Table of Contents

The Forex currency pair, USD/JPY, is one of the most popular currency pairs in the Forex exchange market. Approximately $950 billion in daily turnovers are made using this currency pair. Its total turnover is nearly $5.5 trillion. In the USD/JPY currency pair, the base currency is the U.S. Dollar, and the quote or counter currency is the Japanese yen. The pair expresses how much JPY one would need to buy one USD. The exchange rate is seldom stable and fluctuates by a few pips. For example, if the current USD/JPY exchange rate is 116.00, you require 116 yen to purchase a U.S. dollar.

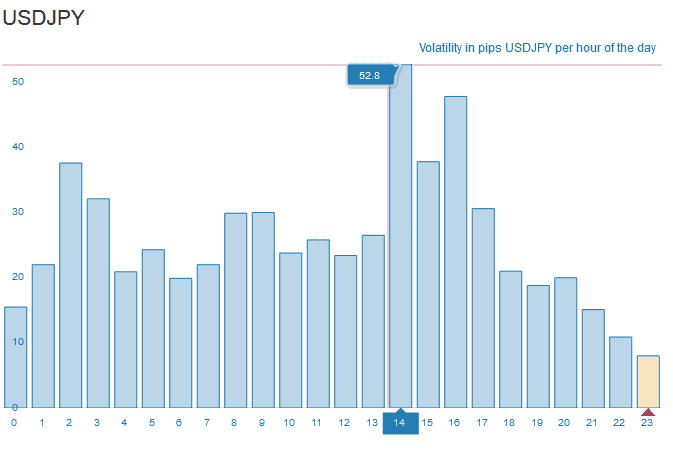

Of course, the best time to trade USDJPY is during the USD trading session. Before you start to trade, you should check how many pips USDJPY moves daily.

Please see my video on how to calculate pips for USDJPY and JPY pairs:

USDJPY represents the currency pair with the highest volatility at 14 and 16 hours GMT.

The USD came into circulation before the yen. While the former was available in April 1792, the latter surfaced in July 1871. The yen was made official on June 27, 1871, when the Meiji government. For over 200 years, the USD has been the US’s standard monetary and the world’s official reserve currency since 1944 when the Bretton Woods signed the agreement.

In MT4 or MT5 USDJPY, traders trade using the lots or 100,000 units.

