Table of Contents

Trading is a skilled activity, and it requires the traders to have enough knowledge about the market trends, analytical tools, indicators, and more. There are a lot of risks involved in trading, and to stay clear of any impact of these risks, traders use different tools that can help them prevent them.

One such tool is Stop-Loss. Read this article to find out how stop-loss works, when you can use it if it can be used during pre-market or after-market sessions, and what type of orders can be used outside the traditional market sessions.

What Is Stop-Loss?

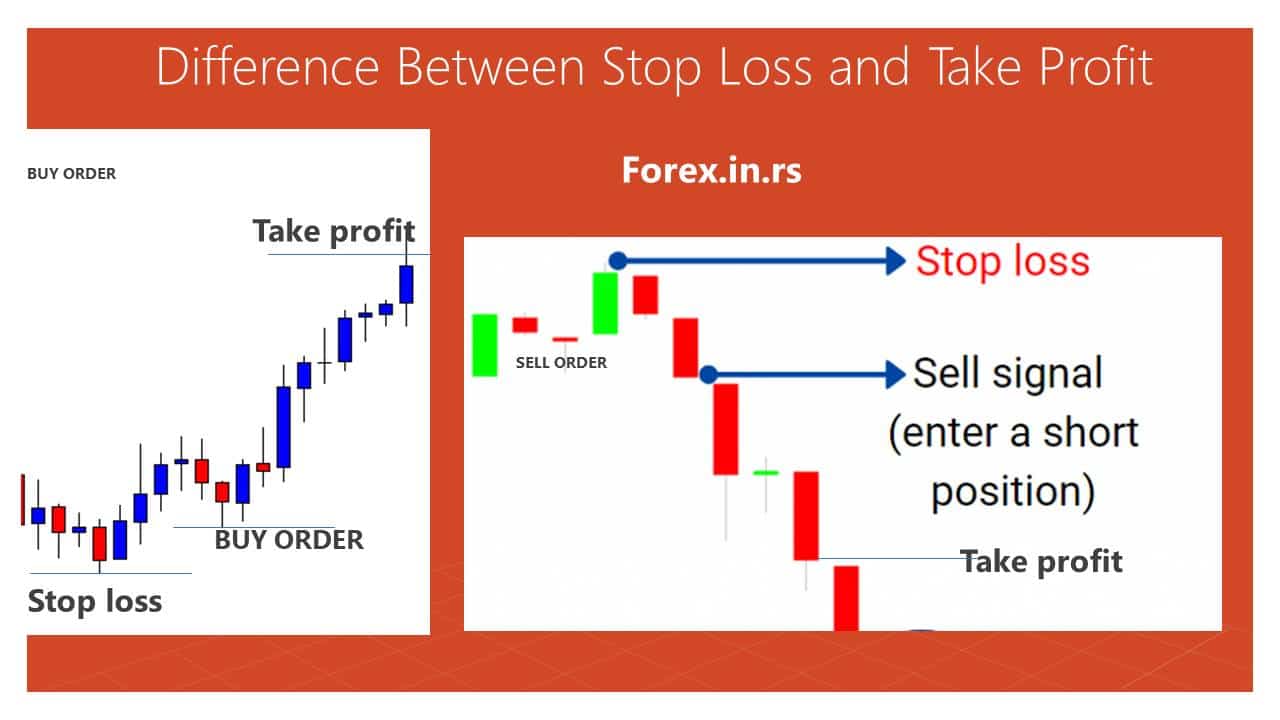

Stop-loss order is an instruction placed with a broker to buy or sell a security by setting a stop loss level, a specified amount of pips away from the entry price. The Stop-loss order’s purpose is to prevent additional losses if the price goes against the trading position.

Stop-loss is a tool used by traders to minimize their trading losses. Using this tool, they put an order on the price chart, where they want to exit the market by buying or selling. These orders are placed at the price levels the traders are willing to take the risk. For example, if the trader at $50 purchased security, he puts the stop-loss at $40. The trader expects to make a profit but is willing to lose only $10. Therefore, if the price falls to $40, the stop-loss will get triggered, and the trader can exit the market to avoid further loss.

If the price doesn’t fall to the stop-loss level in the above case, the order will not be complete. At the end of the market session, your stop-loss will be unexecuted, and hence, it will lapse. You will have to place a new stop-loss order for a new session.

Stop-loss is a widely used tool and is very efficient in performing its task. It is typically used in day trading. It helps traders follow their trading strategy and saves them from market risks.

Do Stop Losses Work After Hours?

No, stop-loss orders do not execute during pre-market or after-hours sessions. Stop-loss orders can not affect when the stock is not trading during weekends or market holidays. The stop-loss orders typically run between 9:30 a.m. – 4:00 p.m., and they will not run during extended-hours sessions.

Stop-loss is placed during the regular trading sessions, from 09:30 AM to 04:00 PM (ET). At the end of the trading sessions, the stop-loss orders placed lapses, triggered or not. If there are any stop-loss orders placed outside the market sessions, they are put towards the next session. It doesn’t matter when you place the order; it will only get executed during the trading session.

Stop orders carried forward to future market sessions are called GTC (Good-Till-Canceled). These stop-losses are functional for a maximum period of 60 days.

Do trailing stop losses work after hours?

No, trailing stop-loss orders do not execute during pre-market or after-hours sessions. Trailing Stop-loss orders can not affect when the stock is not trading during weekends or market holidays. The trailing stop-loss orders typically run between 9:30 a.m. – 4:00 p.m., and they will not run during extended-hours sessions.

How To Successfully Place Stop-Loss Orders?

Stop-loss orders traders and investors put near-critical price levels such as daily low and high, weekly low and high, monthly or yearly low and high. Additionally, strong resistance levels and strong support levels such as Fib levels and other price levels can be potentially excellent levels for stop loss.

Placing the stop-loss on the price chart is not very difficult. It entirely depends upon the trader’s trading strategy and how much they are willing to take the risk. However, a few points must be kept in mind while positioning the stop loss. They are:

- Placing the stop-loss too low can increase the risks and the loss of capital.

- Placing it nearer to the peaks can trigger them more frequently.

- Stop-loss must be placed at the optimal place, where the entry and exit to and from the market are according to the trading strategy.

One simple rule that traders can follow while placing the stop-loss is to position it below and above the swing low and swing high. Swing down and swing high refer to the lower points and higher points on the price charts from where it bounces back. The ideal position is placing a stop loss above or below the swing high and swing low.

The stop-loss below the swing low determines your market entry point or buying position. Stop-loss placed above the swing-high determines your market exit point or selling position. Both positions can turn out to be profitable for traders.

Other technical indicators can also be used to place a stop-loss. It is advisable to use all the methods before deciding which way works better for you.

After-Market and Pre-Market Trading Sessions

The traditional trading starts at 09:30 AM (ET) and ends at 04:00 PM (ET). Trading sessions occurring before the traditional trading session are known as Pre-Market Trading sessions. The usual timing of this session is 08:00 AM to 09:30 AM. While the trading sessions after the conventional trading session are known as After-Market Trading sessions, the timing for these sessions is usually between 04:00 PM to 08:00 PM.

The timings of these extended sessions may vary depending upon the broker. Some may even start the pre-market session as early as 05:00 AM. Instead of a stock exchange, ECN (Electronic Communication Session) is used to match buyers with sellers during the extended sessions.

Benefits of Extended Trading Sessions

Extended trading sessions mean comprehensive benefits. There are certain advantages that traders can expect from the after-market and pre-market trading sessions. These are:

- When a company announces earnings, it impacts stock prices, negative or positive. The announcement made by companies is generally outside of the market sessions. Therefore, do not wait for the market to open to take advantage of these announcements.

- If a trader is not available at regular trading sessions, they can take advantage of these extended sessions to trade. This way, they will not miss out on trading opportunities.

- Any news released outside the trading session will affect the market when it opens. With extended sessions, you can avoid the impact of these news releases.

- Extended sessions can give you a heads-up on the changes in the trend of securities and the market in the new session.

- The volatility risk is higher during extended trading sessions than in general trading sessions. Due to this increased volatility, traders can benefit from profitable stock prices.

- Every stock exchange works according to its local time zone. Therefore, traders can take advantage of the time zone difference and seize profitable opportunities in foreign markets when their local market is out of session.

Drawbacks of Extended Trading Sessions

Due to high volatility and increased risk during pre-market and after-market sessions, there are certain disadvantages that traders may face. High volatility is the low liquidity because very few traders participate in trading activities. Let’s look at some of the disadvantages of extended trading sessions.

- Buying and selling stocks at competitive prices is difficult due to decreased liquidity. Traders may only get to fulfill a partial trade or no trade at all.

- Prices move quickly during standard trading sessions as many people are trading. There is a slower price adjustment during extended sessions than traditional trading sessions.

- There is a more significant gap between the bid and ask price due to lower trading volumes. That is why many traders do not get concluded.

- Institutional traders have more sources for market data. Therefore, extended trading sessions can be disadvantageous for individual traders as the competition is tough.

Types of Orders Allowed During Extended Market Sessions

The following are the orders used during the extended trade sessions, stating that they are approved.

Limit Order- By placing a limit order, a trader specifies the lot size (quantity) of securities and a target limit price (the security price) at which he is willing to buy. Usually, a stop-loss is also placed with the limit order. This order is closed either when the desired trade is made, at the limit order, or when the price stops loss. The limited order gets achieved if the trader gets the desired quantity at the specified price. This order is valid through the extended session also.

Market Order- Once you place a market order during the operational market hours, your order remains pending till the market closes for the day. These purchases move to your portfolio the next day. Even though the investments are finalized the next day, the orders are irreversible. There is also an option where you can buy stocks after the market is closed for the day. With such orders, you have to choose a price point. When the market opens the next day, the order is accepted if the price point matches your bid. Otherwise, it remains pending.

Good-Til-Canceled Order (GTC)- If a Good-til-canceled order is placed during an extended market session, it is not closed until canceled or completed. On the contrary, a GFD (Good For Day)order is valid only through trading sessions. If any order is placed during extended sessions, the order remains pending until the next session begins.

Conclusion

Stop-loss is one of the most efficient tools to help a trader trade more strategically and less emotionally. It helps a trader exit the market before he loses too much or enters the market at the most profitable position. It does not work outside of the market session. However, it is beneficial if its execution is understood correctly. For this, a trader needs to have adequate knowledge about the market and its factors.