A PAMM (Percentage Allocation Management Module) account is an investment account where an investor allocates funds to a professional trader, who then manages the account and trades on their behalf. The trader is known as the manager, and they use their expertise and trading strategies to try and generate profits for the investor.

The PAMM account allows multiple investors to invest in a single account, with each investor allocating a percentage of their investment to the manager. The manager then uses these funds to trade in the financial markets, and any profits or losses are shared among the investors in proportion to their investment.

What is the Best Forex Broker for PAMM accounts?

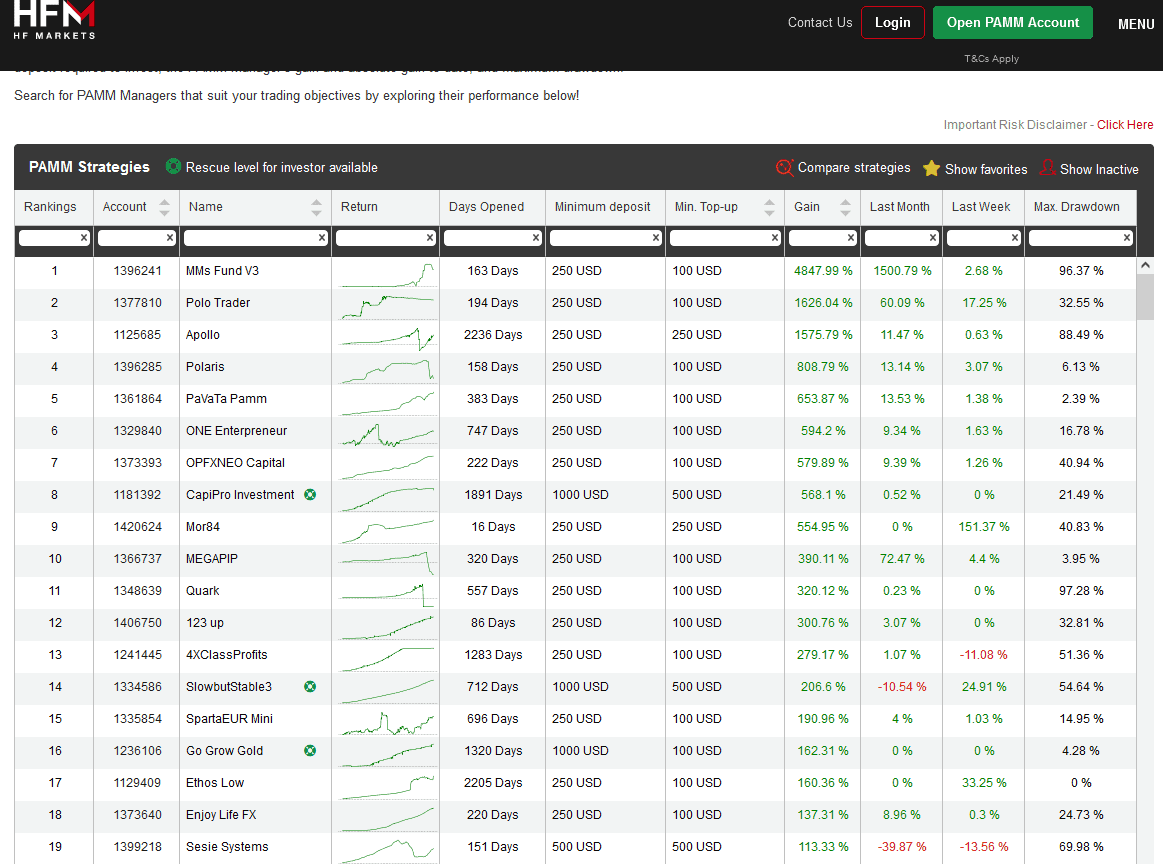

The best forex broker for PAMM accounts is HF Markets because it has fund managers that have managed portfolios for more than ten years and more than 100 profitable accounts to follow.

