The forex market session happens in different places because the market operates in multiple time zones.

In this context, you need to familiarize yourself with various trading sessions. You may be aware that the market is accessible round-the-clock. This, however, doesn’t mean that the market stays active the whole business day.

As you may know, the forex market is operational round-the-clock from Monday to Friday. This happens because the time is different in different parts of the globe. The other interest may be asleep when the trade occurs in a specific amount of the world. By this, the market stays operational as traders in one part of the world are left; traders in different parts fill the void. Thus, the forex market is running because of the forex market hours.

Download Forex Market Open Indicator for MT4

Please download the RAR file and install ex4 in the indicator folder.

In this indicator, you can choose from 65 various market time sessions.

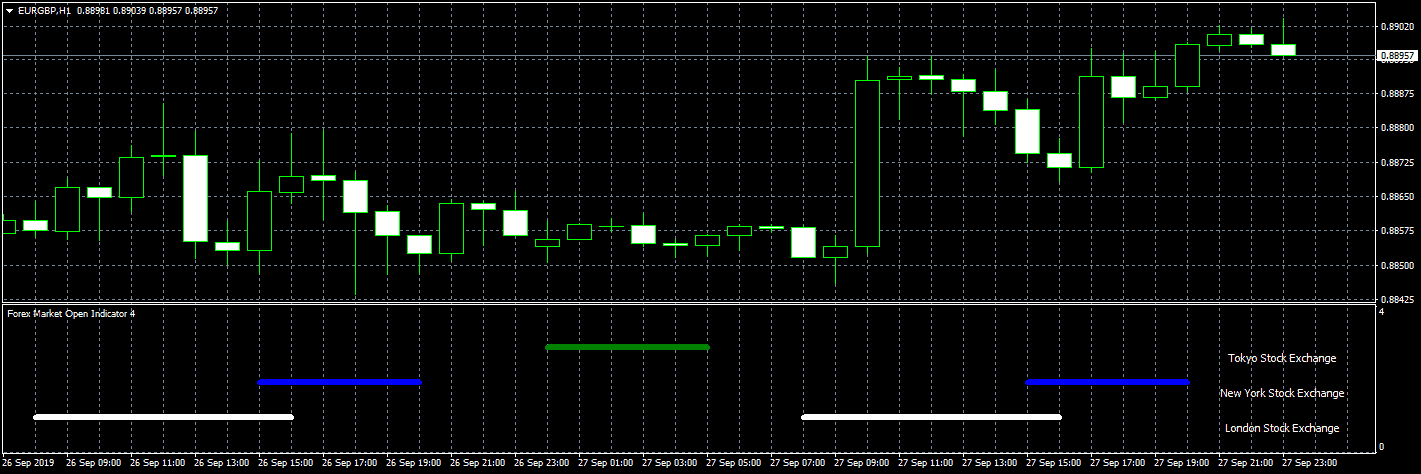

Market open indicator MT4 is a simple MetaTrader indicator that plots trading sessions on the MT4 chart. In that case, traders can monitor trades between trading sessions and make easier decisions based on time impact.

Indicator plots white, blue, and green colored lines in the indicator section below the main chart. In that case, this indicator will not put drawings on the chart and cause visual overload. The excessive number of lines can create visual noise, making identifying patterns, trends, or specific price levels challenging.

Forex trading is a highly dynamic and fast-paced market, and keeping track of the time can sometimes be challenging for many traders. This is where the Forex Market Open Indicator for MT4 comes in handy. The Forex Market Open Indicator is a simple yet effective tool that can help traders visualize and keep track of the various trading sessions, making it easier to make well-informed trading decisions.

The Forex Market Open Indicator for MT4 is a powerful trading tool designed to highlight different trading sessions on the MT4 chart. The indicator plots three colored lines in the indicator section below the main chart: white, blue, and green. Each of these colored lines represents a different trading session that ranges from New York and London to the Asian trading sessions.

The indicator is designed to help traders monitor trades between trading sessions and make sound decisions based on time impact. Using the Forex Market Open Indicator, traders can clearly understand when the different trading sessions begin and end, which can help identify potential trading opportunities.

The Forex Market Open Indicator for MT4 is a powerful tool that can help traders identify patterns, trends, and specific price levels. The excessive number of lines can create visual noise, making identifying patterns, trends, or same price levels challenging. However, this indicator is designed to put traders in a better position to succeed.

Traders can use this indicator to improve their trading strategy by identifying when to enter or exit trades based on the different trading sessions’ volatility. For example, the Asian trading session is generally known for its lower volatility, which allows traders to trade breakouts or ranges. On the other hand, the London and New York trading sessions are known for their higher volatility, and this presents an opportunity for traders to trade breakouts or trends.

The Forex Market Open Indicator for MT4 is highly customizable, allowing traders to change the color of the lines to their preference. Traders can also adjust the indicator’s settings to suit their trading style, which can help improve their trading efficiency and profitability.