Table of Contents

Finance education is essential for traders, real estate, and law experts. Our website has many traders from Islamic countries, so we provided one educational article for them and all other finance-knowledgeable people.

I wrote several articles about this topic. To read about the best Islamic account broker, visit my review. I explained that HF Markets’ broker is Halal. Additionally, I explained in detail what Riba is. I tried to share my opinion about whether forex is halal or haram (personal view) and whether stocks are trading haram. I also tried to answer a similar question about whether investing in stocks is haram or halal (long-term). For Islamic readers, I wrote about Murabaha financing, too.

Of course, to learn about forex Islamic accounts, read my article.

What is Murabaha Financing?

Murabaha financing, or cost-plus financing, is an Islamic financing system in which the cost and markup of a property are negotiated between the seller and the buyer. The markup is a form of interest not legal and restricted in Islam.

Essentially, Murabaha is different from an interest-bearing loan, and it is an allowable type of credit sale under Islamic Law. In the case of a rental purchase, the purchaser is not the actual owner until they pay the loan entirely.

Here are detailed insights into why finance education is essential for these professionals, with a focus on Islamic finance principles like Murabaha financing:

- Understanding Ethical Financing: For professionals in finance, real estate, and law, understanding the ethical implications of financial transactions is crucial. Islamic finance provides a framework for conducting business in a manner that is profitable, ethical, and socially responsible. Murabaha financing, for instance, offers an alternative to conventional interest-based loans, aligning financial transactions with Islamic ethical standards.

- Compliance with Shariah Law: Islamic finance principles are rooted in Shariah law, which prohibits interest (riba) and speculative activities (gharar). Professionals knowledgeable in Islamic finance, like Murabaha, can ensure compliance with these principles, offering services that meet the financial needs of Muslim clients without compromising their religious beliefs.

- Diversification of Financial Products: Finance education that includes Islamic finance principles allows professionals to diversify their financial products, catering to a broader client base. For instance, understanding Murabaha financing enables real estate experts to offer Islamic home financing options, expanding their market reach.

- Risk Management: Islamic finance principles emphasize risk sharing and asset-backed financing, which can lead to more stable financial products. Professionals educated in these principles can design financial products, such as Murabaha-based loans, that are less prone to volatility and financial crises, benefiting providers and consumers.

- Innovation in Finance: The principles of Islamic finance encourage innovation within the financial industry. By understanding and applying concepts like Murabaha financing, professionals can develop new financial products that are compliant with Islamic law, meeting the needs of underserved markets and driving financial inclusion.

- Global Financial Integration: As global financial markets become more interconnected, professionals with a comprehensive understanding of various financial systems, including Islamic finance, are better equipped to operate in international markets. Knowledge of Murabaha financing, for example, enables traders and finance professionals to engage in cross-border transactions that adhere to Islamic principles.

- Social Responsibility: Islamic finance, including Murabaha financing, emphasizes social justice and the community’s welfare. Professionals educated in these principles can contribute to more equitable financial practices, promoting social responsibility and ethical considerations in their financial dealings.

How does Murabaha Work in Islamic Banks?

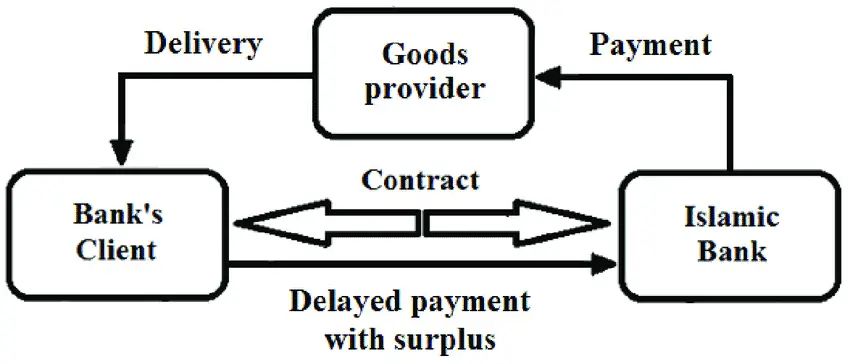

Murabaha financing works in Islamic banks as a sale contract. Murabaha contract of sale is when the customer requests the bank to buy an item on their behalf. The bank complies with the customer’s request and establishes a contract fixing the cost and profit for them on things if the customer repays, typically in installments.