Please visit HF markets PAMM page!

For example, below you can see the screenshot of top-performing fund managers’ portfolios:

There are several benefits to using a PAMM account. Firstly, it allows investors to access the expertise of professional traders, who may have a greater level of knowledge and experience in the financial markets. Secondly, it provides diversification as funds can be spread across multiple traders and strategies, reducing the risk of loss. Finally, it allows for greater transparency and control as investors can monitor the manager’s performance and withdraw their funds anytime.

All participants in a PAMM account are interested in the trading process because their profits are directly linked to the manager’s success. Therefore, the manager’s performance will determine the return on investment for the investors, so it is in their best interest to choose a skilled and reputable manager. Conversely, the manager has a solid incentive to trade effectively, as their compensation is based on a percentage of the profits generated for the investors.

The best PAMM account forex brokers

How to choose the right PAMM fund manager?

When selecting a PAMM fund manager, there are several factors that an investor should consider to make an informed decision. Here are some tips on how to choose the best PAMM fund manager:

- Performance track record: The manager’s track record is one of the most important factors to consider. Investors should look at the manager’s past performance and analyze their returns over time. This information is usually found on the PAMM platform and other performance metrics.

- Drawdown: Drawdown is the most crucial statistic to analyze when evaluating a PAMM manager. Drawdown is the peak-to-trough decline in the account’s balance, showing the maximum loss the account has experienced. A high drawdown indicates that the manager is taking on excessive risk and may not have a sound risk management strategy.

- Risk management: A good PAMM manager should have a well-defined risk management strategy considering stopping loss levels, position sizing, and diversification. Investors should look for managers who have a disciplined approach to risk management.

- Experience and expertise: Investors should look for managers with a proven track record in the financial markets and the necessary knowledge to trade effectively. Managers with experience in a particular asset class or need may be better suited to managing funds in that area.

- Transparency: Investors should look for transparent managers in their trading and communication. Managers who provide regular updates and are open about their trading strategy can help build trust with investors.

My opinion and remark are that many PAMM systems do not track the maximum equity drawdown. Yet, this is the most critical parameter. For example, fund managers that never close the losing trade can have 100% excellent performance with all profitable businesses for several months until they ruin the account.

A PAMM fund manager invests $100,000 in the Forex market and opens a long position on the EUR/USD pair at 1.2000 with a stop loss at 1.1900. The manager is confident that the pair will rise, but instead, the market moves against the position, and the price falls to 1.1800, triggering the stop loss. At this point, the manager decides not to close the losing trade and hopes the price will eventually recover.

However, the market continues to move against the position, and the price falls further to 1.1700, 1.1600, and eventually to 1.1500, resulting in a loss of $5,000. Despite the significant loss, the manager still does not close the losing trade, hoping for a recovery. Unfortunately, the market continues to move against the position, and the price falls to 1.1400, resulting in a total loss of $10,000.

However, the PAMM ranking system will be perfect for this trader until he loses all his money. This is the biggest problem. Drawdowns must be measured for current equity, not after managers close trades.

In this scenario, the PAMM fund manager’s failure to close the losing trade resulted in a significant loss, which hurt the PAMM account’s overall performance. As you mentioned, tracking the maximum drawdown of equity is crucial as it can give investors an idea of the level of risk the PAMM fund manager is taking.

Therefore, investors need to choose PAMM fund managers with a disciplined approach to risk management and are willing to close losing trades to limit losses. Additionally, investors should monitor the performance of their PAMM accounts regularly and withdraw funds if they notice any significant losses.

In summary, when choosing a PAMM manager, investors should focus on performance track record, drawdown, risk management, experience and expertise, and transparency. However, drawdown is the most crucial statistic to analyze, as it shows the maximum loss the account has experienced and indicates the level of risk that the manager is taking. Therefore, investors should choose managers with low drawdowns and a disciplined approach to risk management.