As students gear up for the college application season, one critical form that all applicants must complete is the Free Application for Federal Student Aid (FAFSA). FAFSA is a government form that determines eligibility for financial aid, such as grants and loans, to pay for college expenses. One area often confuses students and parents is reporting their investments on the form. One question many people have is whether their Roth IRA counts as an investment for FAFSA purposes. This article will thoroughly explore this question and provide an in-depth analysis of the Roth IRA and FAFSA.

What is FAFSA?

FAFSA stands for Free Application for Federal Student Aid. It is a form that students in the United States can complete to apply for financial aid from the federal government to help pay for college or career school.

The FAFSA collects information about a student’s financial situation and uses that information to determine their eligibility for federal student aid programs, such as grants, work-study programs, and loans. Many states and colleges also use the FAFSA to determine eligibility for their financial aid programs.

Students can submit the FAFSA online starting on October 1st of each year for the following academic year. The deadline to submit the FAFSA varies by state and college, but it is typically in the spring.

It’s essential to complete the FAFSA as early as possible, as some financial aid programs are awarded on a first-come, first-served basis. In addition, the FAFSA is free to meet and is available in English and Spanish. Students can also get help completing the FAFSA through their school’s financial aid office or other resources provided by the federal government.

Does Roth IRA Count as Investment For FAFSA?

Yes, Roth IRA is counted as an investment for FAFSA. The Roth IRA is included in income on the FAFSA (Free Application for Federal Student Aid) because it is considered a part of the student’s investment income.

The FAFSA collects information about a student’s financial situation and uses that information to determine their Expected Family Contribution (EFC), which is the amount of money the student and their family are expected to contribute toward the cost of college.

One component of the EFC calculation is the student’s income, which includes both earned and investment income. The Roth IRA is considered an investment account, and any distributions or withdrawals from the account count as taxable income. Therefore, when a student takes a distribution or withdrawal from their Roth IRA, it is considered part of their investment income and must be reported on the FAFSA.

It’s worth noting that the FAFSA only considers the previous year’s income, so if a student takes a distribution or withdrawal from their Roth IRA during the year they complete the FAFSA, it will be included in their income year. However, if they take a distribution or withdrawal after submitting the FAFSA, it will not be included until the following year’s FAFSA.

Regardless of whether or not the investment was converted from a traditional IRA, the Roth IRA is treated as a regular investment account. It means that the account holder must report the balance of their Roth IRA on the FAFSA form.

However, it’s essential to note that Roth IRA distributions, even though they are not taxable, are included in income on the FAFSA. Therefore, a tax-free return of contributions from a Roth IRA is reported as untaxed income on the FAFSA.

To fully understand why Roth IRA counts as an investment for FAFSA, we need to know what a Roth IRA IRA is and how it works.

A Roth IRA is an individual retirement account that allows individuals to save for retirement while providing tax-free income in retirement. Unlike a traditional IRA or 401(k), the contributions to a Roth IRA are made with after-tax doThehat the money invested has already been taxed before it is contributed to the account. This allows the account owner to withdraw contributions tax-free at any time.

The Roth IRA also offers tax-free, meaning that all the earnings, interest, and capital gains in the account grow tax-free. This is a distinct advantage over taxable investment accounts, where the account holder must pay taxes on any interest or investment growth.

However, the Roth IRA has some limitations. For example, there are income limits to contributing to an R. Oncend. Once the account owner earns over a certain amount, they are no longer eligible to contribute to the account. Additionally, there are contribution limits, meaning that account owners cannot contribute more than a certain amount perRegardingomes to FAFSA, the reported balance of the Roth IRA is assessed as an invesTherefore, then. The value of any investment accounts that the applicant or their family owns is a factor in determining their expected family contribution (EFC). The EFC is the amount that a student and their family are expected to control the college cost college.

In the calculation of EFC, there is a formula that considers numerous factors, including income and assets. The formula then calculates an EFC number from the extracted information. The higher the EFC, the less need-based financial hat the student will receive.

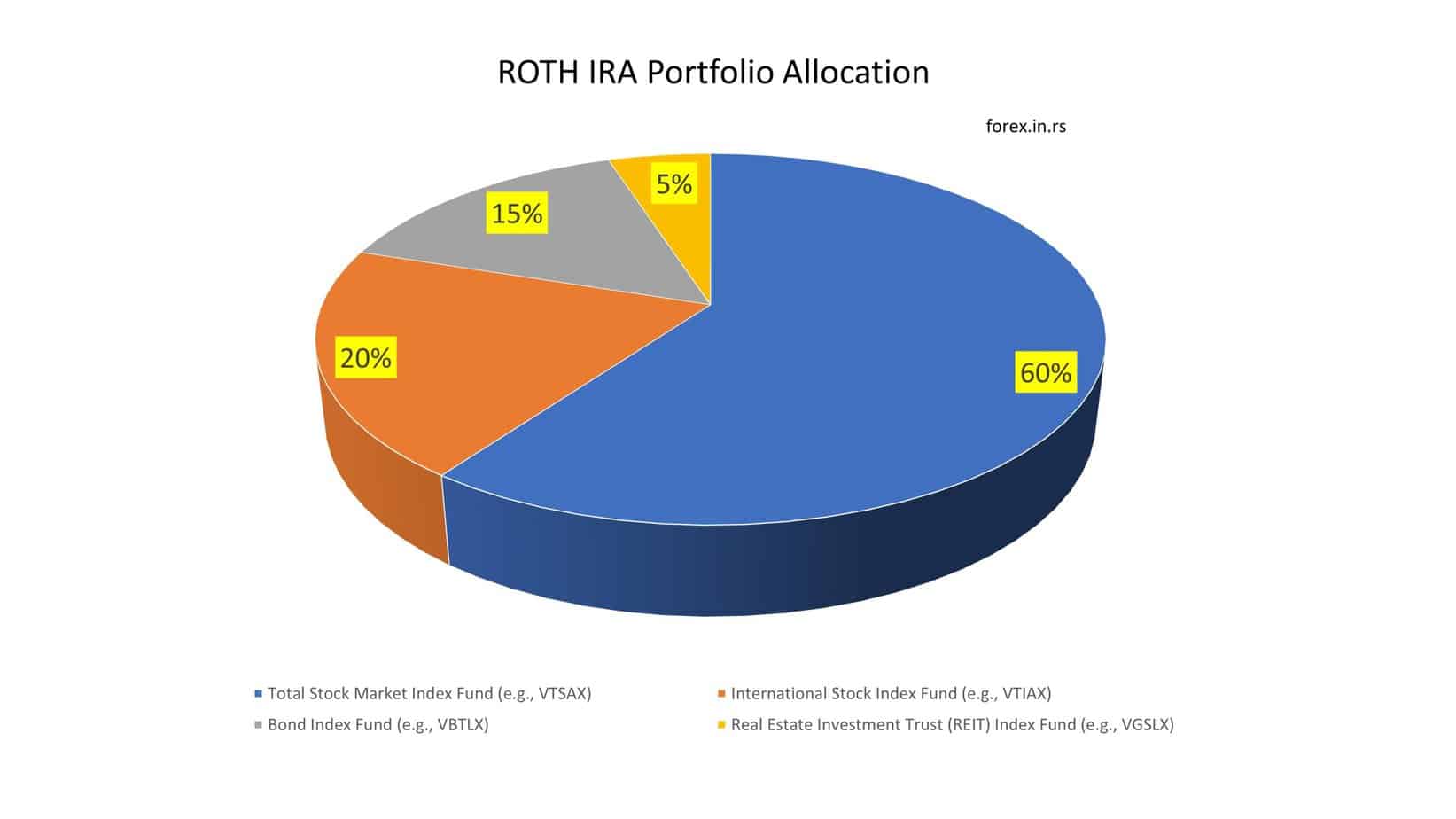

At this point, students and parents who are worried about reporting their Roth IRA on the FAFSA form should not panic. Even though the Roth IRA counts as an investment for FAFSA, it is essential to note that retirement accounts have more weight in the formula than other investments. In other words, unlike other investments, the value of a Roth IRA has comparatively little impact on the EFC.

In conclusion, when it comes to FAFSA, a Roth IRA does count as an investment. Therefore, it is crucial to report the balance of a Roth IRA on the FAF. Regardlessardless of whether or not the investment was once a traditional IRA, it is treated as a regular investment account. However, it is essential to note that Roth IRA distributions, even though they are not taxable, are included in income on the FAFSA.

Therefore, a tax-free return of contributions from a Roth IRA is reported as untaxed income on the FAFSA. Finally, although retirement accounts count in the asset equation, their influence is significant compared to other investments that temporarily fall under the category of assets for FAFSA purposes. Therefore, the bottom line is to report your Roth IRA investment on FAFSA, but it is not significant or determinant of your eligibility for financial aid.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE