Table of Contents

Regarding retirement planning, one of the most popular options people turn to is a Roth IRA. This type of account allows you to save retirement money while offering potential tax benefits. However, it’s essential to be aware that, like any other investment, a Roth IRA can still come with risks, and you can lose money.

What is Roth IRA?

A Roth IRA is an individual retirement account (IRA) that allows you to contribute after-tax dollars to your retirement savings. Your contributions to a Roth IRA are not tax-deductible, but any investment gains and withdrawals you make in retirement are tax-free.

Here are some key features of a Roth IRA:

- Contributions: For the tax year 2023, you can contribute up to $6,500 to a Roth IRA or up to $7,500 if you’re 50 or older. You can contribute to a Roth IRA until the previous year’s tax filing deadline.

- Tax-free withdrawals: Any investment gains leaves were from a Roth IRA in retirement are tax-free ifs if you’ve held the account for at least five years and are over 59 ½.

- No required minimum distributions (RMDs): Unlike traditional IRAs, there are no required minimum distributions (RMDs) for Roth IRAs. You can continue contributing to a Roth IRA even after you reach age 72, and you’re not required to take distributions in retirement.

Roth IRA Income Limits

For the tax year 2023, the income limits for contributing to a Roth IRA are as follows:

- Single, head of household, or married filing separately (if you didn’t live with spouse during the year):

- If your modified adjusted gross income (MAGI) is less than $138,000, you can contribute the maximum amount of $6,500 ($7,500 if you’re 50 or older).

- Your contribution limit will be reduced if your MAGI is between $138,000 and $153,000.

- If your MAGI is $153,000 or more, you cannot contribute to a Roth IRA.

- Married filing jointly or qualifying widow(er):

- If your MAGI is less than $218,000, you can contribute a maximum of $6,500 ($7,500 if you’re 50 or older).

- Your contribution limit will be reduced if your MAGI is between $218,000 and $228,000.

- If your MAGI is $228,000 or more, you cannot contribute to a Roth IRA.

- Married filing separately (if you lived with your spouse at any time during the year):

- Your contribution limit will be reduced if your MAGI is less than $10,000.

- If your MAGI is $10,000 or more, you cannot contribute to a Roth IRA.

It’s important to note that these income limits can change yearly, and it’s always a good idea to check with a financial advisor or the IRS to ensure you’re eligible to contribute to a Roth IRA.

Can You Lose Money in a Roth IRA?

Yes, you can lose money in a Roth IRA as in any other investment. Usually, during recessions, assets price can decline (stocks, bonds), and your portfolio size can drastically decrease.

While a Roth IRA can be a great way to save for retirement, it’s important to remember that investing in the stock market always carries some risk. For example, a recession or economic downturn can cause the value of the investments in your Roth IRA to decline, resulting in losses. Here are a few reasons why this can happen:

- Market volatility: During a recession, the stock market can experience significant volatility, with prices of stocks and other investments fluctuating widely. This can cause the value of your Roth IRA investments to decline, even if they’re well-diversified.

- Corporate earnings: During a recession, companies may see a decline in sales and profits, which can cause the prices of their stocks to drop. This can negatively impact the value of your Roth IRA investments, particularly if you have a significant allocation to stores.

- Interest rates: During a recession, the Federal Reserve may lower interest rates to stimulate the economy. While this can be good for borrowers, it can be not suitable for investors looking for higher returns. Lower interest rates can reduce the yield on bonds and other fixed-income investments, which can be a significant portion of many Roth IRA portfolios.

- Liquidity risk: Some companies may face financial difficulties during a recession and even go bankrupt. This can lead to losses for investors who own their stocks or bonds. Additionally, you may have trouble finding buyers if you need to sell your investments to raise cash during a recession, leading to losses or lower returns.

Overall, investing in a Roth IRA during a recession or economic downturn carries some risk, and it’s important to remember that there’s no guarantee of positive returns. However, diversifying your portfolio, investing for the long term, and keeping a level head during market volatility can minimize your risk and increase your chances of success over time.

First and foremost, it’s essential to understand that a Roth IRA is an investment account. This means the money you contribute to the account is invested in stocks, bonds, mutual funds, or other securities. These investments can go up or down in value depending on several factors, including market conditions and the performance of the companies and industries your assets are tied.

