The Fibonacci indicator is one of the most popular technical analysis indicators used by traders and investors to identify support and resistance levels in the price of a security. Known as the “Golden Ratio,” this tool can be found in any trading platform, including HF Markets. It is an easy-to-use and powerful indicator that can help investors make more informed decisions about buying and selling securities.

The Fibonacci indicator is based on the mathematical sequence developed by Leonardo Fibonacci in 1202 AD. It consists of a series of numbers where each is the sum of the two preceding numbers (1, 1, 2, 3, 5, 8, 13, etc.). This sequence creates a ratio known as the Golden Ratio or phi (?), used for centuries to create art, design, and architecture due to its aesthetic appeal.

Traders use the Fibonacci indicator in financial markets to plot support and resistance levels. Identifying these levels helps traders anticipate potential areas of buy or sell orders that may lead to significant moves in price.

Where is Fibonacci Indicator in the HF Markets Platform?

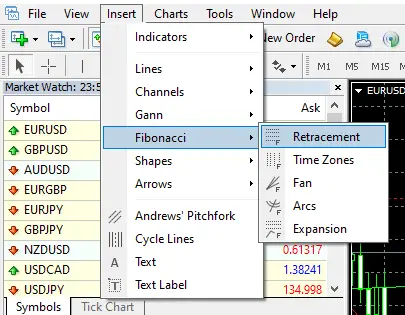

To find the Fibonacci indicator in MT4 and Mt5 platforms, you need to Insert and then choose the Fibonacci drawing tool for Retracement or Expansion.

HF Markets provides access to this powerful tool via their trading platform, enabling users to select from several different methods for plotting Fibonacci retracements/extensions, including manual drawing or auto-tracing tools. HF Markets also provides access to advanced analytical tools such as Elliott Wave Theory and Gann Fan Analysis, which enable users to understand market movements better and make more informed decisions regarding trading.

- The Fibonacci indicator is based on the Fibonacci sequence, a mathematical series found in nature and applied to the financial markets.

- The indicator uses horizontal lines to indicate potential areas of support or resistance based on the Fibonacci ratios (0.236, 0.382, 0.500, 0.618, 0.786, 1.000, 1.272, 1.618, etc.).

- These ratios are derived from the Fibonacci sequence and are believed to represent key levels where traders may look to enter or exit trades.

- The Fibonacci indicator can be applied to any time frame and currency pair, making it a versatile tool for forex traders.

- Traders can use the indicator to identify potential entry and exit points and set stop loss and take profit levels.

- The Fibonacci indicator is often used with other technical indicators and analysis tools to confirm trading signals and enhance accuracy.

- The indicator is widely used by both novice and experienced traders and is considered a valuable tool for identifying potential market movements and trends.

- The Fibonacci levels can also be used to calculate retracements and extensions, which can help traders determine potential price targets.

- The Fibonacci indicator is available on most trading platforms and can be customized to suit individual trading styles and preferences.

The Fibonacci indicator is an easy-to-use yet powerful tool that can help traders identify support/resistance levels more accurately when analyzing securities prices on any platform – mainly HF Markets’ desktop trading platform. With its advanced analytical features, such as Elliott Wave Theory and Gann Fan Analysis, users can quickly draw upon valuable historical data points when making investment decisions – all within seconds!

How to use the Fibonacci indicator in the HF Markets Metatrader platform?

- Open your MetaTrader platform and select the chart to which you want to apply the Fibonacci retracement tool.

- Click on the “Insert” tab in the top menu and select “Fibonacci” from the drop-down list.

- Choose the “Retracement” option from the sub-menu.

- Click and drag your mouse from the high point to the low end of the price move you want to analyze. This will draw the retracement levels on your chart.

- Once the retracement levels are drawn, you can adjust them as needed. To do this, click on the retracement lines and drag them to different levels on your chart.

- You can customize the retracement tool’s appearance by changing the lines’ color and thickness.

- To use the retracement levels for trading, look for areas where the price is approaching a retracement level. If the price shows signs of resistance or support at that level, it may be an excellent opportunity to enter a trade in the direction of the trend.

- You can also use other technical analysis tools, such as indicators and oscillators, to confirm the signals provided by the Fibonacci retracement levels.

- Remember that the Fibonacci retracement tool is not foolproof and should be used with other analysis tools and risk management strategies to minimize losses and maximize profits.