Table of Contents

Artificial Intelligence (AI) is a multidisciplinary branch of science that focuses on creating systems capable of performing tasks that usually require human intelligence. These tasks include problem-solving, pattern recognition, decision-making, and language understanding.

At its core, AI is powered by algorithms and models that learn and evolve from data, allowing machines to make predictions or decisions without explicit programming. In the finance industry, AI is used for various applications such as algorithmic trading, fraud detection, credit scoring, and personalized financial planning. These technologies enable financial institutions to improve efficiency, reduce risks, and offer more tailored services to their clients.

Can AI Predict Forex Price?

No, AI can not predict future forex prices accurately because, except for time and price, AI does not have enough features and overall data to create a high-accuracy model. However, AI algorithms enhance trading by automating strategies, predicting partial market movements, trading classification, analyzing sentiments, managing portfolios, detecting fraud, optimizing routes, etc.

Artificial Intelligence (AI) is a broad field of study focused on creating machines that can perform tasks requiring human-like intelligence. In contrast, Machine Learning (ML) is a subset of AI that concentrates on building models that learn and make predictions or decisions without being explicitly programmed for the task.

While AI encompasses many cognitive tasks, ML explicitly teaches machines to learn from data. Traders often use ML for price prediction by employing regression methods to forecast continuous values (like future stock prices) or classification methods to categorize data (like predicting whether a stock will go up or down). By analyzing historical price data and other relevant factors, these ML models can assist traders in making more informed investment decisions.

So, we can say AI when explaining ML methods and pattern recognition algorithms.

Why is it hard to predict forex prices with AI (ML)?

To forecast future price movements, technical indicators primarily analyze past market data, notably price and time. While these indicators can be valuable in understanding historical trends and patterns, they inherently lack comprehensive insight into the factors influencing currency valuations.

Why is this problematic?

Forex is affected by both macroeconomic and microeconomic events – from changes in interest rates by central banks to political instabilities. Without incorporating these fundamental influences, models that rely solely on technical indicators can be blindsided by sudden market shifts.

Unlike stock markets, where trading volumes are meticulously documented, the decentralized nature of the forex market means there’s no single source of truth for actual transaction volumes.

Volume is an essential metric for traders as it signifies the strength of a price movement. A price change backed by substantial volume is generally considered more significant and likely to continue than one with sparse volume. Without reliable volume data, ML models might misjudge the momentum of a trend.

Forex rates are influenced by economic indicators: GDP growth rates, unemployment figures, manufacturing outputs, and more. Each affects a country’s economic health, affecting its currency’s value.

Incorporating these vast and varied datasets into an ML model can be cumbersome, and more importantly, the exact relationship between each of these indicators and a currency’s value can be intricate and dynamic.

Currencies don’t operate in isolation. An event in one country can ripple through and impact the forex rates of many countries. This interconnectedness means modeling for one currency pair might inadvertently require understanding several seemingly unrelated pairs.

The forex market is notorious for its volatility. News can break, governments can change, natural disasters can strike – and the repercussions on the forex market can be instantaneous and unpredictable. No ML or AI model, regardless of its sophistication, can predict unforeseen global events.

Given the noise in forex data and the multitude of patterns, there’s a significant risk of ML models overfitting past data. An overfitted model might perform exceptionally well on historical data but fail miserably in real-world predictions.

AI Machine Learning Regression Models for Forex Price Prediction

Machine Learning regression models predict or forecast continuous numerical values based on input variables. Regression methods are precious for predicting future stock prices, foreign exchange rates, and other financial indicators in the context of trading. Here’s how they generally operate and a list of some of the most renowned ML regression methods.

How ML Regression Methods Work

- Data Collection: Everything starts with data. This could include historical stock prices, trading volumes, economic indicators, and even sentiment from news or social media for stock price prediction.

- Data Preprocessing: Raw data is seldom ready for ML algorithms. It might have missing values, outliers, or other inconsistencies. Preprocessing involves cleaning the data, normalization (scaling all numerical variables to a standard range), and sometimes feature engineering, where new potentially predictive variables are created from the existing ones.

- Model Selection: This is where the specific regression method is chosen. The selection often depends on the nature of the data, the problem specifics, and the desired prediction accuracy.

- Training: The training process can begin with the data prepared and the model selected. This involves feeding the input data and the actual outcomes (historical prices) into the algorithm. The model learns by adjusting its internal parameters to minimize the difference between its predictions and outcomes.

- Evaluation: Once trained, the model’s predictive performance is evaluated using new, unseen data (often called the test set). Metrics like Mean Absolute Error (MAE) or Root Mean Squared Error (RMSE) can gauge the model’s accuracy.

- Prediction: With a trained and evaluated model, predictions on future stock prices can be made by inputting the relevant data into the model.

Famous ML Regression Methods

- Linear Regression: Perhaps the most straightforward regression method assumes a linear relationship between the input variables and the target prediction. It tries to find the best-fit line that minimizes the difference between the predicted and actual values.

- Ridge and Lasso Regression: Extensions of linear regression; these methods add regularization terms. While Ridge regression adds L2 regularization, Lasso regression uses L1 regularization, which can lead to feature selection.

- Decision Trees: These partition the data into subsets and make decisions at every node based on feature values, ultimately predicting an outcome at the leaves.

- Random Forest: An ensemble method that creates multiple decision trees and combines their outputs for a final prediction, improving accuracy and reducing overfitting.

- Gradient Boosting Machines (GBM): These sequentially build trees, where each tree corrects the errors of the previous one, often yielding high accuracy.

- Support Vector Machines (for Regression, aka SVR): While often used for classification, SVMs can be adapted for regression. They aim for a hyperplane that best captures the relationship between input variables and continuous outcomes.

- Neural Networks: Inspired by the human brain, these are composed of interconnected nodes or “neurons.” Deep Learning, a subset of neural networks with multiple hidden layers, can capture complex, non-linear relationships in the data.

- K-Nearest Neighbors (KNN) for Regression: This method predicts the outcome of a new data point based on the outcomes of its ‘k’ nearest neighbors in the training data.

- Polynomial Regression: This extension of linear regression is used when data shows a curvilinear relationship.

ML regression methods provide valuable tools for predicting financial data, like stock prices. By understanding and leveraging these methods, traders can make more informed decisions, potentially gaining an edge in the competitive trading landscape. Remember, though, that while these tools can be powerful, no prediction method guarantees accuracy, especially in the complex world of finance.

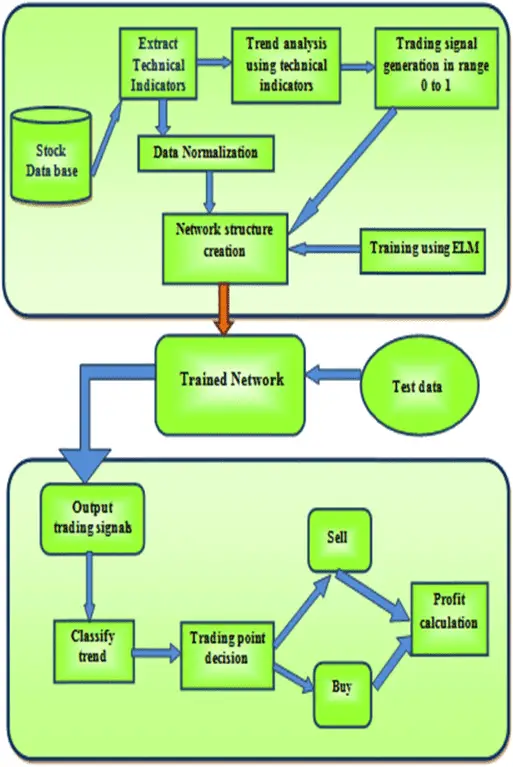

AI and ML Classification in Trading

At its core, ML classification aims to categorize data into predefined classes. In the trading context, it categorizes trades as profitable or non-profitable based on historical data and various market indicators.

1. Data Collection:

Just as with regression, the first step is gathering relevant data. This could be historical price data, trading volumes, technical indicators, economic indicators, or even sentiment data from news articles and social media. Each trade (data point) will be labeled as 1 or 0 based on whether it was profitable.

2. Feature Engineering:

Not all input variables (features) are equally relevant. Some might be redundant or, worse, noisy. Feature engineering involves creating new features, selecting the most relevant ones, and transforming them to make them suitable for the ML algorithm. The goal is to enhance the model’s predictive performance.

3. Model Training:

This step involves feeding the prepared data into the classification algorithm, which then adjusts its internal parameters based on the input data to classify trades accurately.

4. Evaluation:

To ensure that the model can generalize well to new, unseen data, it’s evaluated on a separate test set. Metrics like accuracy, precision, recall, and the F1-score give insight into its performance.

5. Optimization:

With the insights derived from the model, traders can optimize their trading strategies. For example, if a particular technical indicator consistently contributes to profitable trades, it could be weighted more heavily in the trading strategy.

Most Used ML Classification Methods

1. Logistic Regression:

A simple yet effective method, it predicts the probability that a given data point belongs to a particular category.

2. Decision Trees:

These algorithms make decisions at every node based on feature values, resulting in a tree-like model of decisions.

3. Random Forest:

An ensemble method that combines multiple decision trees’ outputs to enhance accuracy and robustness.

4. Gradient Boosted Trees:

Similar to Random Forest, trees are built sequentially, each correcting the errors of its predecessor.

5. Support Vector Machines (SVM):

Initially designed for binary classification, SVMs find the hyperplane that best separates data into two classes.

6. Neural Networks:

These can be tailored for classification tasks and, when used with multiple hidden layers (deep Learning), can capture intricate patterns in data.

7. K-Nearest Neighbors (KNN):

This algorithm classifies a data point based on how its neighbors are classified in the training set.

8. Naive Bayes:

Based on Bayes’ theorem, this algorithm is particularly suitable for high-dimensional datasets.

Conclusion

While ML and AI offer promising avenues to dissect and understand the forex market’s complexities, they are not a magic wand. Predicting forex prices with consistent accuracy is difficult, given the market’s multifaceted and volatile nature. Traders and modelers should approach ML and AI tools cautiously, recognizing their limitations and ensuring a holistic approach that incorporates technical and fundamental analysis. While the future of trading undoubtedly intertwines with advancements in AI and ML, a nuanced understanding of these challenges is crucial for any successful application in the forex market.