to the market’s expectations, these reports were not seen as a trigger for an interest rate increase. Instead, the Fed hinted at a potential interest rate reduction in the spring, which spelled weakness for the dollar.

In the ensuing market reaction, the currency pair surged in my favor. The price swiftly crossed my target level, and in just a few exhilarating minutes, I realized a staggering profit of $14,000. This trade was a vivid reminder of how quickly fortunes can change in the trading world, especially when riding the waves of significant economic announcements.

So, in the end, do not forget this:

Round numbers in trading serve as psychological benchmarks, often influencing trader behavior and market movements due to their simplicity and memorability. However, their significance can vary, as other factors like economic data, technical indicators, and global events also drive market dynamics. Therefore, while round numbers are valid reference points, their impact on the market should be considered with a broader range of trading signals and conditions.