Table of Contents

Funded trading forex accounts represent an innovative approach to forex trading, offering newcomers and experienced traders the opportunity to trade with more considerable capital than they may otherwise be able to access. This method typically involves proprietary (prop) trading companies providing traders with the financial resources they need. Over the past few years, there has been a notable increase in prop firms offering such funded accounts, providing a myriad of opportunities for those interested in the forex market.

The basic idea is simple: prop companies assess your trading skills and offer a funded account to trade once you’ve demonstrated your proficiency. Essentially, they’re betting on your ability to generate profit; in return, they get a portion of your profits. This unique approach allows traders to leverage more significant amounts of capital and potentially earn higher profits without risking their own money.

However, it’s essential to remember that while the opportunities may seem abundant, there are significant differences between each prop company’s offerings. The trading conditions, such as the maximum lot size, drawdown limits, and profit targets, can vary widely among firms. The fees involved, such as the cost for account evaluations or subscriptions and the profit split between the trader and the prop firm, are also quite diverse.

This variability means that while there may be many prop companies, not all will fit every trader. Therefore, it’s crucial for traders to carefully assess each company’s offerings, understand the associated trading conditions and fees, and ensure they align with their trading style and financial goals before making a decision.

What is the Best Funding Program for Forex Traders?

The best funding program for forex traders is TheFivers Bootcamp Program, where traders with only a $100 (95 EUR) fee can get a $100 000 live trading account. However, traders must pass three demo account evaluation phases, each needing to reach 6% profit.

The Bootcamp program allows you to manage up to 4 million dollar funded trading accounts.

Please see my full video explanation from my FxIgor Youtube channel:

The Bootcamp program for funded trading accounts is an exciting opportunity that allows forex traders to progressively scale their trading capital, starting with a small initial investment. The program is typically structured in stages, each with distinct trading conditions, profit targets, and maximum loss limits.

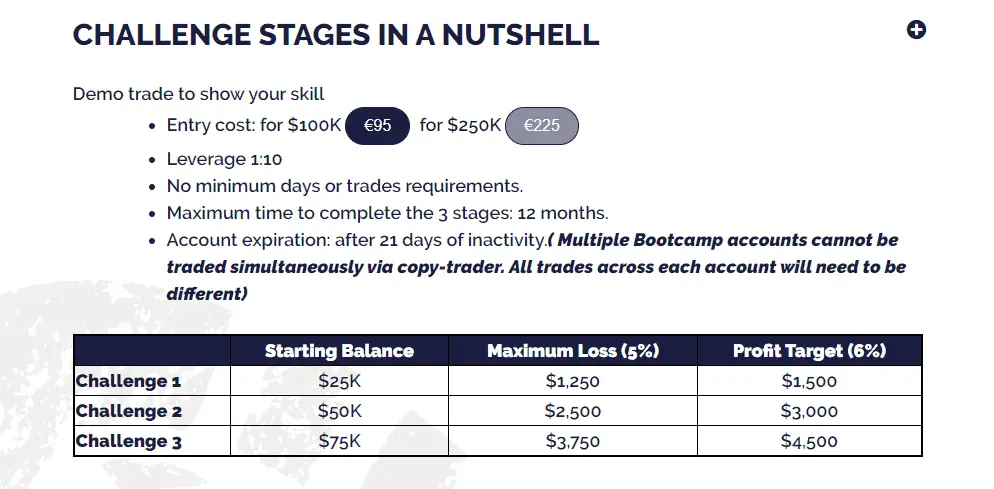

Before actual live trading, there are 3 phases:

Here’s a brief overview of the program:

- Entry Costs: The initial investment to get started depends on the account size you wish to trade. For a $100k account, the entry cost is €95, while a $250k account requires an investment of €225.

- Leverage: The program offers a leverage of 1:10, which allows you to trade a more significant amount of currency than the balance in your account.

- Minimum Requirements: There are no minimum day or trade requirements, offering traders the flexibility to trade at their own pace.

