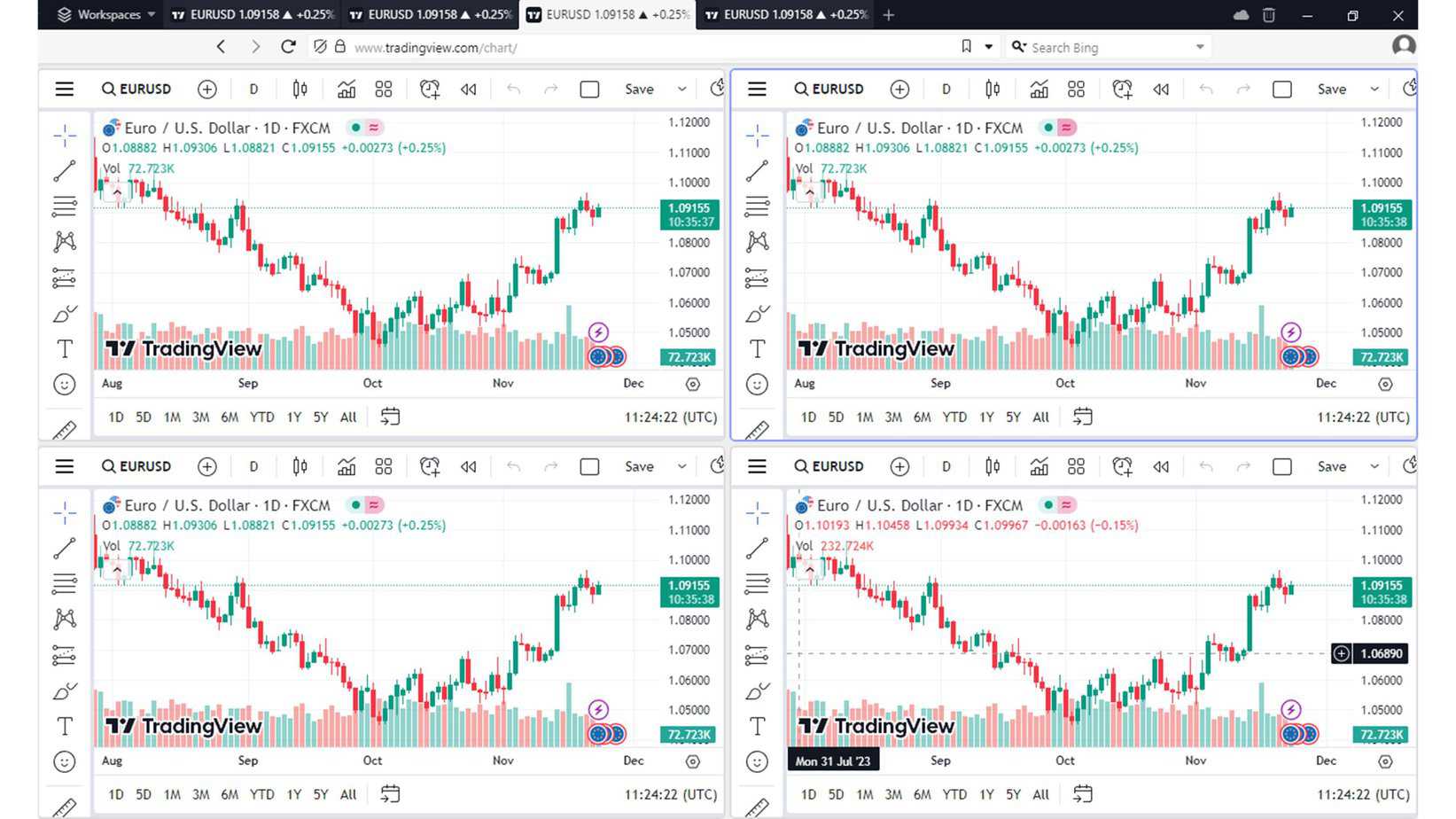

Readers often rely on various platforms to access market data, and two popular choices are TradingView and the MetaTrader platforms, specifically MT4 (MetaTrader 4) and MT5 (MetaTrader 5). However, traders may notice these platforms sometimes display significantly different prices for the same assets. One key factor contributing to this discrepancy is the data delay present in TradingView, which can be up to 15 minutes, while MT4 and MT5 provide accurate live prices even in demo and live accounts. This article will explore the reasons behind these price differences and their implications for traders.

Price Differences Between MT4 and TradingView exist because MT4 and MT5 offer accurate trading prices in the free or live version. However, in TradingView, there are a few minutes of price delays for TradingView’s free account.

But this is not all!

The price differences between MetaTrader 4 (MT4) and TradingView can primarily be attributed to the fact that these platforms use different data sources. Each platform aggregates price feeds from various brokers, while TradingView allows users to select prices from different brokers. This can lead to observable discrepancies due to the variation in spreads, liquidity, and broker-specific pricing policies.

On the other hand, MT4 is typically tied to a single broker chosen by the user, and its prices reflect that broker’s specific feed, leading to potential differences when compared to the broader selection available on TradingView.

So this is why TradingView and mt4 show entirely different prices for AUDCAD, GBPUSD and other pairs.

You can unlock the premium features of TradingView if you click on the button below:

VISIT TRADINGVIEW

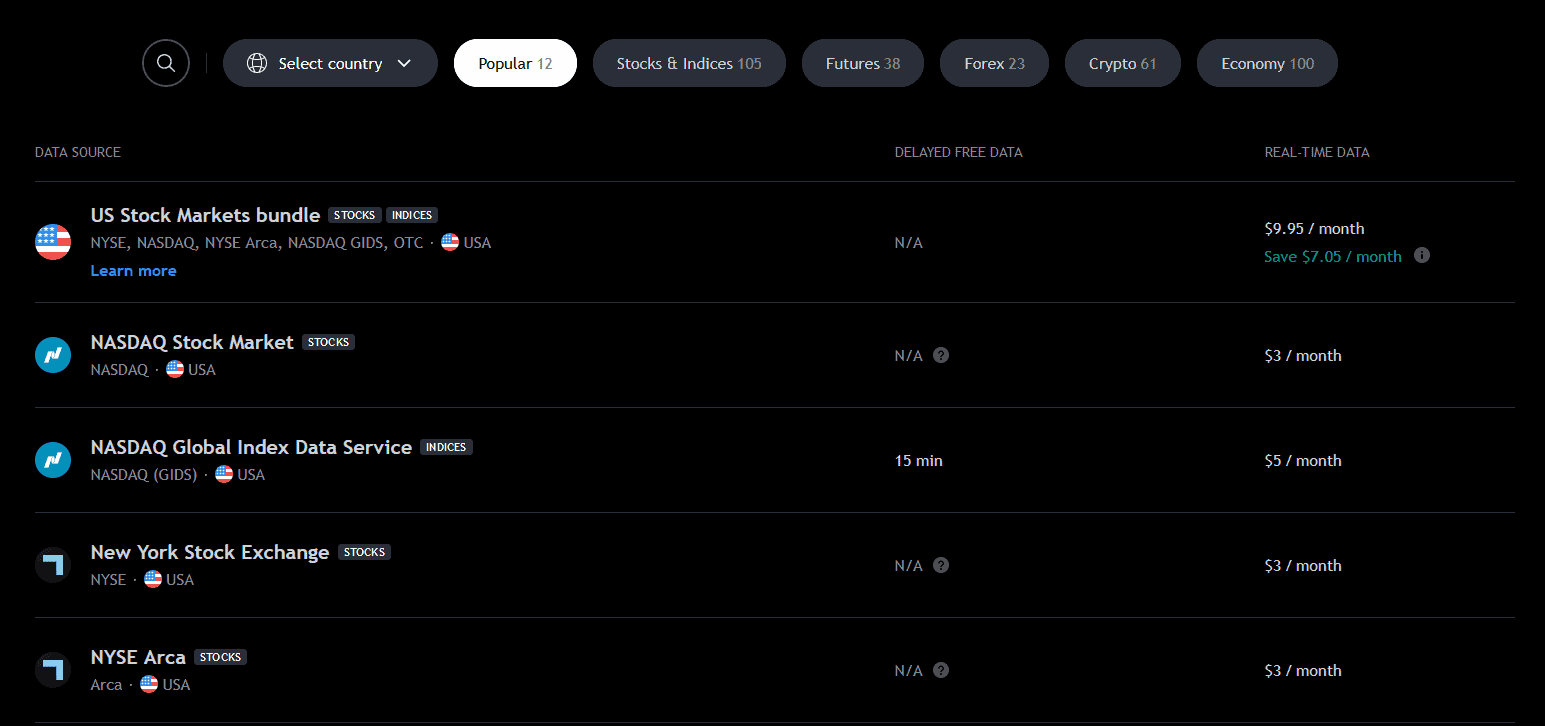

TradingView offers access to real-time data for various stock markets, including the US stock markets such as NYSE (New York Stock Exchange), NASDAQ, NYSE Arca, NASDAQ GIDS (Global Index Data Service), and OTC (Over-the-Counter) markets. However, this real-time data comes at a cost, and traders must subscribe to specific data bundles or exchanges to access it.

