Intraday trading, often called day trading, involves buying and selling financial instruments within the same day. Traders use this practice to profit from short-term price movements in stocks, currencies, or commodities. The approach and intensity of intraday trading can vary significantly among traders, with some making more than ten daily trades. At the same time, specific automated systems can generate thousands of trades annually. This discrepancy in trading volume is attributed mainly to the diversity in trading strategies and the use of technology in executing trades.

Typical intraday traders who exceed ten daily trades rely on technical analysis and real-time market data to make swift decisions. Their strategies might include scalping, where trades are held for a few minutes or seconds, or momentum trading, which capitalizes on trends within the trading day. These traders are highly active, quickly monitoring the market for opportunities to enter and exit positions to capture small price movements.

On the other hand, some trading systems, particularly those driven by algorithms, can generate thousands of trades in a year. These systems use complex mathematical models to identify trading opportunities based on market conditions and historical data. Algorithmic trading allows for high-frequency trading (HFT), where orders are executed at extremely high speeds, often in fractions of a second. This capability enables such systems to perform trades across multiple markets and instruments with minimal human intervention.

So, based on this, traders pay large commissions, and brokers earn a lot of money from spreads.

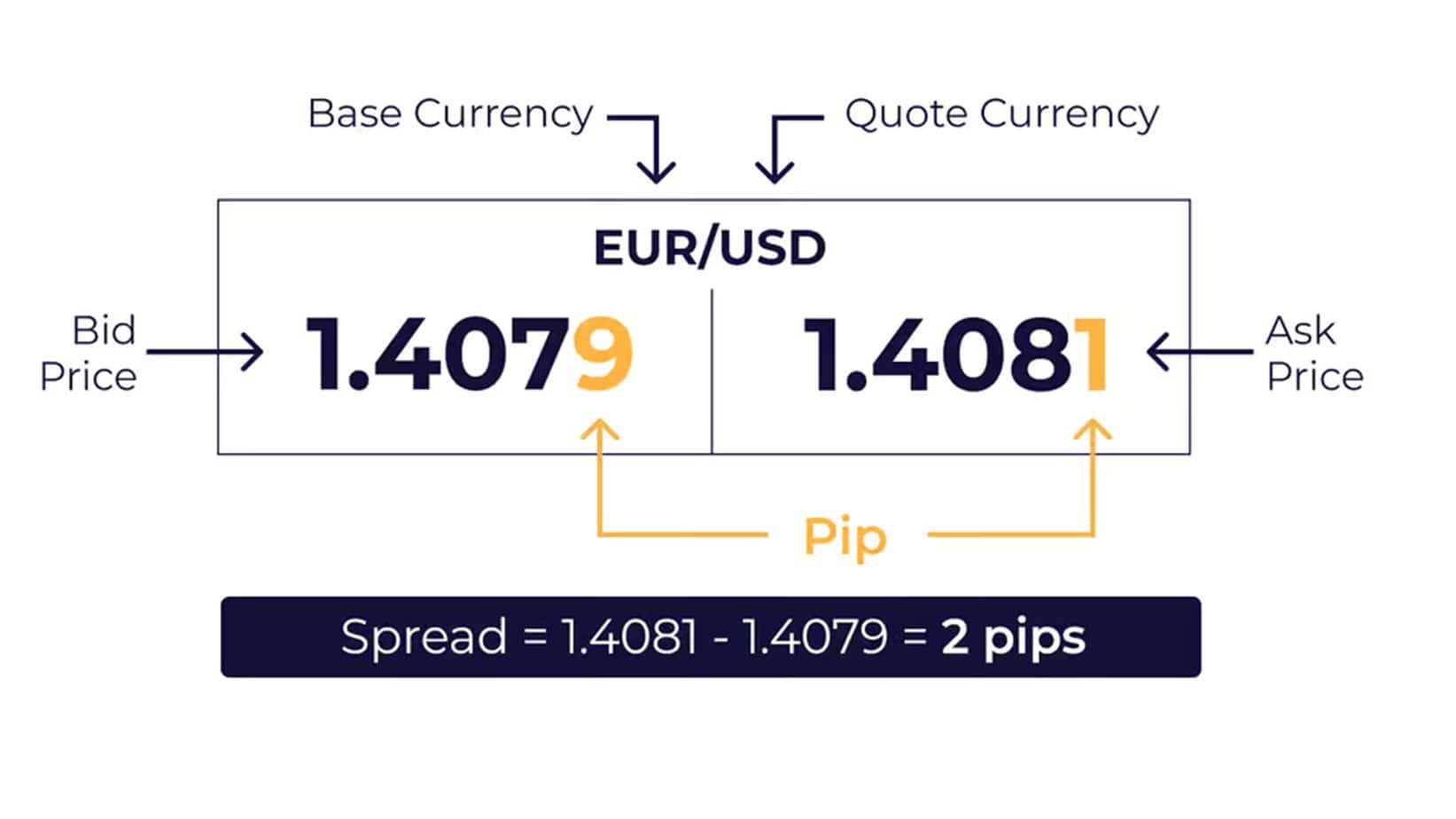

Spreads in trading refer to the difference between a financial instrument’s buying price (ask) and the selling price (bid). This gap represents the transaction cost to the trader and indicates the asset’s liquidity and volatility.

Zero or Raw spreads accounts represent trading accounts offering instruments with zero or tight spreads, usually from 0 to 0.2 pips for major forex pairs. However, zero-spread accounts charge an additional commission, usually around $3.50 per lot, payable per side. Therefore, if you buy one lot and close the trade, you will pay a $7 commission.

IC Markets zero spreads account offers $3.5 per lot commissions. (visit broker)

HFM offers $3 per lot for zero-spread accounts.

Please watch my video about zero spreads accounts vs. standard accounts:

Zero spread accounts, like those offered by IC Markets or HFM (previously known as HotForex), are designed to provide traders with the lowest possible spreads on their trades, often starting from 0.0 pips. This is particularly advantageous for day traders, scalpers, and users of expert advisors who benefit from tight spreads for their high-frequency, short-duration trading strategies. These accounts typically charge a small commission per trade instead of making money on wider spreads, offering a more transparent cost structure that can benefit traders executing a large volume of trades.

For example, IC Markets’ Raw Spread account showcases an average EUR/USD spread of 0.1 pips and charges a commission of $3.50 per lot per side. Such accounts are supported by deep liquidity pools, ensuring that orders are filled quickly and at the best possible prices. This setup is critical for strategies that rely on fast, efficient execution, such as scalping, where the goal is to quickly profit from minimal price changes.

The technological infrastructure supporting these accounts is also noteworthy. IC Markets, for instance, locates its MetaTrader 4 and 5 Raw Spread servers in the Equinix NY4 data center in New York. This strategic placement near major financial exchanges and liquidity providers minimizes latency, meaning traders experience almost no delay between their trade order and execution. Such an environment is essential for all traders, especially those using automated trading systems that require high-speed order execution to be effective.

The platforms offer raw pricing, meaning traders can access market prices directly from liquidity providers without markups. This is possible through a network of pricing providers that send executable streaming prices (ESP) directly to the broker, passing them on to the clients without dealing with desk intervention, price manipulation, or requotes. This approach ensures traders execute their strategies under the best possible trading conditions.

Moreover, IC Markets and similar providers allow flexible trading conditions, such as no minimum order distance, which enables placing orders, including stop-loss orders, very close to the market price. This flexibility is crucial for strategies like scalping and supports practices like hedging without the restrictions of rules like FIFO (First In, First Out).

In summary, zero-spread accounts offer a competitive edge to certain types of traders. They provide low-cost, high-speed, and flexible trading conditions that can significantly enhance trading performance, especially for strategies that rely on minor price movements and require quick execution.

Zero Spread Accounts vs. Standard Variable Spread Accounts

Zero Spread Account:

- Spreads: Offers spreads from 0.0 pips, meaning the difference between the bid and ask prices can be nearly non-existent.

