When it comes to market mt5, it is noted that the depth of the market showcases bids. It also seeks to provide a specified instrument about the best prices currently considered the closest to the market’s value.

Depth of market MT5

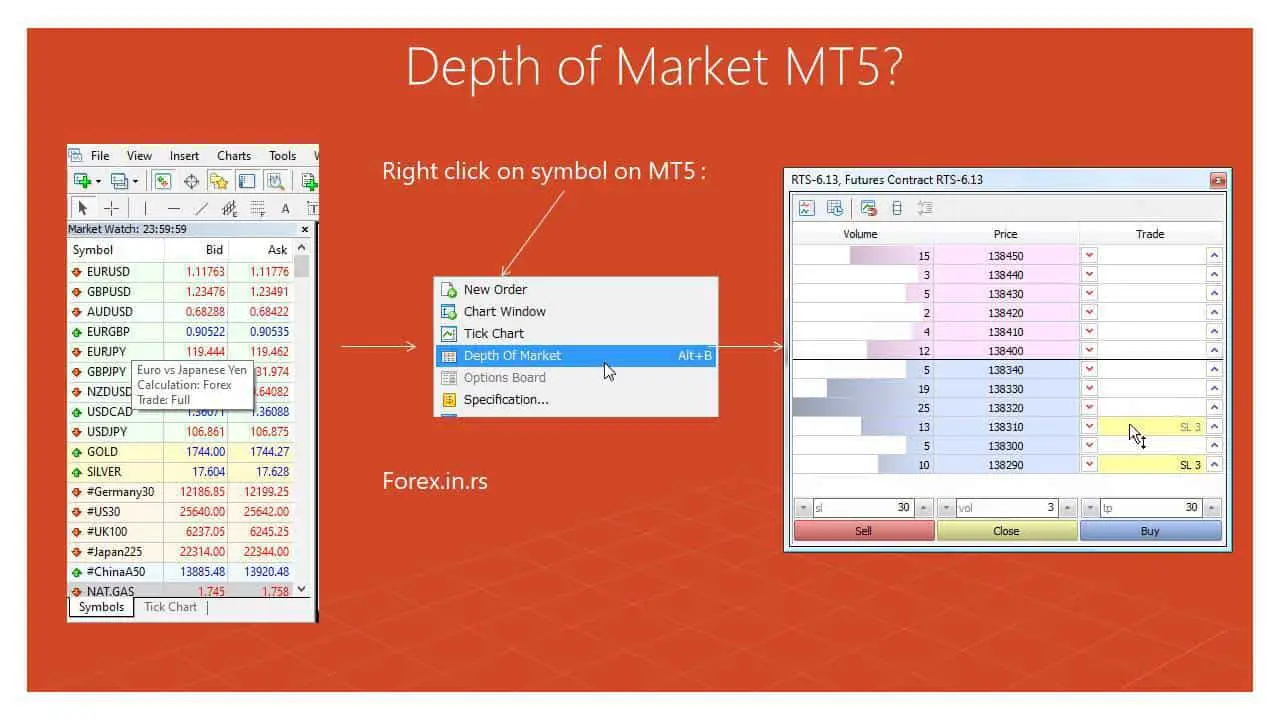

Depth of market or DoM is the MetaTrader 5 tool, which allows the client to see the market liquidity (depth of liquidity) for the financial asset. When a client clicks the right mouse button on the Market Watch symbol, he can choose from the drop-down menu “Depth of market” option. A trader can see from this tool that the market is the most liquid and used as trading information. Using this tool, traders can avoid slippage. When a trader trades more lots than available volume, slippage is possible.

It is important to realize a difference regarding the market’s depth about the exchange and over-the-counter markets.

If the exchange mode is used during the trading of an instrument when operations of trading that are related are directed toward a trading system that is regarded as being external such as an exchange, the depth of market reveals real prices and as well as real order volumes that are derived from participants of the market.

