Inflation is one of the most important economic concepts in the world, as it can significantly impact an individual’s ability to save and invest money. It is one of the main reasons economists are always so focused on inflation and often recommend that people hedge against its effects. But with so many different options, how can you best protect yourself against inflation? One option that has been gaining traction among investors lately is investing in precious metals.

What is inflation?

Inflation is an economic phenomenon characterized by a consistent and overall increase in the prices of goods and services in an economy over a specified period. It represents a decline in the purchasing power of a currency, meaning that consumers can buy fewer items with the same amount of money. Inflation is typically measured using the Consumer Price Index (CPI) and the Producer Price Index (PPI), which track changes in the prices of a basket of goods and services over time.

There are several causes of inflation, including demand-pull, cost-push, and built-in inflation. Demand-pull inflation occurs when the total demand for goods and services in an economy outstrips the available supply, leading to increased competition for resources and higher prices. Cost-push inflation arises due to increased production costs or shortages in critical inputs (e.g., labor, raw materials), leading to higher prices for finished goods. Finally, built-in inflation results from adaptive expectations, where businesses and consumers expect prices to continue rising, leading to higher wages and production costs, contributing to further price increases.

Inflation affects various aspects of an economy. For instance, it can erode the actual value of money and financial assets like savings, affecting the ability of individuals to make long-term financial plans. In addition, it can create uncertainty in the business environment, as it becomes challenging for firms to accurately forecast future costs and consumer demand. Finally, inflation can lead to income redistribution, as it often disproportionately impacts lower-income households and fixed-income recipients like pensioners.

However, modest inflation levels may benefit an economy. They can stimulate economic growth and reduce the risk of deflation, which entails falling prices and can lead to lower production, reduced employment, and a downward spiraeconomic spiral before, central banks, such as the Federal Reserve in the United States, often target a specific inflation rate (e.g., around 2%) to promote price stability and support economic growth.

To manage inflation, central banks use monetary policy tools like adjusting interest rates, open market operations (buying or selling government bonds), and modifying reserve requirements for banks. By implementing changes in these policy tools, a central bank can influence the money supply in the economy, directly affecting the inflation rate.

Are Precious Metals a Good Hedge Against Inflation?

Yes, precious metals are considered a good hedge against inflation because, historically, they have retained their value during economic uncertainty and rising inflation. In addition, investors often turn to precious metals during periods of high inflation because these assets tend to hold their value when fiat currencies lose purchasing power.

