Margin level XM

Margin is the minimum amount of money required to place a leveraged trade in your trading platform. Margin Call is a notification in MT4 and MT5 platforms that lets you know you must deposit more money in your forex trading account or close losing trading positions. A margin call is a notification the trader will get via email or in the platform when floating losses are more significant than the trader’s Used Margin.

But what is the margin call level for the XM forex broker

What is XM Margin call?

The margin call notification level for the XM forex broker or XM margin level is 50%. XM margin call level means that if account equity drops below 50 percent, the trader will get a notification that the margin call level is shallow and that there are possibilities shortly that positions be liquidated (forcibly closed).

XM stop-out level is 20%. If the stop our level is reached (20% and lower), all positions will be liquidated (forcibly closed).

Margin Call Level is a threshold (for XM broker is 50%), and A Margin Call is an event (notification that the trader will get by email or phone, etc.).

When the Margin Level call reaches 50%, the best decision is to close losing trades or add more money into the account after the trader cannot open new trades.

XM margin call example

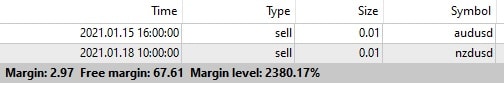

For example, the trader has hazardous trades, and his free margin is $67. The margin level is 2380%, and he thinks he is safe.

But let us see what a margin call looks like:

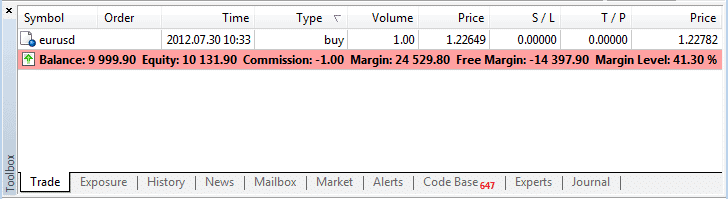

When a margin call is less than 50%, traders can not open new trades, the account is at high risk, and positions can be liquidated.

If you decide to open an account and use the XM MT4 platform, XM deposit, withdrawal methods are Credit cards, Bank Wire, Skrill, Neteller, and various electronic payment methods.

XM Stop Out Level

In forex trading, the Stop-Out Level refers to a threshold set by the broker, beyond which the broker will start closing your open positions, starting from the least profitable one. The goal of the Stop-Out Level is to prevent your account balance from falling into negative territory, which could mean you owe money to the broker.

As you mentioned, the Stop-Out Level is 50% for retail clients at XM broker. This means that when the equity (the total value of the funds in the account, including any unrealized gains or losses from current positions) falls to 50% or less of the required margin (the minimum amount of money required to maintain your open positions), XM broker will start closing your positions.

So, for example, if you have open positions that require a total margin of $2000, and the total value of your account (including any unrealized gains or losses) falls to $1000 or less, XM will start closing your positions starting from the least profitable one until your account’s equity level is back above the Stop-Out Level.

Stop-Out Level is one of many risk management tools in forex trading. Others include the Margin Call Level (which warns you when your equity is getting too close to the Stop-Out Level) and various types of orders (like Stop-Loss Orders) that you can use to limit your potential losses manually.

XM Offers Dynamic Margin for Cryptocurrencies

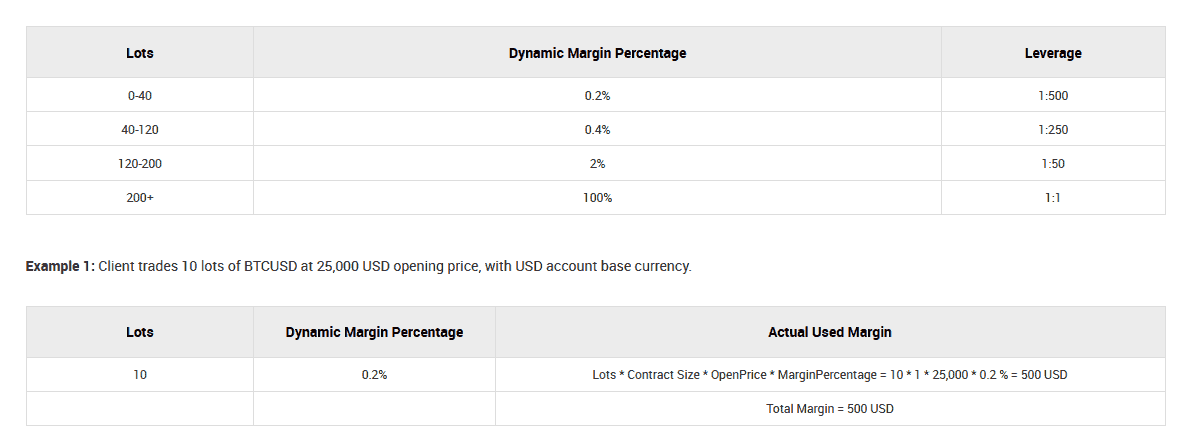

First, let’s clarify a few terms:

- Lot: This is the number of units of the asset (in this case, Bitcoin) you are trading. One lot of BTCUSD at XM is equivalent to 1 Bitcoin.

- Dynamic Margin Percentage: This is the percentage of the total value of the trade that you need to have in your account as a margin. In this case, it’s 0.2%. (Please see screenshot below)

- Actual Used Margin: This is the amount of money from your account being set aside to cover potential losses from this trade. It’s calculated by multiplying the number of lots by the contract size (1 Bitcoin for BTCUSD), the opening price, and the margin percentage.

In the XM example (less than 40 lots size), you’re trading ten lots of BTCUSD. The opening price is 25,000 USD, and the dynamic margin percentage is 0.2%.

The actual used margin for this trade is calculated as follows:

10 (Lots) * 1 (Contract Size) * 25,000 (OpenPrice) * 0.2% (MarginPercentage) = 500 USD

So, you need at least 500 USD in your account to open this position.