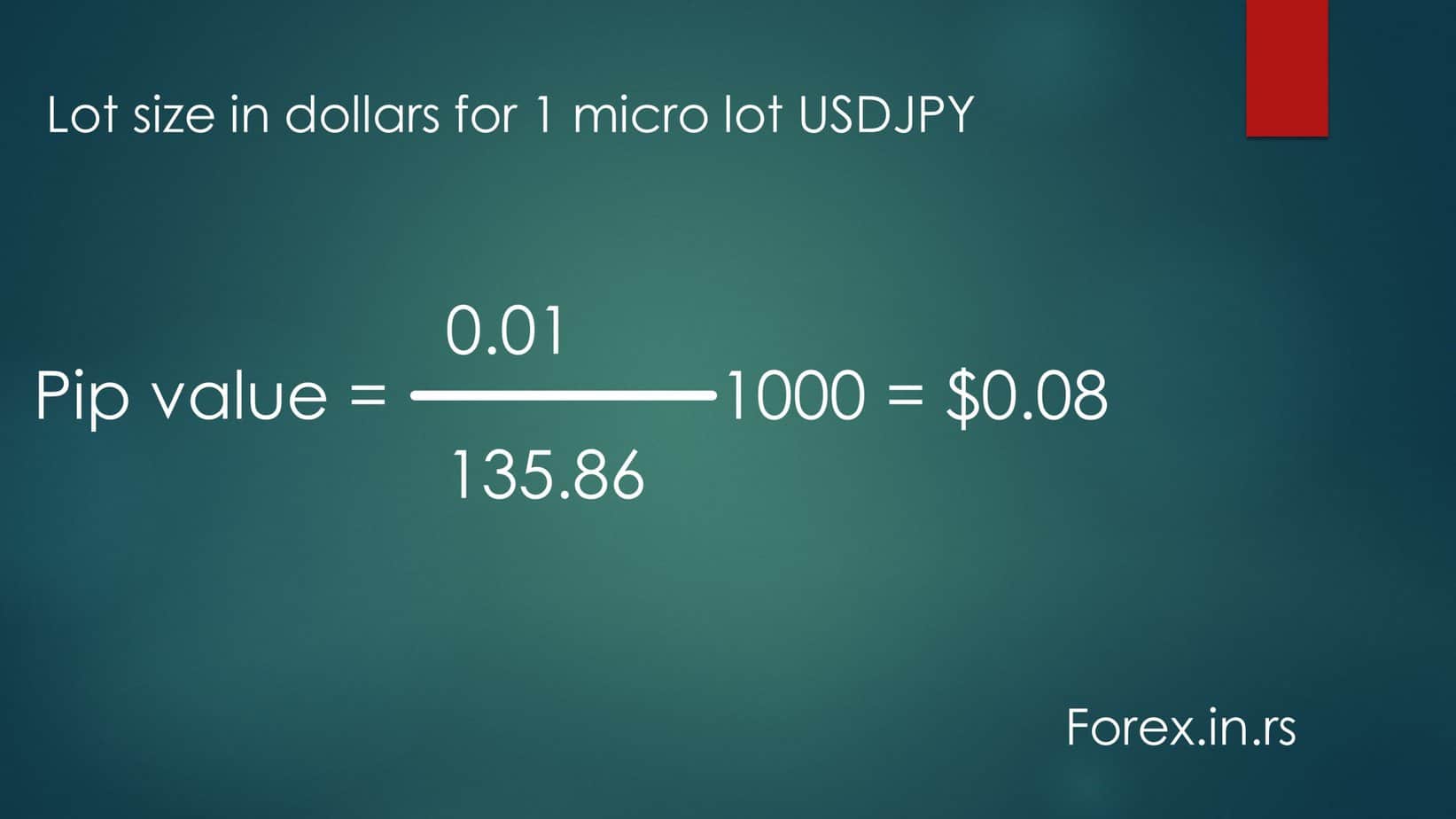

Let us calculate the USDJPY lot size.

USD/JPY lot size

The standard USD/JPY lot size is 100,000 units. However, retail traders usually trade using micro lots, 0.01 lots or 1000 units, mini lots, 0.1 lots, or 10,000 units.

In the Forex market, pip denotes the point movement in the exchange rate of a currency pair. It is generally the commission that your broker charges from you.

So, how much is one pip USD JPY?

USDJPY pip count

How do you calculate the USDJPY pip value?

To calculate the USDJPY pip value for 1 standard lot size, you need to divide 1000 by the USDJPY current rate. For example, if the current exchange rate USDJPY is 107.219, then the USDJPY pip count for 1 standard lot equals 1000/107.219=$9.327. To calculate the 1 mini lot USDJPY pip value, you must divide 100 by USDJPY’s current exchange rate. To calculate the 1 micro lot USDJPY pip value, you must divide 10 by USDJPY’s current rate.

To calculate lot size in dollars for 1 micro lot USDJPY, you need to calculate pip value:

An increase in the forex pair USD/JPY by one pip is a 0.01 movement in the price. If traders trade 1 micro lot, 1 pip, or 0.01 move-in, the price is around 0.1 dollars. If traders trade 1 mini lot, 1 pip, or 0.01 movement in, the price is about 1 dollar. USD JPY lot size for 1 pip or 0.01 move in the price is around 10 dollars.

USDJPY Lots size calculation examples

Here is an example of how we can apply forex USD JPY pip value in real trading:

BUY 1 micro lot of USDJPY pair at 110.00. Close trade at 110. 09.

It is 9 pips profit or around 0.9 dollars in profit (exactly $0.8394)

BUY 1 mini lot of USDJPY pair at 110.00. Close trade at 110. 09.

It is 9 pips profit or around 9 dollars in profit (exactly $8.39)

BUY 1 lot of USDJPY pair at 110.00. Close trade at 110. 09.

It is 9 pips profit or around 90 dollars in profit (exactly $83.9).

So why is it so complicated to calculate 1 pip of USDJPY forex pair? It is because 1 pip is not equal to $1.

The USD/JPY pip value can be calculated with high accuracy by taking the example of a 1K lot. In this currency pair, the value of one pip is 0.01. This also translates to 1/100 times the JPY. After multiplying it by the 1K lot, that is 100, you get 10 yen. 1 USD is equivalent to 110 yen according to the current exchange rate. We will use the following formula to determine how much one pip USD/JPY. To find out the value of the dollar against 10 yen at the current exchange, use the following method:

$1 = 110¥ (current exchange rate)

10¥/110 = $0.090909 or $0.09

$0.09 is the USD/JPY pip count of a micro lot or the 1K per the current exchange rate. The 1 pip USD/JPY will fluctuate whenever the exchange rate ranges, but the pip value for a micro lot will always be estimated at 1K = 10 yen. This also portrays that the currencies in a pair are interconnected; if the yen falls, its pair will also fall.

