Table of Contents

Asian session forex, also known as the Tokyo session forex, is considered the prime time of the day. Though it is frequently ignored as it is not volatile and liquid compared to other significant trading sessions, its unique characteristics attract those with the knowledge to trade in it.

Market Hours of Tokyo Forex Market

The trading in the Asian session starts on Monday at 9:00, stops at 18:00, and is considered in Japanese Standard Time (JST). Therefore, to keep up with the Asian session, traders in London would need to be up early, from 00:00 (GMT) until 9:00 (GMT) in the morning.

Asian (Tokyo) session market hours

Tokyo forex session opens at 23 GMT or 19 EST. The Tokyo session is from 23-8 GMT to 19-4 EST. Tokyo forex session closes at 8 GMT or 4 EST.

It should also be considered that the market’s opening time can be subjective as forex markets trade 24 hours a day. However, in general, it is believed that the Asian session starts when Tokyo banks start operating because of the vast massive amount of trades they deal in. Also, the first to start the trade and which are financial centers are Australia, Sydney, and New Zealand.

Traders who want to deal in the Asian session can deal in their appropriate time zones, that is, 9:00-18:00 (JST) for Asia, with Tokyo being its prime market, 00:00-9:00 (GMT) for Europe, with London being its prime market and 19:00-4:00 (ET) for the United States with New York being its prime market. However, be aware that these times can change with daylight saving changes. Also, less trading is seen from the essential centers in Europe and the US, as the majority is not working when the Asian session is going on.

Best Pairs to Trade During Asian Session

Asian Session Forex Pairs with excellent volatility and well-formed trends are AUD/NZD, AUD/JPY, NZD/JPY, USDJPY, AUDUSD, USDSGD, and NZDUSD. Using a range strategy, you can trade USDJPY, AUDUSD, and NZDUSD Asia session major pairs. If you use a trend trading strategy and look for higher volatility, the best forex pairs to trade during the Asian session are AUD/NZD, AUD/JPY, and NZD/JPY.

If you would like to trade mean reversion strategies to buy from the dip and sell on top, you can trade AUDCAD and NZDCAD during the Asian session and the US session.

When trading mean reversion strategies to buy low (from a dip) and sell high (at the top), focusing on AUDCAD and NZDCAD pairs during the Asian and US sessions can be beneficial. These currency pairs are influenced by economic activities in Australia, New Zealand, and Canada, which see significant movements during these sessions due to overlap in market hours.

The strategy capitalizes on the natural ebb and flow of these currencies, aiming to purchase when prices are temporarily depressed and sell when they rebound. The Asian session offers initial volatility as Australian and New Zealand markets react to any overnight news and economic data. Conversely, the US session can introduce further fluctuations due to North American market activities, offering additional opportunities for mean reversion trades.

If you live in Europe or the US and want to trade at night, you will trade during the Asian session. Learn more about the best time to trade USDJPY.

Asian session forex pairs volatility

In the Table below, I am presenting Asian session forex pairs volatility in pips:

| Pair | Asian Session Pips Range |

|---|---|

| NZDJPY | 67 |

| AUD/JPY | 64 |

| AUD/USD | 63 |

| NZD/USD | 56 |

| EUR/JPY | 56 |

| GBP/USD | 51 |

| EUR/USD | 49 |

| USD/CAD | 38 |

| USD/CHF | 37 |

| USD/JPY | 31 |

| EUR/GBP | 24 |

USDSGD during the Asian Session

In 2023, the USDSGD currency pair became interesting for trading during the Asian Session because of clear trends and FIb. Retracement levels. The USD/SGD (US Dollar/Singapore Dollar) currency pair might be preferable to trade during the Asian trading session for several reasons:

- Market Hours: The Singapore Dollar is Singapore’s currency, so it’s reasonable to assume that the most significant movements and market events will occur during Asian market hours. These hours align with the business day in Singapore when its financial institutions, corporations, and retail traders are most active.

- Liquidity: During the Asian session, trading volume and liquidity for the USD/SGD pair tend to be higher. Higher liquidity typically leads to narrower spreads, reducing the cost of trading.

- Economic Events: Singapore’s economic data releases usually occur during this session. Traders watch these events closely as they can significantly impact the exchange rate. So, if you are up-to-date with the current economic events and understand how they could affect the market, you could potentially gain an edge.

- Lower Volatility: If you prefer lower volatility, the Asian session may be suitable. The USD/SGD pair is typically less volatile during the Asian session than during the London and New York sessions. However, lower volatility might also mean fewer trading opportunities.

NZDJPY Volatile Asian Session Forex pair

The NZD/JPY is volatile, and most traders speculate on the NZD price. As such, this pair can offer profitable opportunities during the Asian session. The key to trading this pair successfully is to take advantage of the high liquidity during this period and to trade with the trend.

