Table of Contents

I wrote several articles about this topic. To read about the best Islamic account broker, visit my review. I explained that HF Markets’ broker is Halal. Additionally, I explained in detail what Riba is. I tried to share my opinion about whether forex is halal or Haram (personal view) and whether stocks are trading Haram. I also tried to answer a similar question about whether investing in stocks is Haram or halal (long-term). For Islamic readers, I wrote about Murabaha financing, too.

Of course, to learn about forex Islamic accounts, read my article.

What is Haram in Islam?

Haram represents any act Allah forbade and is one of the five Islamic commandments.

The concept of trading is an upshot of financial instruments and development in the world of finance. Day trading is the act of buying and selling financial tools and instruments. These transactions are manifested on the same day or even days. It can be an extremely lucrative game, provided the strategies and guidelines are followed. Risk is a necessary part of this game, but it is challenging for those unfamiliar with the concept. A trader or a broker utilizes financial instruments and tools, including stocks, bonds, commodities, and derivatives, as well as mutual funds.

Stock traders capitalize on short-term market events to sell stocks, a complete process. Trading is a money-spinning deal if the guidelines are well-acquainted and comprehended. However, there are specific regulations and limitations, which make the concept of trading questionable. More than half of the population is Muslim, and religious individuals are concerned about the authenticity of trading in their religion. Since everything is performed online, Muslims are interested in understanding the importance and significance of intraday trading following Islamic laws.

Is forex trading halal?

Forex trading is halal (lawful) and not Haram (forbidden) when traders use swap-free trading accounts because riba or interest element doesn’t exist in that case. Most CFD brokers offer Islamic swap-free trading accounts that do not charge or pay overnight interest (no repayment with interest) on the open positions.

Online trading and currency exchange notions are manifested online, signifying the advent of technological gizmos and processes. The financial markets and transactions are very well carried out, with the internet and technology being the official medium. However, Islamic laws and trading need to be addressed for potential interested brokers and traders. There is a debate on the halal and haram aspects of trading; consequently, multiple standpoints and perspectives must be highlighted. Whether it is financial transactions, leasing, credit withdrawal, debit, or trading, Islamic principles and guidelines guide the process in light of religion and make it eventually halal. A halal broker is a trader who receives a particular trading account that encourages trading through Islamic trading principles. This includes the execution of investment, adjustment, settlement of transaction costs, inculcation, and incorporation of minimum or zero interest rates.

Islam is not only considered a religion but is a manifestation of everyday lifestyle. It is directed at the daily affairs of life and routine conducted under Islamic principles. Muslims must observe essential principles outlined in the holy book and conduct their affairs according to sharia law. Many Muslim traders and brokers have debated the concept of trading. In addition, the idea of Forex, stocks, binary options, commodities currency exchange, and futures have been under the direct consideration of Halal and Haram. As far as buying shares is concerned, the buying and selling of stocks are generally considered Halal. This is because of the probability of owning a small percentage of the business. However, the company needs to operate under Islamic guidelines to participate in the buying and selling stages. However, certain establishments with Islamic trading principles, such as Guinness and Ladbrokes, are not allowed or encouraged.

Is Investing in Stocks Haram?

Investing in stocks is not Haram; it is halal because owning a business is a legal way of earning money in the business world. However, strict Islamic laws state that any investment in alcohol companies, insurance companies, nightclubs, pornographic-related companies, and riba-based banks is Haram.

Most Muslims face concerns and uncertainty because of the risk-sharing aspect. Therefore, this aspect should be monitored and regulated through fundamental principles such as Bai’ al, which involves repurchasing sold items. Bai salam, Mudarabah, also known as profit sharing, Bai’muajjal, the credit sale, Bai bithaman ajil, deferred payment sale Murabaha, and Musawamah.

