Table of Contents

Artificial Intelligence (AI) is the simulation of human intelligence in machines, enabling them to perform tasks that typically require human cognition. These tasks include problem-solving, pattern recognition, and decision-making, among others. Machine Learning (ML), on the other hand, is a subset of AI that provides the underlying systems the ability to learn and improve from experience without being explicitly programmed automatically.

ML allows computers to recognize patterns and make decisions based on data. While all machine learning models are a form of AI, not all AI systems utilize machine learning. The dynamic nature of ML, with its capacity for self-improvement, distinguishes it within the broader field of AI.

Therefore, traders often use Machine Learning as an integral part of AI solutions. The importance of AI in trading grows daily.

How to Use AI in Forex Trading?

Traders use AI in trading by applying machine learning methods to enhance prediction models, optimize strategies, and aid decision-making. All ML solutions are AI solutions that can be used for algorithmic trading, portfolio optimization, anomaly detection, risk management, feature engineering, and backtesting.

Using machine learning in trading can enhance prediction models, optimize strategies, and aid decision-making. Here are some ideas on how machine learning can be applied to trading:

- Predictive Analysis:

- Use time series forecasting to predict stock prices or market trends.

- Employ neural networks, especially recurrent neural networks (RNNs) and Long Short-Term Memory (LSTM) networks, for sequence prediction.

- Algorithmic Trading:

- Design and optimize trading algorithms that can automatically execute specific based on certain criteria derived from ML models.

- Reinforcement learning can be used to train trading bots by letting them “learn” which trades maximize returns over time.

- Sentiment Analysis:

- Analyze news articles, financial reports, or social media chatter using natural language processing (NLP) to gauge market sentiment.

- Use sentiment scores as indicators in trading strategies.

- Portfolio Optimization:

- Apply machine learning techniques to optimize asset allocation, maximizing returns while minimizing risk.

- Use unsupervised learning methods, like clustering, to discover groupings of assets that behave similarly.

- Anomaly Detection:

- Detect unusual patterns or outliers in trading data that might signify market manipulation or flash crashes.

- Leverage algorithms like One-Class SVM or isolation forests for this purpose.

- Risk Management:

- Develop models to predict and quantify potential risks, such as market volatility.

- Adjust trading strategies dynamically based on predicted risk levels.

- Feature Engineering:

- Identify and engineer new features from raw trading data that can enhance the performance of trading models.

- Use techniques like autoencoders for dimensionality reduction or feature extraction.

- Trade Execution Optimization:

- Optimize the timing and volume of trades to minimize market impact and slippage.

- Use deep learning models to understand market microstructure and achieve optimal execution.

- Backtesting:

- Utilize ML to enhance backtesting frameworks, ensuring that trading strategies are robust and reliable.

- Avoid overfitting by splitting data appropriately and employing techniques like cross-validation.

- Adaptive Strategies:

- Design trading strategies that adapt over time as market conditions change.

- Use online learning or active learning approaches to update and refine models continuously.

How to use AI Algorithmic Trading?

Using AI in algorithmic trading involves leveraging machine learning models and other AI technologies to make more informed and automated trading decisions.

Usually, quants collect information about price, volume, patterns, and indicator values in various periods. Using regression or classification methods, quants try to predict either future price (regression) or the correct label of a given input data (classification).

AI algorithmic trading example

Let me show you one example.

You have a strategy :

- BUY yesterday’s daily high, stop loss yesterday’s daily low, and target calculated based on a 1:1 risk-reward ratio.

- SELL yesterday’s daily low, stop loss yesterday’s daily high, and target calculated based on a 1:1 risk-reward ratio.

You have features in the moment when you make a buy or sell order:

- MACD value

- RSI value

- Price Value

- 7 days low price value

- 7 days high price value

f(MACD value, RSI value, Price Value, 7 days low price value, 7 days high price value) = 1 or 0

where 1 is profitable trade, 0 is loss

Based on the ML algorithm, you want to determine which values features should have so the target model has value 1. In that case, you can try to create a profitable system.

Here’s a step-by-step breakdown:

- Define Objectives and Strategy:

- Determine your goal (e.g., short-term profit, long-term growth, risk minimization).

- Decide on the type of trading strategy (e.g., trend following, mean reversion, statistical arbitrage).

- Data Collection:

- Gather historical price data, trading volumes, and other relevant market data.

- If relevant, include alternative data sources such as news feeds, social media sentiment, and economic indicators.

- Data Preprocessing:

- Clean the data by handling missing values, outliers, and noise.

- Normalize or standardize data to ensure consistent scales.

- Feature Engineering:

- Extract relevant features that the model will use to make predictions.

- Use techniques like Principal Component Analysis (PCA) for dimensionality reduction.

- Model Selection and Training:

- Choose a machine learning model suitable for the task (e.g., neural networks, decision trees, SVM).

- Train the model using a portion of the data to avoid overfitting.

- Backtesting:

- Test the AI model’s performance on unseen historical data to evaluate its effectiveness.

- Use metrics like Sharpe ratio, drawdown, and return on investment to gauge performance.

- Model Optimization:

- Fine-tune model parameters to improve its predictions.

- Employ techniques like grid search or random search for hyperparameter tuning.

- Risk Management:

- Develop strategies to manage and limit potential losses, setting stop-loss or take-profit points.

- Monitor model performance and adjust risk parameters as needed.

- Deployment:

- Integrate the AI model into a trading platform.

- Automate the order execution process based on the model’s recommendations.

- Monitoring and Maintenance:

- Continuously monitor the model’s performance in real time.

- Retrain or update the model as market conditions change or new data becomes available.

- Ethical and Regulatory Considerations:

- Ensure the trading strategy complies with regulatory requirements.

- Be aware of potential ethical concerns, especially regarding market manipulation or unfair advantages.

Using AI in algorithmic trading requires rigorous testing and a deep understanding of the financial markets and the underlying technology. While AI can enhance decision-making and efficiency, traders should remain cautious and continuously monitor the system’s performance.

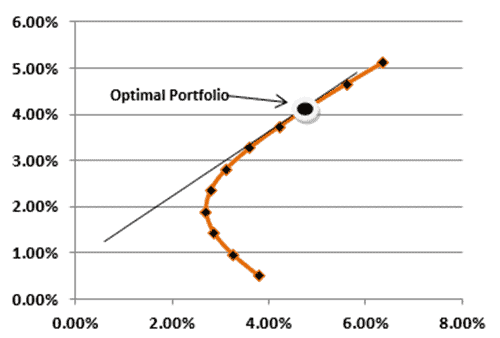

Use AI for Portfolio Optimization

Portfolio optimization involves selecting the best portfolio from all considered portfolios based on a given risk-return trade-off. Traditional methods, like Markowitz’s Mean-Variance Optimization, have limitations that can be addressed using Machine Learning (ML) and Artificial Intelligence (AI) techniques.

Here’s how you can use ML/AI algorithms for portfolio optimization:

- Objective Definition:

- Define your primary objective, whether it’s maximizing returns, minimizing risk, or achieving a specific risk-return profile.

- Data Collection:

- Acquire historical price and return data for the assets you’re considering.

- Integrate alternative data sources like macroeconomic indicators, news feeds, or sentiment data to enrich your dataset.

- Data Preprocessing:

- Normalize or standardize the data.

- Handle missing values, outliers, and potential noise.

- Feature Engineering:

- Extract relevant features like momentum, volatility, and other technical indicators.

- Use techniques like PCA for dimensionality reduction, especially if working with many assets or features.

- Predictive Modelling:

- Implement ML algorithms to predict future returns or risks. Models like regression, neural networks, or time series models like ARIMA and LSTM can be helpful.

- Validate models using out-of-sample data to prevent overfitting.

- Optimization Framework:

- Instead of the traditional quadratic optimization used in Markowitz’s framework, you can employ more complex optimization techniques. Genetic algorithms, particle swarm optimization, or simulated annealing can find optimal weights in high-dimensional spaces.

