Table of Contents

Currency trading spans various markets, each catering to distinct needs. The spot market, for instance, offers immediate currency trades, while forward and futures markets allow traders to hedge or speculate on future price movements.

Options allow traders to choose between trade and swap markets for short-term financing and liquidity management. Meanwhile, innovative platforms like Electronic Broking Services and the rise of cryptocurrencies have introduced new avenues for trade and speculation. Together, these markets enable traders to navigate global financial waters, exploiting opportunities and managing risks.

What are the Different Types of Currency Markets?

The different types of currency markets are:

- Spot Market

- Immediate delivery of currency.

- Transactions are settled “on the spot.”

- A most common form of currency trading.

- Forward Market

- Contracts to buy or sell a set amount of currency at a set price will be delivered and paid for later.

- It can be customized according to needs.

- Futures Market

- Similar to the forward market, contracts are standardized.

- Trade on organized exchanges.

- Requires a specified delivery date in the future.

- Options Market

- Provides the right, but not the obligation, to buy or sell currency at a set price on or before a specific date.

- It can be used as a hedging strategy or for speculation.

- Swap Market

- Two parties exchange one currency for another at the present rate and agree to reverse the transaction later.

- Firms and banks often use them for short-term financing needs.

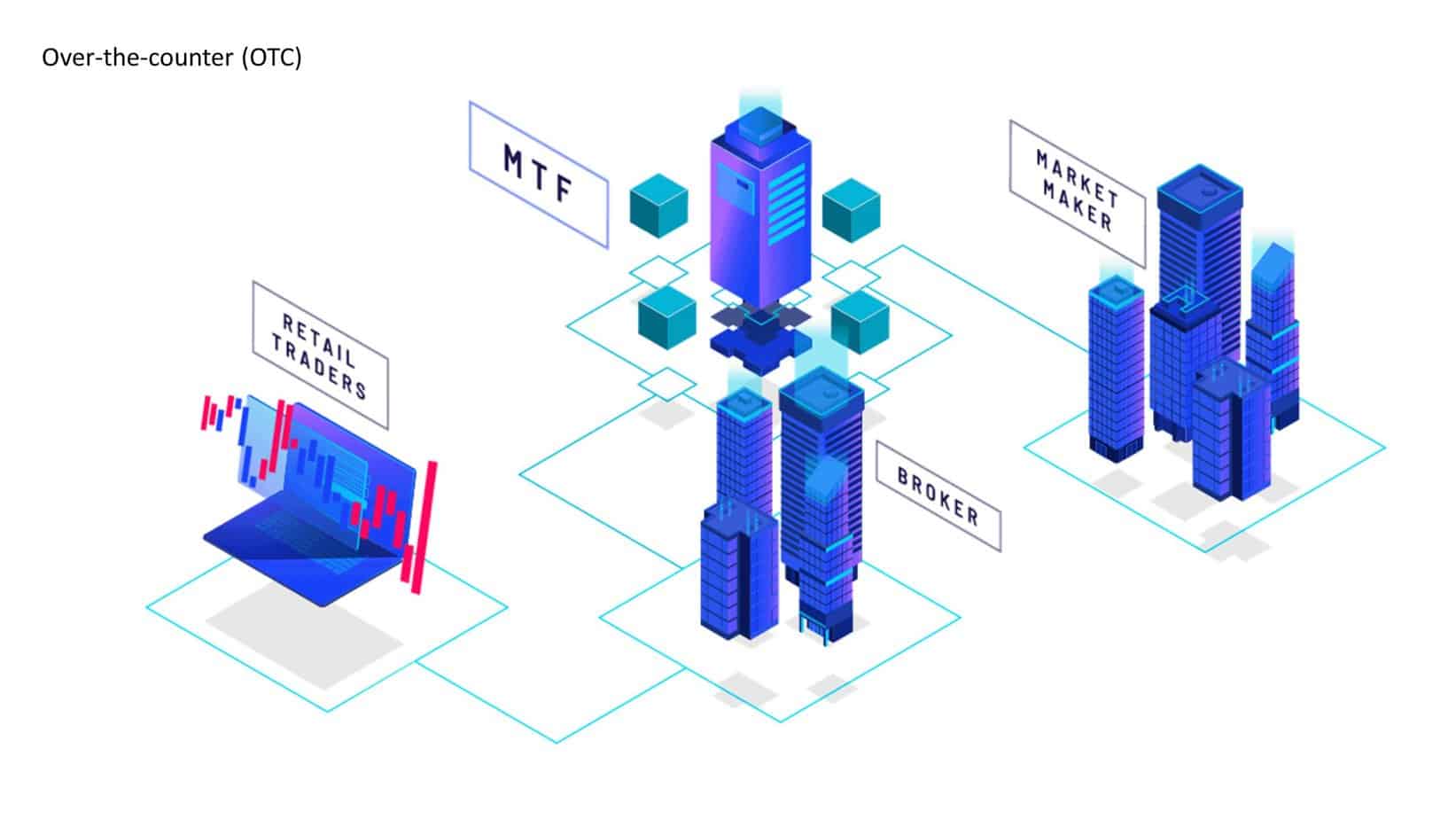

- Over-the-Counter (OTC) Market

- A decentralized market is where trading is done directly between two parties without a central exchange or broker.

- Spot and forward contracts are often traded here.

- Cryptocurrency Market

- Digital or virtual currencies that use cryptography for security.

- Examples include Bitcoin, Ethereum, and many others.

- Decentralized and typically operate on a technology called a blockchain.

- Non-Deliverable Forwards (NDFs)

- A type of forward contract where no physical delivery of the currency is taken.

- They are used in markets where forward FX trading is prohibited.

- Offshore Currency Markets

- Currency trading in countries where the currency isn’t the official currency.

- For example, Euro trading in the US would be considered offshore.

Each market serves a different need, whether for immediate trade, future trade, hedging against currency fluctuations, or speculation.