During economic uncertainty or market volatility, the value of your Roth IRA investments can decrease. For example, if there is a stock market downturn, the value of your stock investments may decline. Similarly, if interest rates rise, the value of your bond investments may decrease.

It’s also worth noting that some investments carry more risk than others. For example, stocks are generally considered riskier than bonds because their value can be more volatile. This means that while stores may offer the potential for higher returns, they also come with greater risk.

You can lose money in a Roth IRA in several ways due to poor investment selection, market volatility, and early withdrawals. Here are some examples:

- Poor investment selection: If you invest in individual stocks, mutual funds, or other securities that perform poorly, the value of your Roth IRA can decline, resulting in losses. Researching and selecting investments that fit your risk tolerance and investment goals is essential.

- Market volatility: The stock market can be volatile, with prices of stocks and other investments fluctuating widely. During periods of market volatility, the value of your Roth IRA investments can decline, resulting in losses. Therefore, it’s important to remember that investing in the stock market always carries some risk and to diversify your portfolio to help mitigate some of that risk.

- Early withdrawals: If you withdraw funds from your Roth IRA before age 59 1/2, you may be subject to a 10% penalty on the amount withdrawn and income tax on any earnings. Early withdrawals can reduce the value of your Roth IRA, particularly if you start funds during a market downturn.

So, what can you do to protect your Roth IRA investments from losses? There are a few strategies that you can consider:

- Diversification: One of the most important things you can do is diversify your investments. This means spreading your money across different types of assets, such as stocks, bonds, and mutual funds. By diversifying, you can help reduce your overall investment risk.

- Dollar-cost averaging: This is a strategy where you invest a set amount of money into your Roth IRA regularly, regardless of market conditions. This can help smooth out fluctuations in the market and potentially reduce your overall investment risk.

- Consider a conservative investment vehicle: If you are concerned about potential losses in your Roth IRA, you may want to consider a traditional investment vehicle, such as a deferred annuity. These products typically offer principal protection, meaning you can’t lose money if the stock market takes a downturn.

- Try a Gold IRA account to protect your IRA account during the recession.

It’s also worth noting that while you can lose money in a Roth IRA, this retirement account is still considered a wise investment choice. The potential for tax-free growth and withdrawals can be a powerful incentive to save for retirement in this manner. Plus, with careful planning and a well-diversified portfolio, you can help protect your investments from potential losses.

In short, while there is always the potential for losses when it comes to investing, a Roth IRA can still be a smart choice for retirement planning. By making informed investment decisions, diversifying your portfolio, and considering conservative investment options, you can help protect your money and enjoy the benefits of tax-free growth and withdrawals over time.

- Evaluate your risk tolerance: Assess your comfort level with risk and ensure that your Roth IRA investment strategy aligns with your goals and risk tolerance.

- Review your asset allocation: Review your portfolio and ensure it is adequately diversified across asset classes, such as stocks, bonds, and real estate. Then, adjust your asset allocation as needed to maintain your desired level of diversification.

- Consider adding defensive investments: Defensive investments, such as bonds and gold, tend to perform well during economic downturns and can help to protect your portfolio.

- Avoid panicking: Avoid making emotional decisions based on short-term market fluctuations. Instead, focus on your long-term investment goals and stay the course.

- Rebalance your portfolio: Regularly maintain your desired asset allocation and minimize risk. This can involve selling overperforming assets and investing in underperforming assets to maintain balance.

- Consider tax-loss harvesting: Tax-loss harvesting involves selling losing investments to offset gains in other areas of your portfolio. This can help to reduce your tax liability and potentially increase your returns.

- Consult with a financial advisor: Consider working with a financial advisor or investment professional to help you navigate the market and make informed investment decisions during economic uncertainty.

