Table of Contents

The USD/MXN currency pair denotes the exchange rate between the US Dollar (USD) and the Mexican Peso (MXN). It indicates how many Mexican Pesos one needs to buy a single US Dollar and is commonly called the “Mexican Peso” or just the “Peso” in trading circles. This currency pair is essential due to the robust economic ties between the United States and Mexico, especially given their status as large trading partners. Their relationship is further accentuated by agreements such as the United States-Mexico-Canada Agreement (USMCA), which came into effect as a replacement for NAFTA.

However, many traders have problems calculating pips for USD/MXN because this forex pair has enormous volatility.

How to Calculate Pips For USDMXN?

To calculate pips for USDMXN, remember that a 0.0001 difference is 1 pip, so if USDMXN rises from 17.60000 to 17.60001, it is one pip difference. Usually, during the day, USDMXN volatility from daily open to daily close is around 1500 pips, which is 10 times bigger than for major forex pairs.

See my video:

The critical point from the video is how to calculate pips for USDMXN forex pair when we trade with lots:

- If we trade one lot size of USDMXN in MT4, one pip is $0.566.

- If we trade one mini lot size of USDMXN in MT4, one pip is $0.0566.

- If we trade one micro lot size of USDMXN in MT4, one pip is $0.00566.

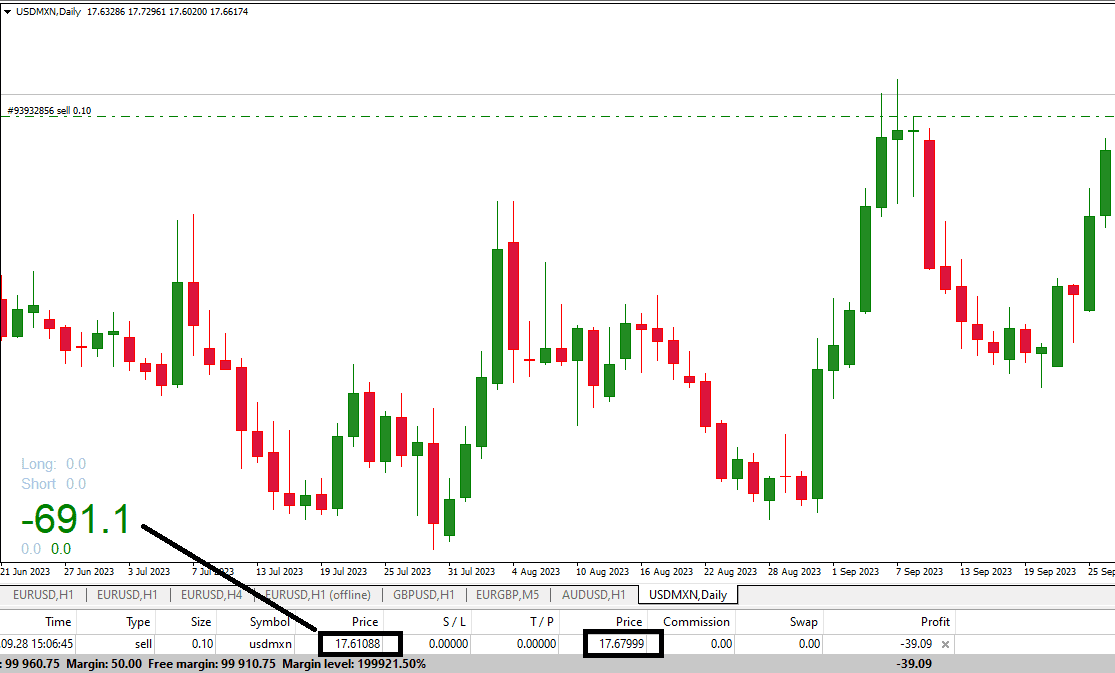

Let us analyze one practical example:

To determine the pips difference for the USD/MXN currency pair, subtract the entry price from the close price and then multiply by 10,000 (since a pip for most currency pairs, including USD/MXN, is 0.0001).