Spot Market

The Spot Market, often called the “spot,” is where financial instruments, including currencies, are traded for immediate delivery. In the foreign exchange (forex) market, the spot market is where currencies are bought and sold based on their current price or “spot rate.” Here’s a detailed breakdown:

- Immediate Delivery: The hallmark of the spot market is the immediate delivery of the asset being traded. For forex, the standard settlement timeframe for spot trades is usually two business days from the date the trade is executed. This is often referred to as a “T+2” settlement.

- Pricing: The price or rate on the spot market, known as the “spot rate,” is dictated by current supply and demand dynamics. This means prices fluctuate frequently throughout the trading day based on real-time events, economic news, interest rate changes, geopolitical developments, etc.

- Participants: The spot market sees participation from a diverse set of entities, including banks, financial institutions, corporations, governments, and individual retail traders. Each participant might have a different motive, ranging from business needs (like a corporation needing to repatriate earnings) to pure speculation.

- Trading Platforms: With technological advancements, most spot forex trading has moved to electronic platforms. These platforms offer real-time price quotes and advanced charting tools and can simultaneously handle large volumes of trades. Central banks and financial institutions often have proprietary trading systems, while individual traders access the market through broker platforms.

- Risks and Advantages:

- Risks: The spot market can be highly volatile, especially during major economic announcements or geopolitical events. This can lead to significant price gaps and slippage. Furthermore, because it’s an over-the-counter (OTC) market, there’s also a counterparty risk, meaning one party in the trade might default on its contractual obligations.

- Advantages: The spot market provides high liquidity, often resulting in lower spreads than other markets. The immediate settlement also means shorter exposure to market risk for traders.

- Comparison with Forward and Futures Markets: Unlike the forward and futures markets, where the delivery of the underlying asset or its cash equivalent happens at a future date, in the spot market, the transaction is settled “on the spot.” This makes it the preferred choice for traders and businesses that require immediate settlement.

Forward Market

The Forward Market is a financial market where participants can buy or sell contracts that obligate them to purchase or sell an asset, typically a currency, at a predetermined future date and price. These contracts are known as forward contracts. Let’s delve deeper into the intricacies of this market:

- Contractual Agreement: A forward contract is a binding agreement between two parties. One party agrees to buy, and the other agrees to sell a specific quantity of an asset (e.g., currency) at a specified price on a specified future date.

- Customization: One of the primary characteristics of forward contracts is their flexibility. They can be tailored to fit the specific needs of the contracting parties in terms of contract size, maturity date, and asset specification. This contrasts with futures contracts, which are standardized.

- Over-the-Counter (OTC): Forward contracts are traded over the counter, meaning they’re not on centralized exchanges. Instead, they are private agreements between parties and, as such, can vary widely in their terms.

- Pricing: The price specified in a forward contract is the “forward rate.” This rate is derived based on the current “spot rate” of the asset (e.g., currency spot rate in the forex market), adjusted for factors such as interest rate differentials between the two currencies (in the case of forex) and time to maturity.

- Participants: Corporations, financial institutions, governments, and other entities often use forward contracts to hedge against future price movements. For instance, an international company expecting to receive payment in a foreign currency at a future date might enter a forward contract to lock in today’s exchange rate and mitigate the risk of future currency fluctuations.

- Settlement: On the maturity date of the forward contract, the parties can either deliver the actual asset or settle the contract in cash based on the difference between the contract’s forward rate and the prevailing market rate.

- Risks and Advantages:

- Risks: Given the OTC nature of forward contracts, they come with counterparty risk, which is the risk that one party might default on its contractual obligations. Also, because forward contracts are binding, there’s a risk that one party might incur a loss if market prices move unfavorably.

- Advantages: They allow participants to lock in prices today for future transactions, safeguarding against price volatility. Their customizable nature ensures they can be tailored to specific hedging needs.

- Comparison with Spot Market: While the spot market involves immediate delivery and settlement, the forward market is all about future delivery. Forward contracts help entities manage future uncertainties by allowing them to set prices now for later transactions.

In summary, the forward market offers tools for hedging against future uncertainties and plays a pivotal role in the financial strategies of corporations and institutions engaged in global transactions. By allowing participants to set future prices today, forward contracts act as a buffer against the unpredictability of market dynamics.

Futures Market

The Futures Market is where standardized contracts, known as futures contracts, are bought and sold. These contracts obligate the buyer to purchase and the seller to sell a specific quantity of an asset at a predetermined price on a specified future date. Here’s an in-depth examination:

- Standardized Contracts: Unlike forward contracts, which are customized to the needs of the two parties involved, futures contracts are standardized in terms of contract size, maturity date, asset quality, and other terms. This standardization ensures that each contract is identical on a particular exchange, facilitating ease of trading.

- Centralized Trading: Futures contracts are traded on organized exchanges. These exchanges act as intermediaries, ensuring the market’s integrity by standardizing contract terms, providing price transparency, and mitigating counterparty risk through a system of margins and clearinghouses.

- Margins: Participants don’t pay the total contract amount upfront when trading futures. Instead, they deposit a fraction of the total contract value, known as the “initial margin.” This margin acts as a good faith deposit, ensuring both parties will uphold their contractual obligations. Daily settlements can lead to “margin calls” if the market moves against a position and additional funds are needed.

- Mark-to-Market: Futures contracts are “marked-to-market” daily. This means the contracts are adjusted daily to reflect their current market value, ensuring all gains and losses are settled at the end of each trading day.

- Participants: The futures market attracts a diverse set of participants, including speculators, hedgers, and arbitrageurs. While speculators aim to profit from price fluctuations, hedgers use futures to mitigate risk by locking in future prices. Arbitrageurs seek to exploit price discrepancies between futures and other markets.

