Calculating the Real Rate of Return

Investors always wish to get the best returns on their investments and compare the various investment options based on the interest offered by the bank or other company. The bank or other financial organization will always declare the nominal rate of return for the investment. However, the prices of various items also change over time due to inflation, so investors should consider the net return on their investment while choosing between various options.

Definition

The Real Rate of Return (actual returns) is the return on a specific investment, calculated as an annual percentage after adjusting it for changes in various items’ prices due to inflation and other factors. This method helps find the actual return on the investment and how much the investor can purchase after considering the price increase after choosing to invest for a specific period instead of spending the money earlier. There is always a risk involved for each investment option, and the investor should consider the actual returns before investing in a specific option.

The actual rate of return formula

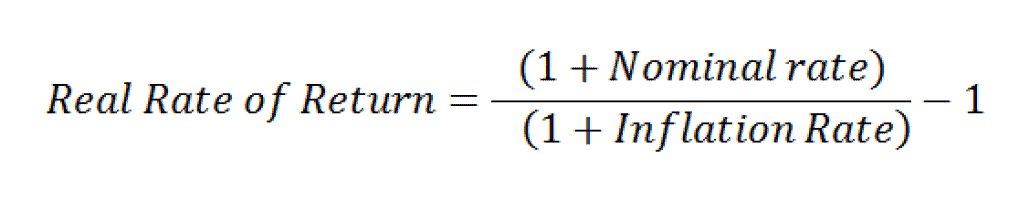

“The real rate of return formula is the sum of one plus the nominal rate divided by the sum of one plus the inflation rate, which is then subtracted by one. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation.”

Real returns = (1 + nominal rate/1+inflation rate) – 1

The nominal rate is declared by the bank or company accepting investments. It is also called the average rate or stated rate for the investment. The inflation rate is calculated using the country’s price indices change for a specific period. The price indices are based on the prices of specified goods over some time. The consumer price index, or CPI, is one of the most widely used indices for calculating inflation rates. Though CPI is popular, investors or companies may consider other price indices. In some cases, they may use a set of more relevant goods to the business while calculating the actual returns.

Average real return calculator

Example 1: Simple Calculation

Scenario: You have an investment that yields a nominal return of 8% in a year, and the inflation rate during that year is 3%.

Step-by-Step Calculation:

- Nominal Rate of Return: 8% or 0.08 (let’s call this N)

- Inflation Rate: 3% or 0.03 (let’s call this I)

Plug in the values for N and I:

So, the real rate of return is 4.85%.

Example 2: Higher Inflation Rate

Scenario: An investment yields a nominal return of 10% in a year, and the inflation rate is 6%.

Step-by-Step Calculation:

- Nominal Rate of Return: 10% or 0.10 (N)

- Inflation Rate: 6% or 0.06 (I)

Plug in the values for N and I:

So, the real rate of return is 3.77%.

Example 3: Negative Real Return

Scenario: An investment yields a nominal return of 4% annually, and the inflation rate is 5%.

Step-by-Step Calculation:

- Nominal Rate of Return: 4% or 0.04 (N)

- Inflation Rate: 5% or 0.05 (I)

Plug in the values for N and I:

So, the real rate of return is -0.95%, indicating a loss in purchasing power.

Explanation

The actual returns are relevant to an investor who postpones his purchases, investing his money instead, hoping to have more money after one year or longer to make the purchases. Though he will earn interest for the period he has invested his money, he will also find that the prices of the goods he wishes to purchase have increased. Thus, like taxes, inflation can also reduce the value of the investment. Most banks and other companies will only specify nominal rates; they do not consider inflation. However, the inflation rate is usually positive, reducing the actual returns for the investor.

Limitation

Banks only advertise nominal rates, but investors who wish to use their money for purchases should consider accurate rates. However, even the actual rate is not very accurate since it does not consider the other costs of investing opportunity costs and taxes on income. It is also possible that the inflation rate is not calculated accurately by the organization providing the data. In most cases, the inflation rate is calculated at the end of a specific period; it is usually impossible to predict inflation in the future.