- Commissions: Charges a commission per trade, a direct fee for each lot traded—for example, a commission of $3.50 per lot per side.

- Trading Strategy Suitability: This strategy is ideal for day traders, scalpers, and users of expert advisors who benefit from tight spreads and aim to make many trades.

- Execution Speed: It often features faster execution speeds due to its direct access to market prices and high liquidity, making it suitable for high-frequency trading.

- Cost Transparency: Provides more transparent trading costs, as traders can easily calculate the total cost based on the commission and traded volume.

Standard Variable Spreads Account:

- Spreads: This account offers variable spreads, which fluctuate based on market conditions. Spreads are generally more comprehensive than zero-spread accounts but without additional commissions.

- Commissions: Typically, no commission is charged on trades. The cost of trading is incorporated into the spread.

- Trading Strategy Suitability: This strategy suits traders who prefer a more straightforward cost structure and are less concerned with tight spreads, such as long-term traders.

- Execution Speed: Execution speed can be competitive, but traders might experience wider spreads during volatile or illiquid market conditions.

- Cost Transparency: While there are no commissions, the spread variability can make it harder to predict the exact cost of a trade in advance.

Emerging Markets Spreads

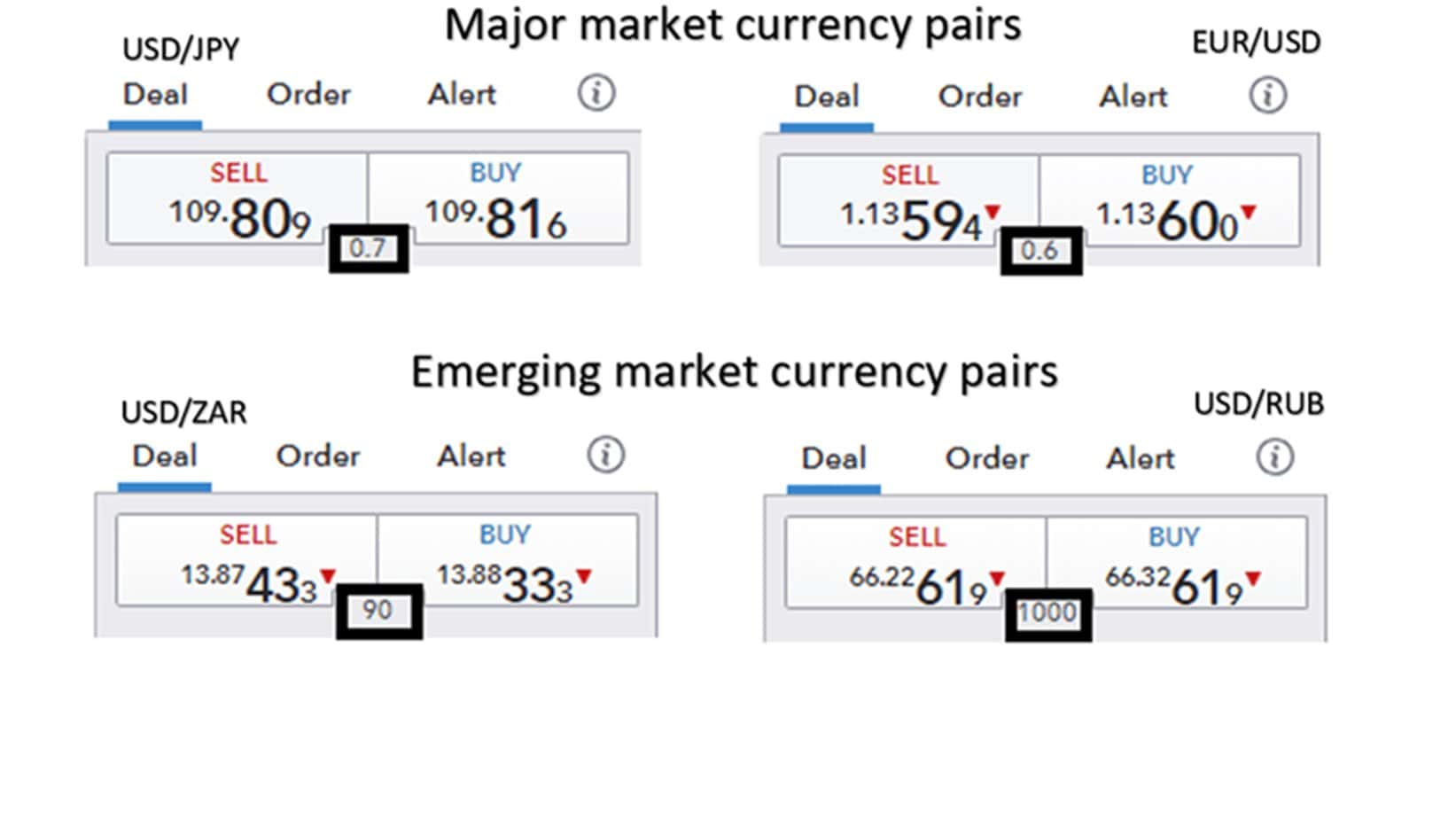

Spreads in emerging market currencies, such as the South African Rand (USD/ZAR) or the Russian Ruble (USD/RUB), are often significantly more comprehensive than those in major currency pairs.

Please see the example below:

This phenomenon can be attributed to several factors inherent to the nature of emerging markets and their financial systems:

- Liquidity: Emerging market currencies are generally less liquid than significant currencies like the USD, EUR, or JPY. Lower liquidity means fewer buyers and sellers at any given time, which can lead to more significant gaps between the prices at which traders are willing to buy and sell (the bid-ask spread).

- Volatility: Emerging market economies can be more susceptible to political, economic, and social instability. Such volatility can lead to rapid and unpredictable movements in currency values, prompting market makers to widen spreads to mitigate risk.

- Market Depth: The forex market for emerging currencies is not as deep as for major currencies. This means that even relatively small trades can significantly impact the market price, leading to higher spreads to compensate for the increased risk of price slippage.

- Economic Policies and Interventions: Emerging markets often have less predictable economic policies, including higher risks of currency intervention by central banks. Traders and liquidity providers factor in the uncertainties and potential for sudden policy shifts, leading to wider spreads to cushion against these risks.

- Access to Information: Information flow regarding emerging markets might not be as efficient or transparent as in developed markets. This lack of information can increase the perceived risk of trading these currencies, resulting in wider spreads as a form of risk compensation.

- Currency Convertibility: Some emerging market currencies have restrictions on currency convertibility, which can complicate entering and exiting positions. This can further reduce liquidity and increase the cost of trading, reflected in wider spreads.

The combination of these factors means that trading emerging market currencies carries higher transaction costs and risks, as reflected in the broader spreads. Traders interested in these markets must be aware of these dynamics and consider them when planning their trading strategies.

In conclusion, the choice between zero spread accounts and standard variable spread accounts largely depends on the trader’s strategy, trading volume, and sensitivity to spreads and commissions. Zero spread accounts offer the advantage of minimal spreads, often starting from 0.0 pips, with a commission charged per trade. A zero spread structure is particularly advantageous for scalpers and intraday traders, who operate on thin margins and benefit from the predictability of transaction costs and the ability to execute many trades at a minimal cost per trade. The tighter spreads and transparent commission structure enhance their ability to capitalize on small price movements within short time frames.

On the other hand, standard variable spread accounts, which come with no commissions but variable spreads, are more suited to swing traders and those employing longer-term strategies. These traders are less affected by spread variations as their positions are held over more extended periods, aiming for more significant price movements that can absorb the higher transaction costs associated with wider spreads. The absence of commissions simplifies the cost structure, making it easier for these traders to calculate their net position without the need to account for additional trading fees on each trade.

Choosing between these account types should be based on understanding one’s trading style, strategy, and the cost implications of spreads and commissions. While zero spread accounts offer clear benefits for high-frequency, short-duration strategies characteristic of scalping and day trading, standard variable spread accounts may be more cost-effective for traders with a longer-term horizon, where the impact of spreads is relatively diminished.