- Maximum Time: The program must be completed within 12 months, and the account will expire after 21 days of inactivity.

- Evaluation: The program consists of three challenges, with increasing starting balances, profit targets, and maximum loss limits:

- Challenge 1: Starting with a $25k balance, your maximum loss is $1,250 (5% of the balance), and the profit target is $1,500 (6%).

- Challenge 2: Starting with a $50k balance, the maximum loss is $2,500, and the profit target is $3,000.

- Challenge 3: Starting with a $75k balance, the maximum loss is $3,750, and the profit target is $4,500.

In video below, I will share my experience as funded trader and provide you few tips:

Please see the screenshot:

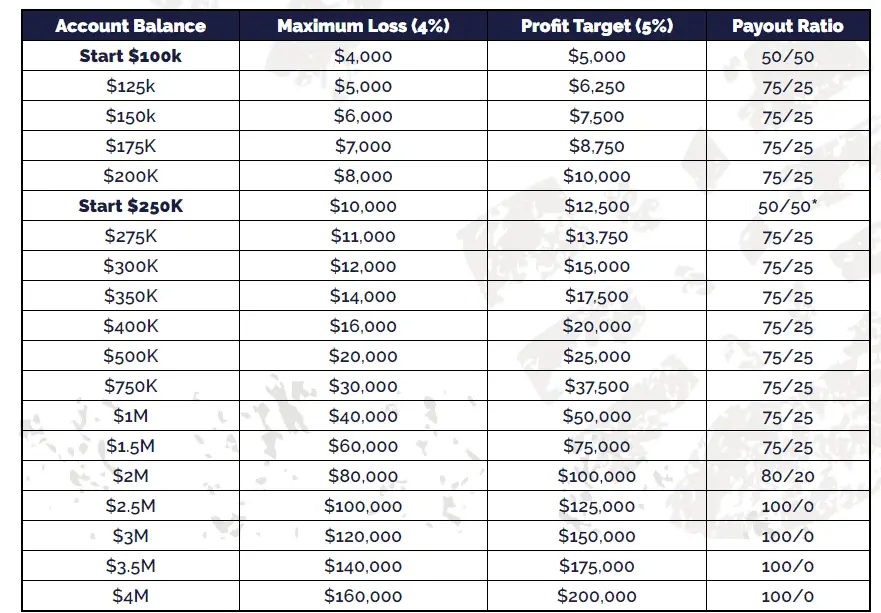

Once you’ve completed these challenges, you move to the live account stage. The account balance, maximum loss limit (now 4% of balance), and profit target (5% of balance) continue to increase. The payout ratio, or profit share, also becomes more favorable as your account balance grows:

- $100k: The maximum loss is $4,000, and the profit target is $5,000. The payout ratio is 50/50.

- $125k: The maximum loss is $5,000, and the profit target is $6,250. The payout ratio is 75/25 in favor of the trader.

- $150k: The maximum loss is $6,000, and the profit target is $7,500. The payout ratio is 75/25.

- $175k: The maximum loss is $7,000, and the profit target is $8,750. The payout ratio is 75/25.

- $200k: The maximum loss is $8,000, and the profit target is $10,000. The payout ratio is 75/25.

Notably, multiple Bootcamp accounts cannot be traded simultaneously via copy-trader; trades on each account need to be unique. This means traders must individually strategize and execute trades on each account rather than simply replicating a successful strategy across multiple accounts.

Evaluation Phases Statistics

The funded trading account programs typically include an evaluation phase to assess a trader’s skills and ability to manage risk effectively. This phase is divided into several stages or challenges, each progressively more complex than the previous one.

