Table of Contents

In Forex trading, the spread is the difference between the bid price (the highest price a buyer is willing to pay) and the asking price (the lowest price a seller is willing to sell). Brokers often offer tight spreads in certain situations, and spreads may increase in other circumstances. Understanding when and why this happens can be critical to a trader’s success.

What pairs have the lowest spread in forex?

The lowest Spread Forex Pairs are EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, and USDCAD. Usually, variable spreads for major forex pairs move from 0.5 up to 2 pips during high market liquidity, while spreads drastically increase (2 up to 10 pips) during the news and lower market liquidity.

EURUSD is the lowest spread currency pair at all brokerage companies. For ECN accounts, the EURUSD spread can be 0.1 pip. However, ECN accounts charge additional commission even when spreads are almost zero.

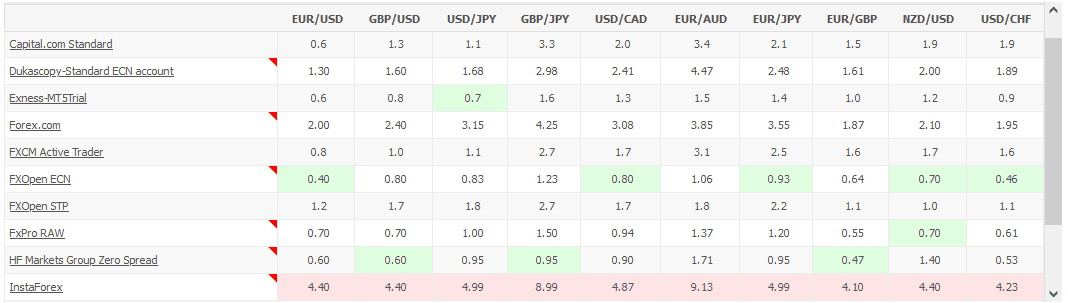

Please see a screenshot from the lowest spread for multiple forex brokers screening moment:

Spreads change over time; sometimes, brokers with the lowest spread can have the most extensive spread. However, on average, some brokerage companies like H.F. Markets offer very tight spreads.

When Brokers Offer Tight Spreads:

- During High Market Liquidity: Spreads are generally tighter during periods of high market liquidity. This typically happens during the overlap of the major trading sessions (New York, London, Tokyo, and Sydney), when the highest volume of trades occurs.

- For Major Currency Pairs: Brokers offer tighter spreads for major currency pairs (like EUR/USD, USD/JPY, GBP/USD) because these pairs have the highest trading volumes and liquidity.

- In Non-Volatile Market Conditions: When the markets are calm, and price movements are small and predictable, spreads tend to be tight.

- With Market Maker Brokers: Market maker brokers often offer tight fixed spreads, as they take the opposite side of your trades and cover your orders with other clients’ orders or with their funds. They make money off the spread regardless of the outcome of the trade.

When Spreads Increase:

- During Low Market Liquidity: Spreads typically widen during periods of low liquidity, such as weekends or holidays, when fewer traders are active in the market.

- For Minor Currency Pairs: Brokers usually offer wider spreads for minor (or cross) and exotic currency pairs because these pairs have lower trading volumes and liquidity.

- In Volatile Market Conditions: Spreads often widen during periods of high market volatility. This can be due to economic news releases, unexpected political events, or crises, which cause prices to move unpredictably and liquidity to decrease.

- With ECN/STP Brokers: ECN (Electronic Communication Network) or STP (Straight Through Processing) brokers usually have variable spreads. They pass your orders onto the interbank market, where spreads can fluctify depending on liquidity and volatility.

EURUSD Forex Pair With Lowest Spread

The EUR/USD currency pair is known for having one of the lowest spreads in the Forex market. This is due to several factors that contribute to its high liquidity and trading volume:

- Popularity of the Currencies: The Euro (EUR) and the U.S. Dollar (USD) are the world’s most widely used and recognized currencies. The U.S. Dollar is the world’s primary reserve currency, while the Euro is the official currency for 19 of the 27 members of the European Union.

- Economic Significance: The United States and the Eurozone are the world’s largest and most influential economies. Therefore, a significant amount of international trade and investment is denominated in these two currencies.

- High Trading Volume: The high demand for these currencies means the EUR/USD pair has a high trading volume. This high volume of trading activity contributes to increased liquidity, resulting in tighter spreads.

- Market Transparency: The U.S. and the Eurozone have mature and highly regulated financial markets, providing high transparency and stability. This reduces the risk for brokers, which allows them to offer lower spreads.

