Table of Contents

Psychological levels in forex trading are an essential concept to understand when we look at the price action of any currency pair. These psychological levels can influence how traders and investors perceive the market and make decisions. They can be used as support or resistance levels, providing a better understanding of the direction and momentum of the market.

What are Psychological levels in forex?

Psychological levels represent critical price levels denoted by round numbers (whole number trading strategies) or multiple weeks or months high or low price levels. If the forex market price breaks these levels, traders expect an accelerated gain in the new trend’s direction.

Psychological levels in forex trading refer to crucial price points that hold particular significance for traders. Such price points may be round numbers (e.g., 1.3000, 1.4000) or whole numbers (e.g., 1.0010, 1.0050). Several different factors can influence why individual traders perceive these price points as significant, including the psychological notion that ‘round’ numbers are seen as more important than other prices by many market participants – resulting in more substantial buying or selling pressure around such levels, which then become self-fulfilling prophecies if enough people act on their sentiment around those prices.

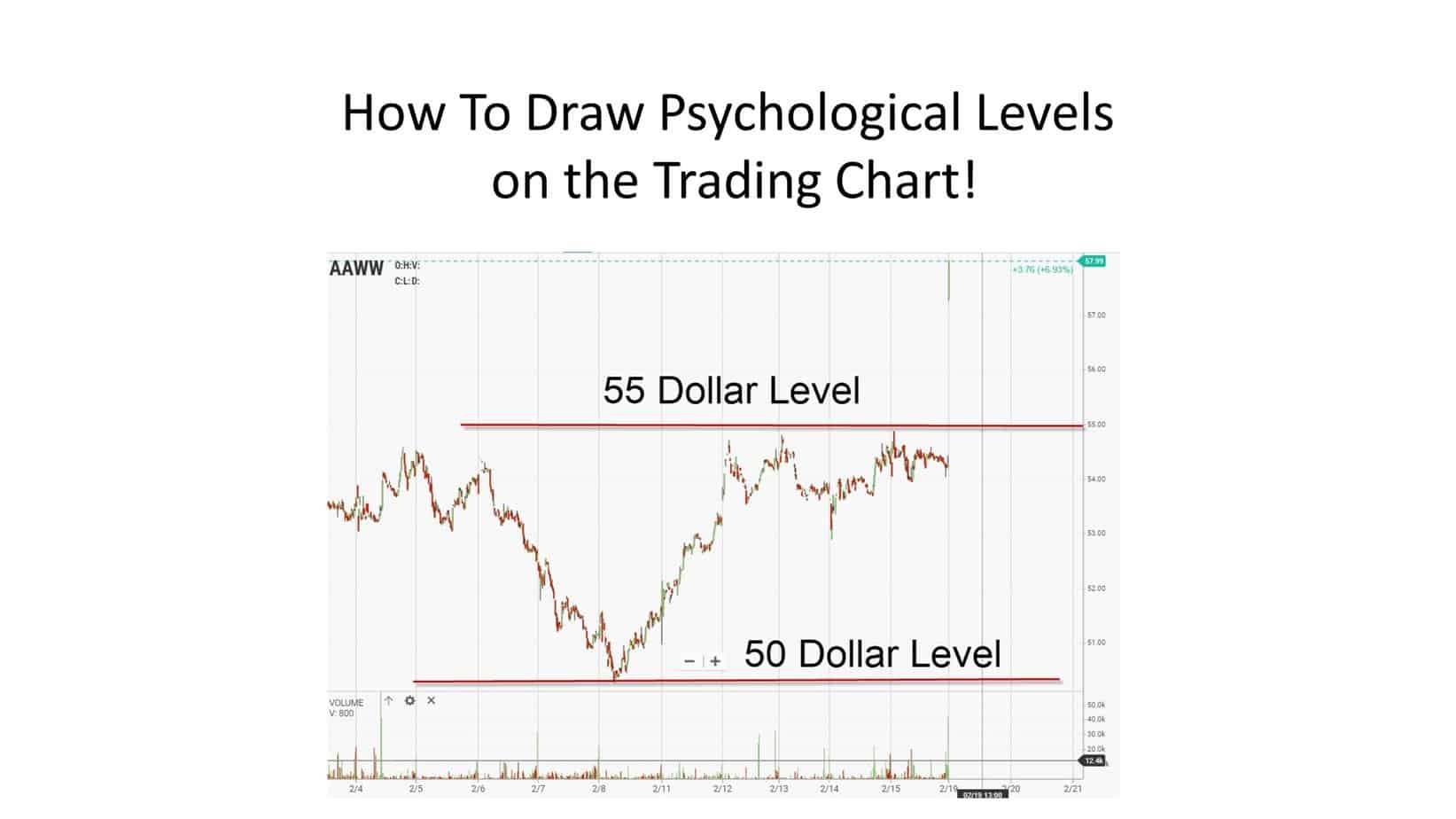

Please watch the video that I have created on youtube, where you can learn How To Draw Psychological Levels on the Trading Chart:

Furthermore, these psychological levels often serve as barriers between buyers and sellers, where either party may be unwilling to cross a certain threshold because of fear or expectations that others will not be willing to pay/sell at higher prices – consequently creating a form of technical resistance/support for those specific prices on the chart itself. In addition, whole number pricing tends to have an additional impact due to its familiarity with most traders and investors, thus making it easier for them to recognize them on charts and quickly act upon them should they choose so.

The traders’ attention is drawn to the market by critical levels in forex. These psychological costs are linked to the human mind and its thinking style. The points listed below about psychological levels and round numbers in forex trading are discussed in this article:

- Definition of psychological level

- How to identify psychological levels

- Ways to use psychological levels to trade forex

- Advantages and disadvantages of psychological levels

Market price levels, which are significant forex levels and are represented by round numbers, are known as psychological levels. These rounded numbers are commonly used as resistance or support levels.

Because of a fundamental human nature, psychological resistance and support continually function. Since humans prefer simplicity, value is given to whole numbers in trading terms. These numbers are frequently used as entry, exit, and stop levels. Order flow and price fluctuations might be affected by these stops and restrictions.

How to Identify Psychological Levels on Forex Charts

To identify Psychological Levels on Forex Charts, you must draw on the chart all-important price levels, Fib. Levels, trendlines, and channels, and look for price levels with round numbers where several important price levels overlap. So steps are:

- Find important levels on the Monthly and Weekly charts.

- Add Fib. Levels

- Add trend lines and channels

- Find Round Numbers on the chart.

- Count how many times important levels trend invalidation points. Look for overlap.

- Read the news for confirmation.

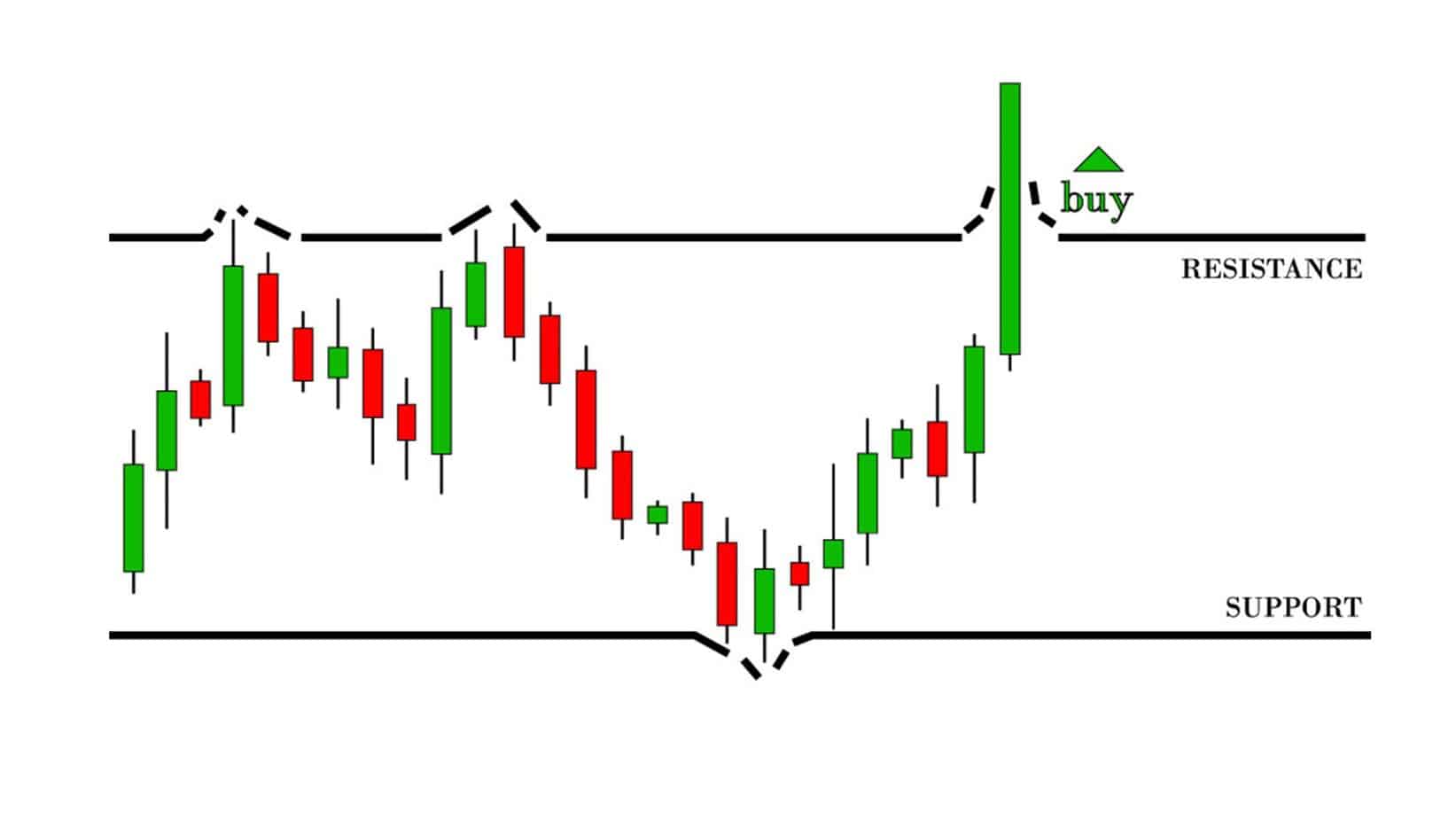

Support and resistance are important price levels. We expect to find a breakout when the price breaks support or resistance, like in the image below:

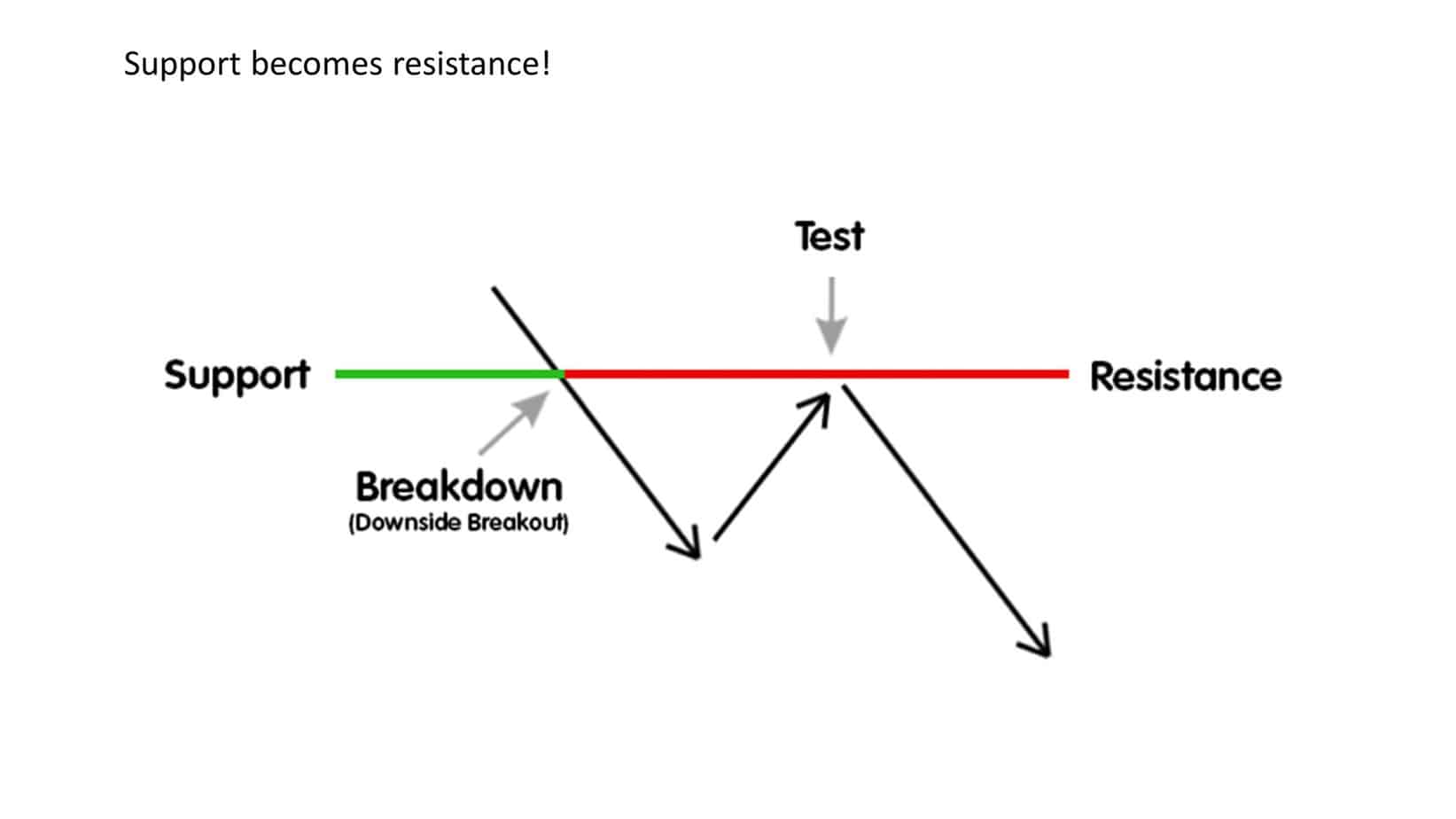

When a breakout occurs, former support becomes resistance, or former resistance becomes support:.’

If support holds but the trend switch from bearish to bullish or bullish to bearish, we have a situation like in the image below:

When we find important price levels, we look for round numbers.

Traders often call these whole number intervals ” double-zeros ” because the prices are even. Some examples – are 1.31000 on the EUR/USD, 1.57000 on the GBP/USD, or 132.00 on the GBP/JPY.

Some traders may go one step further and look at the number amid these absolute numbers, often known as “the fifties.” These levels, such as 1.31500 on the EUR/USD or 131.50 on the GBP/JPY, are frequently used as “double-zeros.”

As prices go up or down, considerable congestion at these critical levels in forex will be noted by traders.

It’s worth noting that many of the price fluctuations on the chart above occur near one of these levels. As a result, traders seek to include these levels in the revisions of support and resistance levels.

As a result, these prices serve as a psychological line that serves as both support and a barrier. Although not all these prices serve as a support or resistance level, many warrant the trader’s attention.

