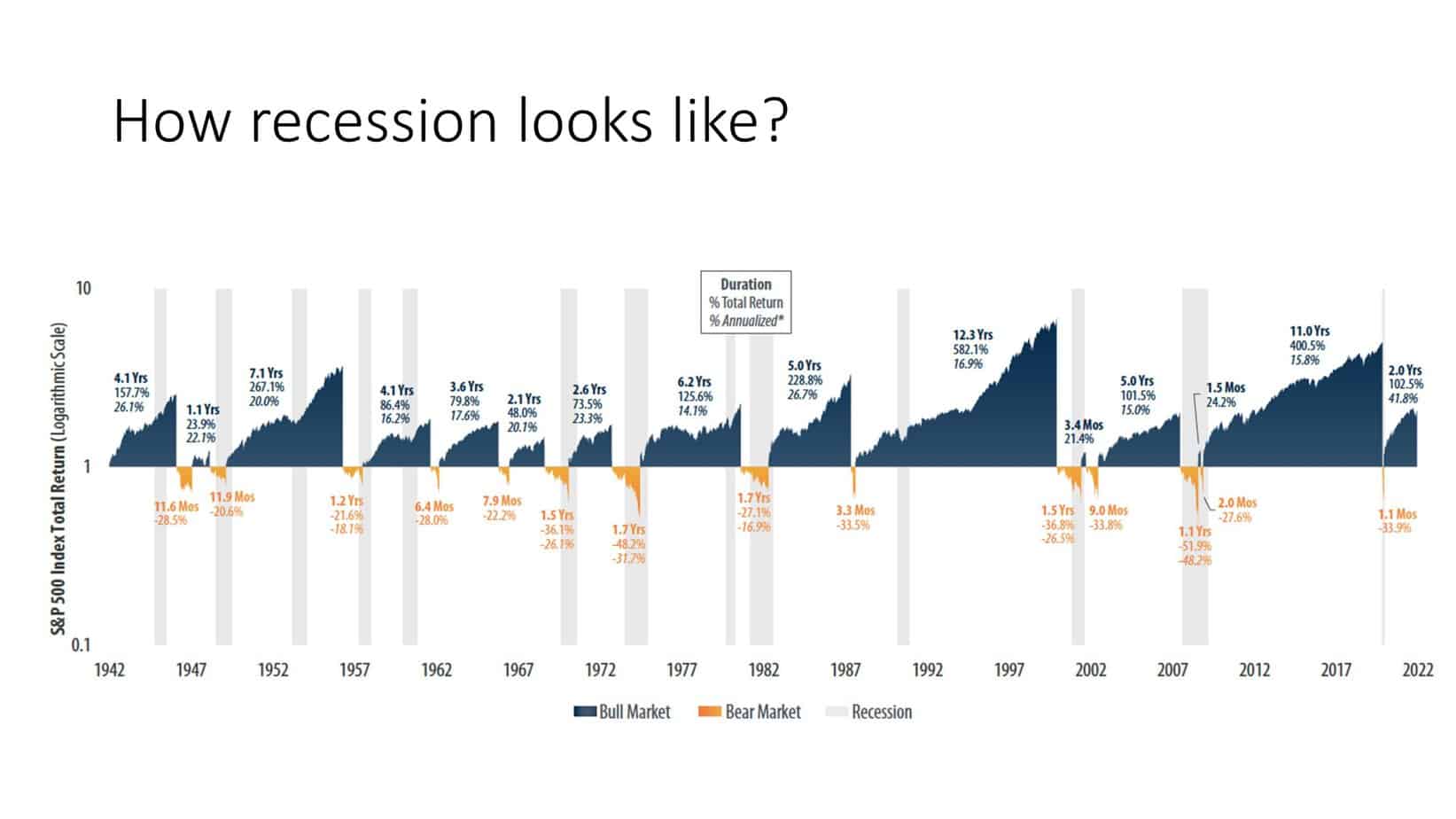

It does not matter how distant the danger may seem; every investor must prepare themselves for the potential of a significant economic slump. In the past, occurrences like this have taken place. Something similar may take place in the future. If it does occur, the loss of years’ worth of savings and assets for retirement might occur in only a few short hours.

Where is The Best Place to Put your Money if the Stock Market Crashes?

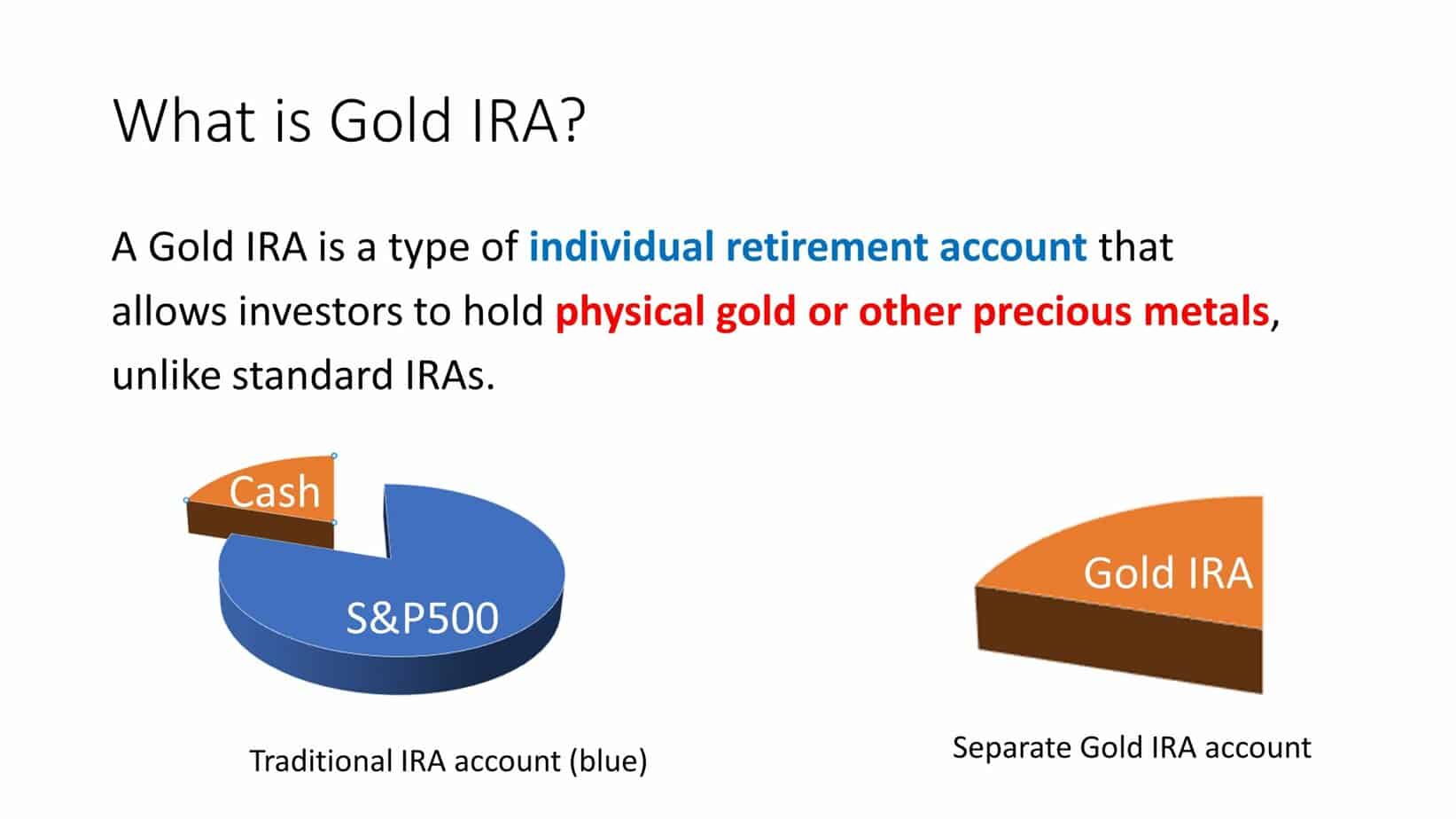

If the stock market crashes, investors usually take one part of the money as cash, and the other invests in precious metals such as gold or silver. Investors typically wait several weeks to several months or years to see stock market recovery and then reinvest in quality, underpriced stocks. In the last decade, Gold IRA accounts have become very popular.

(Read our articles What is Gold IRA? and Augusta Precious Metals Review to learn more about this topic.)

