Table of Contents

NASDAQ, or the NASDAQ 100 Index or NAS100, is a stock index comprised of the largest and most prominent non-financial stocks listed on the Nasdaq Stock Exchange. The index was created in 1985 and is designed to track the performance of America’s leading technology companies.

Please check the NAS100 Pip Calculator to calculate pips on your example.

The NASDAQ 100 comprises the top 100 companies listed by market capitalization. Companies eligible for inclusion must be headquartered in the United States or Canada, have their primary listing on the exchange, and meet specific liquidity criteria. The list includes Apple, Microsoft, Amazon, and Facebook, which are big tech companies.

The index is considered a bellwether for technology stocks as it tracks all publicly traded U.S.-based companies that deal in computing and networking technology, semiconductors, retailing/e-commerce software development, biotechnology, and other related industries. As such, it indicates how well these industries are doing, given that they are often intertwined with each other’s fortunes.

The NASDAQ 100 remains one of the world’s most closely watched indices due to its broad coverage of tech stocks across different sectors. It has become increasingly popular with investors who want to gain exposure to America’s tech sector without having to pick individual stocks themselves. Investors can access the index through derivatives such as futures contracts or exchange-traded funds (ETFs).

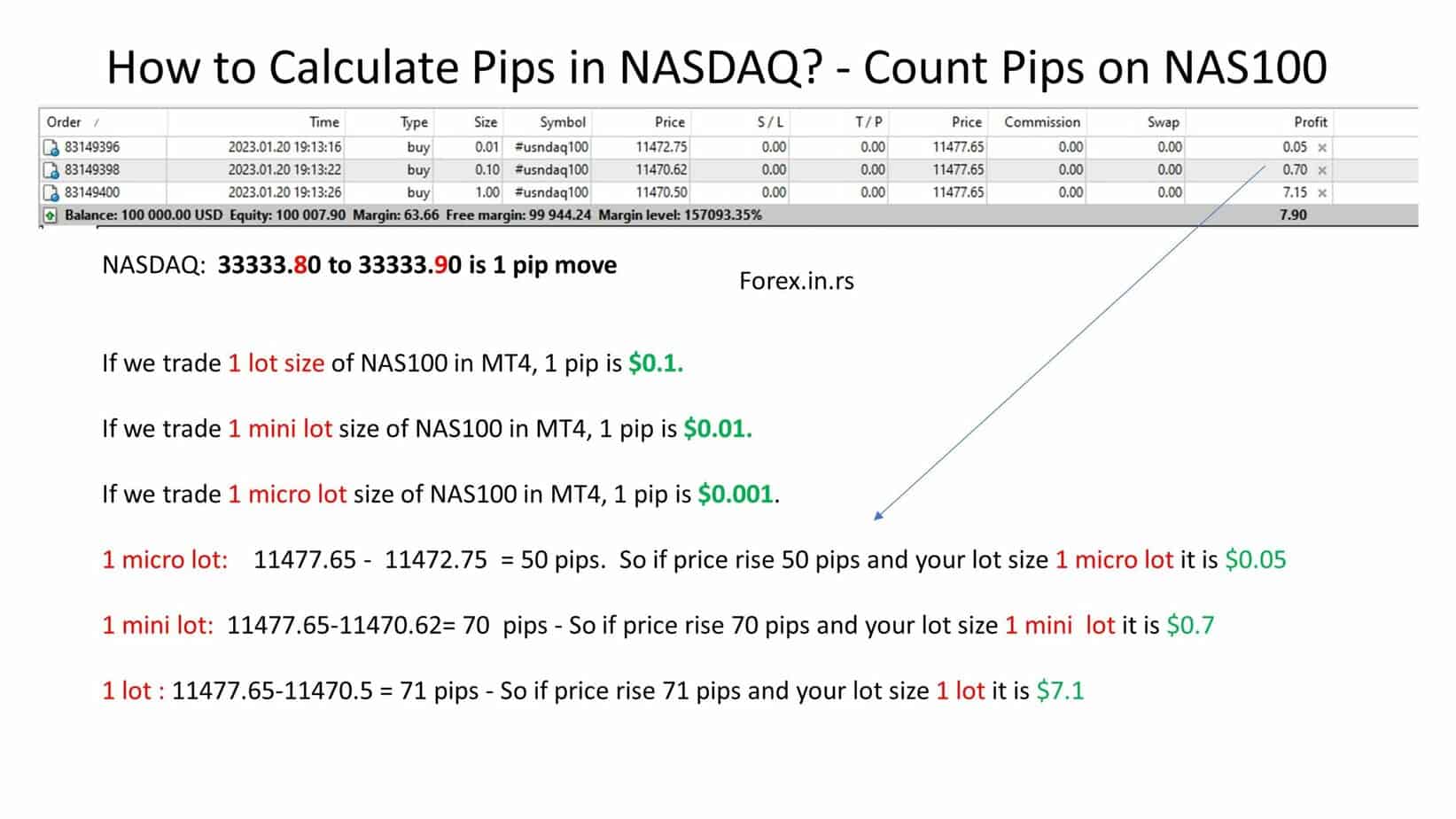

Below, I will show you one example in MT4 where I opened three orders. One order is one micro lot position, the second is one mini lot, and the last is one lot trading size position.

To learn how to count pips for various assets, visit our article. For example, on our website, you can learn how to calculate pips on gold or how to count pips on silver.

How do you count pips on NAS100 (NASDAQ)?

To calculate the number of pips on NAS100 or NASDAQ, you need to know that a 0.1 difference in price is one pip in the Metatrader platform at most CFD brokers. The NAS100 price gain from 11800.00 to 11800.10 is one pip difference on NAS100. If you add 20 pips to the 11800.00 NAS100 prices, you will get 11802.00.

-

- If we trade one lot size of NAS100 in MT4, one pip is $0.1.

- If we trade one mini lot size of NAS100 in MT4, one pip is $0.01.

- If we trade one micro lot size of NAS100 in MT4, one pip is $0.001.

Please see my video about NAS100 pips counting:

For example, if we trade one lot size and the NAS100 price goes from 11800.00 to 11876.00, 760 pips gain or $76 in the MT4 platform.

But I will show you an example from live trading with screenshots from the MT4 platform.

How to Calculate Pips in NASDAQ in MT4 Live Trading Example:

Based on the screenshot example NAS100, we can learn how much nas100 is per pip in the following example:

- One micro lot: 11477.65 – 11472.75 = 50 pips. So if the price rises 50 pips and your lot size is one micro lot, it is $0.05

- One mini lot: 11477.65-11470.62= 70 pips – So if the price rises 70 pips and your lot size is one mini lot, it is $0.7

- One lot: 11477.65-11470.5 = 71 pips – So if the price rises 71 pips and your lot size is one lot, it is $7.1

To further understand how pip calculations work for NAS100 (or NASDAQ) in the context of trading on platforms like Metatrader 4 (MT4) at most CFD (Contracts for Difference) brokers, let’s explore some new examples. These examples will help illustrate how pip values are determined based on different lot sizes and how they affect trading outcomes.

Example 1: Calculating Pip Value for Different Lot Sizes

Standard Lot

- Starting Price: 12000.00

- Ending Price: 12000.10

- Price Movement: 0.1, which equals 1 pip.

- Lot Size: 1 standard lot

- Pip Value: $0.1 per pip

- Total Value of Movement: 1 pip * $0.1 = $0.1

Mini Lot

- Starting Price: 12000.00

- Ending Price: 12000.20

- Price Movement: 0.2, which equals 2 pips.

- Lot Size: 1 mini lot

- Pip Value: $0.01 per pip

- Total Value of Movement: 2 pips * $0.01 = $0.02

Micro Lot

- Starting Price: 12000.00

- Ending Price: 12000.30

- Price Movement: 0.3, which equals 3 pips.

- Lot Size: 1 micro lot

- Pip Value: $0.001 per pip

- Total Value of Movement: 3 pips * $0.001 = $0.003

Example 2: Adding Pips to a Starting Price

Let’s say you anticipate that NAS100 will increase by 50 pips from a starting price, and you want to calculate the new price based on different lot sizes.

Standard Lot

- Starting Price: 11850.00

- Pips to Add: 50

- New Price: Since 10 pips equal a 1.0 price movement, 50 pips equal a 5.0 price movement. So, 11850.00 + 5.00 = 11855.00.

Mini Lot

- Starting Price: 11850.00

- Pips to Add: 50

- New Price Calculation: Same as above, regardless of lot size, the actual price movement calculation remains consistent.

Example 3: Profit Calculation Based on Pip Movement and Lot Size

If a trader predicts a 30 pip increase in NAS100 and trades with different lot sizes, the profit can be calculated as follows:

Standard Lot

- Pip Movement: 30 pips

- Pip Value: $0.1

- Profit: 30 pips * $0.1 = $3.00

Mini Lot

- Pip Movement: 30 pips

- Pip Value: $0.01

- Profit: 30 pips * $0.01 = $0.30

Micro Lot

- Pip Movement: 30 pips

- Pip Value: $0.001

- Profit: 30 pips * $0.001 = $0.03

These examples demonstrate the relationship between pip movement, lot size, and the financial outcome of trades. Understanding these concepts is crucial for effectively managing risk and potential rewards in the forex and CFD markets, especially when trading indices like NAS100.

One important thing:

Remember that some brokers can change one lot size power and the formula to calculate the number of gains or losses in dollars based on pips.

So, I advise always to open a few trades on a demo account to see how your broker calculates pips on NAS100 and other indices and then start live trading.