Table of Contents

What is Stock Market Melt Up?

Market melt-up represents an unexpected sharp uptrend at the end of the bullish cycle. Usually, prices rise during “melt-up” because of investor sentiment rather than fundamental triggers. General market optimism (general hype) pushes other investors to buy assets that impact sudden price rises.

- Melt-up is a hasty but constant surge in defense rates for the market, usually because dealers round up.

- It is not essentially expressive in terms of elemental changes, and it might demonstrate the market’s mindset.

- A mistake of purchasing within a melt-up can be dodged by concentrating on other financial demonstrators, which provide a clear image of the stock market and America’s economy.

Melt-up is a prolonged and generally unpredictable up-gradation in contribution achievement of a resource, which is conducted partially by panic stakeholders, who can’t afford missing it on its growth, instead of up-gradation in economies cornerstone. Achievements coming from melt-up are counted as undependable signals for market guidance. Melt-up generally presages a mishap.

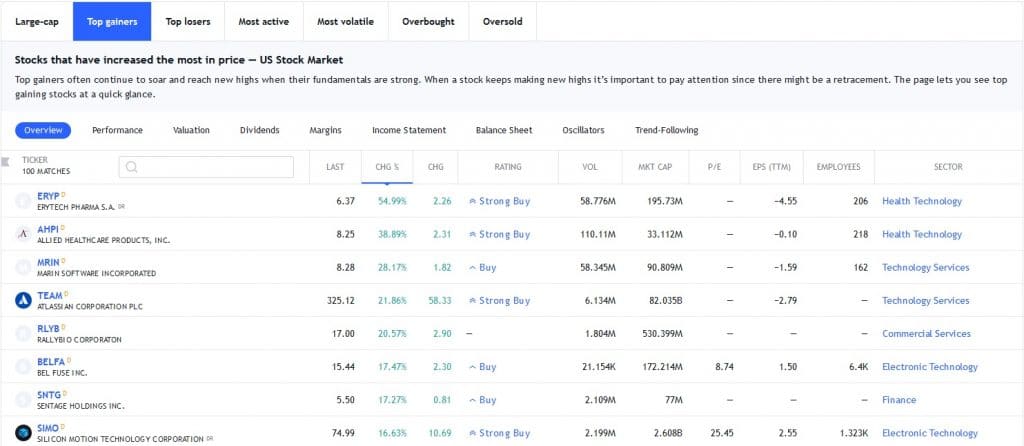

Melt Up Indicator Chart

Melt Up indicator chart is presented below and represents the biggest gainers in the stock market during the day. To get Top stock gainers’ information and spot melt-up stocks, you can go to the public TradingView Top Stock gainers page.

Learning Melt Ups and Nuances of Commercial Signal

Not considering meltdown and melt-up and concentrating on elemental points starts from learning financial signals. Financial signals are of two types one is lagging indicators, and the other is leading indicators. Both of them are financial signals which people in the market refer to calculate the condition of the market and the American economy.

The topmost signals are those which will change before any economy commencing to take a drift and pursue any specific pattern. For instance, CCI (the Consumer Confidence Index) can be said as the topmost signaling system that shows buyers’ views and approaches. Is he/her purchasing easily? Are they facing a shortage of cash to purchase? The rising or falling of the index is a firm signal of the upcoming level, which shows how he will spend. That counts 70 percent of the economy.

One more popular indicating system is DGR (Durable Goods Report), built from a monthly analysis of abundant producers and the PMI (Purchasing Managers Index); some other indicating system based on analysis is called (gross domestic product) GDP growth.

The Lagging indicator changes once the market starts to pursue a specific pattern. Such indicating systems are technically sound, which makes a path for dead stocks. For example, moving average crossover & sequence of bond delinquency.

Melt Ups and Basic Contribution

Many traders make a mistake while laying their bets by concentrating upon the foundation of a company rather than focusing on melt-up and differences made by it on trader’s psychology. For instance, Warren Buffett, as we know, is a popular trader who got lucky by analyzing companies’ economic backgrounds, even during financial turbulence. But, unfortunately, his concentration was on commercial rates and costs. Is the economic foothold of the company strong enough? Is the administration firmly developed? Has it ever been or currently over the price or under it? Such questions can help traders to realize the core values.

Melt Ups Illustration

An Economic professional once caught the run-up in the market at the starting of 2010, where he saw the possibility of a melt-up. The reason was the prolonged unemployment rate; the industrial estates and housing societies were experiencing a fall in their values. In contrast, market dealers were withdrawing all their money from the market.

The most common example is the bullish monthly trend before the market crash.