Table of Contents

What does Islam say about online forex trading? Is Forex Trading Haram or Halal in Islam? In this article, we will analyze forex trading in Islam.

I wrote several articles about this topic. To read about the best Islamic account broker, visit my review. I explained that HF Markets’ broker is Halal. Additionally, I explained in detail what Riba is. I tried to share my opinion about whether forex is halal or haram (personal view) and whether stocks are trading haram. I also tried to answer a similar question about whether investing in stocks is haram or halal (long-term). For Islamic readers, I wrote about Murabaha financing, too.

Of course, to learn about forex Islamic accounts, read my article.

Is forex trading halal?

Forex trading is halal (lawful) and not haram (forbidden) when traders use swap-free trading accounts because riba or interest element doesn’t exist in that case. Most CFD brokers offer Islamic swap-free trading accounts that do not charge or pay overnight interest (no repayment with interest) on the open positions.

Generally, trading is not haram.

Trading is not haram because:

- There is no interest element in trading.

- Trades are conducted “hand in hand” (Islam allows).

- Currency exchange, Stocks exchange, or commodities exchange do not offend against the tenets of Islam.

But let us discuss this…

Some Islamic religious people think that Forex trading is both halal and haram. They think forex is the same as gambling and then try to equalize the concept of trading business (forex trading) and risky entertainment (betting). However, the trading business is not based on luck but analysis.

Halal or Haram for Forex Trading – Is forex trading legal in Islam?

Halal or Haram, Muslims choosing to do Forex Trading constantly think about their Religion and what part of the Quran they should follow. There are many opinions about this issue, which will explain the problems in this article.

There are some Muslims who believe they should follow the words of the Prophet Mohammed :

If the types differ, sell them however you like; it is hand in hand. Those who read these words will trade. However, another Islamic law that usury or any contract or business dealing involving charging interest is strictly forbidden (Riba). Forex trading has no interest calculations to be added or subtracted, so this law does not affect Muslims’ decisions.

Please watch the video below for the Islamic forex trading halal explanation:

A fee is not permissible whenever online brokers charge or pay the difference between the two sides of a currency pair whose position has been held overnight. Some brokers, such as “Islamic Shariah Forex Accounts,” do not charge or pay legal interest.

However, some adhere strictly to Shariah Law, saying since the brokers are finding other ways to earn from the trade, they will not be involved in Forex trading.

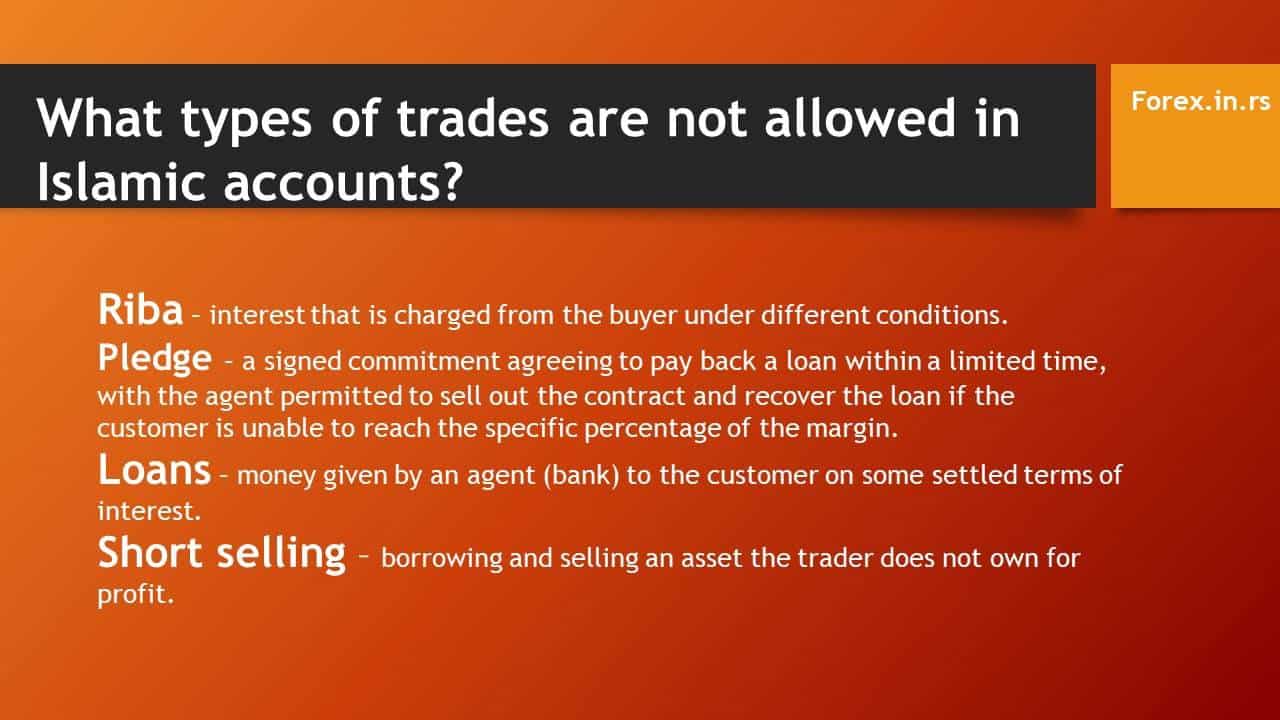

Example – What types of trades are not allowed in Islamic accounts?

In a Regular Spot forex trade, where traders predict an increase in the value of currencies, and there is just regular trading, this could be seen as a hand, and some Muslims won’t have a problem with this Forex trading method.

However, an element of interest is involved with Forex trading forward, so this is strictly forbidden.

Why is Forex trading Haram for non-Islamic accounts?

Islamic law prohibits gambling, which causes some people to wonder if the level of speculation associated with Forex trading is permissible for Muslims. However, the exchange between the dealer and the broker would be hand-to-hand, allowed. However, a swap in forex represents the interest you earn or pay for a trade that traders keep open overnight. Therefore, swap accounts do not respect Islamic principles.

What does Islam say about online forex trading?

Currency trading in Islam is allowed only if traders use swap-free accounts that do not pay or earn swap or interest (overnight fees interest) on trades for Indices, Currencies, and Metals. An Islamic Forex or swap-free account is a halal trading account because it is a swap-free account where Islamic trading accounts do not pay or receive interest rates.

Online Forex Trading in Islam – Forex Trading Islamic Fatwa

What does Islam say about online forex trading? Islam understands that people need to earn, and some level of risk accompanies every trade, and Forex Trading is just like all the rest. Therefore, when Muslims face many opportunities to reach, they will look at the experiences of the persons involved in those opportunities in the past and research before making decisions.

Some say Forex trading is allowed when the correct type of analysis is used. However, when traders can predict when a currency will increase and another will decrease, and there is no speculation, they are not behaving like Gamblers, so Forex Trading is a good thing for Muslims to be involved in.

However, traders who time the trade to get the best results can be seen as breaking the Islamic law as there might be some speculation being done by them. There is a concern; some Muslims might prefer to avoid Forex trading altogether.

However, based on the latest research in Saudi Arabia, more than 90% of Islamic traders use swap-free accounts.

With Islamic trading, Forex Trades should take effect immediately, and it is seen as a natural part of commerce allowed by Islamic law. Muslims must trade with chart-based analysis or fundamental analysis. This will make Forex trading permissible by Shariah law. The regular chart-based analysis can be seen as speculation, which is not allowed.

A lot of research needs to be done for Muslims to determine which currency will increase or decrease in value. There can be no speculation since gambling is prohibited according to Islamic law.

Critics say Muslims should avoid Forex trading because the line between speculation and knowing how to trade can be easily blurred, even though Forex brokers understand the laws and are willing to trade on behalf of Muslims.

Muslims can look at the lists of top Islamic Brokers whenever they want to do Forex Trading.

It seems to be possible for us to go on looking at the issues that surround Forex trading for many days and find it impossible to decide what position a Muslim should take when the problem of Forex Trading arises; some critics might say Muslims should not be using Brokers to trade on their behalf because technically they are still trading and earning from gambling and it is wrong.

However, trading without speculation is possible, making it perfectly fine for Muslims willing to do research and stay within certain boundaries to do Forex trading. It can be seen as hand-to-hand trade permissible by the Shariah Law. These Muslims would not pay Brokers to trade on their behalf; they would do their research and stay away from everything that crosses the line, so they would not be doing anything that looks like gambling; there would be nothing like interest payments, and they wouldn’t be breaking the Islamic laws.

For example, “Hukum forex di Arab Saudi,” or forex law in Saudi Arabia, regulates currency trading. Saudi Arabia-regulated forex brokers offer swap-free Islamic accounts to all Islamic traders.

What Islam Permits – forex halal or haram?

It was recently reported that Muslims who have looked at all the issues connected to Forex trading have decided that using a broker is allowed. This makes it easy for Muslims to put aside the critics’ statements and start doing Forex trading as much as they want to.

Even though there are so many complications surrounding this issue, it is clear that research was done and decisions were made. The law that involves usury and gambling is still being contemplated, and Muslims are still finding ways to do Forex Trading in their own way.

The guidelines are still being used, as the laws are essential, and Muslims are always encouraged to abide by them. The Muslim Forex account is different, as all Islamic laws are considered and upheld.

The Muslim Forex Brokers are persons who are determined to uphold Islamic laws; they do all they can to avoid usury, which is defined very widely as forex forwards (which involves interest payments) and gambling or speculation, and this makes it easy for other Muslims to trust them and use their services without fear.

Despite all the complications, solutions were found for the many issues that seemed to stand in the way of Muslim Forex Traders, and they are now trading in the markets daily.

The question of whether Forex Trading is permissible according to the laws of Islam has been answered even though currency exchange under certain conditions is still halal. Of course, the lines are still blurred because computers and high-tech transactions were not present when hand-to-hand was implemented, but it is clear that Muslims found ways to adapt to the modern world.

Many forex brokers have become Islamic Forex Brokers and offer Islamic forex accounts with standard interest payments to make profits and trade.

The Critic’s Point of View – is forex haram in Islam?

Critics are still saying Islamic Forex trading makes this type of commerce problematic. The lines between gambling and smart trading or speculating can be blurred easily, and avoiding forex forward can sometimes be challenging. They say it seems that Islamic Forex Trading is just a camouflage. They believe Muslims can’t uphold Islamic laws and do Forex trading.

However, it is clear that Muslims are not paying much attention to the critics. They know that each trader will be guided by the laws they hold dear, and that is the most important thing to consider in the middle of this highly complex issue. It is hard for those who have never lived according to specific laws to understand how others can keep the laws when all the odds are stacked against them.

Forex trading in Islam halal or haram – I think HALAL!

Is driving a car halal? Yes, it is! But if you drive your car every day at 200 km/h, you can hurt yourself and people; you will gamble with your life and the lives of other people. So the decision is up to you. Is forex trading a regulated business? Yes. Do banks and the most prominent institutions around the world trade forex? Yes. There is a more significant chance to do insider trading in the stock market than in the forex industry. In the forex industry, there are no loans or market manipulation.

The extraordinary thing about forex is that you can risk 1% per your equity, and 99% of your money is in your pocket.

And one more fact is Surah Al Baqarah, verse 275: “Trade is Halal, interest is Haram.”

Forex halal

The question will always be there, but the truth about how Islamic laws are being upheld in the Forex markets can only be answered by Muslim Traders alone, and critics can only speculate. They really can’t tell if Islamic laws are being upheld or not by Muslim traders. Eventually, they might see this as an issue they should stop discussing, as they have no way of knowing what happens in others’ minds.

Please see my video about Islamic accounts:

Persons find more creative ways to do Forex trading when there is a complication because of Islamic laws. Some professional individuals are determined to do forex trading and make profits. More solutions are being found for other people’s daily problems as barriers.

To sum up:

Is forex trading legal in Islam?

Yes, forex trading is legal in Islam because, generally, there is no interest element in trading. However, some forex accounts are interested in trading when traders keep long-term trades during weekends. So, Islamic traders must use swap-free accounts (do not charge or pay overnight interest) because any interest is strictly forbidden in Islam.

Is day trading haram?

Day trading is not prohibited; it is legal (day trading is halal). Trading size, time frame, or trading duration do not affect the legality of trading. For example, if you trade swap-free accounts in Islam, it is halal because there is no element of interest. However, day trading can be risky because of overtrading, high commissions, and difficult prediction (prediction noise).

Keeping Forex Trading alive and profitable is more important than all the words critics use now. As long as Muslims find ways to trade and are comfortable with their choices, there is no reason for anyone to criticize them.

Is Forex Trading Haram in the Middle East?

No, forex trading is halal in the Middle East. Many brokers are regulated and have headquarters in the Middle East countries such as Bahrain, Gaza, Georgia, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, Syria, Turkey, United Arab Emirates, and Yemen.