However

However, you can always apply for instant forex-funded programs where there are no evaluation phases:

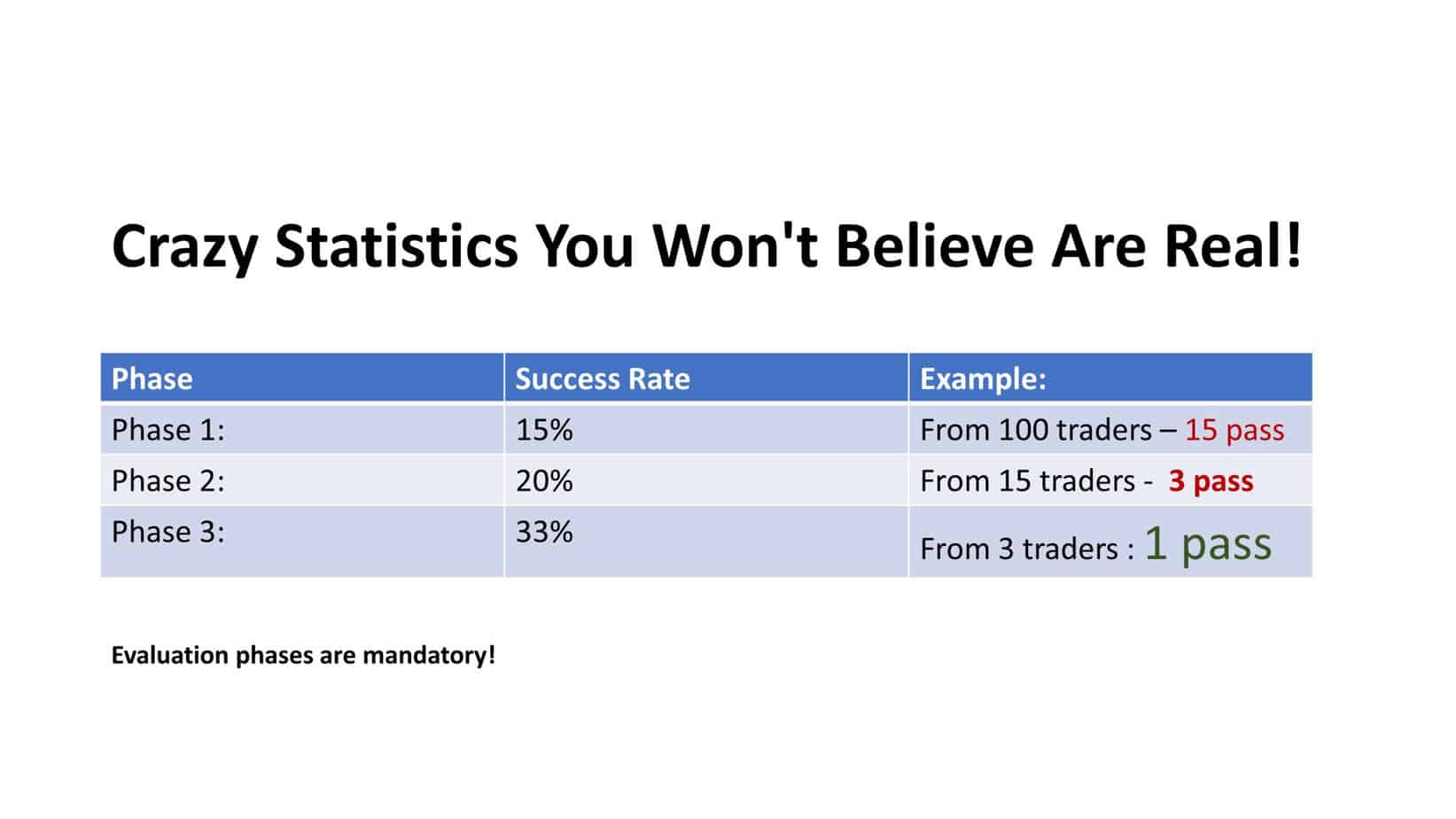

The pass rate for each stage varies significantly. On average, only about 15% of traders complete the first phase. In the second phase, the pass rate tends to be slightly higher, with around 20% of traders moving on to the next stage. In the final third phase, the pass rate increases further, with approximately 33% of traders achieving the necessary targets to pass.