What are the Basic Rules for Murabaha Financing?

The basic rules for Murabaha financing are given as follows:

Islamic Shariah prevents interest-bearing loans.

In Islamic finance, Murabaha financing is an alternative to loans.

Murabaha includes the profit markup in the transaction but not interest; therefore, it is also called cost-plus financing.

The sellers and buyers negotiate, paying the money in installments when they reach the price.

What is the Difference Between Murabaha and Ijara?

The significant difference between Murabaha and Ijara is that you can register the property in your name immediately with a Murabaha pledge. Still, in the case of an Ijara mortgage, you can just rent the asset from your lender, who complies with the Islamic Shariah Laws.

The word Murabaha comes from the Arabic word “Ribh,” which means profit, and Murabaha’s literal meaning is the fixed profit rate. During the Murabaha sale transaction, the seller communicates the profit and cost to the buyer at the time of sale.

The lexical meaning of Ijrah is to give something on rent. In the sense of assets and properties, Ijrah refers to the transfer of usufruct of a specific property to someone in exchange for rent. We can say that the term ‘Ijarah’ is analogous to the English word ‘leasing.’

What is the Difference Between Murabaha and Tawarruq?

Murabaha is the sale contract between the bank and the purchaser, where the bank pays on behalf of its client for buying something like a new home, car, furniture, electronics, etc. Then, the bank fixes a profit, which the client must pay within the due date; otherwise, markup is added with time. But, Tawarruq is the modified form of the Murabaha, often called commodity Murabaha or reverse Murabaha. It involves receiving cash through selling the commodity in an actual transaction.

Tawarruq consists of several steps. In the first step, the customer and the bank reach a commodity, Murabaha. The bank purchases shares or commodities on behalf of the client and leases them to the client. The client then owns the property. During the second stage of the Tawarruq process, asset liquidation occurs, and clients choose to either sell or liquidate their property via an agency agreement with the bank.

What is Murabaha Used For?

Murabaha financing is used for purchasing. It is prominent in multiple sectors as a substitute for loans. For example, clients utilize Murabaha financing while buying home appliances, real estate, or cars. Businesses need this financing to purchase machinery, equipment, or raw materials. Murabaha is also common in short-term trade, such as issuing letters of credit for importers.

A Murabaha letter of credit is sent out on behalf of an importer. The bank issues the letter of credit and concurs to pay. The bank then pays sufficient money in compliance with its terms and conditions, detailed in the letter of credit.

The bank’s creditworthiness is interchanged with the applier’s, and the beneficiary(exporter) is promised the payment. This benefits the exporter because the bank has a greater risk of payment loss.

By following the provisions of the Murabaha financing, the importer must repay the bank for the cost of goods and the profit markup amount.

What is a Murabaha Loan?

According to Islamic Shariah Laws, the Murabaha loan is an amount on which no interest is applied, so we can say this Murabaha loan is entirely different from the conventional loan method.

The banks offer loans to customers to buy assets, which the bank purchases on behalf of the clients and negotiates profits for.

Is Murabaha Halal?

This kind of transaction following Murabaha financing is valid (halal) from an Islamic perspective. The interest-based activities such as issuing conventional loans and getting interested are strictly prohibited (haram) in Islam.

Islamic countries do not prohibit this type of loan because a fixed fee is charged instead of interest (riba). According to Islamic religious beliefs, money is just a medium of exchange. It has no innate worth; therefore, Islamic banks cannot charge interest on bank loans, but they have permission to set a fixed fee for persisting in their daily operations.

Most people assert that Murabaha financing is another way of getting interested, but the contract structure significantly differs. In the Murabaha contract, the bank purchases a property and then sells that back to the customers with a profit charge.

