Table of Contents

Many new beginner traders fear not having enough knowledge to start trading. However, trading or investing does not represent rocket science.

Do I need a forex trading certification?

No certification in the foreign exchange industry will allow you to trade. So anybody can start trading and earning from that, just as programmers can write code without formal education.

For example, a programmer can be self-taught and become excellent. The same thing is in the forex industry. You can be a self-taught forex trader.

If you want to become a professional trader and work in some big corporation, hedge fund, or prop company, you will be asked to have financial certification. There is no consensus on what forex trading certification is the most important. You are a certified forex professional you can become if you pass some exams and get financial market-related certifications.

For me, the best certification that can help you in pro trading is technical analysis certification – a certificate in trading and analysis. There are many other certifications, such as equity trading and investment, commodity trading certification, and stock market trading certification.

Does certification in stock trading help, or does certification in forex trading help? Directly, certification will not help you to develop strategy, consistency, etc. But each course and certification will help you understand the market, learn procedures and terms, and understand how fundamental and technical analysis work. You will get experience, more knowledge, and self-esteem. So, does certification in trading a plus? Yes, college can help you understand the studying field, but you will not learn how to earn money in that field.

Before you start any certification course, you should check the free Financial Markets course created by Robert Shiller, a Yale professor.

How to Become a Certified Forex Trader?

To become a certified forex trader so you can get a job in a hedge fund, big investment company, or some prop company, you can take the following exams and get forex certification:

- CFA certification

- IFTA certification

- FINRA Series 34 Exam

- CMT (Chartered Market Technician) certification

In my opinion, the type of forex certification you choose depends on your preferred job position. For example, if you want to work in any investment company or hedge fund in the US, you must pass the FINRA Series 34 Exam. Additionally, you can take another FINRA test based on your position in that company. However, suppose you want to work in some advice position or more research type of career. In that case, IFTA certification is perfect because, for this certification, you need to write research papers and read a lot of books.

If you have been wondering about obtaining a trading and analysis certificate, it is truly beneficial to have certification. This is because this can be powerful to aid in establishing your credibility as a thought leader within the realm of day trading, swing trading, position trading, and analysis.

Below is presented a video that I made related to forex trading certifications:

Possessing certification does not mean that there will be sure success when conducting trades. On the contrary, it will still require much effort. But certification indicates to your clients that you comprehend trading.

Before we start, please visit our latest article about CFA certification and learn more about the financial industry.

The International Federation of Technical Analysts IFTA certifications

IFTA was founded in 1986 and is a global organization of market analysis societies and associations. This is one of the best certifications for the technical analysis field. The IFTA offers two certifications Certified Financial Technician (CFTe) and Master of Financial Technical Analysis (MFTA) (visit IFTA website).

The International Federation of Technical Analysts offers a course that will permit someone to become a certified financial technician. This certification program tends to address general concepts about the world of trading and details applicable to conducting technical analyses.

IFTA offers an excellent certified financial technician course, free literature, a low-cost price, and a practical exam. It is noted that the International Federation of Technical Analysts offers accreditation for this specified course. Moreover, this organization is regarded as a not-for-profit and has offices represented in more than twenty-four nations at this present time.

The certified financial technician CFTE program represents a Level 1 multiple-choice exam that consists of 120 questions covering a wide range of technical analysis knowledge, but usually not involving experience. However, the Level 2 program offers an exam that incorporates several questions requiring an essay-based analysis and answers. The candidate should demonstrate in-depth knowledge and expertise in applying various technical analysis methods.

The program provides two certification distinctions. Regarding level 1, the course tends to address the early time of Dow and Wyckoff. It also addresses random walk theories along with efficiency in the market. Trends, regression lines along with percentage placements are also mentioned. In addition, there is the provision of testing on various chart elements such as Figures and points.

For level 2, there is a deeper study of the world of technical analysis. Moreover, there is a stronger focus on topics related to Gann and the Eliott wave theory.