However, despite these percentages, the overall pass rate across all three phases is much lower. On average, only about 1% of traders starting the program receive a funded account. This equates to just one trader out of every 100 who starts the evaluation process.

These numbers underscore the difficulty and competitive nature of these programs. While they offer the potential for significant financial rewards, they also require a high level of skill, strict discipline, and effective risk management strategies. Notably, these low success rates do not necessarily reflect the quality of the traders entering the program but rather the challenging nature of professional forex trading and the high standards that proprietary firms maintain for their funded traders.

This information serves as a reminder for aspiring funded account traders to carefully prepare before entering such programs, focusing not only on potential profits but also on managing risks, understanding the specific requirements of each phase, and maintaining consistent trading performance.

How to pass funded trading evaluation?

To pass the funded trading account evaluation, you must keep risk around 0.25% per time, keeping maximum equity drawdown low. Additionally, you should avoid overtrading and define precisely stop loss and target price levels.

You should always choose at least a $100 000 live account size to mentally keep a small drawdown, a low-risk account that can bring you 5% after 6-12 months. If you reach 5%, you will get $5000/2 = $2500, a reasonable sum for your several months’ work.

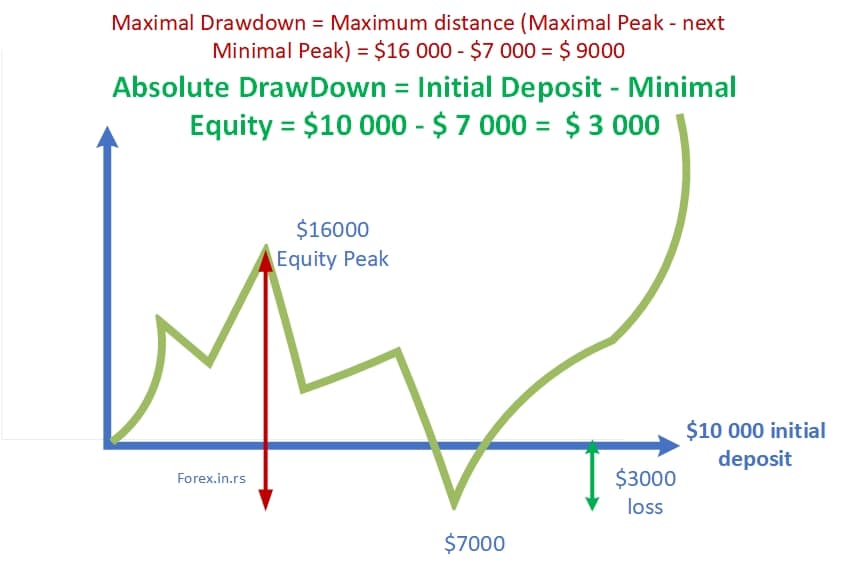

The first problem is maximum drawdown:

Maximum drawdown is calculated based on equity drawdown, so if you have live non-closed trade, the drawdown of that trade is counted.

Avoid Funded Trading Programs with a short evaluation period.

Forex trading requires a balanced approach focusing on short-term gains and long-term sustainability. In the world of funded trading programs, aspiring traders often come across specific programs that promise high returns in relatively short timeframes—for instance, achieving a 10% portfolio profit within a month. While such offers might seem attractive, they usually entail significantly high risk and can potentially lead to severe losses.

Even the most successful forex traders in the world typically achieve around a 5% return after 4 to 6 months. This timeframe allows for proper risk management and a more strategic approach to trading. Achieving a 10% return within a month will often force a trader to take high-risk positions. High-risk trading strategies can lead to substantial gains in the short term if the trader is fortunate. Still, they are also prone to significant losses, often leading to the burning of the entire trading portfolio.

