Neural Network for Forex: Understanding the Basics

A neural network in forex trading is a machine learning method inspired by biological human brain neurons. The machine learns from the market data (technical and fundamental indicators values) and tries to predict the target variable (close price, trading result, etc.).

A neural network is a series of algorithms that seek to identify relationships in a data set via a process that mimics how the human brain works.

So, Neural networks are systems that collect and analyze different types of data provided by artificial intelligence. The system analyzes data like the human brain. With decision-making strategies such as trial and error, segregation, and generalization, the network improves its effectiveness. Neural networks are essential for productive artificial intelligence systems. The use of this technology is currently being applied to the Forex market.

The process of developing neural networks is important for improving the accuracy of artificial intelligence. Artificial intelligence is used all over the globe, from smartphones to cars. In many ways, artificial intelligence makes everyday life easier and more convenient. With all of this advancement, it is important to keep sight of their faults. For this reason, the Forex market needs to see more development on neural networks before they can be used across the board.

We have 2 most common types of problems:

1) Forex regression problem where we try to predict future prices in trading.

2) Forex classification where we try to predict will be trade be profitable or losing trade.

Neural Network Forex Trading Example:

Forex trading Regression problem:

Input: Yesterday open price, Yesterday high price, Yesterday low price, Last 7 days high price, LAst 7 days low price, Relative Strength Index for Daily chart time frame.

Target Variable: Tomorrow Close price.

This is a straightforward regression neural network machine learning problem.

Forex trading classification problem:

Input: Yesterday open price, Yesterday high price, Yesterday low price, Last 7 days high price, LAst 7 days low price, Relative Strength Index for Daily chart time frame.

Target Variable: 1 or 0, where 1 is profit trade, 0 is loss trade.

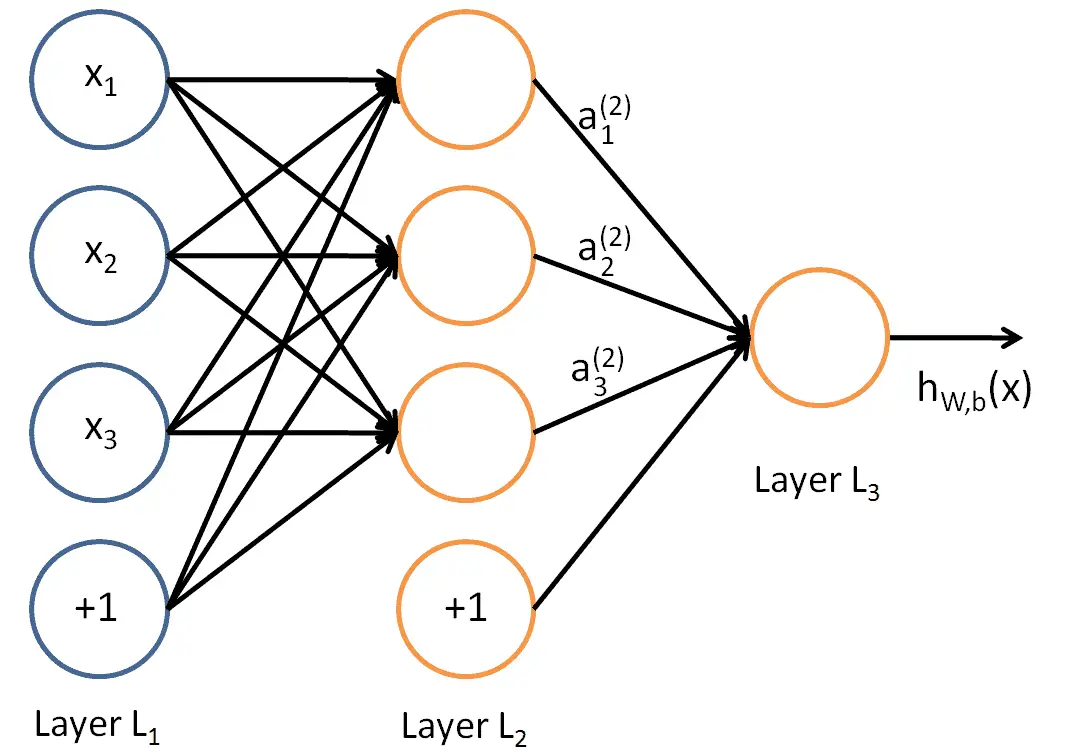

How Neural Networks Work

Neural network systems utilize data and analyze it. The process in which neural networks analyze information is similar to the cause-effect relationship in human thinking. The probabilities of a situation are analyzed before making a final decision. This is also true for neural network systems. The neural network analyzes past information to make a more informed decision in the future. This is similar to when a child makes an error when doing a puzzle and corrects it with their next move. Sometimes finding out what doesn’t work helps us figure out what does work. This is how the system processes information and makes educated decisions.

