A Roth IRA is an individual retirement account allowing people to invest money. Unlike traditional IRAs, Roth IRAs provide tax-free withdrawals on qualified distributions. This means the earnings from investments in a Roth IRA can be accessed without additional tax liabilities. However, in some religious communities, there has been some hesitation regarding investing in this type of account, with some individuals questioning whether or not it is genuinely a halal or haram investment.

- A Roth IRA is a type of individual retirement account compliant with U.S. tax laws.

- Islamic finance principles prohibit earning interest on investments, which is considered a form of usury (riba).

- The earnings in a Roth IRA come from investment returns, such as dividends and capital gains, rather than interest.

- Investing in companies that engage in prohibited activities, such as alcohol, gambling, or pork, is not allowed in Islamic finance.

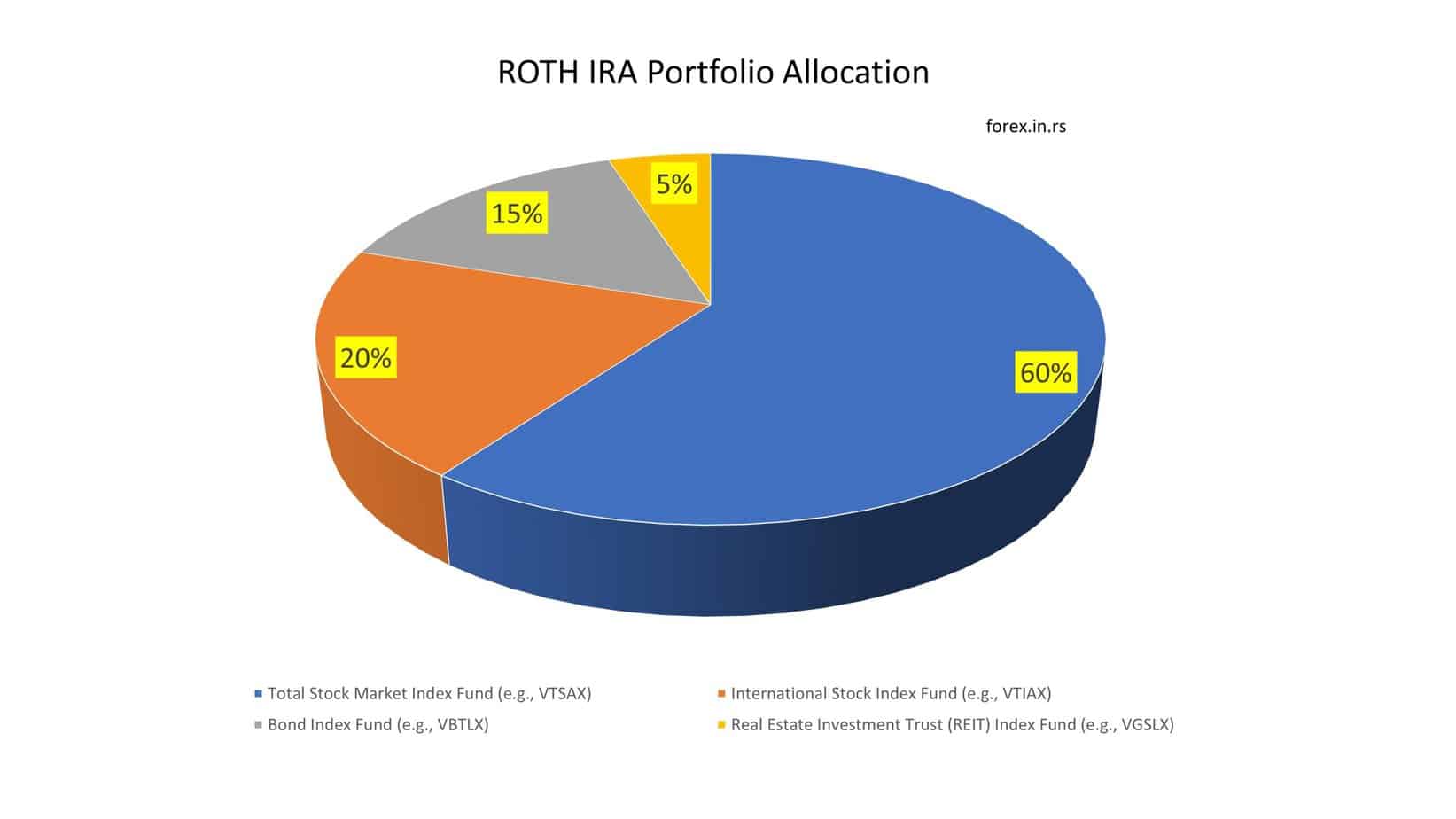

- However, a wide range of halal investment options is available for Roth IRA holders, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs) that meet Shariah-compliant criteria.

- Roth IRA contributions are made with after-tax dollars, meaning that the money has already been taxed, and no interest element is involved.

- Withdrawals from a Roth IRA are tax-free if certain conditions are met, making it an attractive option for retirement savings.

- Overall, the Roth IRA structure aligns with Islamic finance principles as long as the investments made within the account are halal.

Before delving into the religious and ethical implications of a Roth IRA, it is essential to understand what exactly it is clearly. A Roth IRA is a retirement savings account where individuals can deposit money into the history and invest it according to their preferences. The cash grows tax-free, and any withdrawals made after 59 ½ are also tax-free, provided the account has been held for at least five years. This means that individuals can save a substantial amount of money on taxes by using a Roth IRA, especially if they can take advantage of the account’s long-term growth potential.

Is Roth IRA Haram?

No, Roth IRA is not Haram because contributions will not be interest-based. Riba refers to interest charged on loans or deposits, and Roth IRA does not include interest. However, if Roth IRA does not invest in halal investments (“non-haram” stocks), a Roth IRA investment can be haram. Haram stocks are investing in companies such as alcohol, adult, weapons manufacturing, entertainment, gambling, and pork products.

According to Islamic law, there are specific regulations regarding financial transactions and investments. In particular, investments involving interest or usury are considered haram or forbidden. This may lead some individuals to question whether or not a Roth IRA falls into this category, as it involves investing money and receiving tax-free earnings.

While there is no definitive answer to this question, several factors can be considered when evaluating the permissibility of a Roth IRA from an Islamic perspective. One of the main concerns is whether or not the investment involves any element of interest or usury. In general, assets that generate interest or require interest payment are considered haram, as they include profiting from charging interest on loans, which is viewed as exploitative and unfair.

However, a Roth IRA does not involve any interest payments or loans, as individuals invest their own money into the account and receive earnings based on the performance of their investments. This means that it is not inherently haram. However, certain types of investments are made through a Roth IRA that may be considered haram, such as investments in companies that engage in unethical or prohibited practices, such as gambling or selling alcohol.

Another consideration when evaluating the permissibility of a Roth IRA is the concept of gharar or uncertainty. According to Islamic law, investments that involve excessive uncertainty or risk are considered haram. This may lead some individuals to question whether or not investing in a Roth IRA is permissible, as there is always some degree of uncertainty when it comes to investing.

However, many Muslim scholars have argued that investing in a Roth IRA can be considered permissible if the investments are made in reputable companies with a track record of stable performance. Additionally, some scholars have suggested that the fact that the assets are created for retirement rather than for speculative purposes could be seen as a mitigating factor supporting a Roth IRA’s permissibility.

Haram Stocks Investing

Haram stocks refer to stocks of companies that engage in activities that are prohibited in Islamic finance. These activities include:

- Alcohol: Companies that produce, distribute, or sell alcohol or other intoxicating substances are considered haram.

- Adult: Companies that produce or distribute pornographic materials or engage in other adult entertainment activities are also haram.

- Weapons manufacturing: Companies that produce or sell weapons, especially those used in war or against civilians, are considered haram.

- Entertainment: Companies that engage in entertainment activities that promote vulgarity, obscenity, or immorality are also haram.

- Gambling: Companies that provide gambling or betting services are considered haram, as gambling is a form of gambling.

- Pork products: Companies that deal with pork products, such as pork meat, pork-derived food products, or related services, are also haram.

Investing in haram stocks is considered haram in Islamic finance, as it involves earning profits from activities that are not permissible in Islam. Therefore, Muslim investors are encouraged to avoid such stocks and invest in halal stocks that comply with Islamic finance principles. Halal stocks are stocks of companies operating in industries permissible in Islam, such as healthcare, technology, education, and other ethical businesses that comply with Shariah-compliant criteria.

Ultimately, each individual must make their own decision about whether or not a Roth IRA is a halal or haram investment. While there are certainly valid concerns when investing in any account, whether from an ethical or financial standpoint, evaluating the specific risks and benefits associated with a Roth IRA is essential to make an informed decision. By carefully considering the facts and consulting with trusted experts, Muslims can make sound decision when investing in a Roth IRA.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE