Table of Contents

We learned what is spread in forex. Now, we can use this term to analyze futures spreads.

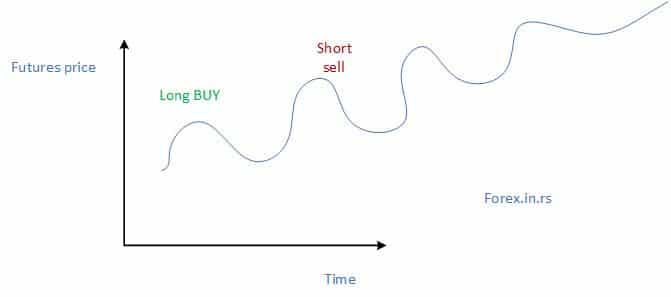

It is an arbitrage technique that enables traders to profit by taking two positions on products. In futures spread trading, you must complete the unit trade using both positions, including buy and sell.

How do trade futures spread?

Futures spreads trading is a strategy in which traders take two positions simultaneously with different expiration dates to benefit from price changes. This strategy is designed to help traders make profits using derivatives on principal investments. The two positions are traded simultaneously as a unit, with each side considered a leg of the unit trade. This trading’s key objective is to use both positions to profit from inconsistent or changing market conditions.

- Types of Futures Spreads:

- Intramarket Spreads: Also known as calendar spreads, they involve buying and selling futures contracts for the same commodity but with different delivery dates.

- Intermarket Spreads: Involve trading futures contracts in two different but related markets, aiming to profit from the price difference between them.

- Intercommodity Spreads: This involves trading futures contracts on different commodities with a relationship or correlation, such as Gold and Silver.

- Identify Trading Opportunities:

- Analyze historical price relationships and patterns regarding your interest in future contracts.

- Use technical and fundamental analysis to assess market conditions and potential spread narrowing or widening.

- Consider Seasonality and Market Trends: Many commodities are subject to seasonal price variations, which affect spreads. Understanding these trends can help you make informed trading decisions.

- Determine Position Sizing and Leverage: Futures trading involves leverage, which can amplify gains and losses. It is crucial to determine the appropriate position size and leverage based on your risk tolerance and trading strategy.

- Entry and Exit Strategy:

- Decide the criteria for entering a spread trade, such as a specific price discrepancy between the contracts.

- Set clear targets and stop-loss levels to manage risk. Before entering a trade, consider both the potential profit and the risk of loss.

- Monitor the Spread: Closely monitor the contract price relationship after entering a trade. Be prepared to adjust your positions as market conditions change.

- Adjustments and Risk Management:

- Use stop-loss orders or options to protect against unfavorable market movements.

- Be flexible and ready to close or adjust your positions to manage risk and lock in profits.

As stated earlier, a futures spread means taking two positions simultaneously. However, the expiration dates will be different to profit from the price change. The two positions will be traded at a time, just like a unit, and each position will be considered the leg of the trade.

There are different types of future spreads. The most common type is calendar spreads. In this trade, you must take two positions according to price speculation. The investors’ position will depend on the market condition.

Spread trading futures example.

For example, if a trader feels that the price will go up, he can take a long-term sell position and a short-term buy position. When the price decreases, the trader can take a short-term sell position and a long-term buy position. The key benefit is two positions. It ensures guaranteed profits. Of course, the trader needs to calculate a spread trading strategy and risk-reward for both positions.

It is a bit riskier to take only a single-leg option. You can make profits from this position only when you hold an underlying product and choose the option to sell that product at a much higher price at any time in the future. When you choose the buy position, the risk of price decline increases. You cannot make profits from your investment in adverse conditions.

The term “futures spread training” is a staple among many professional traders. However, if you do any form of trading, most experts agree that it should be a part of everyone’s trading strategy. This article will explain precisely why that is and help you grasp the latter as part of your trading arsenal.

To understand how futures spreads can augment your trading strategy, it would be best to examine their different forms. Only then can you glean valuable insights into using them to augment your trading.

