Table of Contents

In today’s fast-paced world, private quotes have become essential for individuals seeking personal and financial freedom. Private sections, also known as private placements, offer a unique opportunity to invest in private companies not publicly listed on the stock exchange.

Wealthy individuals or institutions can make these investments, providing many benefits over traditional investments. For example, private quotes offer investors an exclusive chance to invest in high-growth potential companies that are unavailable to the general public. Additionally, personal sections provide higher returns, lower fees, and reduced volatility compared to public investments.

In this article, we will discuss hedge funds’ fee structure.

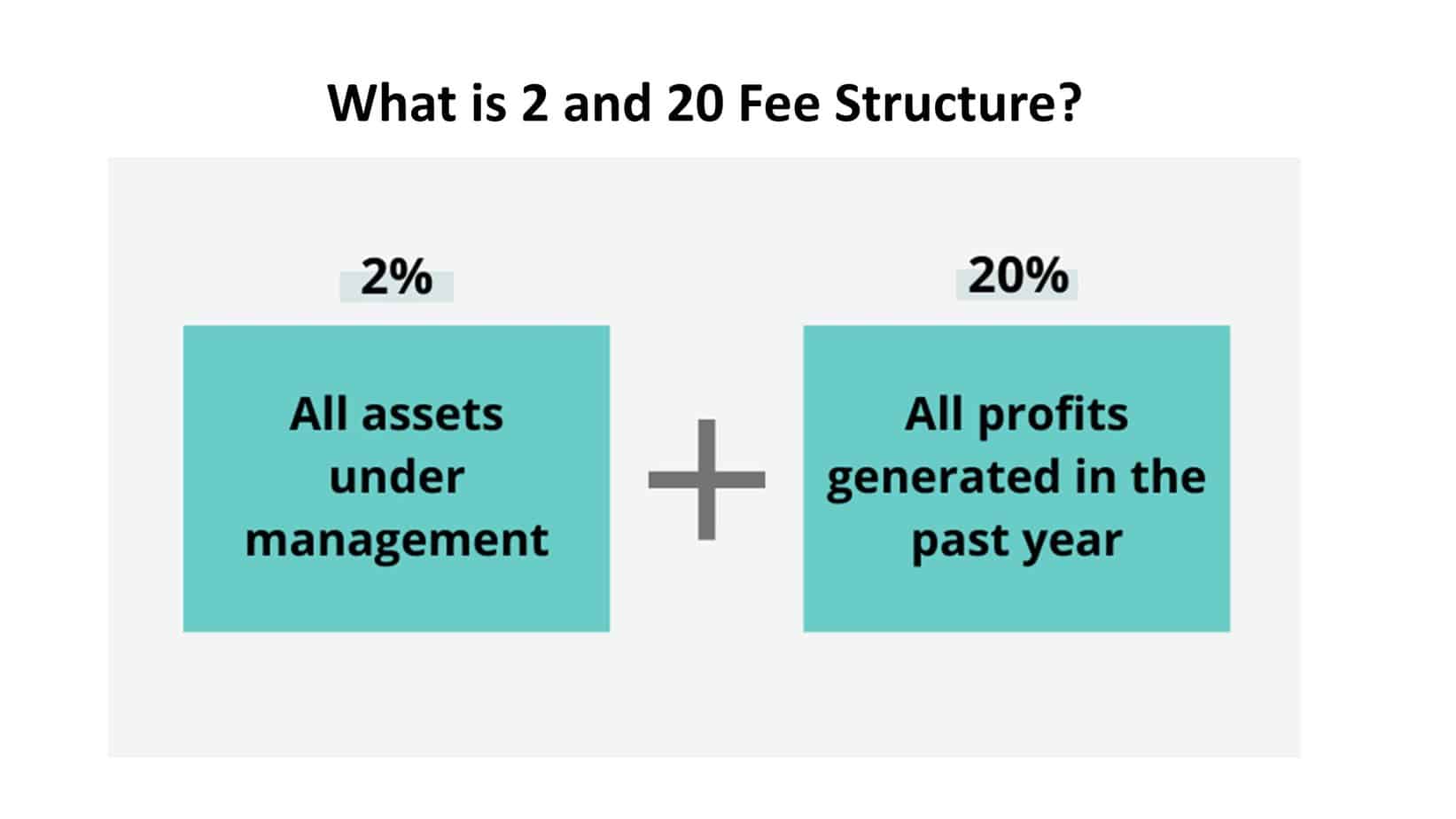

What is the 2 and 20 Fee Structure

The “2 and 20 fee structure” represents a common fee arrangement used by hedge funds and other alternative investment vehicles to compensate their fund managers. Based on this arrangement, the fund manager charges a 2% annual fee on the assets under management and a 20% fee on any profits the fund generates.

Hedge funds managers have finally found an ultimate solution to how they charge for their services.