Let’s assume another situation where the JPY depreciates against the USD till the pair trades at 220.00. If this happens, the pip value will become half of where it stands per the current exchange rate (110.00). To make this work, 10 yen will be divided by the latest exchange rate (220). This will result in a new pip value of $0.04545.

Many traders and investors face losses because they make minor calculation errors. You can avoid this problem if you work with a broker who offers a comprehensive trading platform where the AI calculates.

If you want to do it manually, this is how it’s done:

Let’s take an example of trading the USD/JPY signal with twelve micro-lots bought at 110.00. Let us also assume that this trade made you hit a profit target of 275 pips at the exchange rate of 112.760. Twelve micro lots are equivalent to 12,000 of our chosen currency pair. By multiplying the current pip value ($0.090909) with 276 pips, we will get $301.09, which is the incorrect answer. However, we can get the correct answer by following the other method.

Take 112.760 as your target price and subtract 110.00, our entry price. The result will give you 2.76 yen. Multiply the result by 12000. This will provide you with a profit of 33,120 yen. Now, convert this profit from yen to dollars, considering the yen’s depreciated value. The final tally is $293.72, $7.37 less than our previous incorrect calculation.

As this pair’s pip value is very dynamic, we will always get an incorrect take loss or profit if we use the pair’s current pip value for our calculations. We can use the current pip value as an estimate but never as the actual value.

To get the exact values, you need to calculate your profit and loss in JPY and then convert it to USD at the latest exchange rate of USD/JPY. The pip value fluctuates when we make the USD calculations, but it remains the same in JPY. This is why all the estimates should be made in the quote currency.

This might still seem like a lot for small traders. Opening a $500 account and having $1,000 available to hold a position can be financially draining. However, you don’t need a fixed capital of $1500, as you can use the leverage offered by your broker.

Leverage allows you to operate with more capital in the market than you own. Various Forex brokers offer additional leverage, generally between 1:100 and 1:1000. However, Leverage can vary significantly from instrument to instrument and country to country. For example, the U.S. only allows a maximum leverage of 1:50.

If your broker has offered you the leverage of 1:50, you can operate $50 in the market for every dollar you invest. Thus, if you want to buy a micro USD/JPY lot size, you will not need $1000 anymore.

How do you calculate GBPJPY Lot Size and Worth Pips in dollars?

Let us suppose that GBPJPY is 191.75 and USDJPY 140.

To determine the value of 10 pips in dollars for GBP/JPY given the current rate of 191.75, you will follow these steps:

Step 1: Calculate the value of 1 pip for 1 lot

For currency pairs where the JPY is the quote currency (like GBP/JPY), 1 pip is equal to 0.01 JPY. Since 1 lot of GBP/JPY is 100,000 GBP, we calculate the value of 1 pip as follows:

Step 2: Convert the value of 1 pip from JPY to USD

Now, we need to convert the value of 1 pip from JPY to USD. To do this, you need the current USD/JPY exchange rate. Let’s assume the current USD/JPY exchange rate is 140 (you can replace this with the actual rate).

Using the assumed exchange rate:

Step 3: Calculate the value of 10 pips

To find the value of 10 pips, simply multiply the value of 1 pip by 10:

So, if the current price of GBP/JPY is 191.75 and the USD/JPY exchange rate is 140, 10 pips in GBP/JPY is worth approximately 71.4 USD

Economic Activities and Their Impact on USD/JPY

The value of any currency can never be wholly separated from the condition of its respective country. Numerous economic and non-economic activities can strengthen and devalue the currency. Here are some economic activities that can directly impact the exchange rate of USD/JPY.

1. Monetary Policies

The monetary policies are those set by a country’s central or federal bank. The Federal Reserve of the United States (FED) implements these policies, while the Bank of Japan does the same for its country.

The currency pair becomes volatile with any change these two entities make regarding quantitative easing, economic growth forecasts, inflation, and the interest rate.

2. Economic Indicators

Economic indicators are essential for Forex brokers and traders because they highlight the economy’s health. You can easily find them on the government’s official sites. These indicators tell if the economy is leading, lagging, or stable.

Many economic indicators directly impact the exchange rate: the gross domestic product (GDP), interest rate, wage growth, retail sales, consumer price index (CPI), unemployment rate, industrial production, and wage growth. Any fluctuation in these indicators can lead to the appreciation or depreciation of the currencies.

Conclusion

The USD/JPY currency pair is one of the most sought-after pairs in the Forex trading market. However, you must know about the currency pair before holding any position.