How to Trade Futures Spreads

Futures spread trading involves simultaneously buying and selling futures contracts of the same commodity with different delivery months or on related commodities to exploit price discrepancies. Traders must analyze market conditions, historical price relationships, and seasonal trends to identify profitable spread opportunities. Effective risk management through position sizing, stop-loss orders, and ongoing market analysis is crucial to navigate the complexities of spread trading successfully.

Understanding how each type of future will spread before trading is essential. See list :

Inter-Commodity Futures spread

Inter-Commodity Futures Spreads (ICFs) are a type of Futures contract divided among different but related markets. One good example of this is the Gold vs. silver markets.

Spread trading futures, such as Inter-Commodity Futures spread.

Let us say that one trader believes there will be a higher demand for Gold in the precious metals market than Silver. The trader then buys more Gold and sells Silver without worrying about the price fluctuations between the two. This is a typical example of commodity futures spread trading.

In the example cited above, a trader using ICFS wants to see Gold’s value over Silver’s price. If the precious metals market sells off, the trader expects Gold to retain its value better than Silver. Likewise, a trader expects Gold to increase further than Silver in a booming market.

Intra-Commodity Calendar Spread

In an Intra-Commodity Calendar Spread (ICCS), Futures contracts are allocated in just one market but spread between different months—for example, June Gold vs. December Gold.

ICCS Trading intends to submit an extended position for one futures contract while shorting the other. In the same example, a trader might be looking to play a short position for Gold in June and shift to an extended position come December.

Bull Futures Spread – bull spread futures

A trader who engages in a Bull Futures Spread takes a long position on the same market for the next month and a short one for the protracted month. For example, let us say it’s April 2019. You buy Gold in June and intend to sell it in August 2019; June is closer to April than August.

It is essential to regard that the near months tend to fluctuate further faster than the back months, hence the term “Bull Futures Spread.” Granted that Gold is in a bull market, the price is expected to increase faster during the closer month than during the deferred one. In this case, a bullish trader on Gold would buy more during the nearest month and sell during the deferred month. Such a trader is counting on the possibility that the price of Gold will move faster and faster during the closer month instead of during the deferred one.

Of course, the price disparity between the closer and deferred months is not always accurate. This is how these trades often turn out when on a bullish market, with spreads turning in the trader’s favor.

Bear Futures Spread

A Bear Futures Spread is the polar opposite of the Bull Futures Spread. This means a trader plays a short position (sells) during the near month and switches to an extended position (buys) during the deferred month. The idea is for traders to profit from the spread as prices dwindle during a bear market.

Bitcoin Futures

Bitcoin futures entered the trading industry in December 2017. These products also offer ample opportunity for traders to make money from the future spread and price volatility. If you believe the price will increase over time, you can consider buying a contract for one month and selling a contract two months out at a higher price to make profits. Traders will have the option to buy in the one-month contract and sell in two-month contracts. They can benefit from the price change.

Futures Spread Trading Margins

Futures Spread Trading Margins are when traders reduce their margins for trades that comprise a portion of a spread. Let us say that the margin for one Gold contract is $4050. However, if you have both short and long positions for the said commodity during the same year, the margin could be as low as $400.

Exchanges decrease the margins to account for lower volatility than actual contracts. In effect, a Futures spread stalls the market for traders, enabling them to react faster to significant events such as sudden interest rates, market crashes, an outbreak of war, etc. Whatever the case, Futures Spread Trading Margins enable traders to hedge their risks as the effects of external factors are spread evenly among their contracts.

Futures Spread Pricing

As the name implies, Futures spreads are priced around the price difference between the two contracts. If one troy of Gold equals $1600 in May, and August is trading at $1620, then the spread price is—$20. Conversely, if May traded at $1620 and August at $1600, the spread price is $20.