Roth IRA Account practical example

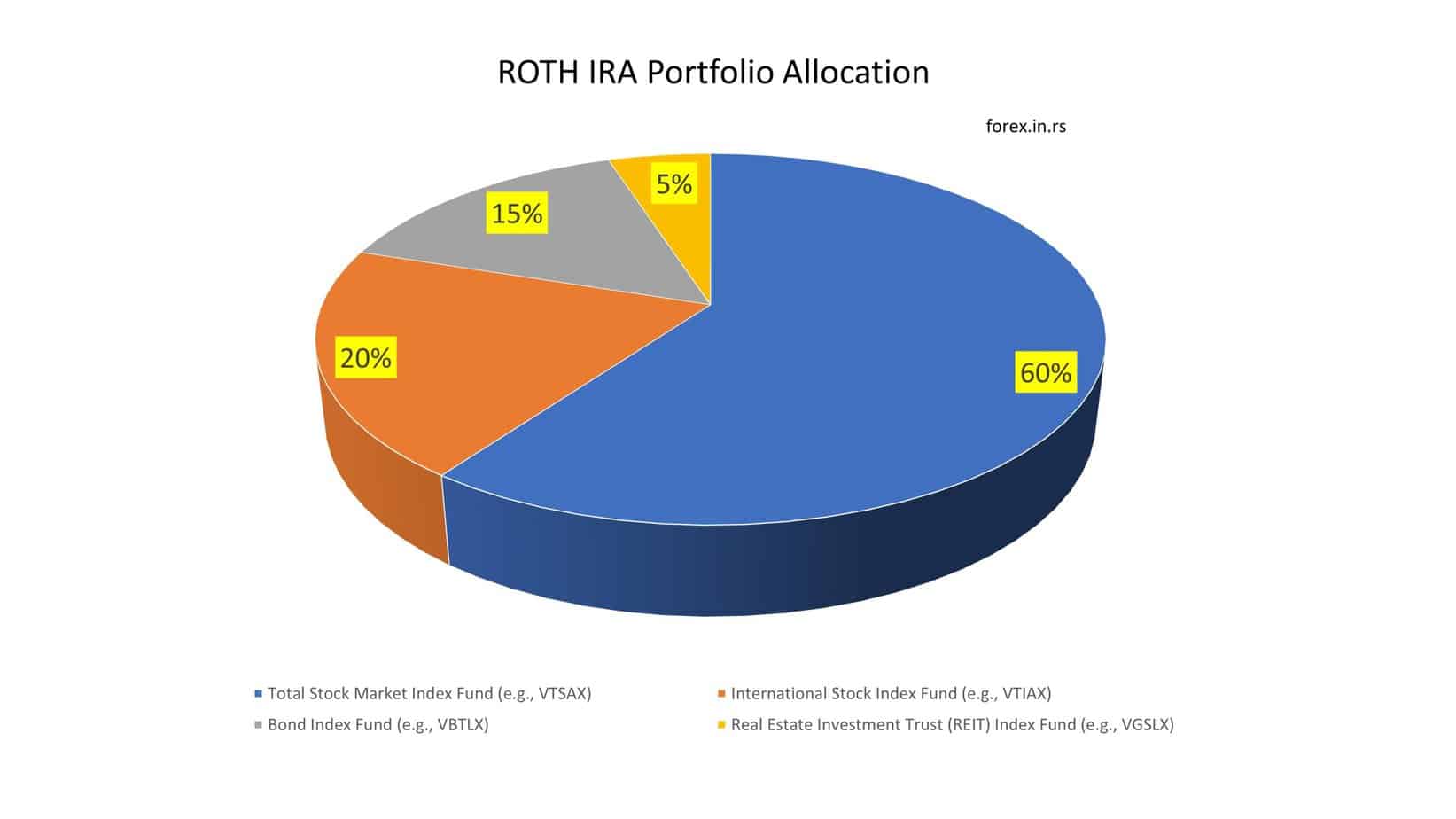

Here is a practical example of a Roth IRA portfolio that might be appropriate for someone who is in their 30s and has a moderate risk tolerance:

- Total Stock Market Index Fund: 60% allocation. This fund provides exposure to a broad range of large, mid, and small-cap US stocks and helps to diversify the portfolio. The Vanguard Total Stock Market Index Fund (VTSAX) is a popular option.

- International Stock Index Fund: 20% allocation. This fund invests in stocks from non-US developed and emerging markets and provides exposure to global markets. The Vanguard Total International Stock Index Fund (VTIAX) is a popular option.

- Bond Index Fund: 15% allocation. This fund invests in various high-quality US bonds and stabilizes the portfolio. The Vanguard Total Bond Market Index Fund (VBTLX) is a popular option.

- Real Estate Investment Trust (REIT) Index Fund: 5% allocation. This fund invests in real estate companies and can provide diversification and growth potential. A popular option is the Vanguard Real Estate Index Fund (VGSLX).

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE