Table of Contents

TradingView is a revolutionary trading platform that leverages the power of crowdsourcing to provide its users with incredible financial analysis and insights. It’s designed to help traders identify potential opportunities and make better, more informed decisions on when to buy or sell stocks, options, futures, currencies, and more.

In my video, I made step-by-step instructions:

TradingView provides investors real-time market data straight from the exchanges, including quotes, charts, and other technical indicators. Its powerful charting tools enable traders to quickly analyze market trends, draw support/resistance lines, create custom indicators, and even set up automated alert systems.

The platform also offers a range of social media-style features such as user profiles, news feeds from exchanges, and comments sections where traders can share their strategies or ask questions. In short, TradingView is a comprehensive trading platform that helps you stay ahead of the curve in today’s ever-changing markets.

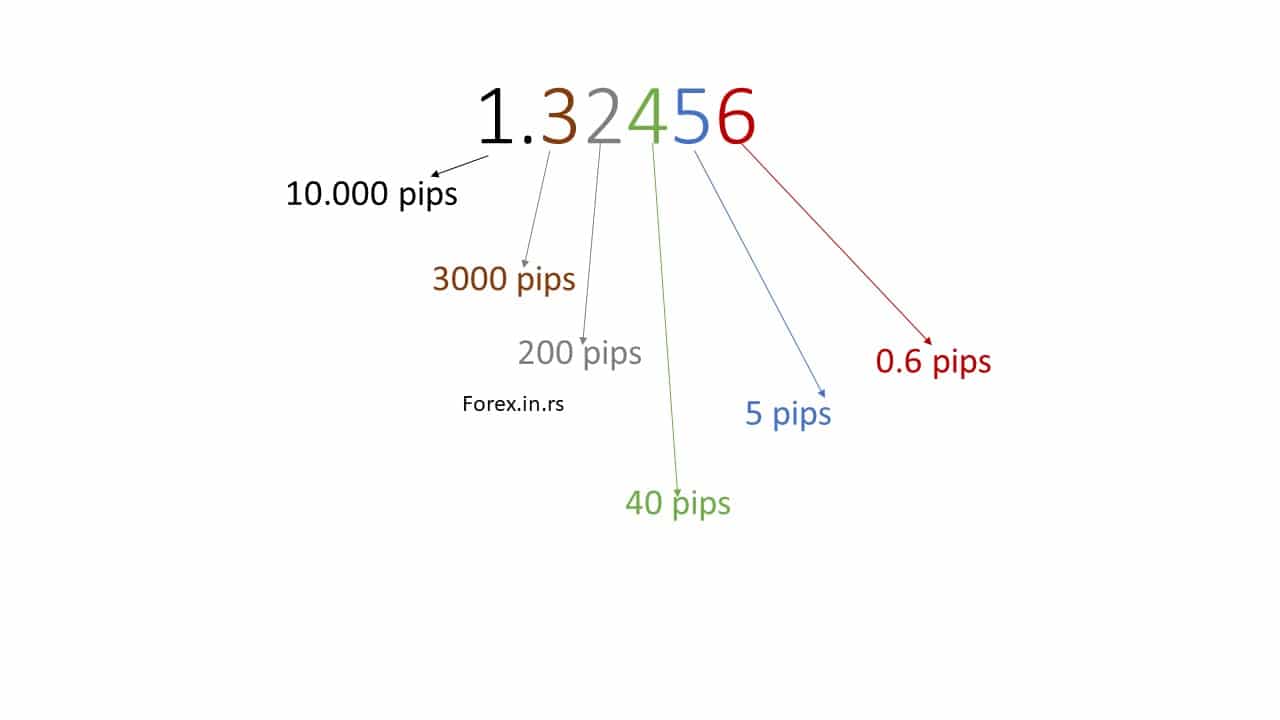

A pip is a minor change in the exchange rate for a currency pair and is calculated using the last decimal point. Since most major currency pairs are priced to four decimal places, the slightest change is that of the last decimal point, equivalent to 1/100 of 1% or one basis point.

Below, you can see my video about TradingView and pips from the fxigor YouTube channel:

How to Calculate Pips on TradingView?

To calculate pips on the TradingView chart, use the tool “Measure.” When you drag and drop the “Measure” tool, you can mark two price levels to calculate pips differences.

In the image below, you can see what the “Measure” tool looks like:

Let us show you how to calculate pips on the TradigView chart if we pick the highest and lowest price levels on the EURUSD chart during the US session.

For example, the highest high price level is 1.0859, and the lowest is 1.0802.

As you can see, this tool shows 57 pips, a difference between 1.0859 and 1.0802.

Here are some examples to illustrate how to calculate pips on TradingView:

Example 1: Basic Calculation from the chart above

- High Price Level: 1.0859

- Low Price Level: 1.0802

- Pip Calculation:

- Subtract the low price level from the high price level:

.

- Since a pip is the fourth decimal place, you count four places to the right: 0.0057 represents 57 pips.

- Subtract the low price level from the high price level:

Example 2: Another Currency Pair

- Currency Pair Exchange Rate: 1.1012 to 1.1013 for EUR/USD

- Pip Calculation:

- The difference is

.

- Since one pip is 0.0001, the difference represents one pip.

- The difference is

Example 3: Using the Measure Tool on TradingView

- Open TradingView and select the EUR/USD chart.

- Use the “Measure” tool to mark the highest and lowest low within a certain period, like the U.S. session.

- Suppose the highest high is 1.0859, and the lowest low is 1.0802.

- The tool will show the difference, which in this case is 57 pips.

Example 4: Larger Pip Movement

- High Price Level: 1.1500

- Low Price Level: 1.1000

- Pip Calculation:

- Subtract the low price level from the high price level:

.

- This difference represents 500 pips.

- Subtract the low price level from the high price level:

Example 5: Minor Currency Pair

- Currency Pair: GBP/JPY

- High Price Level: 150.00

- Low Price Level: 149.50

- Pip Calculation:

- The pip is the second decimal place for pairs like GBP/JPY, where the currency is quoted in two decimal places.

- The difference is

.

- This represents 50 pips.

Important Notes:

- Decimal Places: The pip is the fourth decimal place for most currency pairs. For pairs involving the Japanese Yen, it is the second decimal place.

- Leverage and Risk: Be aware of leverage and risk when tradForexorex, as movements in pips can significantly affect profits and losses, especially when high leverage is used.

- Platform Tools: Utilize the various tools and indicators available on TradingView for more accurate measurements and analysis.

- Practice: Use a demo account on TradingView to practice calculating pips without financial risk.

In any trading platform, to calculate pips for various assets:

For example, how to calculate pip difference?

To calculate the pip difference in the forex pair, you need to count the decimal places where the last decimal place represents one pip difference. For example, the EURUSD currency pair exchange rate of 1.1012 has four decimal places, and each pip has a value of 0.0001. Therefore, from 1.1012 to 1.1013 is a one-pip difference. However, some currency pairs like USDJPY have one pip value of 0.01. So, for example, from 108.20 to 108.21 is one pip difference.

Please visit our page to learn more about how to count pips in MT4.

For example, on our website, you can learn how to calculate pips on gold or count pips on silver.

To unlock TradingView features, try the following: