Table of Contents

The forex market represents the largest and most liquid market in the world. 2022 the forex exchange market accounted for more than $7 trillion in daily trading.

There are different forex markets globally, but as per Reuters and City Asset Management, the world’s recognition for the most prominent forex market goes to London. So, what is the Largest Market in the World? Which is the biggest forex market in the world?

In our article What is the largest forex market in the world, we analyze the forex market and see the forex pairs list. In another article, we wrote about forex market volume, and here, we will analyze only the most traded currencies.

The biggest geographic trading center:

What is the Largest Forex Market in the World?

The world’s largest foreign exchange market is based in London, the capital of the United Kingdom. Based on the latest stats, in 2022. , 38.1% of all foreign exchange market turnover is made in London. As the largest currency trading market, London has a daily average of around 7 trillion dollars per day by average.

The increment rate in this rate was 11 percent and 10 percent, respectively, for the Hong Kong and the New York markets. However, the same rate slumped by 5 percent for the Singapore market.

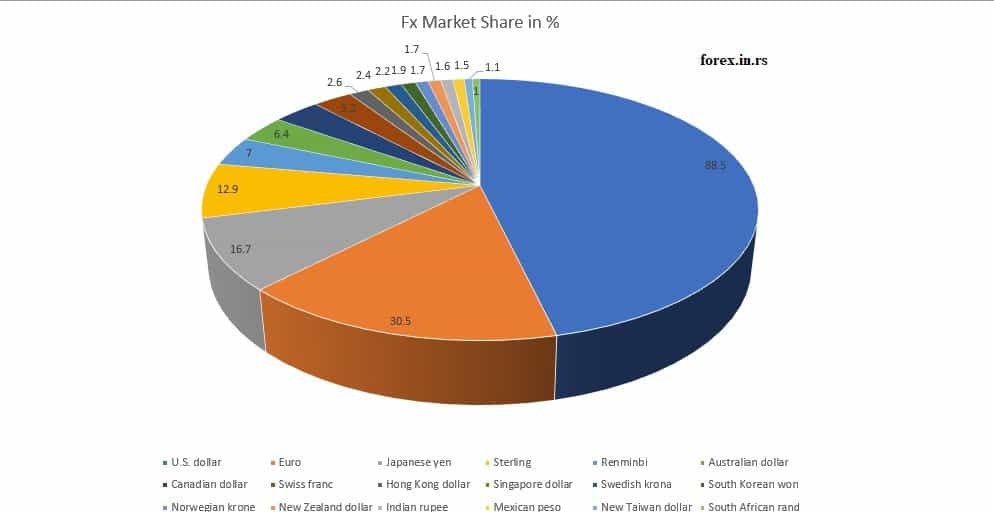

Below in this Table, we can see the most traded currency by value in percentage:

| Currency Rank | Currency | FX Symbol | Fx Market Turnover in % |

|---|---|---|---|

| 1 | U.S. dollar | USD | 88.5 |

| 2 | Euro | EUR | 30.5 |

| 3 | Japanese yen | JPY | 16.7 |

| 4 | Sterling | GBP | 12.9 |

| 5 | Renminbi | CNY | 7 |

| 6 | Australian dollar | AUD | 6.4 |

| 7 | Canadian dollar | CAD | 6.2 |

| 8 | Swiss franc | CHF | 5.2 |

| 9 | Hong Kong dollar | HKD | 2.6 |

| 10 | Singapore dollar | SGD | 2.4 |

| 11 | Swedish krona | SEK | 2.2 |

| 12 | South Korean won | KRW | 1.9 |

| 13 | Norwegian krone | NOK | 1.7 |

| 14 | New Zealand dollar | NZD | 1.7 |

| 15 | Indian rupee | INR | 1.6 |

| 16 | Mexican peso | MXN | 1.5 |

| 17 | New Taiwan dollar | TWD | 1.1 |

| 18 | South African rand | ZAR | 1 |

As we can see from the Table, the most traded currency in the world is the U.S. dollar, with 88.5%. The second most traded currency is EUR, with 30.5%.

Largest Forex Market in London

London is a central global financial hub and is an essential player in the foreign exchange (F.X.) market. This can be seen in the latest statistics, which indicate that, in 2022, London had a 38.1% share of all F.X. market turnover. It is clear then why London is considered the world’s largest Forex market.

London has long been at the heart of international finance since its formation as a trading center during Roman times. Throughout its history, it has maintained its status as an important financial center, which has remained faithful in the F.X. market. As one of the most populated cities in Europe and with direct access to continental Europe and markets further afield via Britain’s rich maritime history, London has always been an attractive target for traders looking to take advantage of its diverse opportunities.

London holds such a significant chunk of F.X. turnover mainly due to its proximity to many countries and markets outside of Europe and its thriving financial infrastructure, which provides stability for traders who use it for their transactions. The liquidity provided by London’s banks also ensures that prices remain competitive, making it easier for buyers and sellers to make their trades more rapidly than elsewhere. Additionally, with more regulation around securities offerings than in many other parts of the world, traders have added confidence when making their decisions here compared with other markets, which may not be as regulated or safe investments.

Around 38.1% of international currency trading occurs within London’s Forex market. Still, this figure could rise even higher in future years thanks to recent technological developments raising efficiency levels even further, which will only help push up volumes further.

Finally, apart from being a top choice amongst traders due to its convenient location and robust infrastructure, there are also plenty of advantages offered by conducting business within the U.K. itself – such as stamp duty exemption on share purchases made through approved stock exchanges (which always helps keep costs down!) alongside various tax breaks available depending on whether businesses want to set up shop permanently or temporarily within Britain too; ensuring that companies can enjoy all sorts of benefits from choosing Britain over other locations around the world!

Today, the biggest forex trading brokers have headquarters in London.

All these factors combined make it no surprise then why London continues to hold onto its position as one of the most prominent players in terms of F.X. turnover worldwide right now – an impressive feat given how fiercely competitive both global banking and forex markets have become over time; showing just how much trust people put in what this city has long had to offer those looking get involved with international currency trading!

April 2022 Forex Liquidity

The foreign exchange market is one of the most liquid markets in the world, and April 2022 was no exception. According to the OTC Derivatives Markets Activity report, trading in foreign exchange markets averaged US$7.5 trillion per day during April 2022, with spot transactions making up $2.1 trillion, outright forwards totaling $1.2 trillion, and foreign exchange swaps accounting for $3.8 trillion of the total amount traded. An additional $124 billion was exchanged in currency swaps, while options and other products added another $304 billion to overall volumes.

This represented an increase of 14% compared to April 2021, when average daily trading volumes totaled just over $6.6 trillion. The rise in activity can be attributed to several factors, such as rising demand for safe-haven currencies due to geopolitical uncertainty and a strong appetite from institutional investors and corporations looking to hedge their foreign exchange exposure.

The sheer size of the F.X. market means that it is highly liquid – meaning that orders can be filled quickly with minimal slippage or price movement – providing investors with more accurate pricing information and lower transaction costs when trading currencies. This liquidity makes it easier for speculators to buy and sell prominent positions without causing significant price fluctuations or disrupting the market order flow.

In addition, high liquidity also contributes to more excellent price stability by allowing participants to enter into trades without significantly impacting prices since they can quickly move into new positions or adjust existing ones if needed. This helps reduce volatility, which benefits short-term traders looking for quick profits and those taking longer-term positions who want more predictable returns from their investments over time.

Given that April 2022 saw record trading volumes across all major currency pairs, including EUR/USD (euro vs. U.S. dollar), GBP/USD (pound sterling vs. U.S. dollar), and USD/JPY (U.S. dollar vs. Japanese yen), there is no doubt that F.X. liquidity remains strong even amidst challenging global economic conditions caused by ongoing pandemic-related disruption across many industries worldwide. In the future, increased liquidity should continue supporting international financial markets despite uncertain times ahead, helping minimize price movements while simultaneously providing investors convenient access to different global currencies at competitive prices.

The Top Location for Trading F.X. Exchange – London

We have stated a few pointers for the favourability of forex brokers and traders towards London.

Favorable Time

The timing of the London market has the most preferred time for forex trading as it falls in the time frame that it opens before the U.S. markets start and ends after the closing of Asian markets.

The Use of Preferred Language

Many languages are being spoken worldwide, but the most common language is English, which is not uncommon for the London forex market.

Flexible Regulations in Place

In the U.K., no doubt, the Finance Conduct Authority (FCA) has placed rules and regulations, but it is also the regulator known for owning responsibilities and providing flexibility.

Use of the Latest Technology

London is the favorite destination for European developers to make an aspiring career in finance. It uses the latest and advanced technologies to aid traders.

Fin-tech is finding its place in today’s world; it is a boon for traders. Currency brokers handling the massive flow of foreign currencies and transfers believe this to be the best transition of decades.

The Bottom Line

Brexit has hit the most prominent forex market globally but has little or no significant impact on foreign brokers and currency traders, tilting toward their top choice. The infrastructural advances, regulatory policies, cultural values, and welcoming gestures for novice traders make London the most preferred and biggest forex market globally.