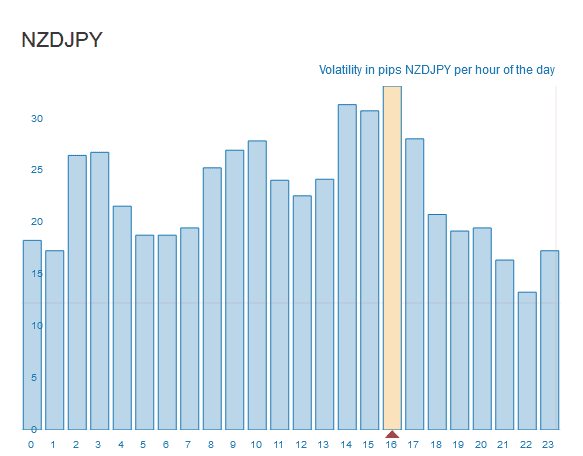

Below, I created one volatility research for the last year, and we can see below the hourly volatility in the Asian session for NZDJPY by average:

Based on the chart above, the NZDJPY forex pair has more than 25 pips on average between 2 and 3 hours after midnight (GMT) during the Asian session. This is the most significant volatility between the forex pairs in this period. Because of news from the Japanese and NZD markets, this forex pair offers opportunities for traders who trade trend trading strategies.

Asian session advantages

Due to the low volatility and liquidity, the Tokyo session forex sticks to different resistance and support levels. Some characteristics are that the liquidity and volatility are low, there are precise exit and entry levels, it is suitable for risk management, and there are breakout opportunities after its closure.

- Liquidity is Low

When the liquidity is low, non-Asian markets such as GBP/USD, EUR/GBP, and EUR/USD are prone to not making big trades outside of the trading ranges noticed.

- Low Volatility

The trade movements can be shorter than those of other markets, such as the US or London because the primary liquidity arrives from Asia.

- Clear exits and entry points

Traders are supported with the opportunities to exit or enter the trades because of the stages of resistance and support. A trader can grow his chances of entering a good trade by using this and merging it with the signs from indicators.

- Good for risk management

Traders can monitor their trades better and study the rewards and risks in-depth in the Asian session because of its still nature. Also, stages of resistance and support are easier to find in the Asian market as they are generally precise and coexist with the trading range.

- Opportunities of breakout after closure

As the closing time of the Asian session and the starting time of the London session clash, it makes more liquidity accessible to the traders, which often witnesses breakouts in trading ranges.

- Currency Pairs Suitable to Trade

The session’s most suitable Tokyo currency pairs depend on the respective trader’s strategy. For example, trades will be dealt in Japanese Yen, Australian dollar, Singapore dollar, and the New Zealand dollar when the trader is focusing on volatility, and trades in GBP/USD, EUR/USD, and EUR/GBP will be made when the trader is focusing on less volatility.

Range Trading During the Asian Session

Asian sessions are more eligible to range trading because the resistance and support levels adhere more than US and London sessions. As a result, range trading and breakouts are the most frequently used strategies in the Japan session forex.

- Setting up trade: One way to trade ranges is to look for signals to sell when the prices come close to resistance with a starting profit set-up near the low end of the range. In addition, oscillators like Stochastic and RBI indicators are used by traders to give sell and buy signals. The Asian session commences in the blue blocks on the chart.

- Entrance point: Traders should sell when prices reach support and buy when prices get resistant using this plan. The stochastic indicators provide a sell signal as they display the market when it is in buying territory. Thus, an opportunity is offered to the trader to enter a small trade when prices are near resistance.

- Stopping losses: A stop can be laid down above the resistance stage as the prices bounce off at this stage.

- Taking Profits: Traders dealing professionally observe for more PIPS in favor when compared to the losses if the trade goes opposite them. This is known as a risk-to-reward ratio, and its ratio should be at the minimum of 1:1. For example, the trader will go for 80 pips and risk 30 pips, which gives a risk-to-reward ratio of 1:2.67 when the market goes from top to bottom.

Range trading is less successful in the London and US sessions when markets are flooded with liquidity. As the charts reflect, extensive breakouts are observed in the downside direction before they recover in the channel. Traders use stops and Limits to continue within the channels.

Breakout Strategies Used in Asian Markets

Take advantage of the sudden price activities when the London session starts at 00:00 GMT (04:00 ET). Traders can foresee breakouts when there is a rush of liquidity.

Conclusion

The Asian session forex pairs are seen as being a bit more stable than the other sessions. This is because the Asian market is influenced by forex news from the Japanese, Australian, and New Zealand markets. This makes the Asian session forex pairs such as NZDJPY and AUDJPY more interesting.