Expert Advisors (EAs) have become a staple in algorithmic trading. These automated systems, often designed for the MetaTrader platform, are programmed to execute trades on your behalf using predetermined rules. Their appeal lies in their promise of delivering profits without the need for constant monitoring or deep expertise in the intricacies of financial markets.

However, many of these EAs are essentially “black boxes.” They take in market data, process it according to undisclosed algorithms, and output trading decisions. The main issue with this model is that the system’s internal workings remain a mystery to the user. The user places their trust, and often significant amounts of capital, in a system whose decision-making logic they do not fully understand. This lack of transparency can lead to severe equity loss, given that the trader is surrendering control to an unpredictable mechanism.

Moreover, many commercially available EAs are not thoroughly tested, and some are created by individuals with little to no trading experience, looking to profit from selling the EA itself rather than it’s trading performance. There’s also a risk of overfitting, where the EA is optimized to perform well based on historical data but fails to adapt to new market conditions.

In this context, self-developed and thoroughly tested Expert Advisors emerge as a significantly safer alternative. By creating your own EA, you have full transparency and control over the trading algorithm, which can be tailored to your specific risk tolerance and investment objectives. It also allows you to extensively test the EA using historical and live data, adjusting and refining its parameters over time for optimal performance. While this requires more effort and technical skill than a pre-made solution, the trade-off regarding safety and potential profitability can be substantial.

Which Forex Robot is The Most Profitable?

The most profitable forex robot is the custom-made Expert Advisor, which trader creates for personal or company trading. Black box EA that traders find on the market are dangerous and can make drastic equity losses.

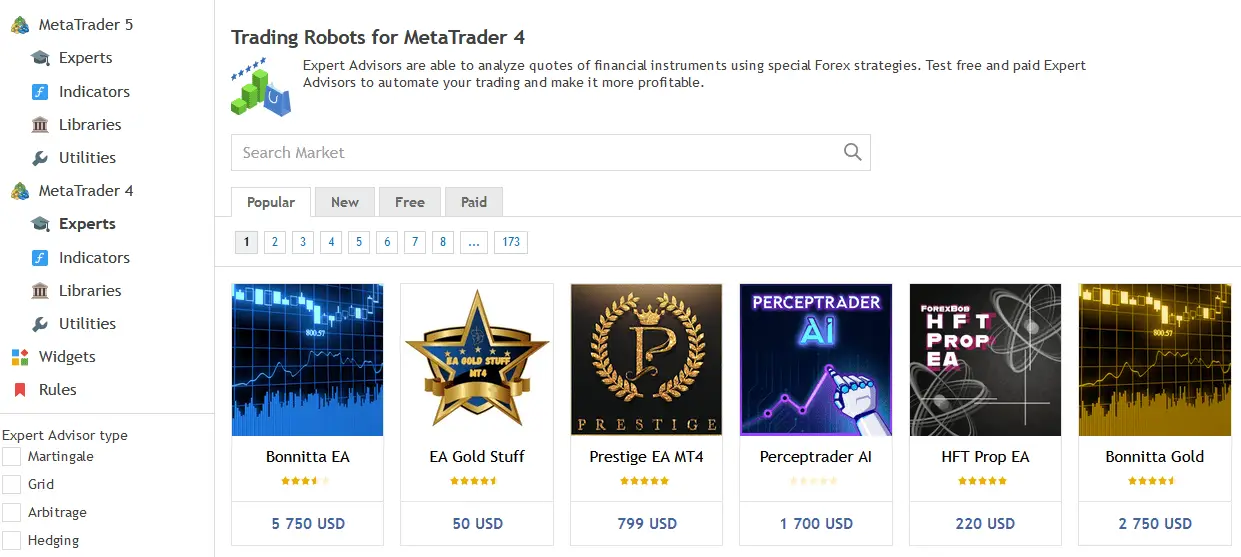

For example, most traders use the most extensive forex robot database connected with each MT4 and MT5 platform – the MQL5.com website. However, you can see terrible results if you test in real trading robots,. Usually, strategies keep losing trades very long.

This is a screenshot from the Experts section on the MQL5 website:

An Expert Advisor (EA) is an algorithmic trading system designed to automate the process of trading in the foreign exchange (forex) market. However, the profitability of these systems can vary greatly depending on their design, implementation, and the understanding of the user.

Arguably, the most profitable Forex robot is a custom-made Expert Advisor developed by a trader for personal or company trading. There are several reasons why this is the case:

- Transparency and Understanding: When you create your own EA, you have complete knowledge of the underlying trading logic. You know precisely when it will open or close a trade based on the specific conditions that you have set. This level of understanding and transparency is crucial in trading, where misunderstanding or lack of knowledge can lead to significant financial losses.

- Customization to Trading Style and Goals: Each trader has a unique trading style, risk tolerance, and profit goal. A custom-made EA can be perfectly tailored to fit these criteria, which is rarely possible with an off-the-shelf solution.

- Flexibility and Adaptability: Markets are dynamic and often unpredictable. With a custom EA, you can tweak and adjust the algorithm as market conditions change, thus ensuring that the system remains relevant and practical.

- Thorough Testing: A self-developed EA allows extensive backtesting and forward testing on historical and live data. This means the system’s robustness and effectiveness can be tested over different market conditions and timeframes before it’s used.

On the other hand, commercially available “black box” EAs that traders find on the market can be dangerous and lead to drastic equity losses for several reasons:

- Lack of Transparency: As the internal mechanics of these EAs are unknown to the user, there’s no way to understand their decision-making process fully. Without this understanding, predicting how the EA will react to various market conditions is difficult.

- Overfitting: Many commercially available EAs are optimized to perform well on historical data. This can lead to overfitting, where the system performs well on past data but fails to adapt to new market conditions, leading to poor performance and potential losses.

- One Size Fits All Approach: Commercial EAs are generally designed to appeal to a broad market. This means that they are not tailored to an individual trader’s specific needs, risk tolerance, and trading goals.

- Insufficient Testing: Commercially available EAs might not be adequately tested across different market conditions and timeframes, increasing the risk of underperformance and losses.

Therefore, while creating a custom-made EA requires more effort and skill, it can result in a more profitable and safer trading system than relying on a black box EA on the market. Only the developer of an EA, who understands its trading logic and can adjust its parameters to fit market conditions, can minimize the risk of drastic equity losses and maximize profitability.

Forex Robot Scam

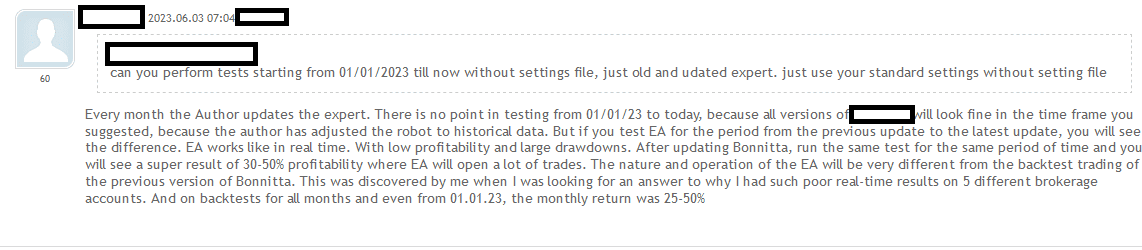

Expert Advisor (EA) sellers often employ a practice known as curve fitting or overfitting to create and update their algorithms. This process involves tweaking the EA parameters to work exceptionally well on past data, but this might not translate into future success due to the dynamic nature of markets.

Here’s a more detailed look at the process:

- Creating the EA: Initially, the EA developer designs a basic trading algorithm. This algorithm could be based on concepts like moving averages, RSI, or other technical indicators. It will have several parameters that dictate its behavior, such as the length of the moving average or the levels at which the RSI indicates overbought or oversold conditions.

- Backtesting and Optimizing: The EA is then run on historical price data, and its performance is analyzed. If the results are unsatisfactory, the developer will adjust the parameters of the EA and rerun the test. This backtesting, adjusting, and retesting process continues until the EA performs strongly on the historical data.

- Updating the EA: Once the EA is sold to traders, the developers might continue to monitor its performance. If the market conditions change and the EA underperforms, the developers might tweak the parameters again to improve its performance based on the recent historical data. These updated versions of the EA are then released to the customers.

While this process might sound logical, it has a major pitfall: the EA is optimized to work well on past data, but financial markets are forward-looking and constantly changing due to many factors, including economic indicators, geopolitical events, and market sentiment. Therefore, an EA that performs exceptionally well on historical data might not necessarily do so in the future.

Additionally, this practice makes it difficult for a potential buyer to conduct meaningful backtesting on the EA. Testing the EA on past data shows excellent results because it has been precisely tuned to that data. However, these results might give a false impression of the EA’s ability to generate profits in live trading.

Therefore, it is essential to understand these practices when considering the purchase of an EA. It’s advisable to test any EA on a demo account over a significant period and be cautious of any system that does not clearly explain its underlying trading strategy.