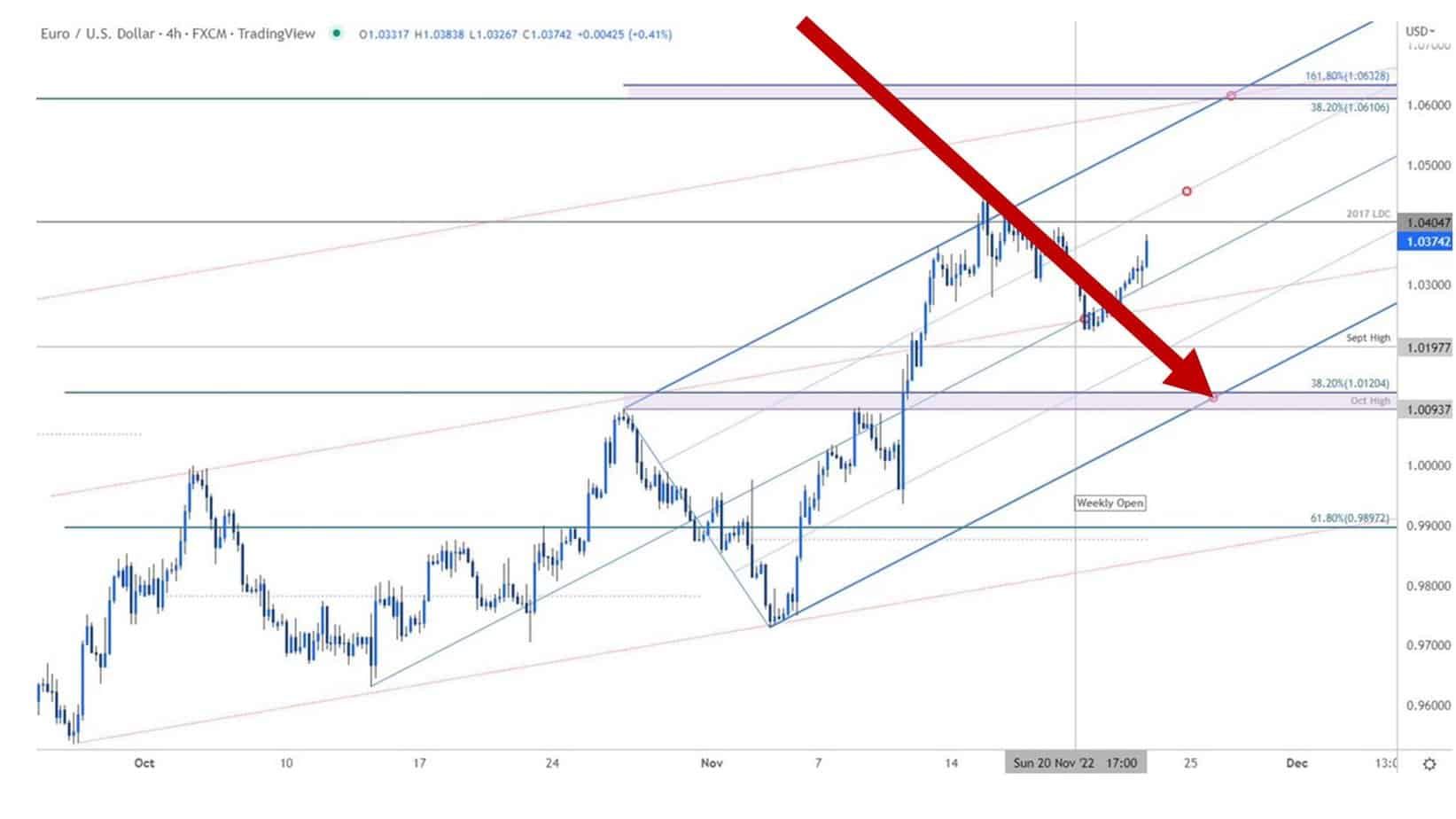

The image below shows how the chart looks when we add all kinds of trend lines, supports, resistances, and Fib. Levels:

A small red circle on the image above is price level 1.01, the current Psychological Level for H4, Daily time frame. For EURUSD, on the monthly chart, price 1.0 is still a psychological Level overall.

Psychological level forex indicator

Please download the Psychological levels forex indicator for MT5 to round the numbers and mark important price levels.