Who Invented Murabaha?

Sami Humid invented the concept of Murabaha financing, which has become the most efficient mode of financing in Islamic banking. Murabaha is a sale contract with banks to buy property based on a credit sale setting.

Why is Murabaha Popular?

Murabaha is prevalent in Islamic banking because it is the only substitute for interest-bearing loans in Islamic countries. Interest is forbidden in Islam, so the Islamic bank utilizes Murabaha financing to make a profit. It also assists people in getting a loan from the bank through a Murabaha sale agreement to buy assets.

What is Sukuk Murabahah?

Sukuk Murabaha originates from the Murabaha, the subdivision of the Murabaha financing. In Sukuk Murabaha, a group seeks financing and agrees with a particular purpose vehicle(SPV) that aims to manage specific property owned by the SPV. The SPV gets hold of the property to control using the proceeds of a Sukuk issuance.

What is Bai Murabaha?

Bai Murabaha is the sale contract between the buyer and the seller for trade purposes and financing. The client purchases specific products from the seller by following the tenets of Islam. They agreed on a cost-plus profit, which the client pays in cash on the fixed future date in a lump sum, before, or sometime in installments. The seller’s gain may be specified in lump sums and vary when the agreement pays them in installments. The seller earns more profit if a client makes it too late to pay the installments.

In the case of Bai Murabaha, the Banks acquire the goods as per the customer’s requisition. Retain in its keeping and then sell. The early adjustment may lead to the consideration of a refund on the profit to the client.

What is Murabaha Payment in Adib?

Murabaha payment in Adib is the profit margin added to the total cost of shares. This occurs when a product is prepared under the Murabaha concept, allowing Adib to purchase the shares for its advantage from the financial market as per the customer’s promise to buy them. Then, Adib puts the claims for sale. The selling of the shares is done under Murabaha, which means offering profit to the net cost of the shares.

What are the Basic Rules of a Valid Murabaha Transaction?

The following are some basic rules for the valid Murabaha financing:

1- There are two groups; one is the capital owner, often called the investor, and the second one is the fund manager(Mudarib).

2—Then, the investor and fund manager and a couple of parties fix a profit-sharing percentage and reach an agreement.

3- In case of loss, the investor bears the loss of capital, which turns out to be a waste of time and effort of the fund manager.

4—The fund manager follows the investor’s instructions and never goes against them, and the investor imposes certain pre-planned restrictions. For example, if the investors prevent investing in textiles, the fund manager abides by their advice.

5- If fund managers do not abide by the pre-planned restrictions, then they will also suffer a financial loss due to negligence if there is loss.

What is Commodity Murabaha?

Commodity Murabaha buys particular commodities based on profit from the cost-plus (Murabaha financing). There is an agreement between the seller and buyer, and then the commodity is sold to a third party (another commodity trader) to obtain the cash.

Why is Murabaha a Commodity?

Murabaha is a commodity because the subtype of Murabaha, Tawarruq, is known as Commodity Murabaha or Reverse Murabaha. This is called so because it involves the trade of commodities in actual transactions to get cash.

What is Murabaha Margin?

Murabaha margin is the gross profit that a customer pays to the bank under an agreement of Murabaha financing sale. More specifically, the monthly Murabaha profit payable by the client to the bank under the Murabaha contract.

What is Murabaha Default?

An increasing concern in Islamic banking is Murabaha default, which occurs when additional charges do not apply after Murabaha’s due date. Many Islamic banks consider blocklisting defaulters and disallowing future loans from any Islamic bank to overcome the Murabaha default. Even though banks do not mention the loan agreement, this agreement is permissible in Islamic tenets.

According to the Holy Quran, if a borrower faces serious difficulty paying due to a financial crisis, give respite to the borrower. But, the government may take action against those who commit the default intentionally. The ruins under Murabaha financing agreements are problematic for the companies functioning under Islamic Shariah rules. There is no clear consensus on dealings, except preventing taking the extra amount than actual debt from the borrower.