If you’re looking to get started trading on the HF Markets, it’s essential to understand the financial requirements for doing so. It takes more than just an interest in trading: you need a certain level of financial resources and an understanding of what it means to be an active trader. So, how much do you need to start trading on HF Markets?

Please read the HF markets review to learn more about HF markets accounts.

How Much Do I Need to Trade On HF Markets?

You need at least $5 to open a live account and trade on HF markets. However, to start profitable trading with proper risk management, you need at least a $500 deposit to start trading and avoid a margin call.

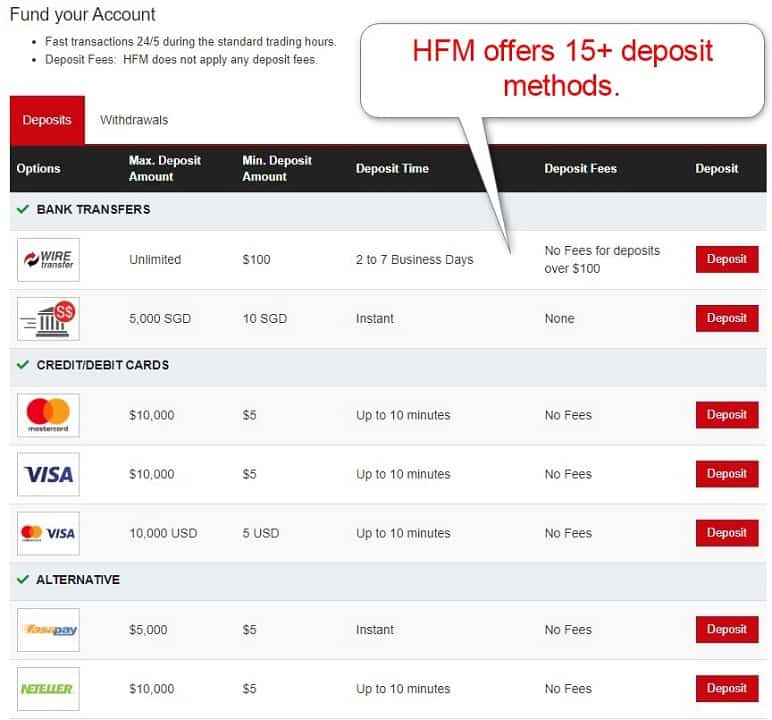

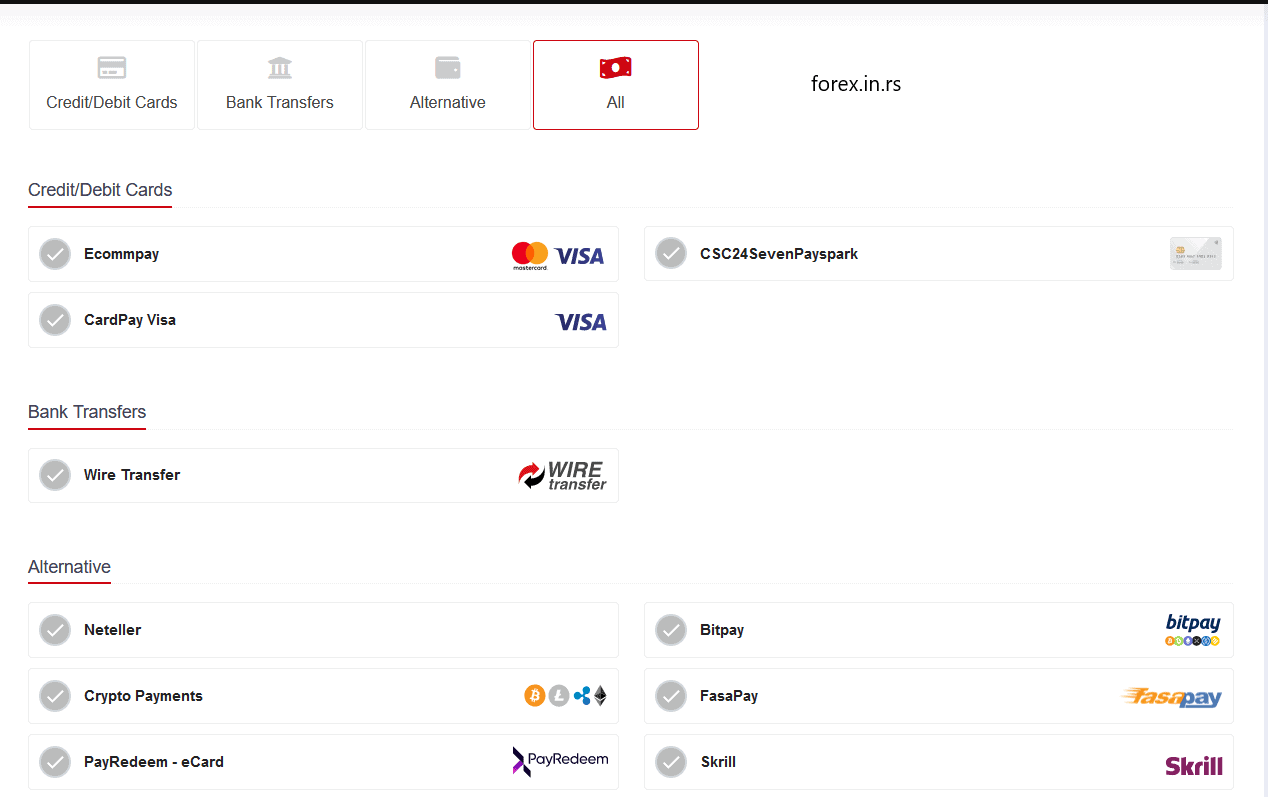

Please see deposit options at HFM:

Most brokers require a minimum deposit of $5 to open an account and begin trading on HF Markets. This is because some brokers have lower financial thresholds than others, meaning they will allow traders with limited capital or experience to open an account and get started with trading.

However, opening a live account will not guarantee success when trading on HF Markets. To be profitable and trade responsibly, you need more than just the minimum deposit amount of $5. Most successful traders advise having at least $500 deposited into your account before starting trading. This allows for proper risk management when taking positions and prevents too much money from being put at risk.

It’s important to remember that investing in any asset carries risks – even if you put down a large deposit. That’s why it is always best practice for new traders (or experienced traders alike) to research their investments thoroughly before entering any positions and use stop losses when appropriate to minimize exposure and losses should the market move against them.

Depositing more money into your trading account is essential to reduce the risk of high-leverage trading. Forex trading involves using leverage, which means you can control a more prominent position size with less money. While this can increase your potential profits, it also increases your potential losses if the market moves against you.

A slight price movement can quickly wipe out your account balance if you have a small account balance and use high leverage. On the other hand, if you have a more extensive account balance, you can use lower leverage, reducing your risk exposure and giving you more flexibility to manage your trades.