If the over-the-counter market is applied during the trading of an instrument, it is comprehended that the market’s depth may be constructed by using the quotes provided by the broker, who may assign varied prices that are proportionate to the volume of buying and selling. In such cases that the broker does not engage in the provision of volumes, the window of the market’s depth serves as a scalping tool. This permits the placement of the market and orders pending via the usage of just one click. Within this type of scenario, the market’s depth showcases price points derived by using the price change step applied to bidding prices and asking prices.

When you desire to access the market’s depth regarding a financial instrument, you should click on the market symbol’s depth, noted as being in the context menu provided by the market watch. The number of bids and offers that are showcased by the market’s depth is formulated via the broker’s symbol parameters. Further, it is important to realize that there is no guarantee concerning the accessibility of the market feature’s depth in correlation to exchange instruments, which depends on your particular broker.

It is understood that there is the performing of two diversified operations about the depth of the market. First, market operations are related to purchasing an instrument that is financial for the market’s set price at the current time. This also entails the selling of an instrument that is financial for the market value as well. Second, there is the placement of different requests about trades, which are regarded as pending orders. Thus, there is the placement of requests for purchasing or selling a financial instrument at a designated price that is not accessible via the market.

MT5 Fill or Kill

Market operations

A market operation is regarded as purchasing or selling a financial instrument for the best price at present provided by the market. A market operation can be executed via the depth of the market. To do this, one must click the trade command that is appropriate that is found in the depth of the market by using the symbol that is appropriate to specify the amount that is required. If one-click trading is accessible, the request is directed toward the server instantly without requiring the specification of any further conditions. This means that in such cases, there is no display of dialog about trading efforts.

Consider, for instance, a scenario where there has been the execution of a buy operation of twenty lots during the time that there are many other offers that are accessible via the market at present. Because there has been a request for twenty lots that come with the condition to fill or kill based on the market price, the volume required would be formulated of the market bids that are considered the nearest. If there were a certain price applied to the order, then there would be the execution of the order that would be done only at the set price and only within the context of the volume that was specified.

One can see the history regarding the order’s execution under the history tab about the toolbox window. One would view the comprehensive finalized volume for twenty lots obtained via some offers that were considered nearest to the market. Then the other offers are deleted from the depth of the market.

Trade request and depth of market

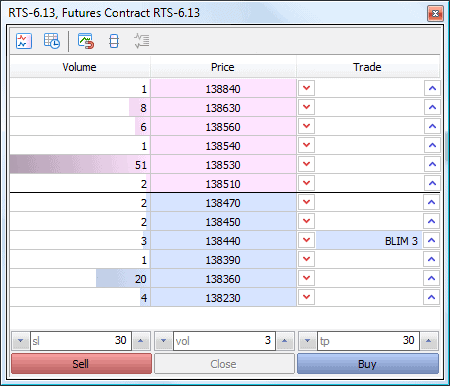

When it comes to the placement of requests regarding trades, this signifies the formation of an order pending for purchasing or selling an instrument that is financial for a designated price that is not accessible via the market at present. They can be showcased straight from the market’s depth based on how many requests go through processing via the server. This impacts primarily requests that are limited. Or there may be waiting for the execution to be done by the broker, such as primarily stopping requests or stopping limit requests. Then they can turn into a market order.

There is a need to provide the specification of the volume that is required in the vol field. You will click the bid price area regarding a desire to conduct a buy limit order. Or you would click the ask price area if there is a desire to engage in a sell limit order. These are located within the trade column regarding the line for the price level you desire to make your order’s placement. If one-click trading is accessible, then the request will be directed toward the server instantly without the need to specify any further conditions. This means that the dialog about trading efforts is not presented.

If there is a successful placement, then the depth of the market will show the request. The trade column will present the order that has been newly placed as BLM 3, which refers to the buy limit order for three lots. When a participant in the market is prepared to sell the financial instrument for the designated price, there will be the order filling, which will cause it to be then regarded as a position.