For example, in Dubai (the central point of the Middle East), a DSF regulation protects clients from unregulated brokers and follows Islamic rules.

The best example is the Avatrade forex broker that thousands of people from Islamic countries have used. Ava Trade Middle East Ltd is regulated by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA).

Dubai is a financial center with wealthy retail sellers. Dubai is an Islamic city with strict religious standards; thus, Forex brokers must follow Sharia. Dubai is tolerant and uncomplicated, allowing multinational organizations and businesspersons tax-free opportunities to set up the company. Dubai investors are interested in forex trading; thus, the government developed an independent regulator to oversee all financial institutions. DFSA was created in 2004 and works with the Dubai International Financial Center, an economic zone. DIFC is one of Dubai’s limited alternatives for a 100% foreign-owned financial firm. UAE nationals must be majority shareholders. Dubai’s free zones have made it a commerce-welcoming state with little government interference.

The DFSA follows US and UK regulations. Dubai’s regulatory system is analogous to the US’s since the DFSA resembles the NFA and CFTC. DIFC and DFSA have an MoU with many countries. DFSA-regulated brokers may follow US, UK, or Cyprus legislation, which has an MOU with the DFSA and DIFC. DFSA demands a 2-5 percent minimum margin, no SWAPs for Islamic brokers, and further exchange regulations in line with Dubai’s religious values. All DFSA-controlled agents must provide traders a jeopardy confession proclamation and only accept DFSA-approved clients for marketing exchange accounts. Forex dealers in the area should have $1 million and not trade the UAE Dirham.

Trading in currency exchange, contracts for difference (CFD), and alternatives are legal for multinational corporations inside the UAE. Dubai and the other states of the UAE, due to their location in the Middle Eastern financial sector, work as a stage for many forex merchants and agents, in addition to other online exchange organizations.

In the United Arab Emirates, the Securities Commodities Authority (SCA) governs internet operations, including foreign exchange trading and contracts for difference (CFDs) (UAE). The SCA’s primary objective is to expand the country’s access to financial markets, fostering economic growth in the UAE.

These institutions make increased stability and Safety for foreign currency investors possible, leading to increased levels of foreign direct investment (FDI). The Securities and Commodities Authority and the Central Bank of the United Arab Emirates are responsible for issuing licenses for foreign currency brokers.

The DIFC and the ADGM, both economic-free regions in the United Arab Emirates, allow for trading non-bank financial products and services, including foreign exchange (Forex), contracts for difference (CFD), and other non-bank financial trading operations. It is essential to know that the Dubai Financial Services Authority (DFSA) in the DIFC is the regulatory agency that oversees forex brokers and other non-banking financial enterprises.

Forex trading in the United Arab Emirates may, at first look, seem to be rather complex, especially for novice traders. This is particularly true given the present restrictions and sharia regulations, which forbid obtaining total gains from trading.

Through the Securities and Commodities Authority (SCA), the Central Bank, and regulated brokers, transactions involving foreign currency (Forex) are authorized. Any person or organization that plans to provide non-banking economic amenities must first incorporate in the United Arab Emirates (either on the UAE continental or inside a finance-free zone), regardless of where you will provide the services. Without a current UAE license, you won’t go very far if you want to do business online in the United Arab Emirates (UAE). According to United Arab Emirates Federal Law No. 2 of 2015, it is unlawful for any foreign company to do lawful business in the UAE without first getting the required license. According to this information, the only free zones in the United Arab Emirates (UAE) that will provide licenses to companies that offer forex and CFD facilities are the SCA, DIFC, and ADGM.

UAE Trade Barriers

You need a local distributor or agent to engage in business in the United Arab Emirates. Since agency law does not apply to food goods, a chosen guarantor, sales mediator, or supplier will only have restricted powers to sell, advertise, and distribute the item if selected. Getting rid of a supplier or mediator in the UAE who is not carrying out their responsibilities satisfactorily might be challenging. In March of 2010, UAE Central Rule number 2 of 2010 brought the first adjustments to the Marketable Agency Regulation, and other amendments were approved in 2015. In 2015, the regulation went through yet another round of revisions.