Here’s a breakdown of the cost and availability of real-time data for select stock markets on TradingView:

- US Stock Markets Bundle: This bundle covers major US stock exchanges, including NYSE, NASDAQ, NYSE Arca, NASDAQ GIDS, and OTC. To access real-time data for these markets, traders need to subscribe to this bundle for $9.95 per month.

- NASDAQ: For traders interested in the NASDAQ Stock Market exclusively, real-time data can be obtained by subscribing to NASDAQ data for $3 per month.

- NASDAQ (GIDS): The NASDAQ Global Index Data Service (GIDS) distinguishes NASDAQ indices for $5 per month.

- NYSE: Traders focusing on the New York Stock Exchange (NYSE) can subscribe to NYSE data for $3 monthly to access real-time information.

- Arca: NYSE Arca data is available for $3 monthly and provides real-time data for this particular exchange.

- OTC: Traders can subscribe to OTC Markets data for $3 monthly. However, this data has a 15-minute difference, which can be substantial when CBOT, COMEX, and NYMEX: The CME Group, including E-mini contracts, provides real-time data for $7 monthly. This bundled futures exchanges.

- NSE (National Stock Exchange of India): TradingView offers free real-time data for the National Stock Exchange of India.

- MYX (Bursa Malaysia Berhad): Access to real-time data for the Bursa Malaysia Berhad (MYX) costs $2 monthly.

- SET (Stock Exchange of Thailand): Traders interested in the Stock Exchange of Thailand (SET) can subscribe to real-time data for $2 monthly.

- TSE (Tokyo Stock Exchange): For $ 3 monthly, you can access real-time data for the Tokyo Stock Exchange (TSE), including TOPIX, Fukuoka Stock Exchange, and Sapporo Securities Exchange.

- BIST Mixed (Borsa Istanbul): Borsa Istanbul data without volume information is available for $1 per month. However, this option does not provide real-time data.

Traders must assess their specific needs and trading strategies when considering whether to subscribe to real-time data and markets on TradingView. The availability and cost of real-time data can vary depending on the exchange, and traders should choose the data subscriptions that align with their trading preferences and goals.

Understanding Data Delays in TradingView: TradingView, a web-based charting platform known for its user-friendly interface and powerful technical analysis tools, offers free access to market data for various financial instruments. However, there is a significant catch: data delays. The extent of the delay varies depending on the exchange and the specific instrument being viewed. In some cases, especially with stock exchanges, data can be delayed by up to 15 minutes for free users.

The Reasoning Behind Data Delays: Data delays are not arbitrary; they serve a specific purpose. The primary reason for imposing data delays on free users is to incentivize them to upgrade to premium plans. Premium subscribers typically enjoy access to real-time market data, which is essential for traders who require up-to-the-minute information to make timely trading decisions.

This strategy benefits the platform by distinguishing between free and paid services, enticing users to subscribe to premium plans. Moreover, exchanges often charge licensing fees for real-time data, which TradingView must cover when offering this service to its users. Consequently, TradingView passes some of these costs onto premium subscribers.

Impact on Trading Decisions: Data delays in TradingView can significantly affect traders. Differences can be substantial when comparing the prices displayed on TradingView with those in real live accounts on MetaTrader platforms like MT4 and MT5. These discrepancies can lead to confusion and may affect trade execution.

For instance, if a trader relies solely on TradingView for price information and executes trades based on delayed data, they risk entering the market at prices that no longer reflect the current market conditions. This can result in unfavorable entry or exit points, leading to potential losses or missed opportunities.

Choosing the Right Platform: To navigate these discrepancies effectively, traders should carefully consider their trading goals and requirements when choosing a platform. If real-time data is essential, especially for intraday or high-frequency trading strategies, platforms like MT4 and MT5, which provide live prices even in demo accounts, may be the preferred choice.

However, TradingView remains a valuable tool for traders who prioritize advanced technical analysis and charting capabilities and those who can tolerate some latency in their market data. Additionally, premium subscriptions to TradingView can offer real-time data, bridging the gap between it and platforms like MT4 and MT5.

The differences in price data between TradingView and MT4/MT5 stem from the deliberate imposition of data delays on free users by TradingView. These delays encourage users to upgrade to premium plans and help cover the costs associated with providing real-time data. Traders should be aware of these discrepancies and carefully consider their trading needs when selecting a platform. While MT4 and MT5 offer accurate live prices, TradingView remains valuable for traders prioritizing advanced technical analysis and charting capabilities. Ultimately, the choice of platform should align with a trader’s specific goals and preferences.

You can unlock the premium features of TradingView if you click on the button below:

VISIT TRADINGVIEW