Table of Contents

Traders always look for the perfect time to enter or exit the market during a price movement. For this purpose, they have many indicators they can download and start using with their trading platform. However, due to high volatility, traders tend to depend heavily on these tools when it comes to Forex trading. To devise a successful trade, they need indicators to find the support and resistance levels, take-profit and stop-loss levels, buy-sell positions, and trends.

Check my whole video about Metatrader and VWAP:

Considering the above points is crucial to Forex trading. However, another thing that is equally important to analyze, whether you are trading Forex or any other asset, is the fair price. Traders can determine the price level at which they will make profits. However, it is equally important to estimate the reasonable cost of security to enter a fair trade or prevent the traders from incurring any loss.

The Volume-Weighted Average Price (VWAP) indicator shows the average price, current volume, and cumulative volume. Forex traders highly recommend this indicator, which is compatible with the MetaTrader platform.

Read this article to understand the VWAP MT4 Indicator and how it can be used for Forex trading.

Download the VWAP Indicator for MT4

What Is the VWAP Indicator?

The Volume-Weighted Average Price (VWAP) is a trading indicator that provides the average price a security has traded at throughout the day, based on both volume and price. In MetaTrader 4 (MT4), VWAP is often used by traders to determine the direction of the market, make trading decisions, and evaluate the performance of trading strategies.

Uses of VWAP in MT4

- Trend Identification:

- Above VWAP: If the prictradesng above the VWAP, it indicates a bullish trend. Traders may look for buying opportunities.

- Below VWAP: If the price trades below the VWAP, it indicates a bearish trend. Traders may look for selling opportunities.

- Entry and Exit Points:

- Buy Signal: Traders might enter a long position when the price exceeds the VWAP, suggesting an uptrend.

- Sell Signal: Traders might enter a short position when the price crosses below the VWAP, suggesting a downtrend.

- Support and Resistance:

- VWAP can act as a dynamic support and resistance level. Prices often react around the VWAP level, providing potential entry and exit points.

- Volume Confirmation:

- VWAP incorporates volume into its calculation, making it a more reliable indicator of market sentiment than simple moving averages, which only consider price.

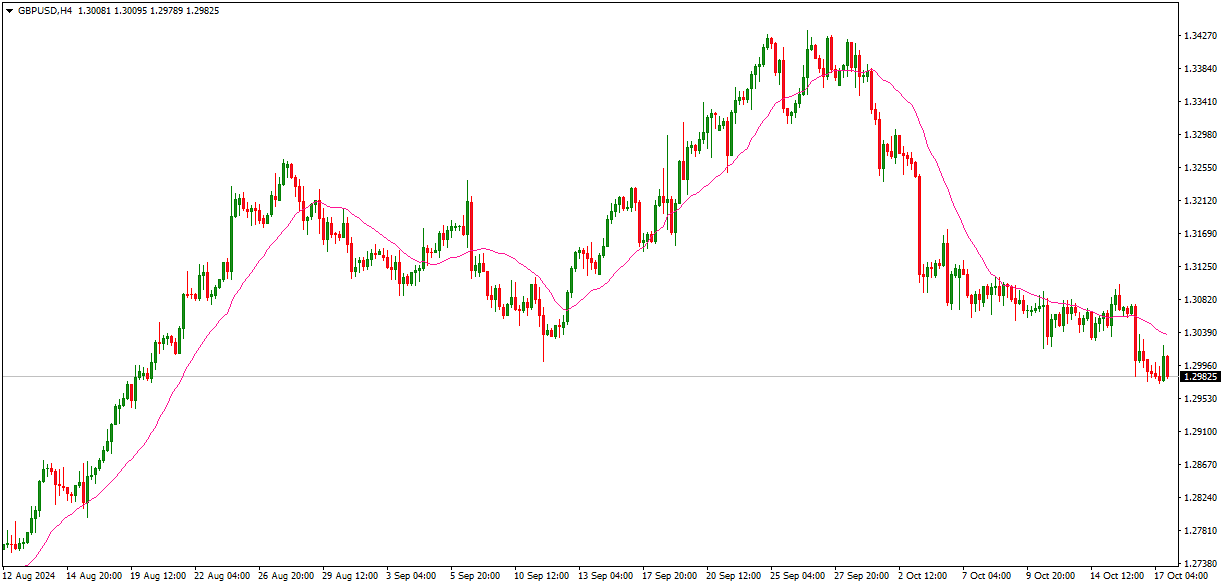

When applied to the MT4 terminal, the VWAP Indicator displays bands on the price chart. The band in the middle is the Volume Weighted Average, which is considered the fair price of the Forex or the asset being traded. After calculating the standard deviation, the indicator displays bands above and below the reasonable price or middle band.