- Incorporate constraints like transaction costs, taxes, and other real-world considerations.

- Risk Modelling:

- Use ML to better model and forecast the covariance matrix or other measures like Value at Risk (VaR) or Conditional VaR.

- Techniques like Gaussian processes, copulas, or Bayesian networks can offer more flexibility than traditional methods.

- Reinforcement Learning:

- Use techniques like Deep Q-Learning or Proximal Policy Optimization to allow the model to learn the best action (buy, sell, hold) over time.

- This iterative learning can adapt to changing market dynamics and refine the portfolio allocation strategy.

- Regular Rebalancing:

- Given the dynamic nature of markets, periodically retrain models and rebalance the portfolio based on new predictions and changing market conditions.

- Evaluation:

- Continuously monitor the performance of the optimized portfolio against benchmarks.

- Adjust strategies based on changing market conditions, new data, or model drift.

Use AI for trading anomaly detection.

Anomaly Detection in trading using AI and ML focuses on identifying unusual trading patterns that might indicate uncommon market behaviors, like market manipulation or flash crashes. Usually, traders can make automated systems that rarely trade only when an anomaly pattern occurs.

Implementing this can enhance the robustness of trading strategies and offer insights into possible unforeseen market events.

Here’s a detailed look:

- Purpose of Anomaly Detection in Trading:

- Identify Unusual Market Events: These could be abrupt market moves, sudden spikes in trading volumes, or abrupt changes in other market indicators.

- Prevent Financial Fraud: By spotting irregular trading patterns, detecting and investigating suspicious activities is possible.

- Enhance Risk Management: By identifying anomalies early, traders and firms can adjust strategies to mitigate losses.

- Data Collection:

- Gather detailed trading data, including price, volume, order book depth, and timestamps.

- Other relevant data might include news feeds, macroeconomic indicators, and social media sentiment.

- Feature Engineering:

- Extract features that capture the market dynamics, like moving averages, volatility measures, and momentum indicators.

- Consider using statistical measures like z-scores to highlight data points that deviate from the mean.

- Model Selection:

- Statistical Models: Techniques like the autoregressive integrated moving average (ARIMA) or Exponential Smoothing State Space Model (ETS) can forecast and compare the actual data against predicted values to find anomalies.

- Machine Learning Models: Algorithms such as Isolation Forests, One-Class SVM, and Neural Networks can be trained to recognize ‘normal’ data and subsequently highlight anomalies.

- Time Series Decomposition: Decompose time series into trend, seasonality, and residuals. Anomalies often appear in the residuals.

- Training and Validation:

- You’d need labeled datasets with standard and abnormal data points for supervised learning.

- For unsupervised learning: The models learn the structure of ‘normal’ data and flag deviations as anomalies. This approach is expected, given the rarity of anomalies.

- Evaluation Metrics:

- Precision, recall, and the F1 score can be used to evaluate the performance of the anomaly detection system, especially in cases with a labeled dataset.

- Real-time Monitoring:

- Implement systems that monitor trading data in real-time, triggering alerts or even automated actions (like pausing trading) when anomalies are detected.

- Feedback Loop:

- Continuously refine and retrain models based on the feedback from the detected anomalies. False positives and negatives from prior detections can serve as valuable training data.

- Visualization:

- Tools that visually highlight anomalies in real time can be invaluable. Time series plots, heat maps, or scatter plots can be helpful.

Conclusion

The integration of AI in trading has revolutionized the financial landscape, offering enhanced predictive accuracy and real-time decision-making capabilities. Leveraging AI algorithms, traders can now identify complex patterns, forecast market movements, and manage risks with unparalleled precision.

Furthermore, AI-driven anomaly detection aids in spotting unusual market behaviors, safeguarding against potential manipulations. However, while AI presents vast opportunities, it’s essential to approach its application with rigor and awareness of potential pitfalls. Continual model validation, ethical considerations, and adherence to regulatory standards remain paramount in the AI-driven trading domain.