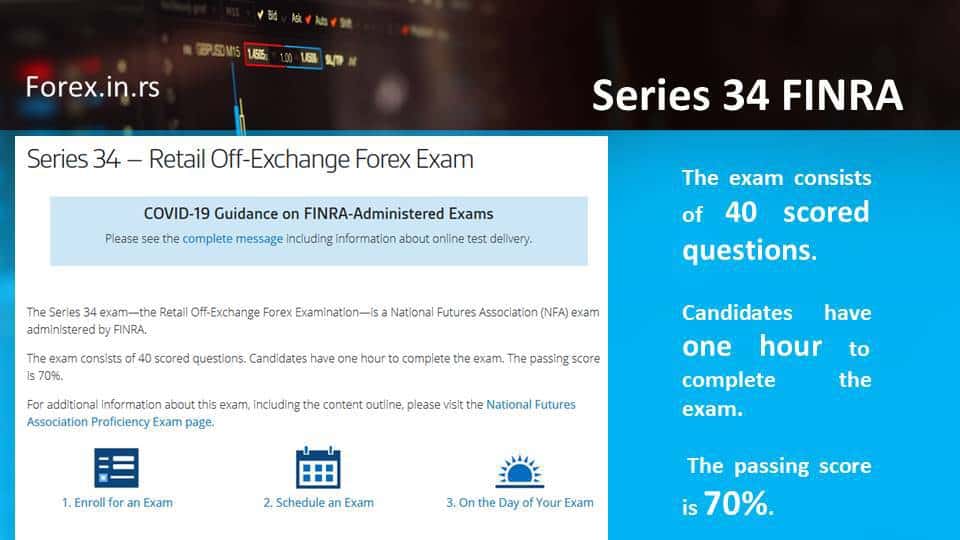

FINRA Series 34 Exam – certificate in financial trading

FINRA forex license implies the Retail Off-Exchange Forex Examination and National Futures Association (NFA) exam. This exam administered by the Financial Industry Regulatory Authority (FINRA) is part of Series 34 and a license required for individuals seeking to engage in off-exchange forex transactions with retail customers. As some student passes the exam, an individual is known as a ‘forex AP’ or ‘forex Associated Person.’ The exam cost $85.

This multiple-choice exam has 60 minutes duration, and student needs 70% correct answers to pass the exam.

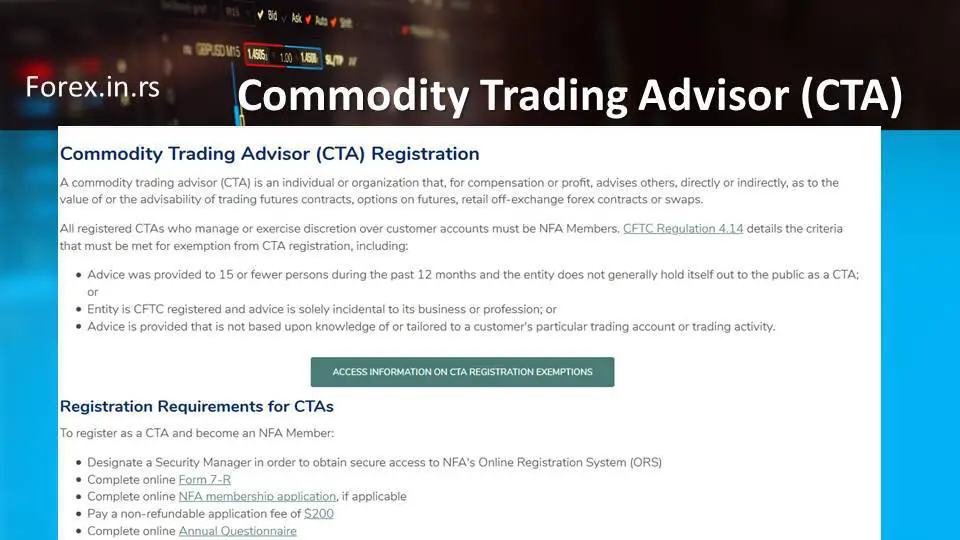

Commodity Trading Advisor

The National Futures Association can provide certification to become a commodity trading advisor, referred to as CTA in the abbreviated form. This professional is qualified to conduct trading and various services for clients interested in options and futures.

Commodity trading advisors are under the regulation of the U.S. Commodity Futures Trading Commission. With this being the case, they must hold a membership with the National Futures Association.

Passing the series three exams is imperative to become a commodity trading advisor. This is a prerequisite to obtaining membership with the National Futures Association. Moreover, you must complete the series three exams two years before joining the National Futures Association.

The fee for the series three exams is presently set at one hundred and twenty-five dollars. It would help if you had a passing score of at least seventy percent for this particular exam. It is noted that this designated exam tends to provide coverage of the elements of agricultural policies, regulations, market terminology, and various technical aspects in the trading realm.

Visit Commodity Trading Advisor CTA exam page and get more information.