Download the Psychological levels forex indicator for MT5

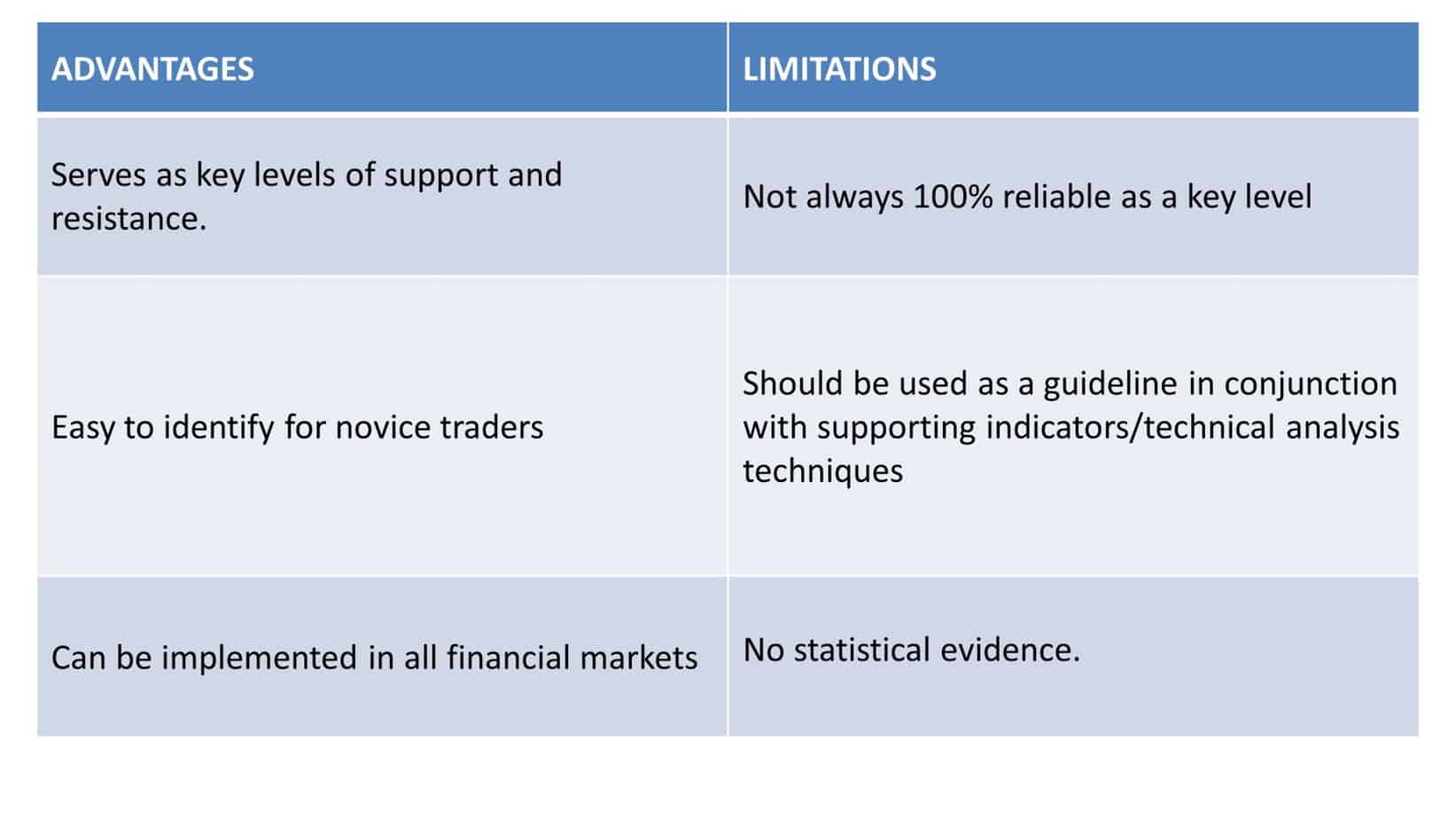

Advantages and Limitations of Psychological Levels

In forex, key levels should be evaluated in light of the present trend. It should also be assessed whether or not any secondary technical recommendations favor the trade. The following are the advantages and disadvantages of psychological levels:

Advantages

- Acts as critical levels of resistance and support

- Easily identifiable by novice traders

Limitations

- As a crucial level, not always 100% reliable

These psychological levels can provide insight into how other traders react to the markets, helping to inform better investment decisions.

Psychological levels on a chart are where several important price points overlap due to the use of round numbers in currency pairs. For example, when looking at USD/EUR, it could be that 1.0600 is a critical psychological level due to investors’ use of round numbers. In addition to rounded numbers, Fibonacci Levels help identify potential areas of support and resistance on forex charts which can also act as psychological levels for traders.

Traders commonly use trendlines and channels to analyze market movement over time and identify possible tops or bottoms in price action. When used alongside Fibonacci Levels and round numbers, trendlines or channels provide even more insight into potential areas of price conflict or convergence, which may indicate potential areas where traders may enter into or exit a position.

To identify psychological levels on forex charts more effectively, traders need to familiarize themselves with all three components: Fibonacci Levels, Trendlines/Channels, and Round Numbers. They should also pay close attention to any news-related events that may affect their trading decisions, as these can also play a part in identifying psychological levels on forex charts. Considering all these factors will allow traders to make more informed decisions about where they should enter or exit positions to maximize profits from their trades.

Finally, it’s essential for traders not only to understand what each component means but also to practice using them effectively before entering into any live trades in the markets; this will help them become better prepared for potential risks associated with trading while still having an opportunity for success in their investments. With proper knowledge, attention paid to news events, and practice using all three components together, traders can better understand psychological levels on their charts that may lead them towards winning trades!

Conclusion

In summary, psychological levels in forex trading can play an essential role in influencing market sentiment and decision-making during periods of high volatility or sudden changes in price movements, making it vital for traders and investors alike to pay attention to these key price points when looking at their strategies and positions within the markets. By understanding how these psychology-driven concepts work with traditional technical analysis tools such as trend lines, candlesticks patterns, or Fibonacci retracements, traders should find themselves better suited when navigating the markets with confidence over time.