The importance of low spread cannot be overstated. It can make or break a trade, particularly for those who engage in scalping and day trading. The tighter the spread, the less the trader pays on every trade, resulting in higher profits. Even a few pips difference in the spread can significantly impact a trader’s bottom line over the long run.

Moreover, tight spreads also imply greater transparency in the trading process. Low-spread brokers typically have greater liquidity and are more efficient in handling orders. As a result, they provide traders with faster execution, which is crucial in the forex market, where a few seconds of delay can make all the difference. This means that traders can enter and exit trades at a more favorable rate, leading to greater profitability.

What is The Best Forex Broker With Low Spread and No Commission?

HF Markets is the Best broker with a low spread and no commission because it offers zero-spread accounts with only $0.03 per 1k lot commission. Additionally, Capital.com offers the lowest spread of 0.00006 without a commission.

Check HF markets spreads:

| Currency Pair | Limit and Stop Levels Spread | Typical ZERO Spread |

|---|---|---|

| EURUSD | 2 | 0.1 |

| USDJPY | 2 | 0.2 |

| GBPUSD | 2 | 0.4 |

| EURGBP | 2 | 0.4 |

| USDCAD | 2 | 0.6 |

| EURJPY | 2 | 0.8 |

| USDCHF | 2 | 0.8 |

| AUDUSD | 2 | 0.8 |

| CADJPY | 2 | 0.9 |

| EURCHF | 2 | 0.9 |

| AUDJPY | 2 | 1 |

| NZDUSD | 2 | 1 |

| USDSGD | 5 | 1 |

| USDHKD | 7 | 1.1 |

| EURCAD | 2 | 1.2 |

| CADCHF | 3 | 1.3 |

| GBPJPY | 3 | 1.4 |

| AUDCAD | 2 | 1.4 |

| NZDJPY | 2 | 1.4 |

| AUDCHF | 2 | 1.5 |

| CHFJPY | 2 | 1.6 |

| EURAUD | 2 | 1.6 |

| GBPCHF | 3 | 1.8 |

| AUDNZD | 3 | 1.9 |

| GBPCAD | 3 | 1.9 |

| EURNZD | 3 | 2 |

| GBPAUD | 3 | 2.3 |

| ZARJPY | 3 | 2.3 |

| NZDCHF | 3 | 2.3 |

| NZDCAD | 3 | 2.3 |

| EURDKK | 10 | 3.3 |

| GBPNZD | 4 | 4.5 |

| USDDKK | 3 | 5 |

| USDCNH | 2 | 5.4 |

| EURPLN | 20 | 6.8 |

| USDSEK | 20 | 9 |

| USDTRY | 5 | 9.6 |

| USDPLN | 20 | 9.8 |

| USDHUF | 50 | 12.5 |

| USDCZK | 20 | 12.6 |

| EURNOK | 20 | 14.1 |

| EURCZK | 30 | 15 |

| USDNOK | 20 | 15.5 |

| EURHUF | 20 | 18.4 |

| USDZAR | 50 | 29 |

| EURZAR | 3 | 55 |

| USDRON | 70 | 60 |

| EURRON | 80 | 70 |

| GBPZAR | 5 | 80 |

| USDRUB | 200 | 810 |

In my experience, you will get the best low spreads for EURUSD and GBPUSD forex pairs and gold. HF Markets and Capital.com offer excellent low spreads for gold. For example, Capital.com offers only a 0.3 spread for gold spots.