- Settlement: At maturity, futures contracts can be settled either by physically delivering the asset or by cash settlement (where the difference between the contract price and the market price is exchanged). However, many futures contracts are closed before maturity, meaning positions are offset without needing physical delivery or cash settlement.

- Risks and Advantages:

- Risks: While the futures market offers significant leverage due to the margin system, this can amplify profits and losses. Thus, it can be riskier for inexperienced traders. Also, because futures are binding contracts, there’s a risk of loss if the market doesn’t move in the anticipated direction.

- Advantages: Futures provide transparency, liquidity, and ease of entry and exit. They also offer a way for businesses and investors to hedge against price fluctuations, thereby providing a measure of predictability in volatile markets.

- Comparison with Forward Market: The primary distinction between futures and forwards is their trading venue and standardization. While forwards are OTC products tailored to the parties’ needs, futures are standardized contracts traded on centralized exchanges with the added assurance of daily settlements and a clearinghouse system.

The futures market plays a crucial role in global finance, offering an organized and standardized environment for trading future obligations. By providing mechanisms to manage risk, speculate on price movements, or exploit arbitrage opportunities, futures contracts remain an integral tool for various market participants.

Options Market

The Options Market is where options contracts are traded. An options contract provides the holder with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (the strike price) on or before a specific date (expiration date). Here’s a comprehensive look:

- Basic Elements:

- Call Option: Provides the holder the right to buy the underlying asset.

- Put Option: Provides the holder the right to sell the underlying asset.

- Strike Price: The price at which the holder can buy (for call options) or sell (for put options) the underlying asset.

- Expiration Date: The date post which the option ceases to be valid.

- Premium: This is the price paid by the buyer to the option’s seller (or writer). The premium is determined by various factors, including the difference between the underlying asset price and the strike price, the time left until expiration, and the underlying asset’s volatility.

- Intrinsic and Extrinsic Value:

- Intrinsic Value: Reflects the actual value of the option if exercised now. A call option is the difference between the underlying asset’s current price and the strike price when the asset’s price is above the strike. For a put, it’s the opposite.

- Extrinsic Value: The part of the option premium that is not intrinsic, often influenced by time left to expiration and implied volatility.

- Moneyness:

- In the Money (ITM): Options with intrinsic value. Call options when the asset’s price is above the strike price; put options when it’s below.

- Out of the Money (OTM): Options with no intrinsic value. Call options when the asset’s price is below the strike price; put options when it’s above.

- At the Money (ATM): When the asset’s price is close or equal to the strike price.

- Exercise and Settlement:

- American Style: Options that can be exercised at any time up to expiration.

- European Style: Options that can only be exercised at expiration.

- Options can be settled either by delivering the underlying asset or cash-settled, which involves transferring the monetary difference between the strike price and the asset’s market price.

- Hedging and Speculation:

- Hedging: Many investors use options as insurance. For instance, purchasing a put option can protect against declines in owned stock.

- Speculation: Traders might buy options hoping the price will move in a direction that makes the option more valuable.

- Risks and Advantages:

- Risks: Options can expire worthless, meaning the buyer can lose the premium paid. Sellers, especially of naked options (options sold without a covering position in the underlying asset), face potentially unlimited losses.

- Advantages: Options provide leverage, allowing for a potentially more significant return on a smaller investment. They also offer diverse strategies, from simple bets on price direction to complex combinations that generate income or hedge other investments.

- Comparison with Futures: While both options and futures are derivatives, a crucial difference lies in the obligation. Futures obligate both parties to fulfill the contract, whereas options give the holder the right without the obligation, which means the risk is asymmetric.

The options market offers a rich array of strategies for traders and investors, from straightforward hedging tools to complex speculative plays. Its unique combination of rights without obligations allows participants to manage risk and leverage potential rewards from other financial instruments.

Swap Market

The Swap Market is the arena where swap contracts are negotiated and traded. A swap is a derivative instrument in which two parties exchange cash flows or liabilities from two financial instruments. While there are various swaps, the most common is the interest rate swap. Let’s delve deeper:

- Basic Concept: In its most basic form, a swap involves two parties agreeing to exchange future cash flows. The swap agreement defines the parameters of this exchange, such as the amounts to be exchanged, the payment dates, and the calculation methods.

- Interest Rate Swaps: This is the most prevalent type of swap. Two parties exchange interest payments based on a nominal principal amount in an interest rate swap. Typically, one party pays a fixed interest rate while the other pays a floating rate based on benchmarks like LIBOR.

- In a currency swap, the parties exchange interest payments and principal in one currency for interest payments and principal in another. It’s a tool used to hedge against foreign exchange risk or to obtain cheaper debt (by borrowing at the best available rate, regardless of currency, and then swapping for debt in the desired currency).

- Commodity Swaps: This type of swap involves the exchange of cash flows associated with commodity prices. For instance, an oil producer might agree to exchange the revenue from its oil sales at the market price for a fixed amount to mitigate the risk of price fluctuations.

- Credit Default Swaps (CDS): A CDS is a form of insurance against credit risk. The seller of the CDS compensates the buyer in the event of a loan default or other credit event. The buyer of the CDS makes periodic payments (like an insurance premium) to the seller.

- Over-the-Counter (OTC): Swaps are typically traded over the counter, meaning they are negotiated directly between parties rather than through a centralized exchange. This allows for customization of terms to fit specific needs but also introduces counterparty risk.

- Risks and Advantages:

- Risks: Since swaps are OTC instruments, they come with counterparty risk – the risk that one party might default on its obligations. Additionally, market risks can arise if interest rates, currencies, or commodities move unexpectedly.

- Advantages: Swaps offer a flexible tool for hedging and risk management. They can help entities transform unwanted exposures, such as a floating interest rate, into a desired profile, like a fixed rate. They can also be used for speculative purposes.

- Valuation: The value of a swap is the net present value (NPV) of its anticipated future cash flows. As market conditions change (like interest rates or exchange rates), the value of the swap will fluctuate, potentially leading to gains or losses for the parties involved.

- Regulation: Post the 2008 financial crisis, swaps, especially CDS, were under the spotlight for regulatory reform. Initiatives like the Dodd-Frank Wall Street Reform and Consumer Protection Act in the U.S. introduced more rigorous reporting and clearing requirements to enhance transparency and reduce systemic risk.

The swap market is a vital mechanism for financial entities to manage and hedge various risks, from interest rate volatility to commodity price fluctuations. Given their customizable nature, swaps can be tailored to address specific needs, making them a valuable tool in modern finance.

Over-the-Counter (OTC) Market

- The Over-the-Counter (OTC) Market is a decentralized market where trading securities, commodities, currencies, or other financial instruments occurs directly between two parties without a centralized exchange or intermediary. This contrasts exchange-traded markets, where transactions are conducted through a centralized exchange.

- Nature of Transactions:

- Direct Negotiations: Transactions in the OTC market are negotiated directly between buyers and sellers. This direct negotiation allows for flexibility in terms, including price, volume, and settlement date.

- Bilateral Risk: Since trades are conducted directly between two parties, there’s inherent counterparty risk. This means that there’s a risk one party may not fulfill its side of the transaction.

- Types of Instruments Traded:

- Equities: Many small-cap and penny stocks are traded OTC, often because they do not meet the listing requirements of formal exchanges.

- Derivatives: Financial derivatives, such as forwards and certain swaps, are often customized and thus are naturally suited for the OTC market.

- Debt Instruments: This includes corporate bonds, municipal bonds, and certain structured products not traded on formal exchanges.

- Currencies: The foreign exchange market, where currencies are traded, operates primarily over the counter.

- OTC Dealers and Brokers:

- Dealers: These entities act as principals in a transaction, meaning they buy or sell the asset for their account.

- Brokers: Brokers act as intermediaries, matching buyers with sellers but not taking a position themselves.

- Advantages:

- Flexibility: OTC markets offer greater flexibility in terms of contract customization.

- Accessibility: Companies that don’t meet the listing requirements of significant exchanges can still access capital by trading OTC.

- Discretion: OTC transactions can be executed without public disclosure, allowing for more discreet trading activities.

- Disadvantages:

- Counterparty Risk: Without a centralized clearinghouse, there’s an increased risk that one party may default.

- Liquidity Concerns: Some OTC instruments or securities can be illiquid, making them harder to buy or sell without impacting the price.

- Transparency Issues: The decentralized nature can lead to less pricing and trade reporting transparency.

- OTC Markets Group: This American financial market offers price and liquidity information for OTC-traded securities. It’s organized into different marketplaces, like the OTCQX, OTCQB, and Pink Markets, based on the level of disclosure companies provide.

- Regulation: Post the 2008 financial crisis, there has been a global push for greater regulation and transparency in the OTC market, especially for derivatives. Regulations such as the Dodd-Frank Wall Street Reform and Consumer Protection Act in the U.S. have created requirements for more robust reporting, more transparent risk management practices, and a move towards centralized clearing for certain standardized OTC derivatives.

In summary, the OTC market is vital in global finance, offering a platform for instruments and securities unsuited for standardized exchange trading. While it offers flexibility and opportunities, it also comes with inherent risks due to its decentralized nature. As a result, understanding the nuances of the OTC market is crucial for traders and investors alike.

Cryptocurrency Market

- Definition: The cryptocurrency market is a decentralized digital or virtual financial market where cryptocurrencies are bought, sold, and traded.

- Origin: The foundation of the cryptocurrency market is traced back to 2009 with the invention of Bitcoin by an anonymous entity known as Satoshi Nakamoto. Bitcoin introduced a decentralized, trustless, peer-to-peer financial system without a central authority.

- Decentralization: Unlike traditional financial systems, where a central authority (like banks or governments) oversees transactions, the cryptocurrency market operates on a decentralized network of computers.

- Blockchain:

- Concept: The backbone of most cryptocurrencies is blockchain technology. This distributed ledger records all transactions across numerous computers so that the record can’t be altered without altering all subsequent blocks.

- Security and Transparency: The blockchain’s design is inherently secure and transparent, ensuring transactional integrity.

- Types of Cryptocurrencies:

- Bitcoin: The first and, for many, the flagship cryptocurrency.

- Altcoins: Any cryptocurrency other than Bitcoin is often called “altcoin.” This includes Ethereum, Ripple (XRP), Litecoin, and thousands of others.

- Tokens: Digital assets issued on existing blockchains, often representing assets or utility. A well-known example is Ethereum’s ERC-20 tokens.

- Cryptocurrency Exchanges:

- Centralized Exchanges (CEXs): Platforms where users can buy and sell cryptocurrencies. Examples include Binance, Coinbase, and Kraken. They act as intermediaries, holding users’ funds and posing a central failure risk point.

- Decentralized Exchanges (DEXs): Operate without a central authority. Trades occur directly between users. Examples include Uniswap and Sushiswap.

- Storage:

- Wallets: Digital tools that allow users to store and manage their cryptocurrencies. There are various forms, including hardware, software, and paper wallets.

- Use Cases:

- Digital Currency: Cryptocurrencies can be used as a medium of exchange for goods and services, although acceptance varies.

- Investment: Many buy and hold cryptocurrencies as a form of investment, speculating on price increases.

- Smart Contracts: Self-executing contracts with the terms directly written into code, notably on platforms like Ethereum.

- Decentralized Applications (dApps): Applications that run on a blockchain or P2P network of computers.

- Regulation and Legal Status:

- The regulatory environment for cryptocurrencies varies globally. Some nations have embraced them, while others have strict regulations or outright bans.

- Regulatory concerns often involve preventing illegal activities, ensuring financial stability, and protecting investors.

- Risks and Challenges:

- Volatility: Cryptocurrency prices can be highly volatile, leading to significant investment risks.

- Security Concerns: While the underlying blockchain is secure, ancillary services like exchanges can be hacked.

- Regulatory and Legal Risks: As governments define their stance, there’s a risk of stringent regulations or potential crackdowns.

- Adoption and Acceptance: For broader adoption, cryptocurrencies must overcome challenges like scalability and energy consumption.

- Future Potential: Innovations like the Lightning Network for Bitcoin or Ethereum’s transition to Proof-of-Stake show the dynamic evolution of the sector. Moreover, the rise of Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) showcases the diverse applications of blockchain and cryptocurrency technologies.

In conclusion, the cryptocurrency market represents a groundbreaking intersection of finance, technology, and decentralization. It challenges traditional notions of currency and financial systems, offering a vision of a decentralized future. However, it comes with both immense potential and significant risks. As the technology matures and adoption grows, its role in the broader financial landscape will likely become increasingly pivotal.

Non-Deliverable Forwards (NDFs)

- Definition:

- An NDF is an over-the-counter (OTC) financial derivative used primarily for hedging or speculating on currencies where direct trading or settlement is restricted or limited. It’s a cash-settled forward contract on a non-convertible or thinly traded foreign currency.

- How it Works:

- Contract Agreement: Two parties agree to an NDF contract specifying the amount, the exchange rate (called the “forward rate”), and a future date.

- Settlement: On the agreed date, the difference between the negotiated forward rate and the prevailing spot rate is settled in a significant, freely convertible currency, usually the U.S. dollar. No physical delivery of the non-convertible or restricted currency occurs.

- Where It’s Used:

- NDFs are particularly useful for hedging or speculating in currencies with government restrictions, capital controls or where the currency is non-convertible on the international market. Examples have included the Chinese Yuan (CNY), Brazilian Real (BRL), and the Indian Rupee (INR) in various periods.

- Market Participants:

- Hedgers: Companies exposed to restricted currencies due to business operations might use NDFs to manage currency risk.

- Speculators: Traders or investors who want to take positions on currency movements without actual delivery.

- Banks and Financial Institutions: Often serve as intermediaries or counterparties in NDF contracts.

- Comparison to Traditional Forwards:

- Settlement: Unlike traditional forward contracts, where currencies are exchanged at maturity, NDFs are cash-settled.

- Purpose: NDFs exist primarily because of capital controls or other barriers in the forex market.

- Advantages:

- Access to Restricted Markets: NDFs allow businesses and investors to hedge or speculate on currencies they can’t directly access.

- Flexibility: Being OTC derivatives, they can be customized to fit specific needs regarding amounts and maturity dates.

- Risks:

- Counterparty Risk: Since NDFs are OTC contracts, there’s a risk that one party might default.

- Liquidity Risk: While major NDF pairs can be relatively liquid, some might not be, leading to challenges in entering or exiting positions.

- Market Risk: As with any financial instrument, there’s a risk that market movements might result in losses.

- Regulation:

- Because NDFs are OTC derivatives, their regulation varies by jurisdiction. They fall under the broader regulatory umbrella governing OTC derivatives in many places.

- Post the 2008 financial crisis, there’s been a global push for increased transparency and centralized clearing for OTC derivatives, which can impact the NDF market.

- Recent Evolution:

- As some emerging markets have liberalized their capital accounts and forex markets, the need for NDFs in those currencies diminishes.

- Conversely, if new restrictions emerge, the NDF market can provide an essential alternative to traditional forex dealings.

Non-Deliverable Forwards are essential for businesses, investors, and speculators to navigate the challenges of currencies with trading restrictions. While they offer unique advantages in accessing restricted markets, they come with risks primarily due to their OTC nature. As global markets evolve and regulations change, the role and usage of NDFs may shift accordingly.

Offshore Currency Markets

- Definition:

- The offshore currency market refers to trading a nation’s currency outside its home jurisdiction. It functions outside the regulations and monetary controls imposed by the nation’s central authority.