The “2” refers to the management fee, typically 2% of the assets the hedge fund manages under management (AUM). This fee covers the fund manager’s operating expenses, salaries, and other costs associated with running the fund.

The “20” refers to the performance fee, which is typically 20% of the profits generated by the fund. This fee is designed to align the fund manager’s interests with those of the investors, as it incentivizes the fund manager to generate strong returns.

While the 2 and 20 fee structure has been criticized in recent years for being too expensive for investors, particularly given the rise of lower-cost passive investment options, many hedge fund managers continue to use this fee structure. This is because it provides a lucrative compensation model for successful hedge fund managers and remains the industry standard.

Practical Example of 2 and 20 Fee Structure

A hedge fund has $100 million in assets under management (AUM), generating a 10% return for the year. The fund manager charges a 2% management fee and a 20% performance fee under the 2 and 20 fee structure. Here’s how the fees would be calculated:

Management fee: 2% of $100 million = $2 million

Performance fee: The fund’s return is 10%, so the profit generated by the fund is: 10% of $100 million = $10 million

The performance fee is 20% of this profit so that the fee would be: 20% of $10 million = $2 million

Therefore, the total fees charged by the hedge fund manager under the year 2 and 20 fee structure would be $2 million (management fee) + $2 million (performance fee) = $4 million.

So in this example, the hedge fund manager would earn $4 million in fees for the year. This compensation structure provides a strong incentive for the fund manager to generate solid returns for the investors, as the manager’s compensation is directly tied to the fund’s performance.

Jim Simons didn’t use the 2 and 20 Fee Structure.

Jim Simons, the founder of Renaissance Technologies, uses a unique fee structure for his hedge fund. The structure is sometimes called a “high water mark” or “waterfall” fee structure.

Under this fee structure, Renaissance Technologies charges a 5% management fee on assets under management (AUM) and a 44% performance fee on profits generated by the fund. However, the performance fee is only charged if the fund exceeds its previous high watermark. In other words, the performance fee is only charged on profits earned above the highest level the fund has ever reached.

This fee structure provides a strong incentive for the fund manager to generate consistent returns over the long term, as it ensures that the manager only earns a performance fee when the fund’s value exceeds its previous high watermark. The high watermark structure also aligns the interests of the fund manager and the investors, as the manager only earns a performance fee when the fund generates profits for investors that exceed previous highs.

It’s worth noting that the fee structure used by Renaissance Technologies is quite different from the 2 and 20 fee structure that is more commonly used in the hedge fund industry.

Different Hedge fund Fees Structures

- 2 and 20 fee structure: The most common fee structure in hedge funds. The fund manager charges a 2% annual fee on assets under management (AUM) and a 20% fee on any profits the fund generates.

- High watermark fee structure: A fee structure where the performance fee is only charged when the fund’s value exceeds its previous high watermark. The management fee is typically lower than in other fee structures.

- Performance fee-only fee structure: A fee structure where the fund manager only charges a performance fee on any profits generated by the fund and does not charge a management fee.

- Fixed fee structure: A fee structure where the fund manager charges a fixed fee, usually as a percentage of AUM, regardless of the fund’s performance.

- Hurdle rate fee structure: A fee structure where the fund manager only charges a performance fee if the fund exceeds a certain return threshold, called the hurdle rate. The hurdle rate is typically set at a level higher than the risk-free rate of return.

- Fulcrum fee structure: A fee structure where the performance fee percentage increases or decreases based on the fund’s performance relative to a benchmark. For example, the fund manager might earn a higher percentage of the profits if the fund outperforms a specific market index.

From the hedge fund’s perspective, a fee structure that is too expensive can make it challenging to attract and retain investors, particularly if the fund’s performance does not justify the fees charged. On the other hand, a fee structure that is too low can create challenges for the hedge fund manager in covering the fund’s operating costs and generating a profit.

From the manager’s perspective, a fee structure that is too low may not provide sufficient compensation for the work involved in managing the fund, particularly if the manager is generating solid returns. However, a fee structure that is too high may create incentives for the manager to take on excessive risk in pursuit of higher returns, which can be detrimental to the fund’s long-term performance.

Generally, a fee structure that aligns the interests of the manager and the investors is likely to be most effective. For example, this could mean a fee structure that charges a performance fee only when the fund generates profits above a certain threshold or high watermark. This ensures that the manager only earns a fee when the investors have also profited. Alternatively, a fee structure that adjusts the performance fee percentage based on the fund’s performance relative to a benchmark can incentivize the manager to outperform the market while aligning the manager’s compensation with the fund’s overall success.

Ultimately, the best fee structure for a hedge fund will depend on various factors, including the fund’s investment strategy, performance history, and the preferences of its investors. Therefore, it’s essential for hedge fund managers to carefully consider their fee structure and ensure that it aligns with the interests of investors and managers.