Capital.com low spread

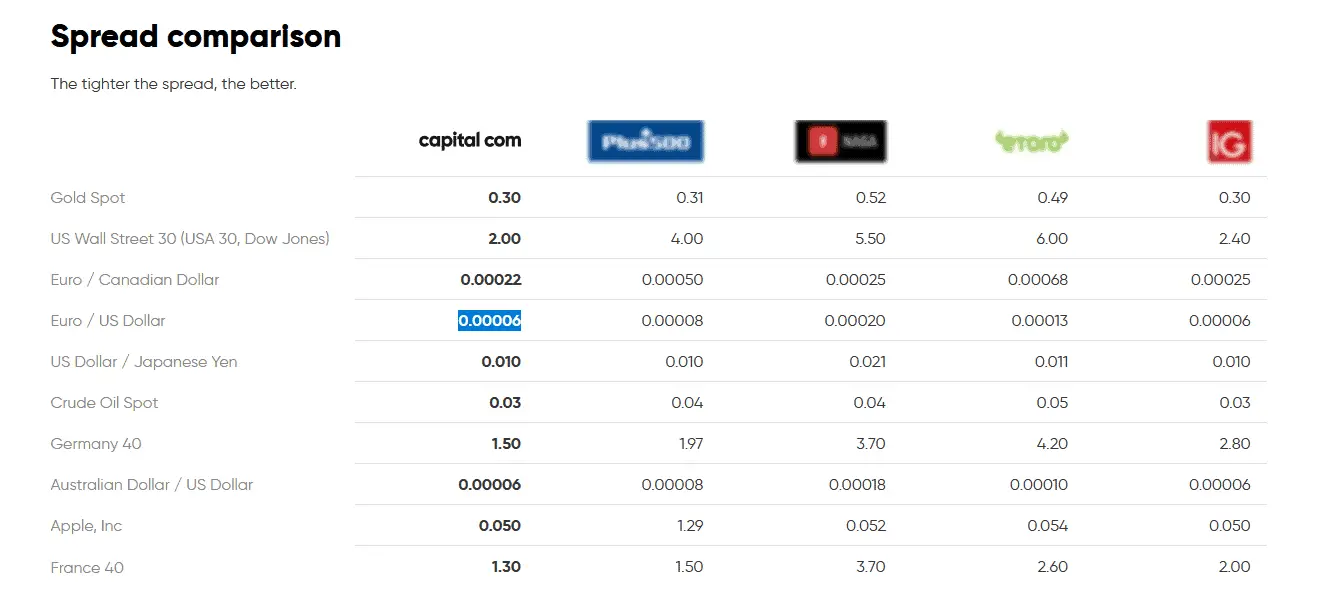

Low spread commission is a term used in financial trading to refer to the difference between an asset’s buying and selling prices. It represents the cost that traders incur when executing trades. Capital.com is a trading platform that offers competitive low spreads on various financial instruments, and here are the detailed spread commissions for some specific assets:

- Gold Spot: The spread commission for trading Gold Spot on Capital.com is 0.3. This means the difference between gold’s buying and selling prices is 0.3 units of the base currency (such as USD).

- US Wall Street 30 (USA 30, Dow Jones): The spread commission for trading the US Wall Street 30 index (USA 30 or Dow Jones) on Capital.com is 2. This indicates that the difference between the buying and selling prices of the index is 2 points.

- Euro / Canadian Dollar: The spread commission for trading the Euro against the Canadian Dollar on Capital.com is 0.00022. This means that the difference between the buying and selling prices of the currency pair is 0.00022 units of the base currency (such as EUR).

- Euro / US Dollar: The spread commission for trading the Euro against the US Dollar on Capital.com is 0.00006. This indicates that the difference between the buying and selling prices of the currency pair is 0.00006 units of the base currency (such as EUR).

- US Dollar / Japanese Yen: The spread commission for trading the US Dollar against the Japanese Yen on Capital.com is 0.01. This means that the difference between the buying and selling prices of the currency pair is 0.01 units of the base currency (such as USD).

- Crude Oil Spot: The spread commission for trading Crude Oil Spot on Capital.com is 0.03. This indicates that the difference between crude oil’s buying and selling prices is 0.03 units of the base currency (USD).

- Germany 40: The spread commission for trading the Germany 40 index on Capital.com is 1.5. This means that the difference between the buying and selling prices of the index is 1.5 points.

- Australian Dollar / US Dollar: The spread commission for trading the Australian Dollar against the US Dollar on Capital.com is 0.00006. This indicates that the difference between the buying and selling prices of the currency pair is 0.00006 units of the base currency (such as AUD).

- Apple, Inc: The spread commission for trading Apple, Inc. (the well-known technology company) on Capital.com is 0.05. This means that the difference between Apple’s stock’s buying and selling prices is 0.05 units of the base currency (such as USD).

- France 40: The spread commission for trading the France 40 index on Capital.com is 1.3. This indicates that the difference between the buying and selling prices of the index is 1.3 points.

Please check our detailed article about low-spread brokers.

In conclusion, the low spread is undoubtedly one of the most critical factors traders consider when selecting a forex broker. Tight spreads provide traders with more opportunities to make profitable trades while promoting greater transparency and efficiency in the trading process. Therefore, traders must do their due diligence and choose a low-spread broker for their profits and overall performance.