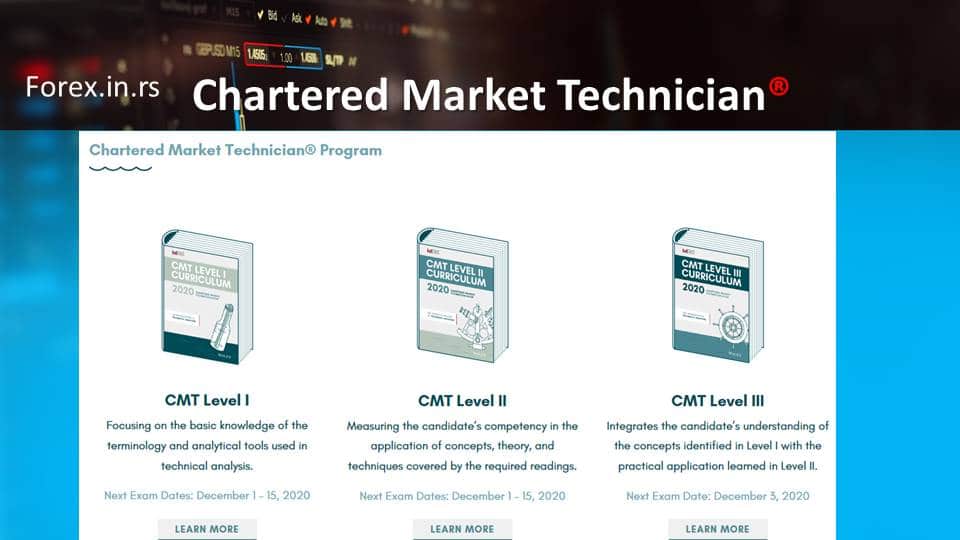

Chartered Market Technician

The Market Technician Association offers a course to become a certified market technician. This course provides three distinctive levels. Each level must be completed within five years after the exam for level 1.

Many seek to enroll in this course, particularly those in the United States of America. The Market Technicians Association is recognized as having offices across the globe. To take the exam, the person must possess three years of work experience relevant to this field.

Though many courses offering Technical analysis certification are available, the Chartered Market Technician(CMT) is the most comprehensive course, combining the latest analytical methods with theory. The CMT designation will help in developing charting and technical analysis skills. Finance professionals will find this qualification will get them a job on Wall Street. More information is provided for those who are interested in completing the training.

CMT course

The CMT Association is managing the CMT program. In addition to technical analysis, analytical skills are also developed professionally. The analyst will also be provided with an ethical framework that includes ethics codes. The course has a self-study program with different study aids and a reading list equipped. It also includes webinars, questions and answers, and online bulletin boards. Using these study aids, textbooks, and sample exams, most students can understand the subjects taught and pass the exams. The comprehensive covers all aspects of technical analysis like candlestick charts, chart pattern identification, measurement, indicators, point-and-figure charting, Gann angles, and Elliott wave theory.

Advantages of CMT

FINRA, the financial industry’s regulatory authority, accepts that completing the first couple of levels of the CMT examination is a valid alternative to the analysis series 86, an exam that technical analysts are expected to meet. Though the analyst will still have to pass the regulatory-series 87 exams to ensure that the analyst understands the independence rules, potential employers will prefer applications exempt from 86 series exams. In addition to getting a job, potential traders will also learn to use technical tools that match their temperament and trading style. This course will also help registered representatives since they can provide their clients with technical options on the stock market.

How to get CMT certification?

The candidate should first become an affiliate of the CMT Association, agree to the code of ethics, and enroll in the program. After this, they should pay and register for the exam. Wiley publishes the CMT curriculum, and the student should study the curriculum. There are three exams which have to be answered. The student has to answer multiple-choice questions in the first two exams and complete an extended essay in the final exam of four hours. Since each exam is offered twice a year, applicants could get the CMT certification in 18 months; typically, most applicants take three years. Though the CMT association recommends 100 hours of study time for each exam, most applicants study more.

Job prospects

CMT certification was first granted in 1989, and according to the CMT Association, there are more than 9000 professionals. More than 60% of the members have an annual income of more than $100,000. In addition, 10% of the CMT professionals work in hedge funds, 15% work as buy/sell analysts, and 40% work in investment firms. John Murphy, John Bollinger, and Ralph Acampora are famous market technicians with CMT certifications.

Visit the Certified Market Technician CMT webpage and learn more about exams.

Society of Technical Analysts STA

Beyond the previously mentioned courses, those in the United Kingdom may be familiar with the Society of Technical Analysts based in the UK. It provides the opportunity to take classes that provide diplomas. It is equivalent to the course for certified market technicians.

On the other hand, this course is more demanding than the other courses, as a requirement for the SAT is to engage in physical engagement. This course occurs each year from October through December and is held at the London School of Economics. If someone desires to participate in this course, there is a fee of nine hundred and ninety-five British pounds.