- Origins and Need:

- Currency Controls: Some countries impose currency controls to stabilize their currency, control capital flows, or protect their economy from external financial shocks.

- Bypass Restrictions: To navigate these controls, an offshore market often emerges, allowing investors, businesses, and financial entities to engage in transactions without the constraints of onshore regulations.

- Prominent Examples:

- CNH vs. CNY: The Chinese Yuan (CNY) is a prime example of an onshore-offshore currency dichotomy. CNY represents the Yuan traded within mainland China (onshore), while CNH refers to the Yuan traded outside mainland China, primarily in Hong Kong (offshore).

- INR vs. USD/INR NDF: While the Indian Rupee (INR) is traded onshore within India, there’s a non-deliverable forward (NDF) market for the Rupee in places like London or Singapore, which operates outside the purview of India’s regulatory controls.

- Characteristics:

- Price Disparity: Prices in the offshore market can differ from the onshore market due to supply-demand dynamics, speculation, or diverging market perceptions about economic fundamentals.

- Greater Flexibility: Offshore markets often offer greater flexibility regarding contract sizes, maturities, and transaction types.

- Different Regulatory Environment: Offshore markets may have a different regulatory landscape, which can be more lenient than the onshore market or simply distinct due to the jurisdiction in which it operates.

- Participants:

- Multinational Corporations: Businesses operating in multiple countries may use offshore markets to hedge currency risk without facing onshore restrictions.

- Investors and Speculators: They are looking to profit from currency movements or diversify their portfolios.

- Banks and Financial Institutions: Often act as intermediaries or market makers.

- Advantages:

- Liquidity: Some offshore markets can offer substantial liquidity, making it easier for participants to execute large trades.

- Hedging and Speculation: Provides an avenue for entities to hedge or speculate when the onshore market has restrictions or lacks specific financial instruments.

- 24-hour Trading: Given the global nature, offshore markets can operate around the clock, accommodating various time zones.

- Risks and Challenges:

- Regulatory Differences: The regulatory environment can vary significantly from the onshore market, leading to potential uncertainties.

- Liquidity Risk: While major offshore currency pairs may be liquid, others might not be, potentially causing difficulties in executing trades.

- Repatriation Issues: Moving funds between onshore and offshore markets might be challenging due to controls and regulations.

- Impact on Onshore Markets:

- Convergence of Rates: Central authorities might intervene in either market to align onshore and offshore rates if they diverge significantly.

- Policy Indicators: The offshore market can sometimes indicate investor sentiment or expectations about onshore policy changes.

- Evolution:

- As economies open up and relax their currency controls, the distinction between onshore and offshore markets might diminish. However, if there are currency controls, capital restrictions, or differences in regulatory regimes, offshore currency markets will likely persist.

Offshore currency markets are an integral part of the global financial landscape, providing a complementary and sometimes alternative platform for currency trading outside the restrictions of onshore markets. They highlight the balance between national regulatory control and global financial imperatives.

Conclusion

The vast expanse of the global currency market comprises various segments, each designed to cater to specific financial needs and strategies. From the immediacy of the Spot Market, which handles instant transactions, to the innovative realm of Cryptocurrencies, which challenges traditional financial paradigms, the diverse range of markets offers tailored solutions for hedging, speculation, and investment.

Offshore Currency Markets and Non-Deliverable Forwards provide crucial avenues for dealing with currencies with restrictions or controls. On the other hand, platforms like Electronic Broking Services and Reuters epitomize the technological advancements reshaping forex trading. The Options and Futures Markets introduce derivatives that allow sophisticated risk management strategies, while the Swap and OTC markets emphasize customization and direct counterparty agreements. Collectively, these markets underscore the complexity, dynamism, and adaptability of global currency trade.

They reflect the interconnected nature of the world economy, the evolving regulatory landscape, and the perpetual drive for financial innovation. As the world continues to change, so will these markets, adapting to new challenges and opportunities in the ever-fluctuating world of finance.