MT4: Market Execution vs. Instant Execution

Have you ever used the MT4 platform? Do you want to have a better idea of MT4 market execution vs. instant execution?

What is Market Execution in forex?

Market execution is a type of execution in which the client places an order and specifies only the volume. If an order can not be executed, the broker will execute the order at the next available price.

What is Instant Execution in forex?

Instant execution meaning:

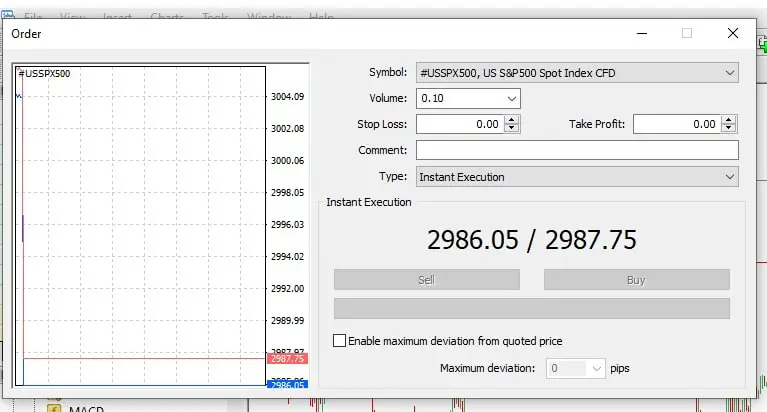

Instant execution is a trading order execution specified with price and volume immediately (instant) processed by the broker. If the price changes at that moment, a broker cannot change the execution price. The broker can reject the instant execution of the order and respond with a requote. Prices in instant execution are predefined. The trader can set stop loss and take profit levels before opening a trade.

Mt4 instant execution explanation

Instant execution brokers

For example, instant execution broker Hotforex has the option for clients that can close and manage orders over the phone with the Execution trading desk when necessary.

When the STP brokers use market execution, the dealing desk brokers are known for using instant execution. You might find it more profitable since it offers more options and flexibility. Here you do not need to wait to establish your position to place the stop loss. In this type, you can set the stop loss and place take-profit orders while entering the trade. Instant execution forex example :

When a client places an order and selects both the quantity and the price explicitly, the order should be processed immediately. This model is known as instant execution. If a price were to change instantaneously, a broker would have no power to change the execution price. He does, however, have the ability to reject the execution and respond with a requote.

This requote can be accepted or denied. Market maker brokers generally utilize this type of execution. Instant execution uses what is known as a specified spread. This spread is larger than the actual market spreads. Since some trading mediums do not support the Depth of Market or DOM, the instant execution model is used. In market execution, it would be opportune to explain to prospective clients why an executed order’s price is higher than when the order was placed. This would be especially noticeable in large quantities of thirty lots or more. The causes of this are that defined bidding and asking prices are constituted only in defined amounts on the market. The orders of large quantities will be filled according to the amounts of prices that are available. However, there is nothing that averts brokers from utilizing market execution without DOM and computing their clients’ prices using their exclusive algorithm. A broker utilizing instant execution may also experience some obstacles when placing trades at large liquidity providers (LP). This difficulty is linked back to the DOM since nearly all LPs utilize the market execution model.

The main obstacle seems to be because the LP that uses market execution can not ascertain a specific price for a broker, but the broker must verify the client’s price. A potential solution for this issue is to simulate instant execution in the market execution environment using limited orders. Respectively, the limited order would ascertain the execution of a fixed volume at a fixed price. By placing an order limit with a limited timeout period, we will ascertain execution by the requested price. However, this solution can’t be used for the issue with orders of large quantities. If there are not adequate quantities by the requested price in the DOM, the orders can not be filled. This will cause an increase in the amount of requotes for a broker’s customers.

This will also affect the quantity of execution. When a client places an order and only specifies the volume, this is known as market execution. The asking price of a product is computed during the process of execution. The main factor that differentiates market execution from instant execution is that a broker can not reject the customer’s request in the event of a price change. The broker will instead fill the order with the present rate. The final price is calculated by taking the necessary quantity available by the prices from the DOM. The majority of the LPs and A-book brokers (STP / ECN) work by this concept.

Can One Use Both?

Yes, one can use both. However, you can be easily confused when you have different types of execution. If you mostly use instant execution, it might be hard for you to enter a trade without placing your stop loss. It is worth mentioning that trading without placing stop loss is not going to be easy.

We can learn from the example of Trader John, A scalper. He was used to trading with instant execution. However, Broker A suddenly changed the execution-style, making it difficult for him to stop loss and profit while entering a trade. This sudden change caused troubles to the scalper, John. He relied on small spikes. But if the price goes off quickly, he will be left with no choice except to lose a major amount, which can adversely affect his account.

Even expert advisor programmers can face this problem while considering market execution. They first need to get in a trade, and then the program can set stop loss or profit levels. It can cause problems in the actual creation and execution of the trade.

So, do your research before considering any of these options. You can first try demo trade to know how a broker executes a trade. You cannot afford all your hard-earned money by simply saying that “I had no idea.”