Bloomberg Terminal and FactSet are famous in the financial industry, providing a comprehensive suite of services, including real-time and historical data, market news, analysis tools, and more. However, this comes at a significant cost: Bloomberg Terminal, for example, starts at an annual fee of $20,000, while a FactSet subscription can set you back $12,000 per year.

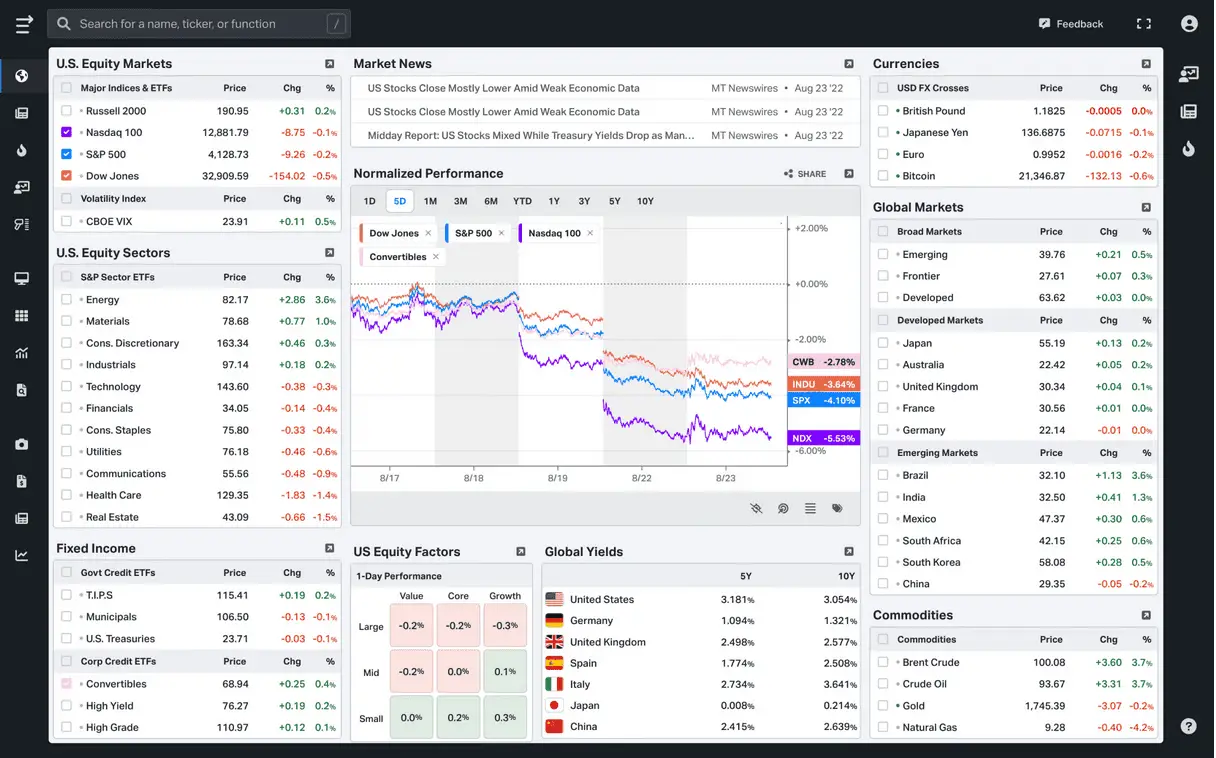

Bloomberg terminal example

These costs can be prohibitive for small to mid-sized businesses, start-ups, independent traders, or individuals who need access to high-quality financial data but don’t have the budgets of large financial institutions. Accessing reliable and comprehensive market data without breaking the bank presents a challenge.

Thankfully, a new wave of platforms is emerging that offers many of the features of Bloomberg Terminal and FactSet at a fraction of the cost or even for free. Among these is Koyfin, a financial data and analytics platform that aims to democratize access to financial information. Koyfin provides a range of features from portfolio tracking to advanced charting, all in an accessible and user-friendly format and, most importantly, without the hefty price tag associated with more traditional platforms.

In the following sections, we will delve deeper into how these cost-effective solutions level the playing field, allowing a more comprehensive range of users to access the kind of financial data that once was exclusive to those willing to pay substantial fees.

Do not forget to read our article How to Access the Bloomberg Terminal For Free if you are a student. Additionally, learn more about Bloomberg Terminal Free Alternative.

Koyfin Review

Koyfin is a financial data and analytics platform that provides investors with tools to research stocks and understand market trends. Koyfin’s primary objective is to offer sophisticated and broad-ranging financial data to a broader audience. It aims to democratize access to advanced financial data analytics, previously the purview of elite financial institutions.

It offers a wide range of features, including:

- Real-time and delayed data: Koyfin provides real-time data for various financial instruments, including stocks, ETFs, bonds, currencies, and commodities. It also offers delayed data for a broader range of instruments.

- Advanced charting tools: Koyfin has a powerful charting tool allows investors to create custom charts and analyze market data. The charting tool includes a variety of indicators, drawing tools, and technical analysis studies.

- Financial analysis tools: Koyfin provides investors with various financial analysis tools, including fundamental analysis tools, valuation tools, and risk analysis tools. These tools can help investors make informed investment decisions.

- News and research: Koyfin provides investors with access to news and research from various sources. This can help investors stay up-to-date on the latest market news and research.

- Community features: Koyfin has a community of investors who can share ideas, discuss strategies, and learn from each other. This can be a valuable resource for investors of all levels.

Koyfin is a robust financial data and analytics platform for investors of all levels. It is a good option for investors who want to research stocks, understand market trends, and make informed investment decisions.