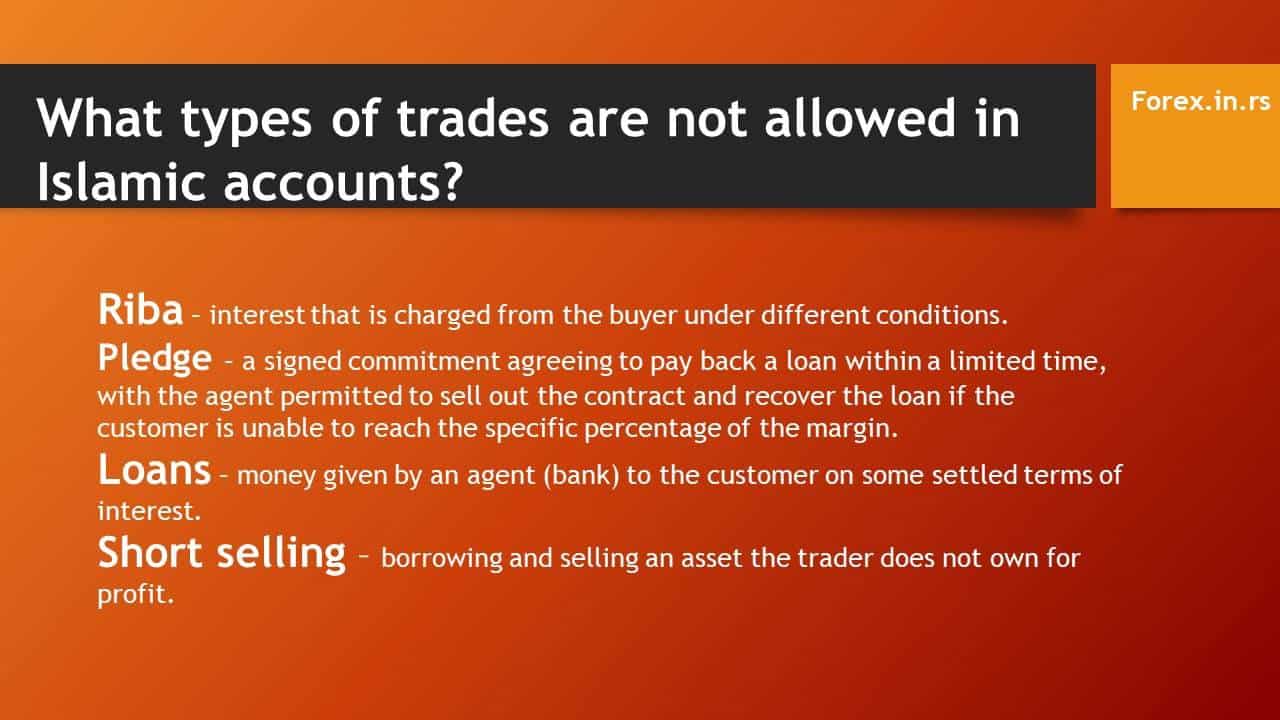

Example – What types of trades are not allowed in Islamic accounts?

To establish an official acquaintance with their trading companies, they should be analyzed and evaluated from an Islamic point of view, which is as follows:

Receiving shares from permissible concepts

Based on the Riba, the business, lending, and loaning concept should be accessible from cheating and borrowing. Standard practices in Islam and business dealings include shipping, clothing, manufacturing, real estate, furniture, stockpiles, and medical equipment under haram-free methods. Other than these practices, the businesses operate on unjustified lending, which is not permissible in Islam.

Shares are acquired through unIslamic ways.

Any company garnering its shares through unIslamic and unorthodox practices such as alcohol, nightclubs, pornography content, hotels, insurance providers to businesses and corporations, and Riba or interest-based banks is not allowed, Islam. Under these highlighted scenarios, the stock market is also rendered as Haram; therefore, finances accumulated through this practice are labeled unIslamic.

Shares accumulated through partial Haram practices.

Certain companies are known as mixed companies, delivering and accumulating shares on most haram practices. This includes some transportation companies that operate on interest-based commercial banks and monetary assistance through loans on interest rates or individuals with the help of stocks.

If there is significant uncertainty regarding the company’s Halal and Haram incentives, it is usually suggested not to invest or accumulate shares through that company. However, there are some instances in which individuals may have the authority to trade under Halal circumstances.

Some authentic scholars and Islamic experts encourage trading, buying, and selling stocks by excluding the Haram portion of the goods, services, or facilities you have invested in. If a company has a minor presence of haram activities, then individuals or Muslims can still invest. However, the profits generated and accumulated through any corporation’s Haram aspect or methodology can be thrown away. For example, if around 5% of the profit comes from alcohol generation, you can gift that amount to charity.

One of the solutions is Islamic trading accounts.

Please see my video about Islamic accounts:

Interest is probably the most crucial topic currently involved in multiple debates. Most businesses, establishments, and organizations often have to deal with the concept of interest, allowance, and prohibition. Trading should not be performed with interest.

Suppose you are interested in investing under Islamic accounts for stocks, Forex, or other options. In that case, the broker must clarify and highlight the exact description and background of the reports operating under Islamic principles. Traders and brokers should review that those companies deal with immature execution of trades. Delay and postponing will not assist in sudden and prompt exchanges between two parties. Furthermore, there should be a spontaneous settlement of financial transaction costs. If the account is moved to the next trading day, interest charges for the rollover are likely. Lastly, there should be zero interest rates on trades. Interest should not be acquired under any circumstances. The interest taken under any circumstances will make the trading invalid.