Given: Entry price = 17.61088 Close price = 17.67999

Pips difference = (Close price – Entry price) x 10,000 = (17.67999 – 17.61088) x 10,000 = 0.06911 x 10,000 = 691.1 pips

So, the pips difference between the entry and close prices is 691.1.

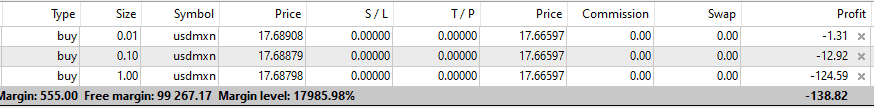

USDMXN pips calculation Example for 1 lot

When trading forex, a lot typically refers to 100,000 units of the base currency. For the USD/MXN pair, the base currency is USD.

Let’s break down the calculation:

- Determine the Pips Difference: First, we must determine how many pips you lost during the trade. Pips difference = (Closing price – Entry price) x 10,000 = (17.66597 – 17.68798) x 10,000 = (-0.02201) x 10,000 = -220.1 pipsSo, the trade moved against you by 220.1 pips.

Given your information that the loss is $124.59 for a 220.1 pip move:

Pip value = Total Loss / Pips difference = $124.59 / 220.1= $0.566 per pip

So, the value of a pip in your trade was approximately $0.566. This variation in pip value can occur due to factors like leverage, lot size variations, or broker-specific conditions.

To conclude, when you traded 1 lot of USD/MXN and the price moved against you by 220.1 pips, you incurred a loss of $124.59. This loss equals a pip value of approximately $0.566 for your trade.

USDMXN pips calculation Example for 1 mini lot

Determine the Pips Difference: Calculate the change in pips between your entry and closing price.

Pips difference = (Closing price – Entry price) x 10,000 = (17.66597 – 17.68879) x 10,000 = (-0.02282) x 10,000 = -228.2 pips

The trade moved against you by 228.2 pips.

However, your mentioned loss is $12.92 for a 228.2 pip move:

Pip value for mini lot = Total Loss / Pips difference = $12.92 / 228.2= $0.0566 per pip

The discrepancy arises because the pip value for USD/MXN, when traded as a mini lot, isn’t exactly $1 (as it would be for many major pairs). This could be due to a combination of factors including, but not limited to, the specific characteristics of the pair, leverage, and broker-specific conditions.

To conclude, when you traded 1 mini lot of USD/MXN and the price moved against you by 228.2 pips, your loss was $12.92. This equates to a pip value of approximately $0.0566 for the trade with a mini lot.

USDMXN pips calculation Example for 1 micro lot

- Determine the Pips Difference: Calculate the change in pips between your entry and closing price.Pips difference = (Closing price – Entry price) x 10,000 = (17.66597 – 17.68908) x 10,000 = (-0.02311) x 10,000 = -231.1 pipsThe trade moved against you by 231.1 pips.However, your mentioned loss is $1.31 for a 231.1 pip move:Pip value for micro lot = Total Loss / Pips difference = $1.31 / 231.1 = $0.0057 (rounded) per pip

This indicates that, for your specific trade on USD/MXN using a micro lot, the value of a pip was approximately $0.0057, not the typical $0.10.

In summary, when you traded 1 micro lot of USD/MXN and the price moved against you by 231.1 pips, your loss was $1.31. This translates to a pip value of roughly $0.0057 for your micro-lot trade.

Conclusion

In trading the USD/MXN pair on MT4, the pip value varies based on the lot size chosen, for a standard lot representing 100,000 units, a single pip movement equates to a $0.566 change.

When trading a mini lot, which consists of 10,000 units, the pip value decreases to $0.0566. Opting for a micro lot, representing 1,000 units, further reduces the pip value to a mere $0.00566. Traders must know these values to manage risk and understand potential profit or loss.