Futures Spread Quotes

A trader engaging in what’s known as Futures Spread Quotes takes the price for the near month and deducts it from the price for the deferred month. Not surprisingly, if the near month is trading lower than the deferred month (i.e., June vs. August, for example), the spread will negatively value. Conversely, if the near month trades higher than the deferred month, the spread value will be positive.

Futures Spread Tick Values

Futures Spread Tick Values refer to the incremental increase or decrease in value for spreads and individual contracts. Let us say that the spread for June Gold and August Gold is—$100; if it moves to—$110, then that is a $10 move.

$10 in Gold is $500 for all months in a $50,000 Gold contract because the tick value is similar in spreads and individual markets.

Con-tango market

A contango market refers to the “regular” market wherein a commodity’s value tends to be higher during the deferred months than the near month.

Backwardation

A market that is said to be in backwardation is the polar opposite of a Contango market. Hence, it is also aptly called an “inverse” market, wherein markets trade higher during the near month and lower towards the deferred month. The latter usually occurs during a bull market as demand rapidly overtakes the available supply.

Seasonal Futures Spreads

Many markets, like wheat, cooking oil, and natural gas, are subject to seasonal fluctuations in supply and demand. Some commodities experience high demand during the winter (i.e., natural gas), while others peak in summer (i.e., gasoline).

A seasoned trader knows how to take advantage of any disparity in supply and demand. In the process, they consider the past performance of spreads across several years to glean patterns that will help them weigh their risks and increase the probability of trading success.

Final Tip

Trading Futures Spreads – Key Points

- Definition: A futures spread involves taking two positions in different futures contracts simultaneously—buying one and selling another—to profit from the price difference between them.

- Types of Spreads:

- Intra-commodity Spread: Involves contracts for the same commodity but with different expiration months (e.g., buying December wheat and selling March wheat).

- Inter-commodity Spread: Involves contracts for two different but related commodities (e.g., buying crude oil and selling heating oil).

- Inter-market Spread: Involves trading the same commodity on two different exchanges (e.g., buying gold futures on CME and selling gold futures on ICE).

- Calendar Spread: A common intra-commodity spread where the trader buys a contract in one month and sells a contract in another month for the same commodity.

- Purpose: Traders use spreads to reduce outright directional risk, speculate on price differences, or hedge existing positions.

- Risk Management: Spread trading is generally considered less risky than outright futures trading because the trader is exposed to the price difference (spread) rather than the total price movement of the commodity.

- Lower Margin Requirements: Futures spread positions often require lower margins than outright futures contracts because they carry less risk.

- Seasonality: Many future spreads are influenced by seasonal patterns, especially in commodities like grains or energy (e.g., planting seasons or heating demand in winter).

- Volatility: Futures spreads tend to be less volatile than outright positions, as the contract price relationship often exhibits more stability.

- Profit Potential: The goal is to profit from the convergence or divergence of prices between the two contracts. If the spread widens or narrows as expected, the trader gains.

- Hedging: Hedgers (e.g., farmers or manufacturers) often use Spreads to lock in the price difference between buying raw materials and selling finished products.

- Popular Spread Examples:

- Crack Spread: Involves buying crude oil futures and selling gasoline and heating oil futures to capitalize on the price relationship between crude oil and refined products.

- Bull Spread: Buying a near-term contract and selling a longer-term contract, anticipating that the near-term contract will increase more in value.

- Bear Spread: Selling a near-term contract and buying a longer-term one, expecting the near-term price to decline relative to the longer-term one.

- Market Analysis: Traders analyze the supply-demand dynamics, macroeconomic conditions, and seasonal trends to anticipate how spreads might change over time.

- Execution: Futures spreads can be executed manually or through specific spread orders offered by brokers, allowing both legs of the trade to be placed simultaneously.

Futures spread trading is completely risk-free in virtual cash with $ 100,000. You can use the Free Stock Stimulator to try your trading skills and make money from the futures spread. You must submit the trade in a virtual environment before risking your hard-earned money and practicing the traits to perform better in the real market.