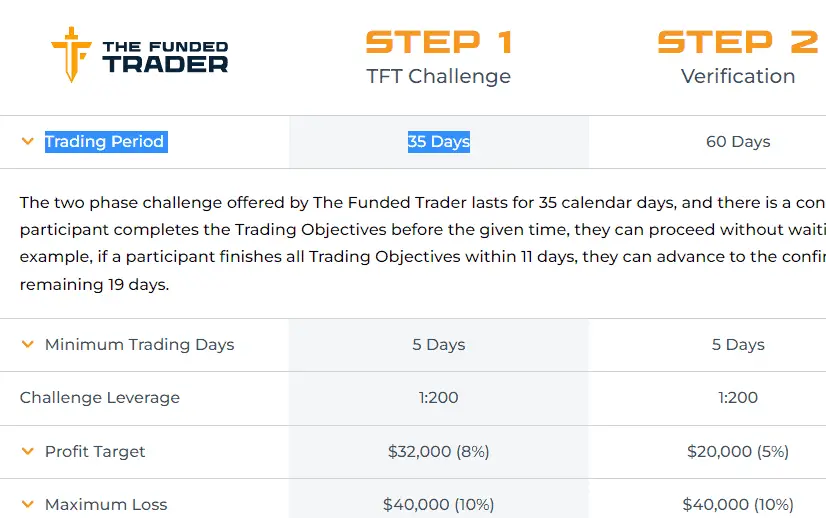

The above image is an example of a lousy evaluation short period. However, the Bootcamp program has 12 months to achieve the target, which is enough for conservative traders.

This high-risk approach goes against the grain of successful trading: consistency, discipline, and sound risk management. Rapid trading can lead to overtrading, a common pitfall for forex traders. Overtrading can lead to excessive losses, as not all trades will be as thoroughly analyzed and thought-through as they should be.

Therefore, traders interested in funded trading programs should be wary of those offering short evaluation periods. A program requiring a significant return in a short period can encourage risky trading behavior and may not be in the trader’s best interest. Instead, traders should look for programs that allow enough time for careful trading and risk management, aligned with the average returns seen by successful professional traders.

Forex trading is not about getting rich quickly; it’s about consistently making profitable trades over the long term while effectively managing risks. Sustainable trading practices might seem less glamorous or exciting, but they’re the key to long-term success in the forex market.

Bootcamp Program Advantages

the Bootcamp program offers many benefits for aspiring funded traders, making it an excellent choice for those interested in this trading method. Here are several key reasons why:

- Progressive Scaling: The Bootcamp program is designed to help traders progressively scale their trading capital. Starting with a relatively small initial investment, traders have the opportunity to progressively manage larger capital pools as they successfully navigate through each stage.

- Structured Learning: The program’s structure, with its increasing difficulty levels and higher stakes, provides a steep but effective learning curve. Traders are pushed to improve their strategies, risk management, and trading discipline as they progress, equipping them with the necessary skills to handle significant capital effectively.

- Flexible Trading Conditions: With no minimum day or trade requirements, traders can trade at their own pace. This can be particularly beneficial for those who prefer a less pressured trading environment and need time to execute their strategies effectively.

- Risk Management Practice: The explicit maximum loss limits at each stage help traders practice and understand risk management’s importance. In the real world of trading, managing downside risk is just as important, if not more so, as seeking upside gains.

- Fair Profit Sharing: The payout ratio becomes increasingly favorable for traders as they progress through the stages, rewarding those who perform well and manage their risk effectively.

- Realistic Expectations: Unlike some programs that promise high returns in short periods, the Bootcamp program sets realistic profit targets that align more closely with what professional forex traders can expect to achieve. This helps traders develop sustainable trading habits rather than taking excessive risks.

The Bootcamp program is well-structured to provide a realistic, challenging, yet rewarding pathway for traders aspiring to manage substantial trading capital. It provides an excellent environment for learning and improvement while offering substantial financial rewards for those who can successfully navigate its challenges. However, as with all trading opportunities, it demands a high level of dedication, skill, and effective risk management from its participants.