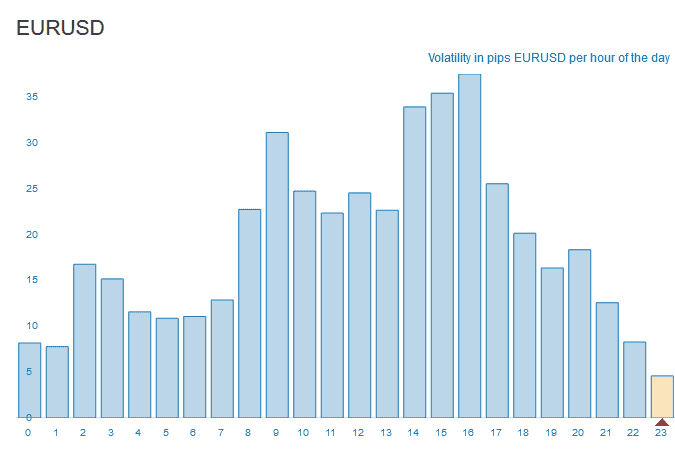

The highest EURUSD liquidity is when the E.U. and U.S. sessions overlap. Usually, volatility can be very high then:

The average spread for EUR/USD is often around 0.6 pips, although this can vary depending on the broker and market conditions. Spreads can go as low as 0.1 pips during times of high liquidity, such as during the overlap of the European and U.S. trading sessions. On the other hand, the spread can widen to as much as four pips during periods of lower liquidity or higher market volatility, such as during major news releases.

GBPUSD Forex Pair With Low Spread

The GBP/USD, commonly known as “cable,” is another currency pair with a relatively low spread in the forex market. The low spread of the GBP/USD pair can be attributed to several factors:

- Major Currencies: The British Pound (GBP) and the U.S. Dollar (USD) are major global currencies. The U.S. Dollar is the most traded currency in the world, and the British Pound is also among the top. This status contributes to the high trading volume of the GBP/USD pair.

- Significant Economic Relationship: The U.S. and the U.K. have a significant economic relationship with substantial trade and investment flows between the two countries. This economic relationship results in a high level of liquidity in the GBP/USD pair.

- Active Trading Sessions: The U.K. and U.S. trading sessions are active periods in the forex market, with high trading volume and liquidity. When both these sessions overlap, it leads to even tighter spreads.

- Market Transparency: Both the U.S. and the U.K. have highly transparent and regulated financial markets. This transparency reduces the risk for forex brokers, allowing them to offer lower spreads.

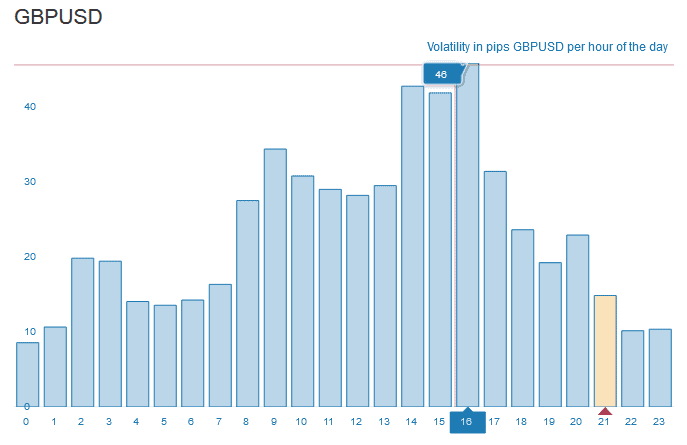

High Volatility for GBPUSD is usually a period with a lower spread (except during the news):

On average, the spread for the GBP/USD is around 1.5 pips. However, depending on market conditions and the broker, it can go as low as 0.6 pips during periods of high liquidity. Conversely, during low liquidity or heightened market volatility, such as major economic news releases, the spread can widen to 5 pips.

USDJPY Low Spread Forex Pair

The USD/JPY currency pair, often known as the “gopher,” boasts one of the lower spreads in the Forex market, thanks to several critical factors:

- Major Currencies: The U.S. Dollar (USD) and the Japanese Yen (JPY) are significant global currencies. The USD is the world’s primary reserve currency, and the JPY is Asia’s most heavily traded currency. Their status leads to a high trading volume for the USD/JPY pair, contributing to its liquidity.

- Substantial Economic Relationship: The United States and Japan have a substantial economic relationship, with substantial trade and investment volumes between the two countries. This economic interaction results in high liquidity for the USD/JPY pair.

- Active Trading Sessions: The U.S. and Japanese trading sessions are active times in the Forex market, with significant trading volumes. This contributes to higher liquidity and narrower spreads, particularly during the overlap of the U.S. and Asian trading sessions.

- Market Transparency: Both the U.S. and Japanese financial markets are highly regulated and transparent. This reduces the risk for Forex brokers, allowing them to offer lower spreads.

The average spread for the USD/JPY is around 0.9 pips. Depending on market conditions and the broker, it can go as low as 0.7 pips during periods of high liquidity. On the other hand, during times of low liquidity or increased market volatility, such as during significant economic news releases, the spread can widen to as much as five pips.

Conclusion

Trading with the lowest spread Forex pairs, such as EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, and USDCAD, can offer considerable benefits, particularly to short-term traders who enter and exit the market frequently. These pairs all involve the U.S. Dollar, whU.S.is the most heavily traded currency in the world, and other major global currencies, contributing to their high liquidity and relatively low spreads.

Under normal trading conditions with high market liquidity, variable spreads for these major Forex pairs typically range from 0.5 to 2 pips. However, it’s important to note that spreads can widen substantially during low liquidity or significant news events. In such situations, spreads can increase from 2 to 10 pips.

Lower spreads are desirable as they represent a minor trading cost. However, while trading on lower spreads is beneficial, traders should not forget that ECN brokers charge additional fixed commissions even if spreads are almost zero.