Here are some additional features of Koyfin:

- Portfolio management: Koyfin allows investors to create and manage portfolios. This includes tracking performance, analyzing risk, and backtest strategies.

- API: Koyfin offers an API that allows investors to connect the platform to other trading platforms and software. This can be useful for investors who want to automate their trading or integrate Koyfin with their trading systems.

- Educational resources: Koyfin offers a variety of educational resources, including articles, videos, and webinars. These resources can be helpful for investors of all levels who want to learn more about investing and financial analysis.

Koyfin is a comprehensive financial analytics platform poised to reshape the landscape of investment and financial analysis by offering its users a wide array of features. This review delves deep into the platform to explore its tools, capabilities, and limitations, providing a nuanced understanding of its offering.

- Overview

Koyfin’s primary objective is to offer sophisticated and broad-ranging financial data to a broader audience.

- User Interface

The platform’s user interface strikes a balance between professionalism and user-friendliness. It is sleek, modern, and streamlined, with many features that can be accessed seamlessly. The UI doesn’t overwhelm with data; instead, information is organized into discrete modules, making it manageable even for novice users. However, navigating through the myriad of features Koyfin offers can take a bit of time.

- Data Coverage

Koyfin’s extensive data coverage covers many assets, including equities, ETFs, mutual funds, bonds, commodities, and more. The depth and breadth of data available are impressive. They cover global financial markets, including developed and emerging markets, offering a truly global perspective for investors and analysts.

- Analytics Tools

Various analytics tools are available to users, such as charting capabilities, financial statement analysis, macroeconomic data, sector and industry analysis, portfolio tracking, and more—the charting capabilities allow users to chart many variables and indicators and compare them across different periods. The platform’s “Graph” function allows users to visualize complex financial data intuitively, aiding in data interpretation and analysis.

- Macro Dashboard

The Macro dashboard is one of Koyfin’s standout features. It provides a concise yet comprehensive view of the global macroeconomic landscape. Users can quickly gain insights into the macroeconomic conditions affecting financial markets with information on GDP, inflation, unemployment rates, and more.

- My Dashboards Feature

The “My Dashboards” feature allows users to customize and create them. Users can organize different types of information in one place for easy access and review. Customizing and saving dashboards makes the platform highly adaptable to individual needs.

- Data Accuracy and Reliability

Koyfin’s data is mainly accurate and reliable. The platform sources its data from reputable providers and offers real-time data updates for premium users. Some latency may occur for free users, but it is within acceptable ranges for non-professional investors.

- Customer Support and Learning Resources

The customer support at Koyfin is responsive and helpful. In addition, the platform has a comprehensive learning center, with detailed guides and video tutorials that help new users understand how to make the most of the platform.

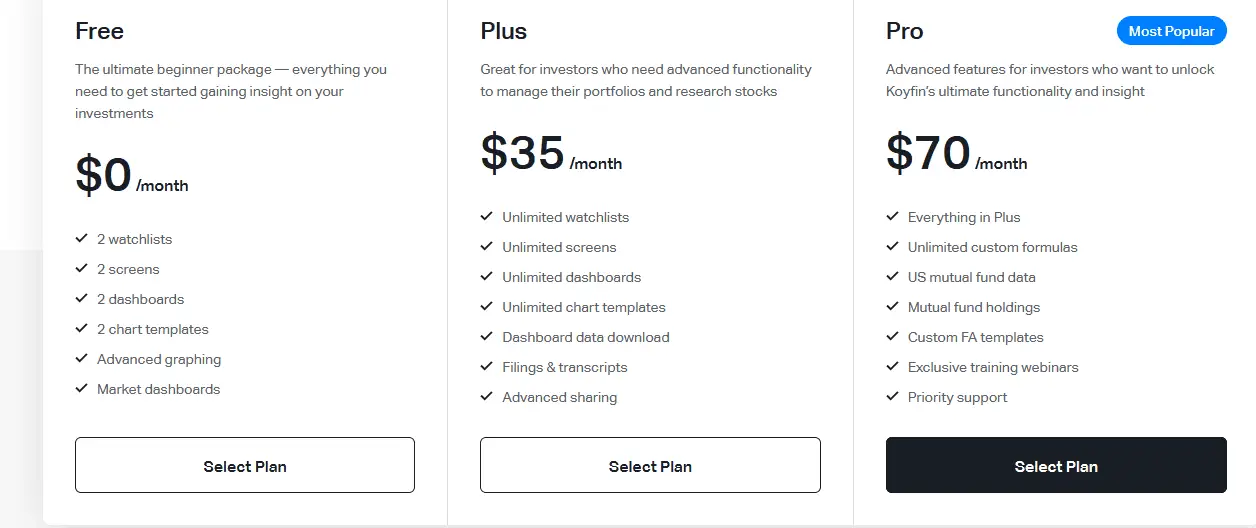

- Pricing

Koyfin offers both a free and a premium version. The free version provides considerable value but has certain limitations. The premium version, priced competitively, unlocks the full power of the platform, providing access to real-time data, premium features, and priority customer service. Koyfin prices start from $0 per month (free) to $70 per month.

- Limitations

Koyfin, while powerful, does have its limitations. The platform is web-based, which may affect performance during heavy data usage. In addition, while Koyfin offers extensive coverage, there are some niche markets and unique financial instruments it doesn’t cover.

Final Verdict

Koyfin is an excellent tool for anyone seeking a comprehensive financial analysis. With its extensive data coverage, powerful analytics tools, user-friendly interface, and reasonable pricing, it stands out in the crowded fintech space. Despite minor limitations, it offers considerable value to professional investors and novices.

Koyfin bridges the gap between advanced financial data analytics and the broader investing public. Its dedication to democratizing access to high-quality financial data and analysis tools makes it essential in today’s digital investing landscape.