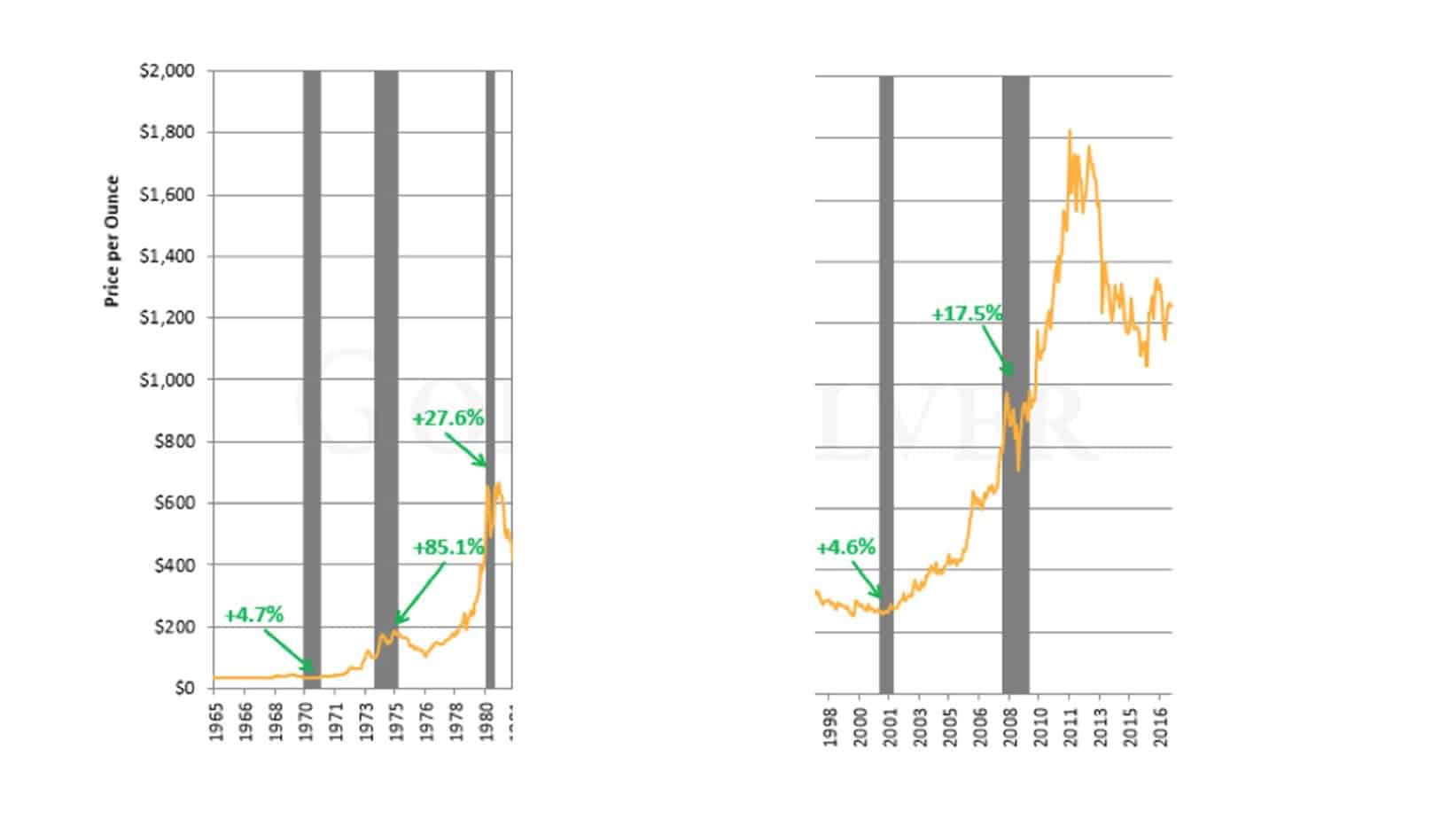

Now let us see historical proof for this claim:

For example, during the 1970s, the United States experienced a period of high inflation, and gold prices soared. From 1971 to 1980, the cost of gold increased from around $35 per ounce to more than $800 per ounce. This surge in gold prices demonstrated its effectiveness as a hedge against inflation during that time.

From the early 1990s to the early 2000s, gold prices remained relatively stable, ranging between $250 and $400 per ounce. During this period, the United States and many other developed economies experienced low and stable inflation, partly due to globalization, technological advancements, and relatively stable monetary policy. As a result, during this time, the correlation between gold prices and inflation was weak.

However, in the early 2000s, gold prices began to rise significantly. Multiple factors drove this increase, including economic uncertainty, low accurate interest rates, and increased demand from emerging markets like China and India. In addition, the 2008 financial crisis and its aftermath led to even more uncertainty, with central banks worldwide implementing aggressive monetary policies to stabilize their economies. These actions and concerns about potential future inflation further boosted the demand for gold as a hedge. As a result, gold prices peaked at around $1,900 per ounce in 2011.

The best example of how precious metals can be used as a hedge against inflation is the 2008 crisis!

In the decade following the 2008 financial crisis, gold prices have been more volatile and sensitive to changes in market sentiment, interest rates, and geopolitical events. Inflation remained relatively low in most developed economies, although concerns about potential future inflation have periodically influenced gold prices.

Please see this image below where we can see inlfation and gold prices during the crisis:

It is essential to note that precious metals investing as a hedge against inflation can be influenced by various factors, such as interest rates, geopolitical events, and market sentiment. While it’s difficult to pinpoint specific time frames when precious metals were a good hedge, they have generally performed well during periods of high inflation or economic uncertainty.

Precious metals, such as gold and silver, are seen as great hedges against inflation for several reasons. Firstly, history has shown us that the prices of precious metals typically go up when the value of other assets falls due to inflation. This means that if you invest in gold or silver when inflation hits, you may be able to make a profit off of your investments. At the same time, other investors watch their portfolios suffer due to currency devaluation.

Another reason why precious metals are viewed as good hedges against inflation is that these materials will retain their value regardless of what happens to currencies worldwide. This means that even if certain countries experience high inflation levels, gold, and silver can remain valuable and protect investors from currency devaluation.

In addition to serving as a hedge against inflation, several other benefits are associated with investing in precious metals. For example, unlike stocks or bonds, which are subject to market volatility, precious metals tend to maintain their value over time. This makes them an attractive investment option for those looking for consistent returns from their investments without taking too much risk.

Furthermore, physical gold and silver are considered tangible assets, making them easier for investors to store and manage than paper investments such as stocks or bonds. Lastly, since gold and silver do not pay dividends or interest like other financial instruments, they offer more privacy and anonymity than other investment options since they do not require disclosure statements or tax returns like other investments do.

All in all, there are many advantages associated with investing in precious metals that make them an attractive option for those looking to protect themselves from the effects of inflation. With their tangible nature making them easier to store than paper investments and their ability to maintain their value regardless of what happens around the world, making them great hedges against currency devaluation, it’s no wonder why more people have started turning towards these alternative assets when looking for ways to guard themselves against rising prices caused by inflation.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: