My journey as a trader began approximately 18 years ago when I first encountered the Metatrader platform. Back then, Metatrader was a game-changer for me. This Windows-based software not only provided live chart prices but also offered an incredibly intuitive charting experience. It was my gateway into the exciting world of trading. In this article, I’ll share my experiences and insights, reflecting on how my trading journey has evolved since those early days with Metatrader.

To ensure impartiality in my assessment of trading platforms, I acknowledge my long-standing affinity for MT4 while striving to evaluate its strengths and weaknesses objectively. I maintain an open-minded approach by considering alternative platforms and recognizing that personal preferences can differ among traders.

Metatrader (MT) and TradingView (TV) are reading and analysis platforms widely used. This article aims to provide an in-depth summary of these platforms, drawing from various opinions and experiences. While both have merits, choosing them depends on your needs and preferences.

Metatrader excels as the best Windows/Mac platform due to its algorithmic solid trading focus and robust execution. It offers traders reliable access to financial markets through forex brokers. On the other hand, TradingView’s strength lies in being the best web-based platform. It offers an array of advanced trading tools, powerful charting capabilities, and a social network that fosters interaction among traders.

While both platforms provide essential features like charts and broker connectivity, Metatrader’s distinct advantage lies in its extensive library of community Scripts, Indicators, and Expert Advisors, making it a valuable choice for traders who rely on automated strategies and advanced technical analysis tools. Furthermore, MetaTrader’s direct market access with live prices without delay available in the free version ensures a real-time trading experience, unlike TradingView, which offers live prices only in premium plans.

You can unlock the premium features of TradingView if you click on the button below:

VISIT TRADINGVIEWThe comparison between Metatrader and TradingView reveals some significant distinctions that can significantly impact a trader’s experience. While both platforms offer essential charting capabilities and connectivity to brokers, Metatrader stands out with its extensive library of community-contributed Scripts, Indicators, and Expert Advisors. This expansive resource pool is valuable for traders who depend on automated trading strategies or require advanced technical analysis tools.

One of Metatrader’s standout features is its direct market access, with live prices in the free version. This real-time data stream allows traders to make informed decisions promptly, which is crucial for the fast-paced nature of financial markets. In contrast, TradingView provides live prices only in its premium plans, which could be a significant limitation for traders on a budget.

The availability of live prices without delay in Metatrader’s free version saves costs and ensures traders can access accurate and up-to-the-minute market information. This advantage can be a game-changer for those who must react swiftly to market fluctuations or execute trades precisely.

Furthermore, the vast community of Metatrader users contributes to constantly developing new and innovative trading tools and strategies, which can enhance a trader’s capabilities and effectiveness. This collaborative environment fosters learning and growth within the trading community.

While TradingView is undoubtedly a powerful charting platform and offers a social network for traders to connect and share ideas, its limitation in providing real-time data in the free version can be a drawback for those looking to maximize their resources and capitalize on market opportunities efficiently.

TradingView’s Strengths:

- User-Friendly Interface: One common opinion is that TradingView is exceptionally user-friendly. It provides an intuitive and visually appealing interface that makes chart analysis and marking up charts a breeze.

- Customization: TradingView offers a high degree of customization. Users can create different layouts for various purposes, allowing for a tailored trading experience.

- Web-Based Access: TradingView’s web-based nature allows traders to access their charts and analysis from different devices, providing flexibility and convenience.

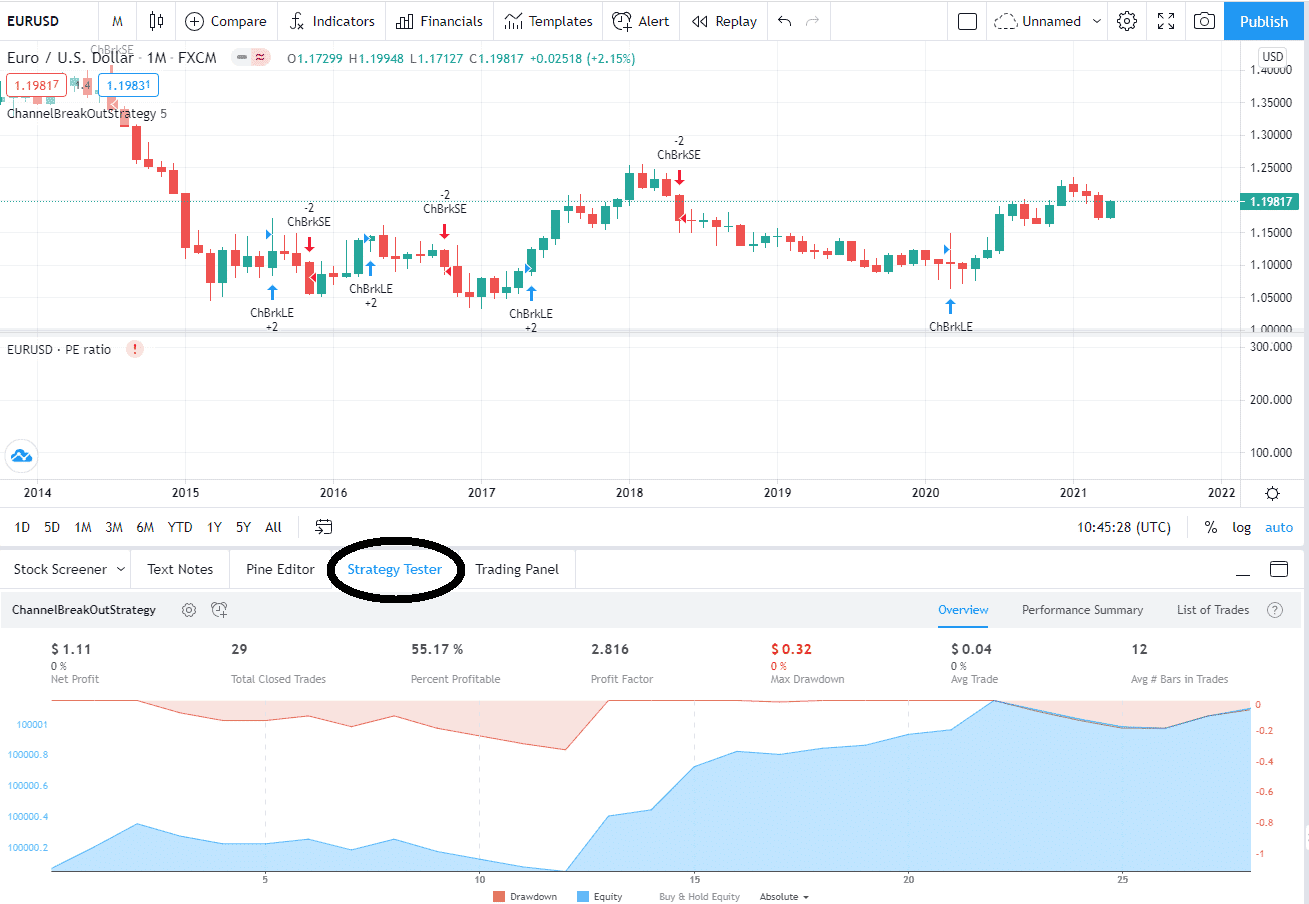

- Bar Replay Feature: The bar replay feature in TradingView is considered a game-changer. It allows users to test trading strategies quickly and efficiently, saving valuable time.

- Abundant Indicators: TradingView boasts a vast library of indicators, making it suitable for traders who rely heavily on technical analysis.

- Risk: Reward Tool: Including the Risk: Reward tool aids in risk management and decision-making.

- Affordable Plans: Many traders find the accessible version of TradingView sufficient for their needs, while the paid plans offer additional features at reasonable prices.

- EliteAlgo Integration: Users have reported success with EliteAlgo trading integration on TradingView, which can offset the subscription cost with profitable trades.

Meta trader’s Advantages:

-

- Performance: These platforms are optimized for Windows, resulting in faster execution speeds and responsive charting. Traders can rely on them for quick order execution and real-time data updates.

- The Metatrader platform is entirely FREE: You can use it for free on MT4 and MT5. For liveemo trad,ing. For live accounts, you can trade using $10 (for example, a cent an account).

- Customization: MT4 and MT5 provide extensive customization options, allowing traders to tailor the platform to their needs. They can modify charts, indicators, and templates and even create custom scripts and Expert Advisors (EAs) for automated trading.

- User-Friendly Interface: MT4 and MT5’s intuitive and user-friendly interfaces make them accessible to traders of all experience levels. The navigation and functionality are designed to be straightforward, enabling traders to focus on their analysis and strategies rather than struggling with the software.

- Compatibility: As Windows-based software, MT4 and MT5 are compatible with various third-party indicators, EAs, and scripts, enhancing their versatility and usefulness for traders who wish to expand their toolkit.

- Scalability: Both MT4 and MT5 are scalable to accommodate the needs of traders at different stages of their journey. Whether you’re a beginner or an advanced trader, these platforms can cater to your requirements.

- Community Support: The widespread popularity of MT4 and MT5 has fostered a strong community of traders and developers contributing to an extensive library of resources, tutorials, and add-ons that enhance the functionality of Windows software.

- Stability and Reliability: MT4 and MT5 have been developed to run seamlessly on Windows operating systems. Their robust architecture ensures stability, minimizing the risk of crashes or system errors during trading.

- Live prices: Metatrader 4 (MT4) and Metatrader 5 (MT5) have a distinct advantage over TradingView regarding their demo versions. MT4 and MT5 offer real-time live prices in their demo accounts, providing traders with a more authentic trading experience for testing strategies and honing their skills. In contrast, TradingView’s demo version does not offer access to accurate live prices, potentially limiting the accuracy and realism of one’s practice sessions.

- Exclusive Indicators and Scripts: For users heavily reliant on specific MT4-exclusive indicators, Expert Advisors (EAs), or scripts, sticking with Metatrader might be more practical.

Conclusion

Metatrader and TradingView ultimately depend on your specific trading requirements and preferences. Metatrader’s distinctive advantages, including its extensive library of community-contributed Scripts, Indicators, and Expert Advisors, as well as its direct market access with real-time prices available in the free version, make it a solid choice for traders who rely on automated strategies and need up-to-the-minute market data.

On the other hand, TradingView offers a powerful charting platform and a social network for traders to collaborate and share ideas, making it an attractive option for those who prioritize advanced charting and community engagement.

Ultimately, your decision should be guided by your trading style and goals. If you prioritize advanced technical analysis and automation, Metatrader may be the more suitable choice. However, if you value social interaction and charting capabilities, TradingView could be the platform that aligns better with your needs. In some cases, traders might even choose to use both platforms in tandem, leveraging the strengths of each to optimize their trading strategies.