The ADR indicator for MT4 is useful for finding the ADR range and the market range of the ongoing day. Hence, it displays the estimated market range for the current day. To understand this, a shift in the trade momentum and volume close to the ADR- Level indicator indicates the onset of a trend or the reversal of a trend. These values are also the foundation of many forex technical indicators and are also an esteemed part of many trading strategies.

ADR indicator is utilized by both new and advanced forex traders. Rookies can use this indicator to find support and resistance levels and trace the price movement at different levels. While advanced traders can use it as a part of their trading strategy. This indicator is free to download and install.

How Does ADR Indicator Work?

ADR indicator represents MT4 indicator that will draw on your chart potential future resistance and support. This indicator uses the Daily Average True Range as the main input to calculate future support and resistance. You can use the ADR indicator to set stop loss and target.

DOWNLOAD ADR INDICATOR

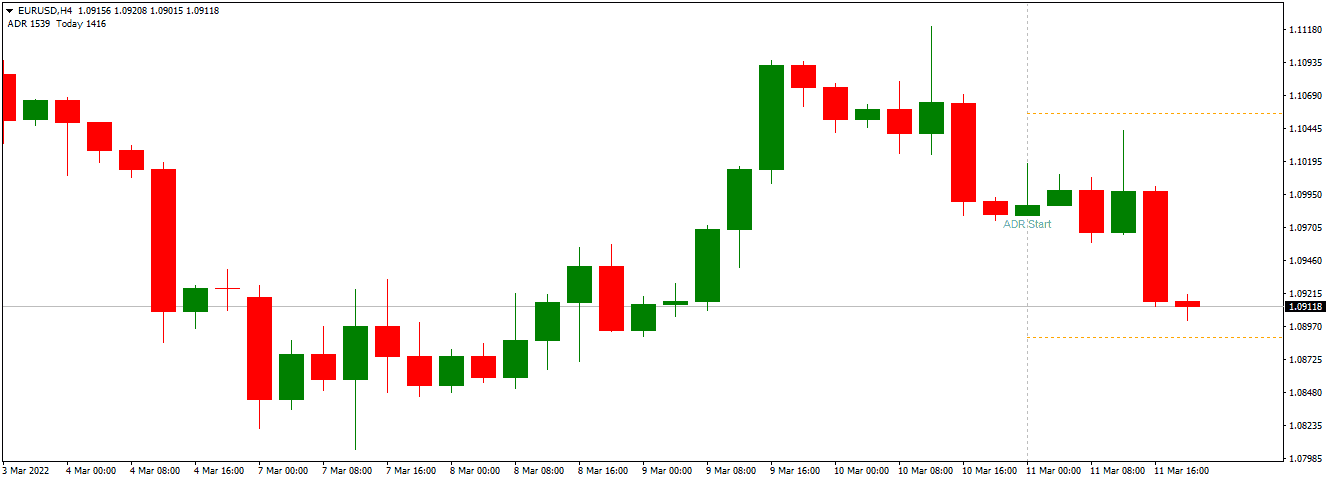

In the EURUSD H1 chart, this indicator will represent ADR values of the current day in the top left corner. Moreover, you can also see the upper and lower average daily range in the form of dotted lines as an extension of the current trading day.

The ADR indicator finds its value with the help of the Average True MetaTrader indicator. Hence, the calculation time of the average daily range plays a pivotal role in setting a range. If the ATR value is low, the ADR value will be calculated with more data. Hence, it is crucial that technical traders choose their ATR input from the indicator settings with the utmost diligence. To test the volatility of the currencies, traders should experiment with various ATR settings too.

Forex traders can benefit from using the breakout trading strategy and reversal trading strategy for trading via the Average Daily Range. Since ADR represents an estimated market range, the forex trader can also comprehend the price extremes. Hence, forex traders should buy when the price is close to the ADR level and the stop loss point is below the last swing low. The upper ADR level is the most beneficial for bringing in profits.

In the same manner, forex traders should take the selling position once the price is close to the upper ADR line and look for reversal signs.

ADR levels also display the same results in the intraday charts and serve the purpose of intraday support and resistance levels. Hence, the price movement near the upper and lower ADR levels garners the best signals for the traders related to the reversal or breakout.

Conclusion

Forex traders can use this ADR indicator with the MT4 technical indicator in combination. To get the best results, use the range breakout and reversal trading strategies.