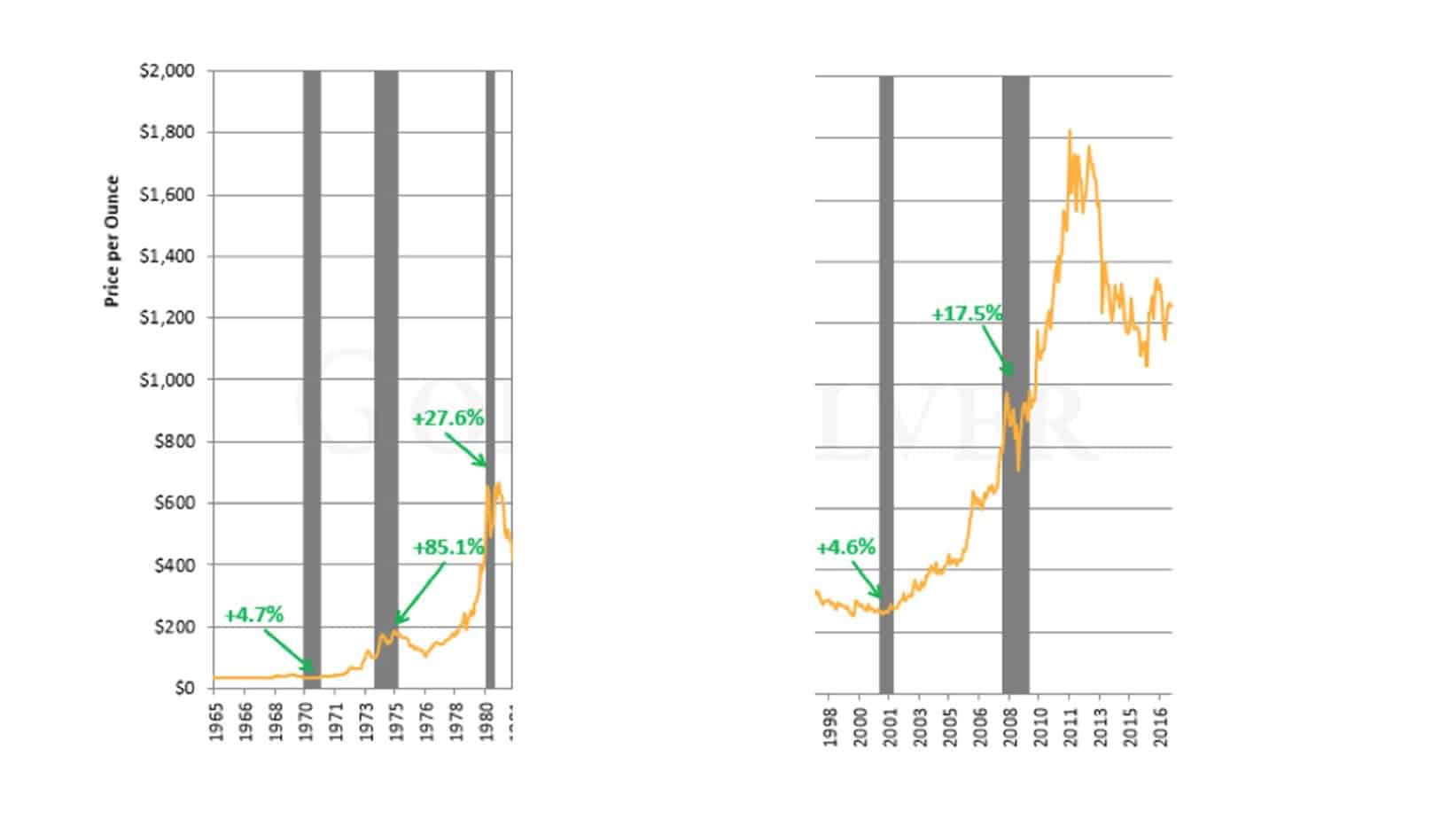

However, investing style and investment strategy are different for each person. It is hard to tell where is the best place to invest money during the recession. But let us analyze gold as an investment.

For example, in the image below, we can see gold price during the recession:

The last crisis was interesting:

To a large extent, however, there are precautions that you may take to protect yourself against a market collapse or even a catastrophe that affects the whole global economy. You need to be well-prepared and have a variety of alternatives available to you if you want your defensive strategy to be effective. With the help of these two, it is possible to weather the storm of a difficult financial situation.

IMPORTANT THOUGHTS

- In the event of a market collapse or global economic depression, stockholders can take place to protect most of their possessions through groundwork and modification.

- When it comes to protecting your finances, diversifying your portfolio is perhaps the most critical step you can proceed.

- Most professional traders turn to cash or currency counterparts when the market is teetering on edge.

- At the very least, have a modest percentage of your assets in investments guaranteed to rise in value regardless of the market.

- The options game, paying down debt to maintain a constant balance sheet, and due loss reaping are all good ways to protect your portfolio in the event of a market crash.

- Expand your horizons.

One of the most effective ways to protect your finances from an unadorned bear arcade is by diversifying your portfolio.

Your menace acceptance and age may dictate whether you should invest most of your superannuation assets in individual equities, shared reserves, or ETFs.

However, if you perceive a crisis approaching, you should be ready to relocate a part of that money into something more secure.

A wide variety of assets are available to folks these days, each with its degree of menace: shares of stock, bonds, cash, real estate, derivatives, cash value life cover, endowments, and precious metals are all examples of investments. There are several ways to diversify your assets, including a minor stake in an oil and gas production that is already producing.

The most accessible approach to guarantee that you have something to fall back on is to spread your money over many of these areas.

- Take a Plane to Safety

Most skilled traders turn to cash or cash counterparts when the markets are tumultuous. If you have the opportunity to do so before the crash, you may want to consider doing the same.

