Table of Contents

After the crisis in 2008, the US government adopted several new trading rules to regulate the trading industry. One of them is the FIFO rule.

What is the FIFO rule in forex trading?

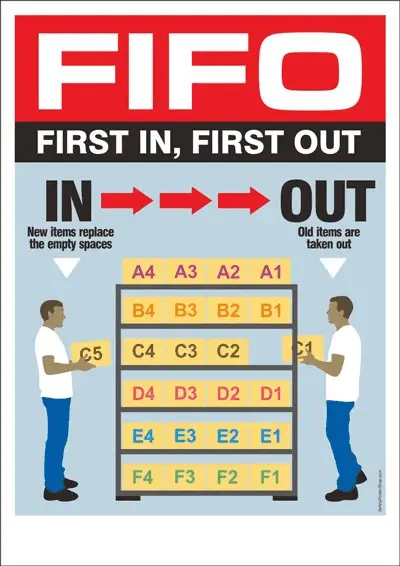

The FIFO rule, or First in, First Out, requires that the first (or oldest) trade be closed first if a trader has more than one open trade of the same pair and size. This rule is the US National Futures Association policy and applies to traders using US brokers. So, in simple words, the FIFO rule means that forex traders must close positions based on chronological order (earliest trades “first in” will “first-out” – first will be closed).

Prohibited by the FIFO rule means The First in, First Out, and the rule in forex trading.

FXCM FIFO rules

If you trade using USA brokers such as FXCM or OANDA, you get a message in your trading platform “prohibited by FIFO rule” or “mt4 hedge is prohibited”. Since FXCM US accounts (unlike FXCM accounts in other countries) must comply with US FIFO regulations, when traders stop, or limit orders are triggered, they will close out the older trades in a given currency pair before closing out new ones. FXCM FIFO rule applies only to USA brokers.

Many years ago, I gave one example on this website, Prohibited by FIFO rule, and it is a problem that I need to solve mt4 FXCM FIFO rules. Here are more details and everything you need to know about FIFO forex rules. These rules (FXCM FIFO rules, OANDA FIFO rules, etc. are the same for all USA forex brokers).

If you’re a Forex trader planning to involve handing with a Forex broker based in the United States, you must abide by the rules under FIFO. You must read this article carefully from the beginning to the close. Many ways and techniques are there – when you understand and put them to work, it will help you deal with issues under these restrictive rules. For this, you need to plan on a priority basis.

Forex traders have traded and opened several positions on the same currency pair ever since Forex trading started. However, considering the business conditions, many industry watchers believe that the Forex market will likely implement rules similar to the futures and stock market, implementing the First In, First Out (FIFO) rule for forex traders. Though there may be some resistance initially, most forex brokers will likely agree to implement this rule because of the enormous losses they face due to the null positions adopted by many forex traders.

FIFO compliance and NFA

Don’t get overwhelmed. It’s simple and easy to execute. You could plan and build your star. You can refer to the demo account if you think this is not credible. Experience shows things keep changing during a period unlikely to work later. And, as a matter of proof about the extent of success, you can create a demo account before venturing into live trade.

Be aware that you are not permitted to hedge forex; traders do not favor FIFA because of this. They would instead prefer it to go. In this context, it’s also crucial to what hedging is.

Therefore, It’s also essential to define hedging and explain it.

Many traders would like more information since the FIFO rule is being discussed. The United States accepted the FIFO rule for stock market brokers in 2009, according to the National Futures Association (NFA). According to this rule, the investor or trader will have to close the oldest positions they have opened when they have multiple traders of the same pair and size. Hence, all brokers regulated by the NFA must ensure that they and their traders comply with this policy. Forex’s FIFO rule provides that investors do not keep open positions for a currency pair while finalizing other trades for the same currency pair. This ensures that the market remains active and volatile since the fluctuations are reduced due to open positions. The FIFO rule hopes to minimize the problems caused by open positions so that forex trading is profitable and there is no stalling.

How does the FIFO principle work?

The FIFO principle is used in the US trading system for First In, First Out. This principle is based on the idea that the first goods to be bought or sold are the first ones to be sold or repurchased. This applies to both stocks and commodities. The FIFO principle is crucial because it helps to ensure that the market functions in an orderly manner. Prices cannot be manipulated as easily when this principle is followed because it is challenging to know the next order if traders do not follow it.

Let us see the image below:

The FIFO (First In, First Out) requirement is a rule implemented by the National Futures Association (NFA) in the U.S. for forex trading. This rule mandates that the first or oldest trading position you open must be the first one to be closed.

An example makes understanding how the FIFO rule will be implemented easier. A trader wishes to invest in the EURUSD currency pair by scaling. Hence the trader will go long on the three positions at different times and entry levels. In the first position, position 1, the trader purchased USD/EUR Forex futures at 1.3004; in the second position, the trader chose 1.3001; and in the third position, the trader purchased at 1.3007. If the USD/EUR level reaches 1.3005, the trader wishes to close the second position since his profit will increase. However, this will not be possible under the new rules of NFA and FIFO. Under the new FIFO rules, the trader will have to sell position one first and the other in the same order they were purchased. Every investor must comply with this new FIFO rule for trading in the forex.