By combining these bands with the price action, traders can determine buying and selling positions. The ideal strategy is to place the buy-sell position near the extreme bands. However, traders can buy low and sell high to make a profitable trade. This means traders open a selling position near the influential upper band and a buying position near the lower outer band.

To stay aware of the market trend, it is essential to check the price action before placing a buy-sell position. As the direction changes, traders can hold their current positions and exit when there is a trend reversal signal.

The VWAP Indicator is more active during volume trading sessions, which is the other way around regarding other sessions. Moreover, this indicator is suitable for multiple timeframes. However, this feature does not restrict it from performing well in short- or long-term or intraday trading.

VWAP is a trading indicator showing the average price a security has traded throughout the day based on price and volume. It helps traders understand the average price a security was traded at, adjusted by volume. VWAP is particularly useful for assessing whether the current price is above or below the average price traders pay during the day.

Formula for VWAP

Where:

Typical Price =

- Cumulative means the total values since the trading session opened.

In simpler terms, VWAP is calculated by taking the sum of the product of the typical price and volume for each trading period and then dividing it by the cumulative volume for the same periods.

Steps to Calculate VWAP Manually

- Calculate the Typical Price for Each Period:

- Use intraday data (such as a 5-minute chart).

- For each 5-minute interval (or any chosen period), calculate the typical price:

- Multiply the Typical Price by the Volume:

- After calculating the typical price for the period, multiply it by the trading volume for that same period:

- Calculate the VWAP for the First Period:

- For the first 5-minute period (or the first period of the day):

- Maintain VWAP Throughout the Day:

- To calculate VWAP for later periods, you need to update the cumulative totals.

- This means that after each period, add the current PV value to the previous cumulative PV values and do the same for volume.

- To calculate VWAP for later periods, you need to update the cumulative totals.

Example: Calculating VWAP on a 5-Minute Chart

Let’s assume you’re working with a 5-minute intraday chart, and we want to calculate VWAP for the first three periods of the day:

- Period 1 (first 5 minutes):

- High: $102, Low: $100, Close: $101

- Volume: 10,000 shares

- Typical Price:

- PV:

- Period 2 (next 5 minutes):

- High: $103, Low: $101, Close: $102

- Volume: 8,000 shares

- Typical Price:

- PV:

- Period 3 (next 5 minutes):

- High: $104, Low: $102, Close: $103

- Volume: 9,000 shares

- Typical Price:

- PV:

- Calculate Cumulative VWAP:

- Cumulative PV (after 3 periods) =

- Cumulative Volume (after 3 periods) =

- VWAP (after 3 periods):

- Cumulative PV (after 3 periods) =

This process continues throughout the trading session, updating the cumulative PV and volume and recalculating VWAP for each period.

How VWAP Helps Traders

- Institutional Traders: Often use VWAP to execute large orders without disturbing the market. They aim to execute their trades at or better than the VWAP to ensure they aren’t paying too much.

- Day Traders: Use VWAP as a reference point. When the price is below VWAP, the security may be considered undervalued; when it’s above VWAP, it might be seen as overvalued.

VWAP combines price and volume, making it a robust indicator for understanding price action relative to volume flow.

Interpreting VWAP on MT4

- Bullish Bias: When the price is consistently above the VWAP, the asset is being bought more aggressively, and the market sentiment is bullish.

- Bearish Bias: When the price is consistently below the VWAPt, the asset is sold more aggressively, and the market sentiment is bearish.

- Mean Reversion: If the price deviates significantly from the VWAP, it often reverts to the VWAP. Traders might take advantage of this behavior by taking contrarian positions.

Conclusion

The Volume Weighted Average Price (VWAP) Indicator is accessible to download and apply. Since it provides such crucial information, new and expert traders prefer it, especially while trading Forex. This indicator can provide all the necessary information for a successful trade, provided that traders use other technical tools to confirm the indications.