Commercial agencies may no longer be ended or renewed without good reason by the principal. A principal might not reenlist a commercial organization in the designation of a new mediator if the agency is terminated or not renewed in good faith by both parties or for justifiable causes, as determined by the Commercial Agencies Committee. The dissolution of the expert Marketable Agencies Committee in 2006 was reinstated in the 2010 Amendments. All disagreements between licensed business agents must be taken to the Commercial Agencies Committee for arbitration. You should report any possible commercial conflicts to the Commercial Agencies Committee.

Conduct exhaustive research on latent marketable managers and carefully craft agreements to assure complete surrender by the Organization Act. This is one of the most crucial steps you must take.

Brokers can lawfully do business after getting licenses from the Safety and Object Ability (SCA). Meanwhile, the SCA is keeping an eye on what they are doing. Most UAE business owners would instead conduct financial transactions in AED and USD.

The regulatory agencies provide their customers with a diverse selection of services. To ensure that all deals are honest and open to scrutiny, the broker’s financial records are audited as part of the protections. If a disagreement arises, brokers also have an ethical duty to protect the cash belonging to their customers and record the procedures they follow.

Both the CBUA and the SCA must monitor compliance with this requirement. Organizations inside the continental area of the UAE must have an Emirati individual serve as the main shareholder in their company. In the free financial zones of the United Arab Emirates (UAE), it is legal for companies to have foreign ownership and to do business. These zones are governed by the Dubai Financial Services Authority and the Abu Dhabi Financial Services Authority (ADGM). There are notable differences between the controllers in the free financial zone and those in the rest of the country, even though all regulators in the UAE are required to adhere to the same essential regulatory principles.

On the other hand, brokers must adhere rigorously to Sharia law to do business on the mainland. The Sharia commandment does not apply to brokers in countries regulated by the ADGM or the DFSA. Because of that, we can conclude that trading forex in the Middle East is halal.

Under the CBUA and SCA-issued regulations, agents are prohibited from charging customers for currency exchange services. According to Sharia law, interest charges and inducements, sometimes referred to as exchange dues, are entirely forbidden. Because interest might be financed by different methods, such as management due, even brokers registered by the DFSA and ADGM who provide swap-free accounts could not be Sharia compliant.

All DFSA-regulated firms must follow UAE rules. Every DFSA-controlled Forex dealer must provide inspection information and financial transaction data. The DFSA’s rulebook begins with tax evasion and anti-terrorist funding regulations. Registered brokers must obey fair and honest competition rules. Therefore, DFSA regulations cover the marketing and promotion of economic merchandise. DFSA prohibits unethical advertising and fact-bending. DFSA controls members to guarantee a fair market. DFSA penalizes firms outside the authorities’ framework and suffers severe concerns if they disobey their license’s requirements.

Dubai allows only DFSA Forex dealers. UAE nationals can’t use unlicensed services, and criminal firms face lawsuits and prison time. Dubai’s exceptional, cost-effective regions let investors service a global market. Dubai brokers may operate without DFSA oversight. Investors aren’t protected by DFSA-planned rules or management. Dubai-centered agents duped many investors. DFSA and regulators have criticized all DFSA-controlled F forex companies for scamming.

DFSA’s complaint mechanism permits customers to resort to advanced establishments if they can’t resolve their issues with the agent. If no acceptable resolution is achieved, both parties may seek a DIFC-facilitated private court. DIFC and DFSA courts handle complaints and regulatory control independently from UAE judges. Without government meddling, any foreign investment may enjoy legal transparency.

Official DFSA registration is the most reliable source for Forex broker authenticity. Ask for a broker’s license or an official website to validate their DFSA status. All regulatory organizations require member businesses to provide regulatory and licensing information upon request. Due to trading limitations and significant account starting capital, DFSA-regulated Forex businesses might not be appropriate for all stockholders. DFSA brokers may implement Sharia trading limitations, hurting trading methods. If you reside in Dubai, have excellent exchange capital, and accept Islamic trading limitations, choose a Forex broker.

Is trading CFD halal?

Yes, trading CFD is halal as forex trading (forex and CFD trading are the same), but only if you trade using swap-free trading accounts (no overnight interest paid). Most CFD brokers offer Islamic swap-free trading accounts that do not charge or pay overnight interest (no repayment with interest) on the open positions.

In the end, there is one more interesting question:

Is trading on the stock market halal?

Trading company shares are not haram; they are halal because owning a business is part of the legal way of earning in the business world. However, strict Islamic laws point out that any investment in alcohol, insurance companies, nightclubs, pornographic materials, and riba-based banks is haram.