Understanding why the FIFO rule was implemented – FIFO rule forex

The main reason it was necessary to implement the FIFO rule was that the market’s volatility was reducing. Many traders kept their trades open for many days; their position stagnated, decreasing the volatility. The currency volumes traded each day also declined. Hence to overcome these problems, Forex trading’s new FIFO rules were implemented. Forex experts believe this will positively impact the Forex market in the long term. The rule is already implemented for the stocks and futures market and will help forex trading. Any broker can provide more information on this rule and other aspects of forex trading.

Hedging

Hedging involves a set of ways to secure your investment from the harmful effect of a pair of currencies’ adverse movements.

If you’re a trader in the United States, you have to abide by the rules associated with hedging and FIFO. Don’t get confused if you’re a newbie in the market. And don’t indulge in things prohibited by the FIFO rule.

As you gain experience, it will be easy to understand and somewhat predict the movement. Of course, if you’re an experienced trader and have gone forward, you can tackle the situation efficiently.

How to forex hedge in a US-based account?

When a foreign currency such as the US dollar wildly fluctuates, it is sensible to prevent the high risk involved as much as possible. The benefit of a forex hedge in a US-based account is that you’re unlikely to lose money if the other currency in your investment drops.

Hedging forex is, in reality, simple. To make it easy for you, create two different accounts. The objective is to ensure safety; remember which version is for what. If one of the accounts does not do well, the other makes profits. You need to keep the money from one account to another to reach the account’s desired balance.

In this context, you should also consider that the broker you are linked to lets you perform the inter-account money removal.

The job described in the preceding paragraphs becomes easy if you work with a USA brokerage such as OANDA or FXCM. On the OANDA’s Java platform, access one of your accounts on one browser, such as Google, and use Firefox to open the forex trading platform. Ensure you open both accounts simultaneously. It would be best to keep all the logs in one of the accounts and all the sorts in the second account. The background color should be different so you can easily differentiate between them. It also helps you minimize errors in the entry of orders.

Get Around FIFO Rule

How to deal with Forex Hedging and FIFO

In this context, you need to work under the purview of rules. It will be easier to comprehend if you know the market’s modalities. Of course, you must be competent in planning everything, which will likely help you immensely.

Many people dislike the rules under FIFO. If you don’t wish to hedge, it’s okay. To many people, FIFO rules don’t accrue benefits. However, knowing how to deal with IFO’s situation will be easier for you.

The way to deal with it quickly is to use many different sizes. If the earlier lot differs in size from the one that comes later, FIFO rules don’t apply in such an instance.

As OANDA or FXCM brokers let nano lots, you can use the lots in different sizes without coming under the purview of rules under FIFO. The nano-sized lots enable you to mitigate the risk significantly. This is particularly true in the case of small accounts.

When does hedging forex fail to work?

The strategies and methods can work for any forex broker. However, checking it out using a demo account is sensible before you move forward.

Be warned not to take anything for granted.

In some instances of platforms and brokers where the FIFO is not compatible, it will not work. Many brokers are unable to work in the FIFO tech environment.

For instance, when working on the FXCM platform, all the trades overlap, which does not let lots of nano. In such a case, you cannot use a FIFO strategy.

Forex broker’s hedging allowed.

All non-USA brokers allow hedging if you are a trader outside the USA. The FIFO rule is designed to stop hedging in forex trading in the USA. Visit our page brokers ranking to find forex brokers hedging allowed.

A simple example

First, you worked with 1,000 currency units at 100.00 and the second lot with 1,001 at 105.00. The total number at the blended position is 2001, and the average price at 102.50. If the price is 104.00, you cannot remove the 1,001 units at a profit of 100 units. If you exit, you will have to lose 150 units.

When you work under FIFO’s stringent rules, the odds are few to divert part of the profit earned. The best thing to do is wait until the older position becomes profitable to realize a profit.

So if you intend to realize a profit, test it with a demo account you created with your broker. You don’t have to be registered and pay for an account. In such a case, you will give the broker an undue advantage who does not let the position sizes work correctly.

Conclusion

Of course, you may or may not like FIFO norms and hedging forex rules; they are all meant to protect traders’ interests like you against the onslaught of other traders. This is important because dealing with multiple positions can lead to a complex situation. So, don’t commit things that are prohibited by the FIFO rule.

They are all strategies, and you should consider them to implement them when you are clear with the fundamentals and are familiar with the platform and rules, etc. However, the strategies may not work with the system and your typical personality.

Therefore, remember not to use the various methods and techniques – you should not apply them all because they may not work well. You should take caution and move forward.