Table of Contents

A trader’s lot size in the forex market refers to the number of currency units that make up a trade. The lot size is important because it affects the risk that is taken on with each trade. A trader who uses a smaller lot size will typically have less risk per trade than one who uses a larger lot size.

There are a few things to consider when choosing a lot size. The first is the trader’s account balance. A trader with a small account balance should use a smaller lot size to minimize the amount of money at risk on each trade. The second consideration is the traders’ risk tolerance. A trader comfortable taking on more risk can use a larger lot size, while a trader who wants less risk should use a smaller one.

See my video about What Lot Size Should I Trade:

The final factor when choosing a lot size is the spread between the bid and ask prices. A wider spread means less room for the cost to move in your favor before you start losing money on the trade. For this reason, traders with tight spreads should use a smaller lot size, while traders with wide spreads can use a larger lot size.

How To Choose A Lot Size For Ultimate Forex Trading?

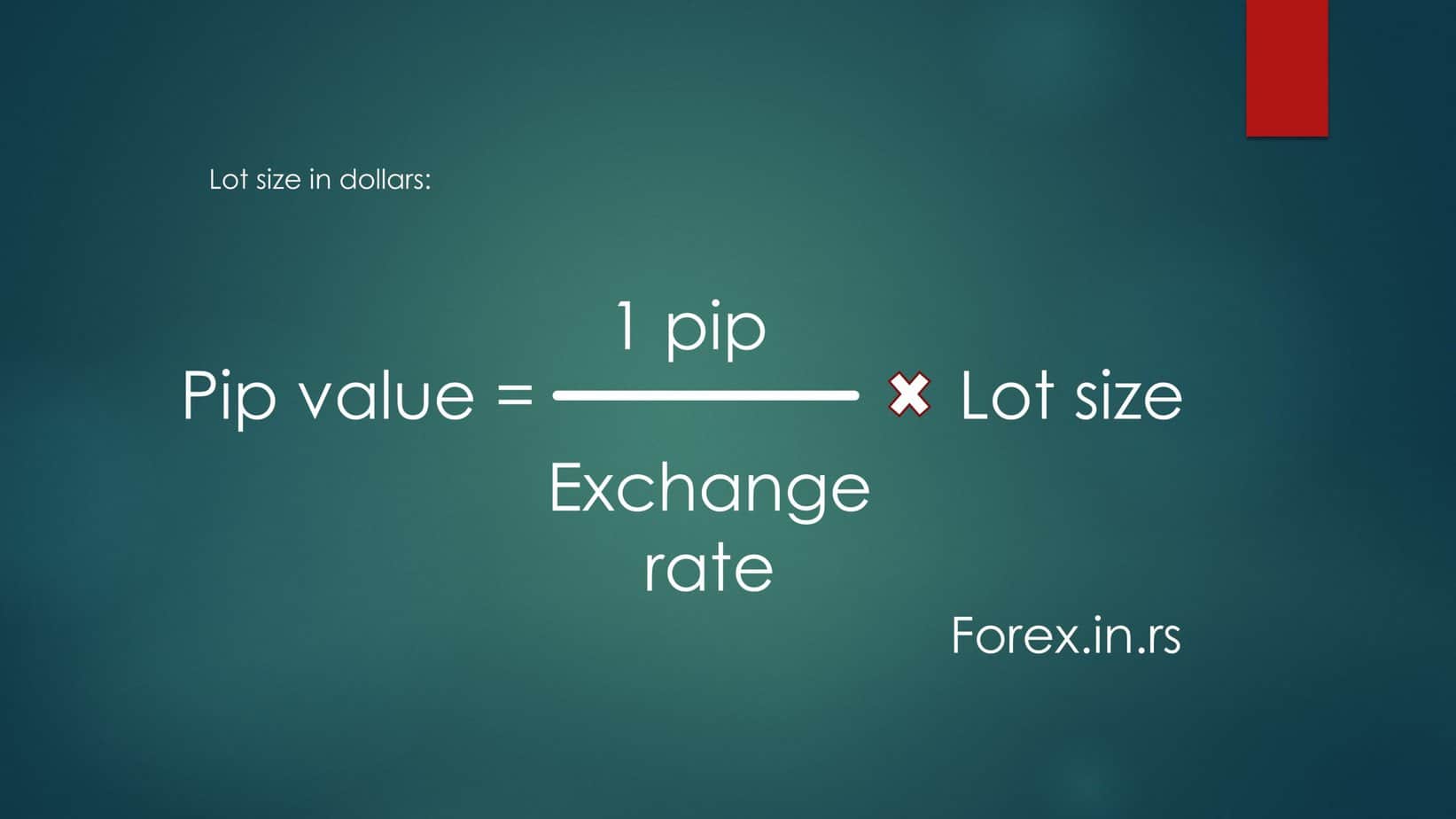

You must calculate lot size or position size based on your equity, risk, and trade probability. You can read our article about the position size formula in detail.

Selecting a trading lot-size forex to trade comes down to a few basic principles. A lot refers to the trade size when trading pairs within the forex market. There are various sizes of lots. With each size comes different levels of risk involved. Brokers will refer to lots by 1,000 increments. The lot’s size directly affects the risk associated with a specific trade. There are many ways to determine the type of lot best for your trade. Position sizing methods can be analyzed in our article in detail.

Recommended lot size forex

What lot size should I trade?

The best lot size for forex is based on equity size. Usually, the recommended lot size in forex equals 1% account risk. However, professional traders use position size formulas such as Kelly criteria, The Fama and French Three-Factor Model, etc., to define the number of lots for each trading position.

The most straightforward strategy to calculate position size in lots is:

Strategy 1: Calculate the size of the lot based on equity

For example, you can set 1 mini lot per $5000 or 1 micro lot per $500 (the gold standard for new traders or lot size forex recommendation). So, based on your equity, you can calculate position size.

So, what Lot Size Should I Trade as a beginner trader? If the trading account is funded in U.S. dollars, a micro lot is worth $1,000; 1 pip equals 10 cents. Beginner’s trader position size should be one micro lot ($1000 worth) for each $500 in account size. For example, if your account has $ 10,000, the approximate position size should be 2 mini lots (1 micro lot x 20 = 20 micro-lots = 2 mini lots).

Of course, position size should be calculated based on risk appetite, account size, previous trading performance, and strategy.

The Best lot size for $500

If you trade a $500 forex account, you must trade with 1 micro-lot or 2 micro lots at most. If you risk 50 pips for EURUD, you risk $5 or 1% from your account, which is the perfect safe risk ratio.

This is a minimal amount of money, and it will allow you to stay in the market for a more extended period while still being able to make money if your trades are successful.

Risk is significant in trading.

See this Table:

The Best lot size for $1000

If you trade a $1000 forex account, you must trade with 2 micro-lots up to 4 microlots at most. If you risk 50 pips for EURUD, in that case, you risk $10 or 1% from your account, which is the perfect safe risk ratio.

To keep your drawdown less than 10%, you need to have the most significant drawdown of $100. In that case, two micro lots should be the maximum lot size.

However, it is hard to evaluate risk tolerance for different strategies. For example, suppose you use a strategy with a $1000 balance account and use several non-correlated pairs, applying maximum diversification. In that case, you can trade up to 1 mini lot because your maximum drawdown will be stable.

- Trade Size Management: With a $1000 forex account, limit your trading to 2 to 4 micro-lots.

- Risk Calculation for EURUSD: If you risk 50 pips on EURUSD, it equates to risking $10 or 1% of your account, aligning with a safe risk ratio.

- Drawdown Limitation: Aim to keep your drawdown under 10%, a maximum drawdown of $100. In this scenario, trading with two micro-lots is advisable as the maximum lot size.

- Risk Tolerance in Various Strategies: Evaluating risk tolerance can be complex with different strategies. For instance, using a strategy on a $1000 balance account with several non-correlated pairs and applying maximum diversification allows for trading up to 1 mini lot, as it will likely maintain a stable maximum drawdown.