You can acquire back in at considerably lesser pricing if you leave soon. So, when the trend inevitably turns around, you’ll be able to reap even more rewards.

- Get an Assurance

You generally don’t want to put all your funds into guaranteed investments. They don’t reimburse enough for my liking. At least a modest amount of your money should be invested in something that will not be affected by the market’s fluctuation.

Bank CDs and Assets safekeeping are ideal investments for short-term investors.

Secure or indexed allowances, or even categorized universal life cover, might yield superior revenues than Reserves bonds if you want to invest for a longer length of time. With minimum to moderate risk, corporate bonds and even preferred stock of blue-chip corporations may also give competitively high returns.

- Protect Your Investments

Don’t hesitate to benefit immediately from a significant slump if you sense it coming. Depending on your tolerance for risk and your period prospect, there are various methods to do this.

It’s possible to short a stock you own and then purchase it again the minute the graph configurations reveal that it’s approaching the bottom if you believe it will decline in value.

It’s simpler to short a stock when you own it. If the marketplace goes counter to you, you may only supply your stores to the agent and repay the difference in worth in cash.

Another approach is to purchase hard choices on any of your equities or financial indexes that offer options. If the worth of the fundamental securities or benchmark falls, the value of these derivatives will skyrocket.

- Make a Plan to Eliminate Debt

If you have a lot of debt, you may be comfortable selling off part or all of your investments and buying off the bills rather than trying to cling to your assets. This is a wise decision, mainly when dealing with excessive interest debt like credit card bills and personal loans. As long as the bear market roars, you’ll be left with a relatively steady balance sheet.

Paying off your mortgage in whole, or in any case, a significant portion of it is another option. It’s not a wrong indication to reduce your monthly financial commitments.

- Look for the Silver Lining in Taxes

It’s still possible to minimize your losses even if you can’t do anything to prevent the market from collapsing directly on your assets.

Tax drop harvesting is an alternative for taxable accounts that have suffered losses. Selling all your lost positions and repurchasing them 31 days ahead is all that must be done to recover your losses. Provided you sell before the end of the current duty year, you may avoid paying taxes on the loss until January 1 if you purchase the shares back within 31 days after selling.) The IRS considers a “wash sale” if the stock is repurchased before this period, and you cannot claim the loss.)

In this case, you may write off all your damages against your profits in those respective accounts. Losses above $3,000 may be carried over to the next year and deducted from your yearly taxable income.

Consider a Roth IRA Rollover

It is an excellent time to convert conventional IRAs or other eligible sequestration policies from previous employment into Roth IRAs while their prices are at their lowest. Consequently, you will have less conversion and, as a result, less income to report as taxable.

For example, you may avoid paying taxes on $27,000 if you transform a $90,000 IRA’s worth by a 30% decline in value in a year.

If you’re out of work for a significant portion of the year, converting to a pass-through entity may still put you in a lower tax bracket.

Before a Crash Happens, Where to Put Your Money

It’s normal to be concerned about the budget and your assets when unemployment is high and foreclosures are widespread. If you have a large portion of your wealth invested in the stock marketplace, you may have no time to delay for the market to recover. The stock marketplace isn’t the only choice. If you believe that clang is imminent, you may wish to investigate some of these.

TIPS

You may get some protection from inflation by purchasing Treasury Inflation-Protected Securities from the US Treasury or a bank or agent. During inflation, your principal would rise, and during deflation, it would fall. The CPI (Consumer Price Index) is used to calculate this. TIPS may mature in five, ten, or thirty years. You’ll get interest payments, which are added to your account balance twice a year. At maturity, you’ll get the larger of your adjusted principle or your novel principal, whichever is greater.

Gold and Silver

If you’re worried about the dollar’s value depreciating, consider investing in costly metals such as gold, silver, platinum, and palladium. People have long retained precious metals in their portfolios to diversify. Many commercials utilize the catchphrase “the price of metals varies, but it never sinks to zero,” which is a bit of a ruse but also valid. If you want to participate in expensive metals, you may do it in various ways, including stock in mining firms, ETFs containing bullion, or coins.

Exchanging Currencies

Investing in foreign currency may be a good idea if you’re worried about the state of the US dollar. Currency fluctuations might cause a significant loss of money if you select the incorrect one. You may diversify your risk by investing in various foreign exchanges. Foreign currency investing carries danger, so you should know how much chance you’re willing to take. Carl Resnick, a portfolio strategist with Rydex SGI, advises Bankrate.com readers to consult with a financial intermediary.

Accounts for Savings

If you’re concerned about a market collapse, save your funds in savings accounts and credentials of deposits. They’re the best value for your money in terms of safety. Investments accounts, inspection accounts, certificates of deposit, and money fair credit accounts cover up to $250,000 per shareholder by the Federal Deposit Insurance Corp. and the National Credit Union Administration.

GET GOLD IRA GUIDE