The biological neural network operates very similarly to the nerves in the human body. For example, all system elements communicate with each other to determine a final answer. The neural network is multi-layered and detail-oriented. There are two main databases involved with neural networks. There is a training base as well as a test base. Database improvements are completed through trial and error. The network maintains permanent progress. The system is always using new information to improve the result.

The Forex market has been increasingly expanding its technology to improve trading outcomes. Tech developers have the ability to improve the effectiveness of all forms of artificial intelligence greatly. The most important feature of neural networks is their ability to gather data and analyze it. This information is then stored and used when it comes time to make predictions. The system takes time to recognize and learn patterns before it can be used consistently with guaranteed success. The process of system learning does not take long, which is another benefit of this quick network.

The different features of the network include immersion, extraction, neural training, and decision-making. These are the steps involved in creating an accurate prediction.

How Neural Networks Benefit the Forex Market

Neural networks have the ability to benefit the forex market significantly. The main reason for this is due to their accuracy and intuitive instincts. They have the ability to analyze fundamental data as well as technical data. Mechanical systems are not well-equipped to analyze this type of data. Human errors are even more common when faced with analyzing this data. This is why neural networks have the ability to benefit traders greatly.

Another major benefit of neural networks is their quick adaptability. Neural networks do not take a long time to train. This is beneficial as it saves time and resources. Neural networks can help bridge the gap between human intelligence and computers.

Where Have These Systems Been Used?

Neural networks are already in use today. Popular search engines such as Google already use neural networks to improve their system. Google uses neural networks to analyze and classify images, text, and other data. The neural network has the ability to sort images and distinguish certain features from others. Google translate also utilizes neural networks in part. For example, the translations have become more accurate with the use of neural networks. The benefits of these systems include self-learning, highly improved reaction speed, and problem-solving capabilities.

Can The Network Generate Success for Forex?

Many people want to know if the system is fully compatible with Forex and how to generate a successful outcome. Neural networks have the ability to make a forecast. They can also generalize and highlight the data as well. The network is trained and can make educated predictions based upon the historical information it has saved. Classical indicators are different from neural networks. Neural networks have the ability to view dependencies between data and therefore make adjustments based upon this information. It will take a level of available time and resources to train the network; however, these are minor and worth the outcome.

For example: Predict Forex Trend via Convolutional Neural Networks

or A case study on using neural networks to perform technical forecasting of forex.

As with any other system, neural networks have a margin for error. They can produce an inaccurate forecast. Final solutions mainly rely upon input data. Neural networks can decipher patterns and relationships where a human eye can not. The intelligence of the system has the potential to be faulty as a result of emotion. The lack of emotion can be seen as an Achilles heel in a fluctuating Forex market.

My opinion on Neural Networks

Neural networks are extremely perspective in science. They have a unique ability to predict market trends and situations more efficiently than a traditional advisor. They can distinguish patterns, trends, and dynamics. They can discover and detect behavioral cycles. Traders that utilize neural networks prefer long-term trades. Scalpers do not utilize neural networks often. Neural networks existed a decade ago. However, their popularity is increasing as a result of big data. The technologies associated with big data, such as cloud storage, have rapidly increased the use of neural networks and their potential development.

In forex trading, Neural networks have big disadvantages because they can overfit very easily. How to explain this? When we train the data set, we will get a training error. When we test our model on unseen test data, we will get the test error. Overfitting has an excellent small training error but a huge test error. It isn’t good. Our expert advisor will have an excellent small error in forex trading when testing data but terrible results in live trading.

In my experience, simple regression models can be very robust and have excellent live trading performance. So, be careful with Neural networks…