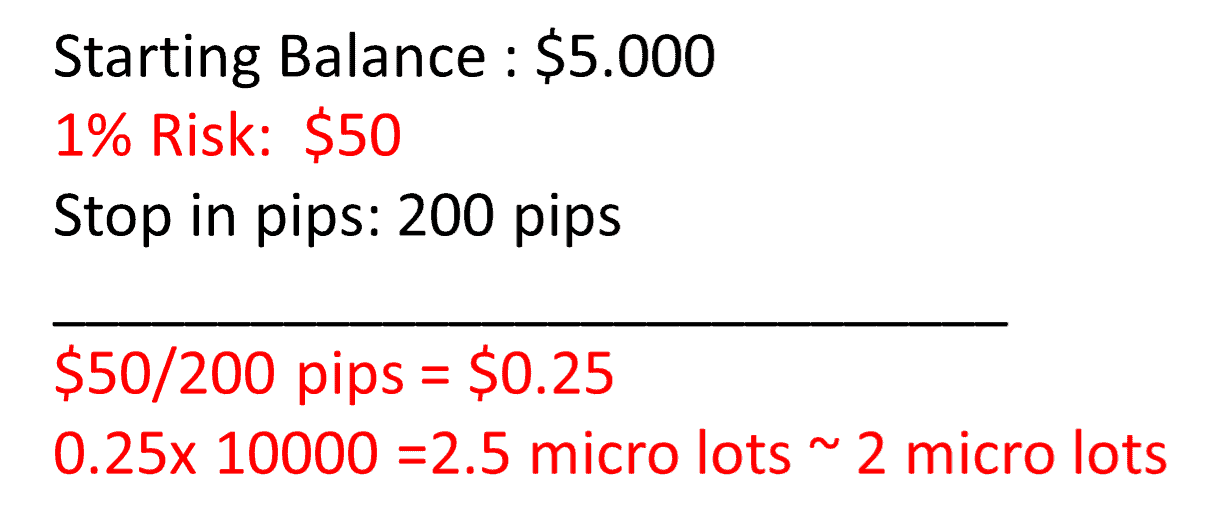

The Best lot size for $5000

If you trade a $ 5,000 Forex account, you must trade with 1 mini lot up to 2 mini lots at most. If you risk 50 pips for EURUD, in that case, you risk $50 or 1% from your account, which is the perfect safe risk ratio.

Strategy 2: Calculate position size using Kelly criteria or some other position size formula

You can calculate how to increase your position size based on your past performance. How much percent can you increase the current position size?

Position size = Winrate – ( 1- Winrate / Risk Reward Ratio)

You can read the example in our article about money management EA.

Last 50 trades :

26 trades were positive ( profitable ) with a total gain of 780 pips

24 trades were negative with a total loss of 600 pipsTo get the Kelly ratio:

W = 26/50=0.52

R = (780/26)/ (600/24) =1.2

K% = W – [(1 – W) / R]

K% = 0.52- [(1 – 0.52) / 1.2]

K% = 12%

Goal is to compare various systems to see which system has the smallest risk.

This is the wrong approach for forex trading because you always have a 50% probability of winning; you risk $1 and target $1. Kelly is usually too risky, in my preference.

A risk management calculator can prove to be helpful when trying to anticipate the associated risk. This also depends on your current assets from your trading account. The size of the lot will determine how much or how little the trade outcome affects your accounts. There are different levels of movement on the forex market, such as 100 pips. If the trade is small, 100 pips of movement will not be a big deal. However, 100 pips of movement can be significant if the trade is extensive. Throughout a broker’s career, they will be able to experience larger lots and smaller lots.

Micro lot trades are a common type of lot that beginners use. These are the smallest possible lots a trader can use on the forex market. There are many benefits to using a micro lot. Micro lots are equal to 1,000 units of the currency you currently use. For example, if EUR or USD is used, this number will be reflected by 1,000 units of currency. Micro lots are an excellent option for keeping the level of risk low.

Mini lots are the next size up from micro-lots. Mini lots allow traders to experience more risk without a significant loss. A mini lot is equal to 10,000 units. This is a considerable difference compared to micro-lots; however, it is not as large as a standard lot. Mini lots are a great middle-ground between micro and standard. It is important to note that the market can move 100 pips within an hour. This is a factor all traders should consider before deciding on any size of the lot. $2,000 is a good starting point when working with mini lots.

The next size of the lot is known as a standard lot. A standard lot uses 100,000 units for trading. A standard lot’s most common pip size is $10/pip. It is recommended to have approximately $25,000 when working with standard lots.

The majority of traders will be working with micro and mini lots. Few traders work with standard lots as a result of the status they hold. It is best to preserve capital to ensure long-term trading. There are many analogies to help understand precisely how lot size works and how to select the best one, including comparing it to walking on a narrow bridge. The larger the bridge, the more support you have.