PAMM accounts are managed trading accounts designed to offer forex traders the opportunity to access professional money management services. PAMM stands for Percentage Allocation Management Module and is a form of investment that links an investor’s capital with an experienced trader’s expertise. With this type of account, the investor can essentially “outsource” the trading decisions to another person – the manager – who will make all trading decisions on behalf of their clients, most often without any input or consent from them. The manager will usually have access to higher levels of leverage and better spreads than most individual investors have access to, so they can maximize profits while minimizing risk.

With a PAMM account, investors don’t need to worry about making their manual trades; instead, they provide funds managed by a professional trader. This allows them to benefit from the experience and knowledge of having someone else manage their investments without worrying about researching markets themselves or manually entering and closing trades. The manager has complete control over how the money is invested and when trades are made, which provides the investor with potential returns that may not be achievable on their own. The manager also has complete visibility into each trade’s performance so they can make informed decisions quickly and efficiently.

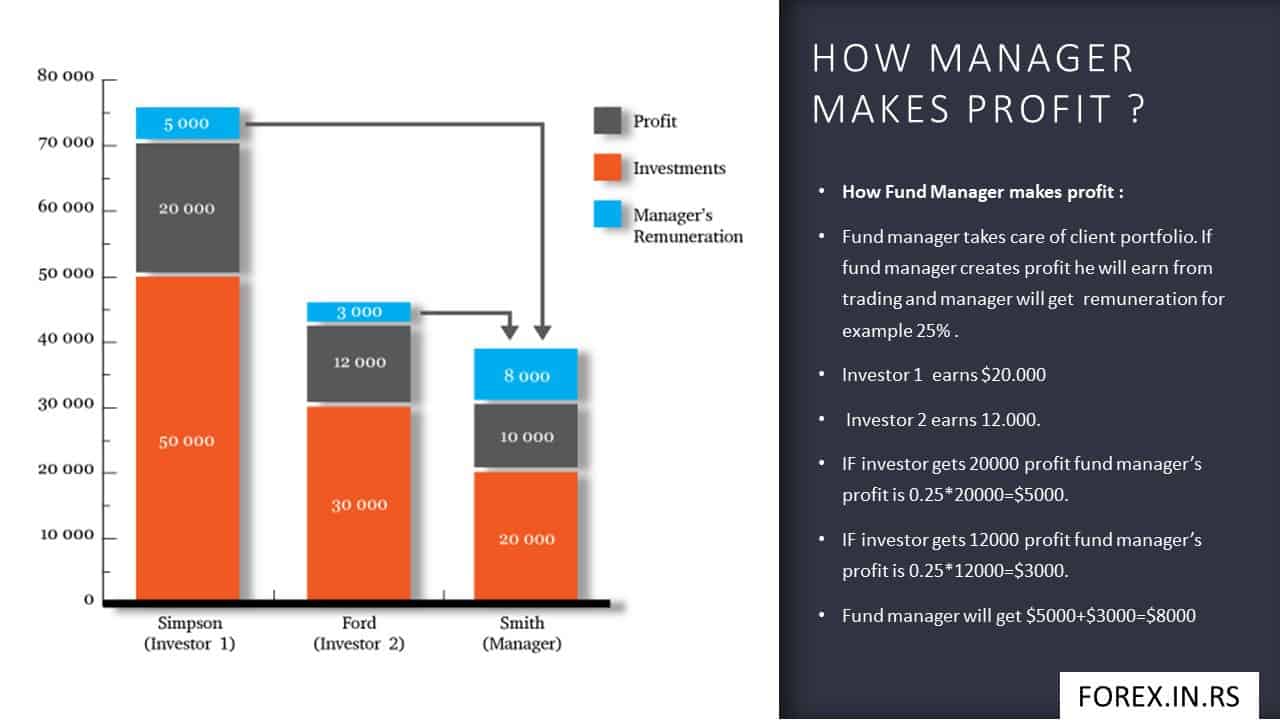

In exchange for managing clients’ funds, managers receive a percentage of any profits achieved through successful trades. Depending on the specific terms of each PAMM account, these fees can range from 5-20% depending on how much profit is achieved through each month’s trading activities. Managers also sometimes charge a small flat fee to cover administrative costs.

Are PAMM Accounts Safe?

PAMM accounts is a patented safe technology based on technical specifications and the ability to do transaction allocations for each transaction processing system based upon the estimated handling resources. However, PAMM accounts are secure for investors only if the broker who provides the PAMM account is reputable and has a license.

The safest PAMM accounts are accounts from A-grade forex brokers. Please check the list of regulatory bodies that provide the safest environment for investors:

- USA (Commodity Futures Trading Commission CFTC, NFA)

- Japan (FSA Japan)

- United Kingdom ( Financial Conduct Authority FCA)

- Australia (Australian Securities and Investments Commission ASIC)

- Singapore (Monetary Authority of Singapore MAS)

- Hong Kong ( Securities and Futures Commission SFC)

- Switzerland (Financial Services and Markets Authority FSMA)

- Germany (Federal Financial Supervisory Authority BaFIN)

In addition to security measures offered within these systems, PAMM accounts are also subject to government regulations and compliance standards like any other major financial institution. For example, if you live in the United States, you should look for a PAMM provider registered with FINRA (Financial Industry Regulatory Authority). All reputable companies adhere to these regulations, which ensure your funds remain safe from fraudulent activities or misappropriation.

Money Managers and PAMM safety

Sometimes bad money managers can create a bad reputation for PAMM systems. People think if they lose money on PAMM, PAMM is not safe. However, a bad money manager and risky portfolio strategy can harm your account.

Tips to protect your PAMM account are:

- Choose PAMM managers that risk less than 1% of their portfolio per position in one moment.

- If you see more than a 10% drawdown, avoid that money manager

- Avoid managers that open a large number of trades.

- Avoid managers who close trades too often and, at the same time, keep losing trades for too long.